Nonresident Alien Templates

Nonresident Alien Documents

Are you a nonresident alien living and working in the United States? If so, it's important to familiarize yourself with the necessary paperwork and forms to ensure you're meeting your tax obligations. The nonresident alien documents collection is a comprehensive resource designed specifically for individuals in your situation.

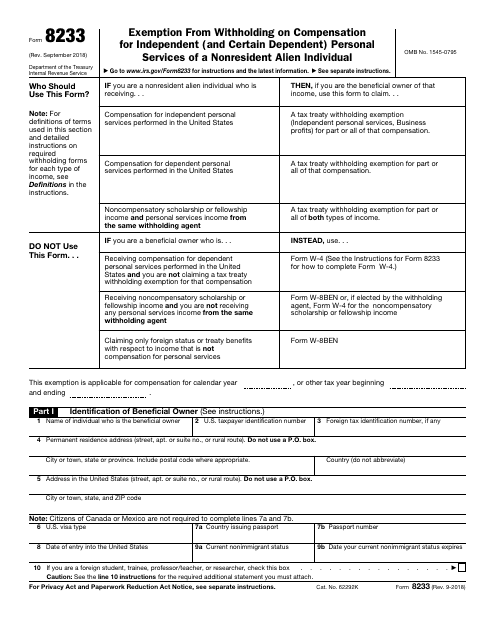

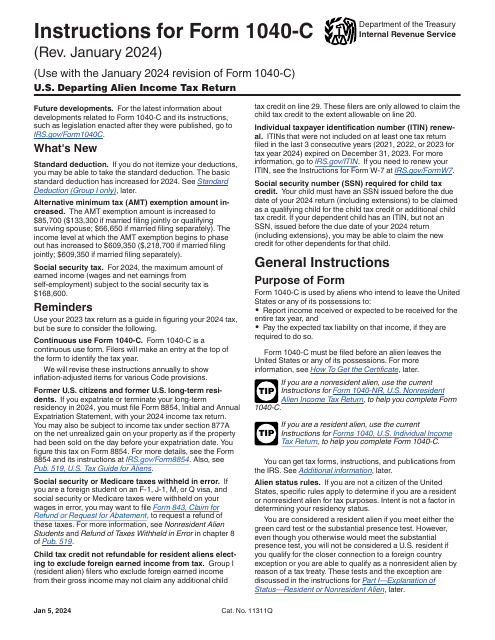

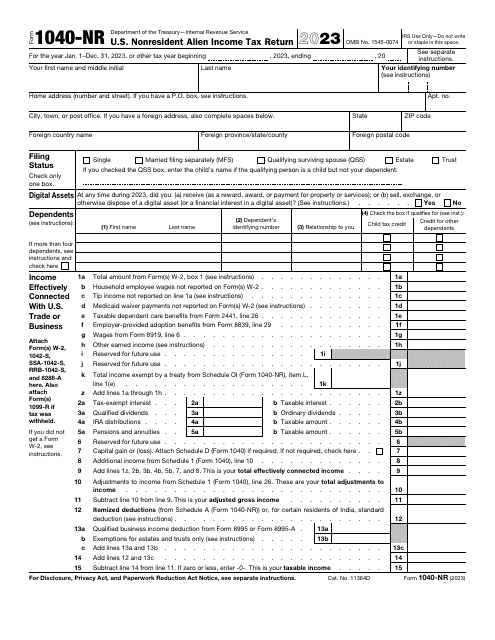

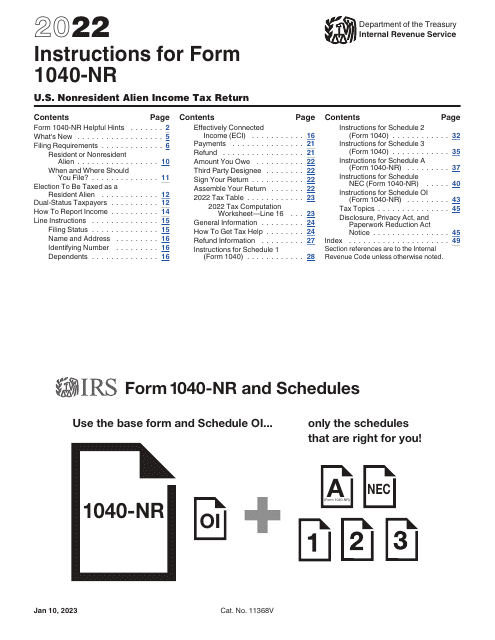

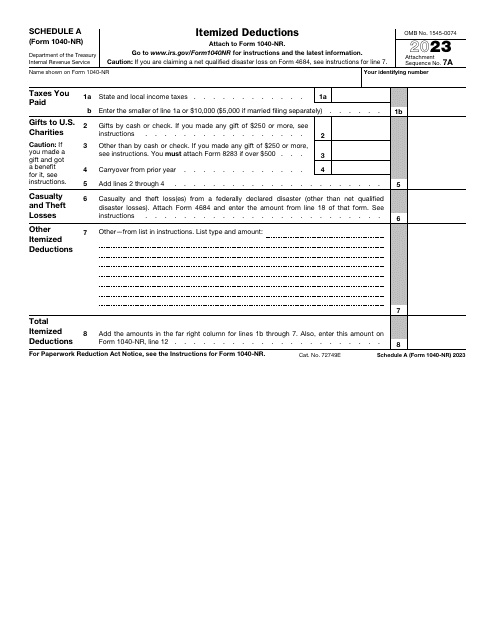

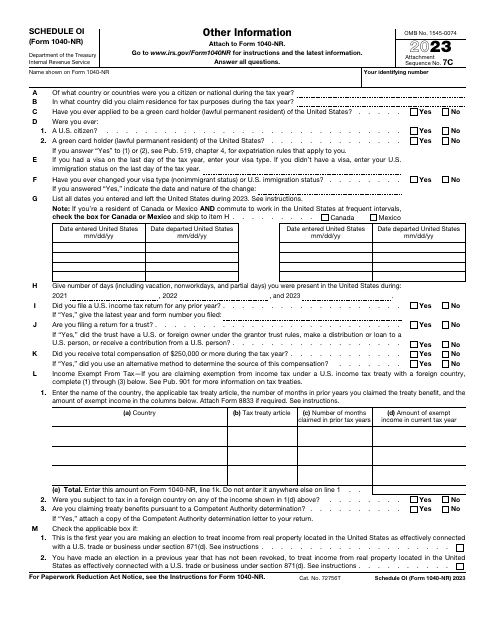

