Noncash Donations Templates

Are you looking to make a noncash donation? Whether you want to support a charitable cause or simply declutter your home, making a noncash donation can be a great way to give back. However, it's important to understand the documentation requirements and the tax implications of noncash donations.

At USA, Canada, and other countries document knowledge system, we have a comprehensive collection of documents related to noncash donations. These documents provide guidance and information on how to properly document and report your noncash contributions.

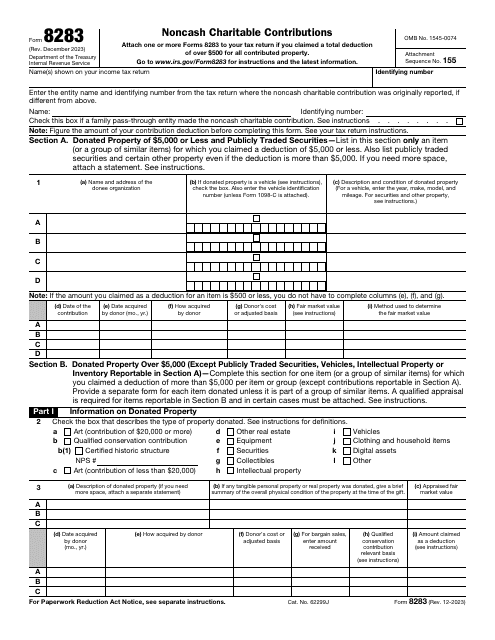

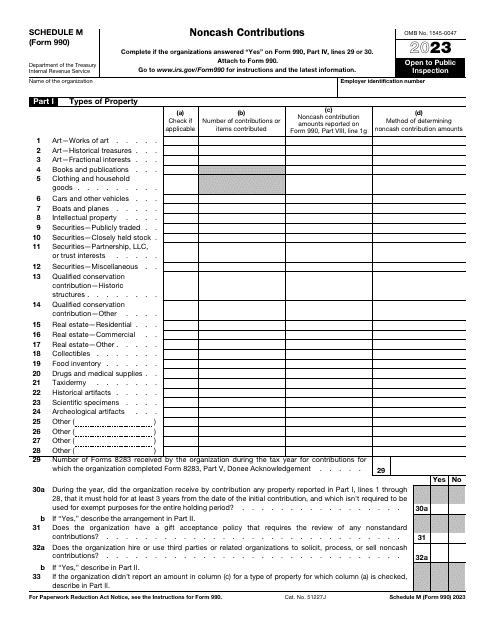

One of the frequently used documents in this collection is the IRS Form 8283 Noncash Charitable Contributions. This form is used to report noncash donations over $500 and provides detailed information about the donated items. Additionally, the Form 990 Schedule M Noncash Contributions is another important document for tax-exempt organizations to report noncash donations they receive.

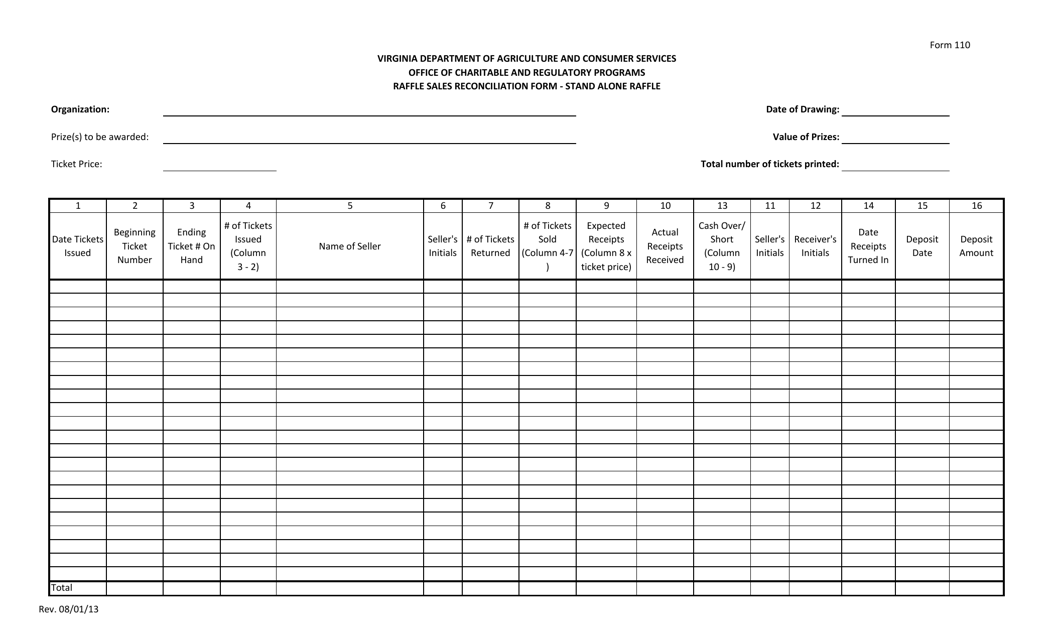

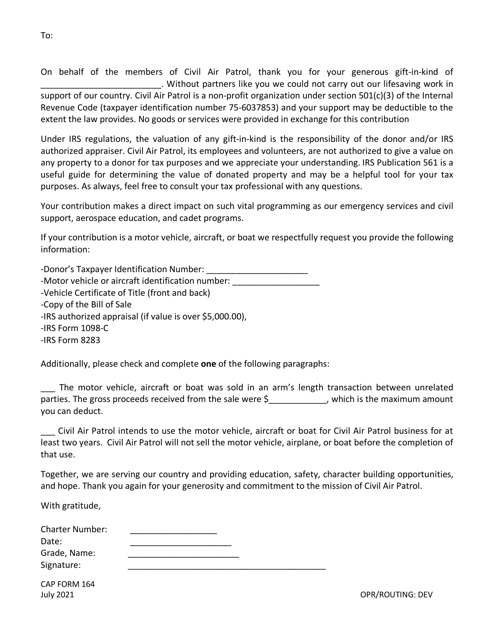

In addition to these specific forms, our collection includes a variety of other documents that cater to different types of noncash donations. For example, if you are organizing a raffle and want to reconcile the sales, the Form 110 Raffle Sales Reconciliation Form - Stand Alone Raffle is the document you need. If you receive in-kind donations and want to issue receipts to acknowledge them, the CAP Form 164B Inkind Donation Receipt is an excellent resource.

No matter the type of noncash donation you are involved with, our collection of documents has you covered. Our documents are regularly updated to reflect the latest regulations and requirements, ensuring that you have access to the most accurate and up-to-date information.

So, whether you are an individual making a noncash charitable contribution or an organization receiving noncash donations, our collection of documents will provide you with the guidance and resources you need. Take advantage of our comprehensive collection and ensure that your noncash donations are properly documented and reported.

Documents:

5

This document is used for reconciling and tracking sales for stand-alone raffles in the state of Virginia.

This document is used for recording and acknowledging in-kind donations received by an organization. It helps to keep a record of the donated items and their value for tax purposes.