Trust Law Templates

Trust Law, also known as Trust Laws, is a set of legal principles that governs the establishment and administration of trusts. Trusts are a widely used legal tool for managing and protecting assets, providing for beneficiaries, and ensuring the fulfillment of an individual's wishes even after their passing. Trusts can be created for various purposes, such as estate planning, charitable endeavors, or managing funds for minors or incapacitated individuals.

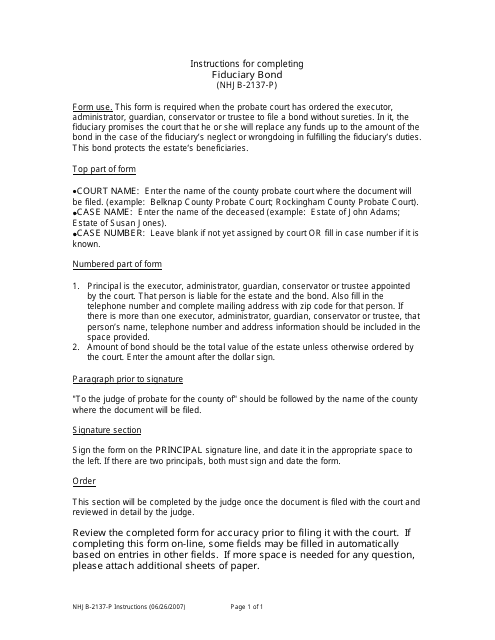

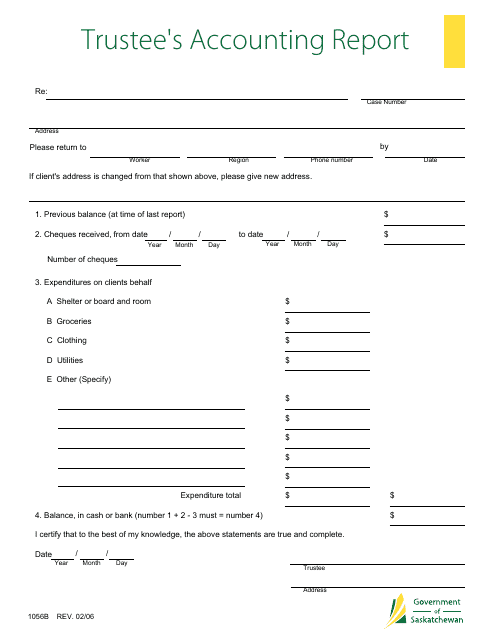

In jurisdictions like New Hampshire and Saskatchewan, Canada, where trust laws are well-established, specific forms and instructions have been created to guide individuals in the process of establishing and managing trusts. For example, in New Hampshire, the Instructions for Form NHJB-2137-P Fiduciary Bond provide guidance on the requirements for obtaining a fiduciary bond in connection with a trust. Similarly, Form 1056B Trustee's Accounting Report in Saskatchewan, Canada, offers a standardized template for trustees to report the financial activities and transactions of a trust.

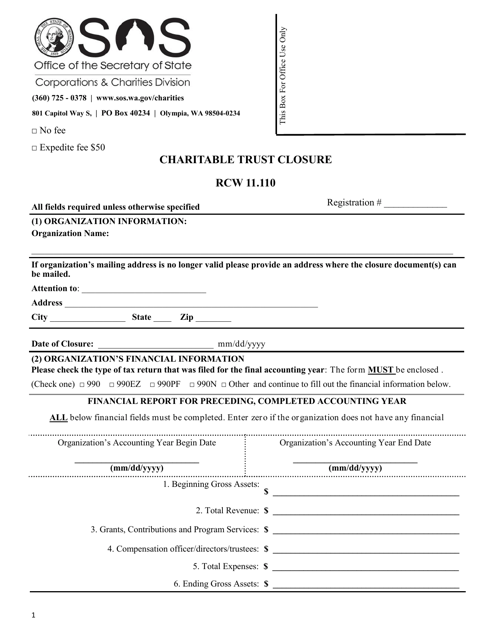

Trust laws also provide mechanisms for the closure or termination of trusts under certain circumstances. In Washington, for instance, the Charitable TrustClosure process ensures that the assets of a charitable trust are distributed according to the intended charitable purpose once the trust has served its purpose or is no longer viable.