Also referred to as nonresident aliens paperwork or forms for nonresident aliens, this collection encompasses a range of documents to address various aspects of your tax requirements. As a nonresident alien, you'll need to complete the IRS Form 1040-NR, which is the U.S. Nonresident Alien Income Tax Return. This form allows you to report your income earned in the United States and determine your tax liability.

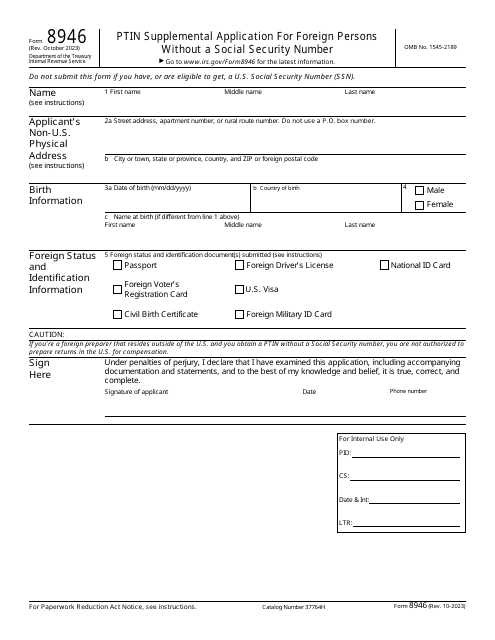

In addition to the Form 1040-NR, there are other important forms included in this collection. For example, the IRS Form 8946 is the PTIN Supplemental Application for Foreign Persons Without a Social Security Number. This form is necessary if you don't have a Social Security Number and need to obtain a Preparer Tax Identification Number (PTIN) in order to properly file your taxes.

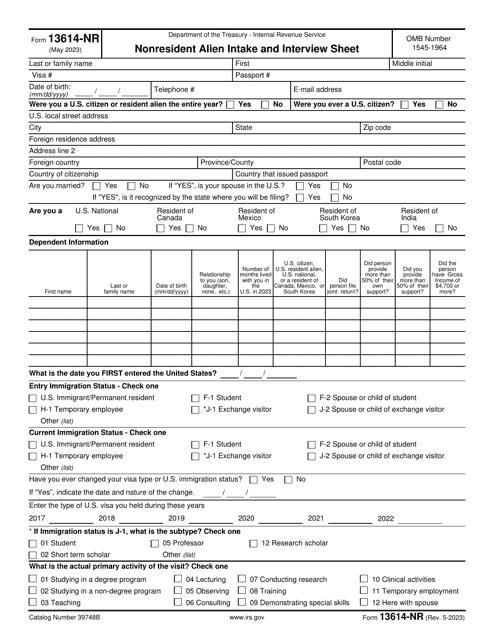

To ensure that you provide accurate information, the IRS Form 13614-NR, also known as the Nonresident Alien Intake and Interview Sheet, is included in this collection. This form helps to gather all the necessary information about your residency status, income, and deductions, ensuring that you complete your tax return correctly.

In some cases, if you're employed in North Carolina as a nonresident alien, you may also need to complete the Form NC-4 NRA, which is the Nonresident Alien Employee's Withholding Allowance Certificate. This form allows you to specify your withholding allowances, ensuring that the correct amount of tax is withheld from your paycheck.

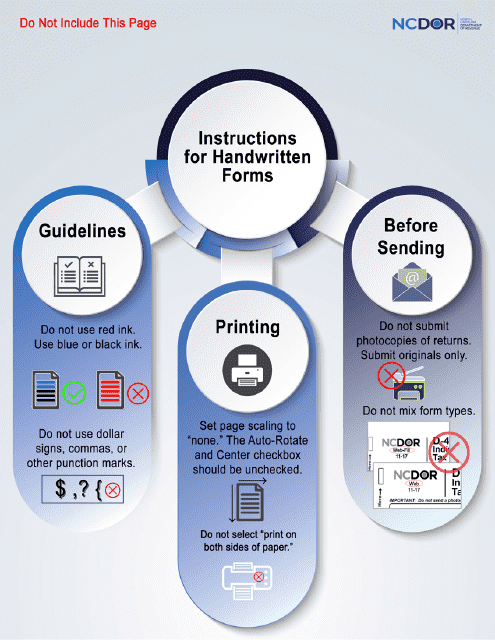

Navigating the U.S. tax system can be complex, especially for nonresident aliens. However, with the nonresident alien documents collection at your disposal, you can be confident that you have all the necessary forms and information needed to fulfill your tax obligations. Make sure to consult with a tax professional or refer to the official IRS website for detailed instructions on how to complete and file these forms accurately.

Documents:

43

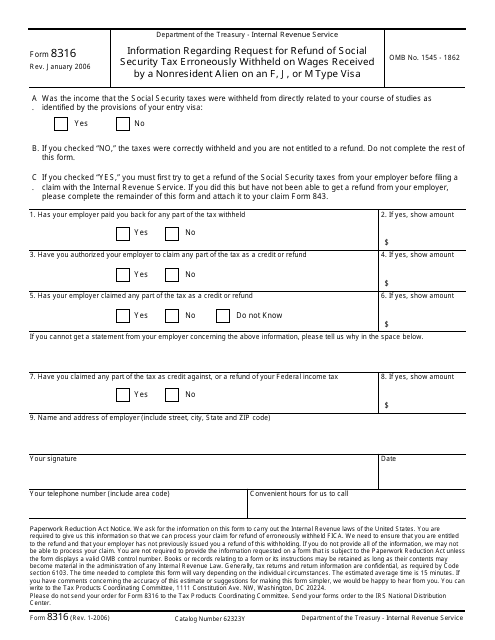

This form is used for providing information regarding a request for refund of social security tax that was mistakenly withheld on wages received by a nonresident alien on an F, J, or M type visa.

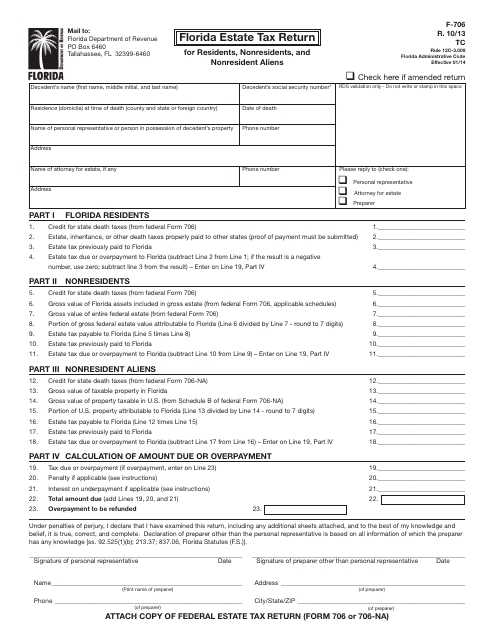

This form is used for filing estate tax returns in Florida by residents, nonresidents, and nonresident aliens.

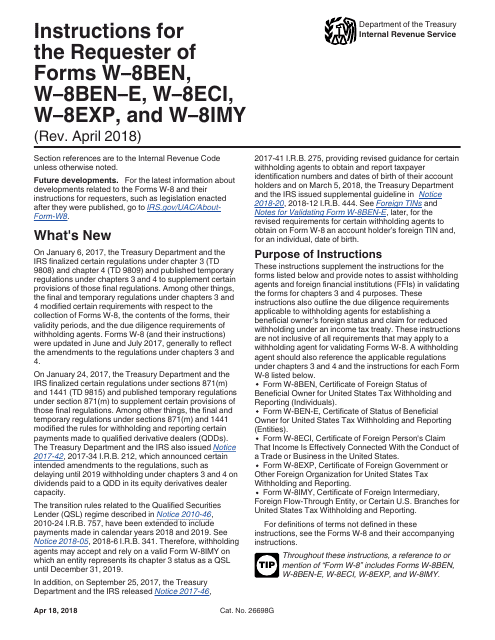

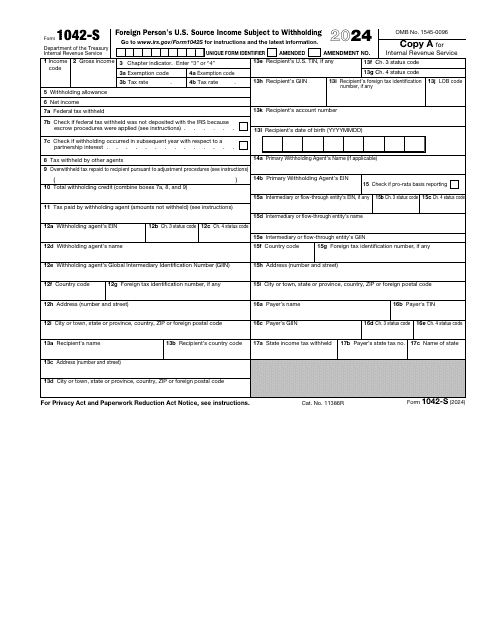

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.

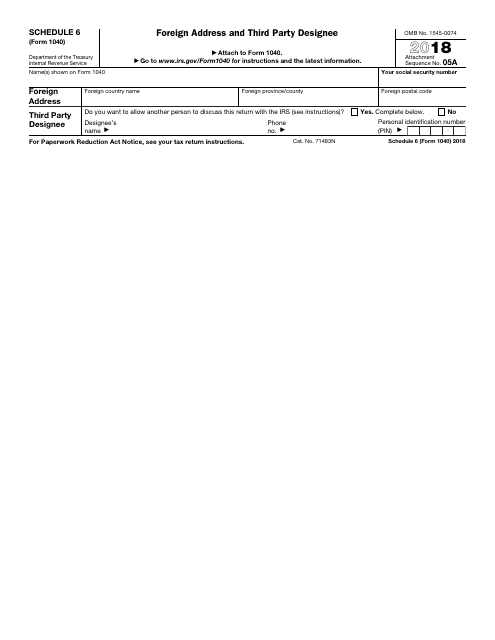

This form is used for providing a foreign address and designating a third party for tax purposes on IRS Form 1040.

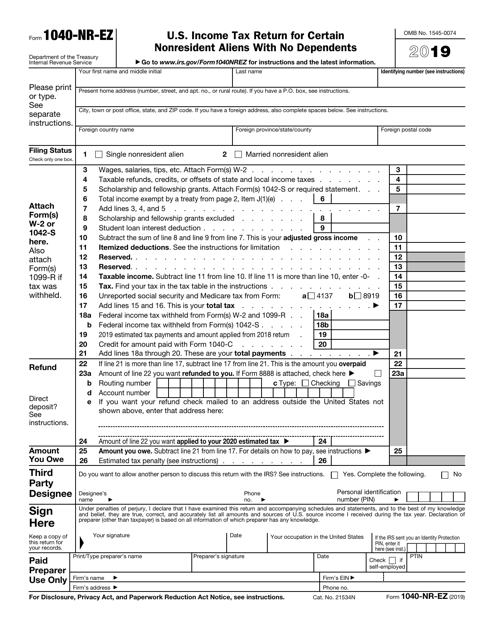

Use this form if you are a non-resident alien (non-United States citizen who has not passed the green card or the substantial presence test) and claim no dependents. This form was issued by the Internal Revenue Service (IRS).

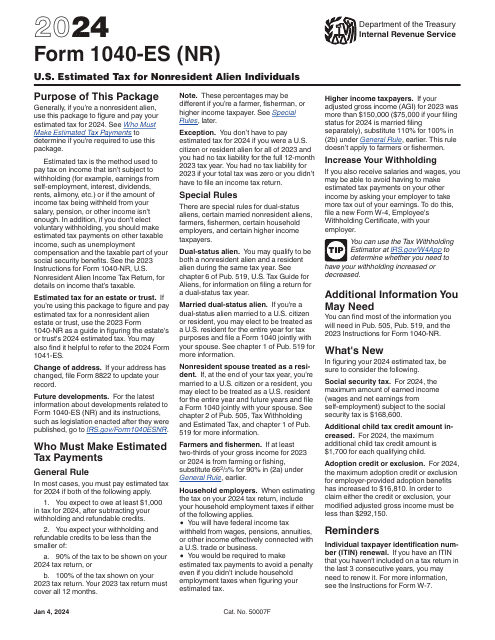

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

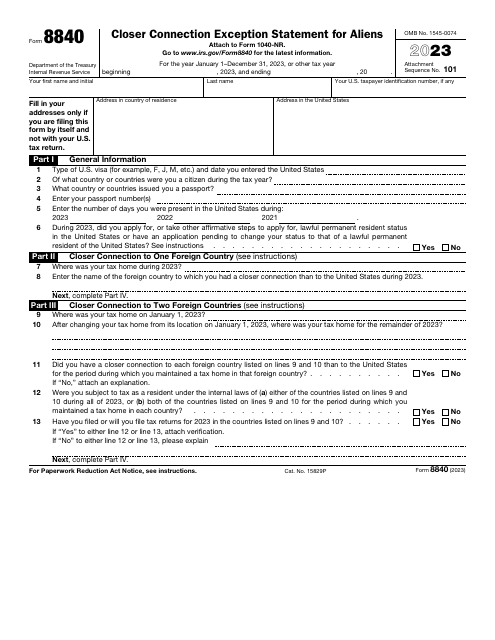

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

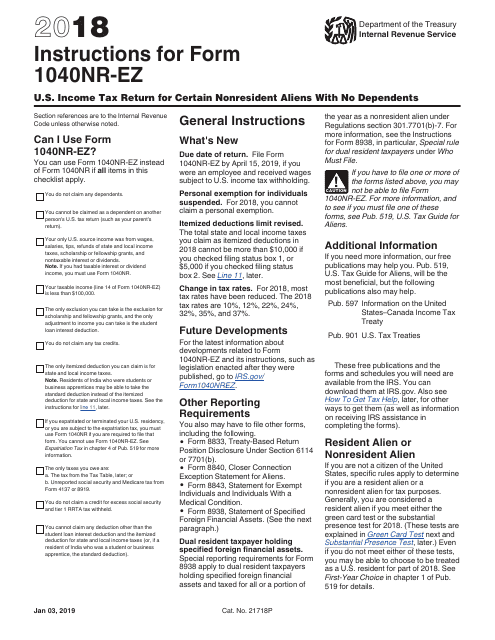

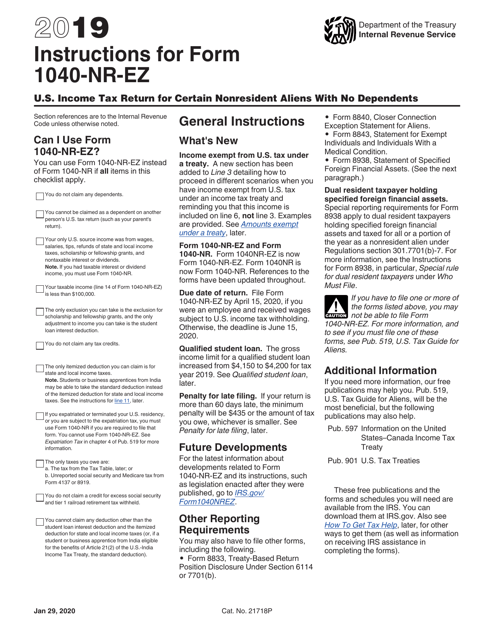

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

This Form is used for filing U.S. income tax return by nonresident aliens with no dependents. It provides instructions on how to report income, deductions, and credits for the tax year.

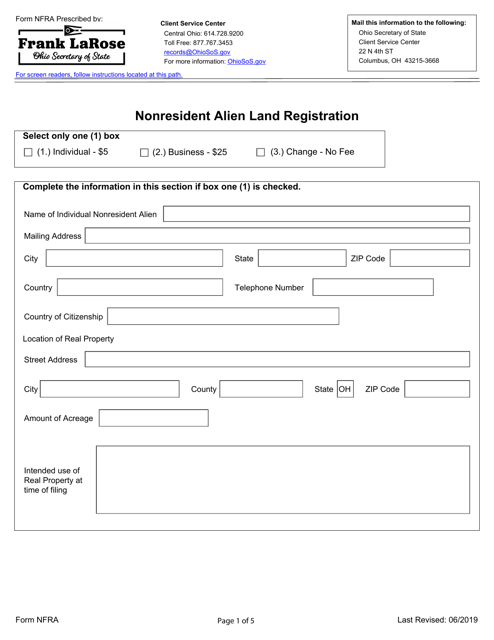

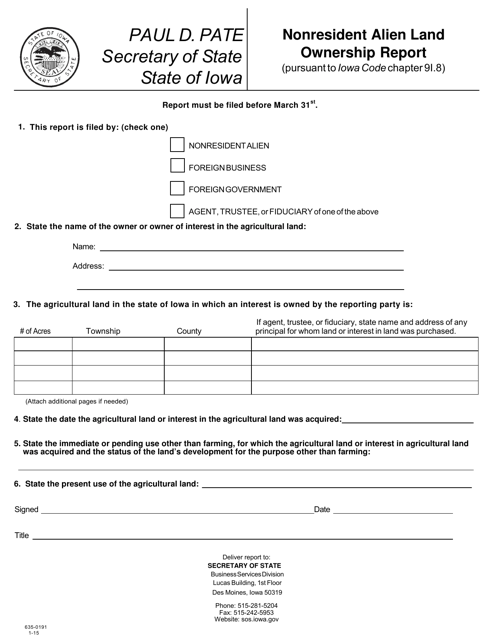

This Form is used for reporting land ownership by nonresident aliens in Iowa.