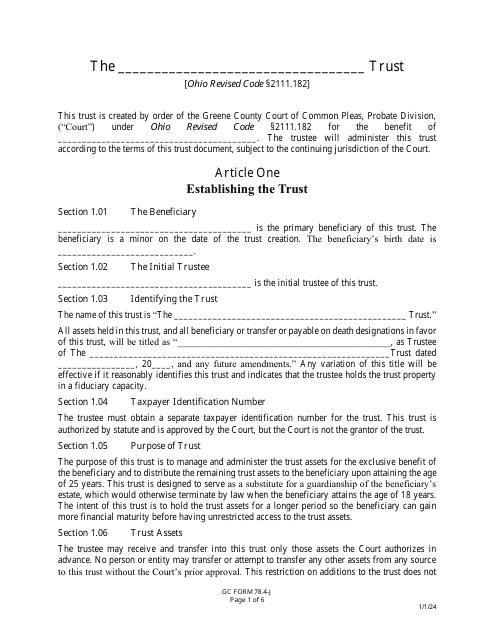

Additionally, trust agreements play a crucial role in establishing the terms and conditions of a trust. Counties like Greene County, Ohio, provide standardized forms such as GC Form 78.4-J Trust Agreement to assist individuals in creating legally binding trust agreements. These agreements outline the responsibilities and powers of the trustee, the beneficiaries' rights, and the distribution of assets.

Understanding trust law is essential for individuals and organizations seeking to protect and manage their assets, fulfill charitable endeavors, or plan for the future. Whether you are looking to establish a trust, administer an existing one, or navigate the legal requirements for trust closure, consulting with legal professionals experienced in trust law is crucial. By availing yourself of the knowledge and guidance provided in trust law documents, you can ensure compliance with legal requirements while effectively managing your assets and protecting the interests of your beneficiaries.

Documents:

7

This Form is used for obtaining a fiduciary bond in the state of New Hampshire. It provides instructions on how to complete and submit the necessary information for the bond application. Follow these instructions carefully to ensure compliance with the state's requirements.

This form is used for reporting the financial activities of a trust as per the regulations in Saskatchewan, Canada. It helps trustees to provide an accounting report for the trust.

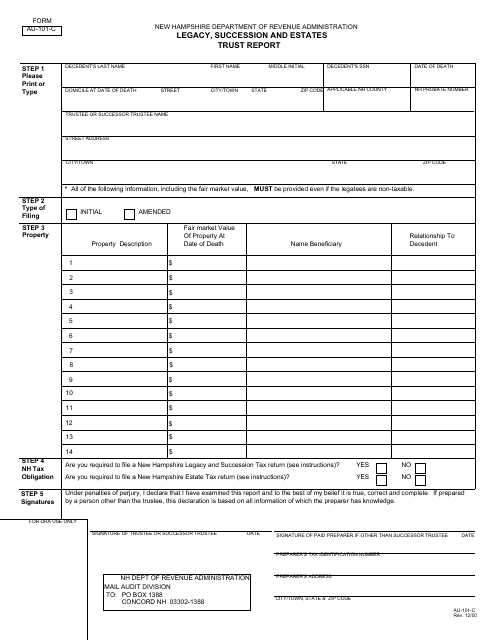

This form is used for reporting legacy, succession, and estate trusts in the state of New Hampshire.

This document is for closing a charitable trust in Washington. It provides the necessary forms and instructions for properly terminating the trust.

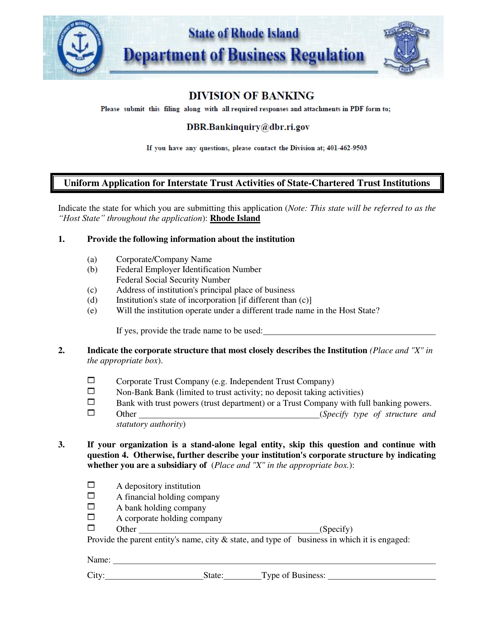

This document is used for applying for interstate trust activities for state-chartered trust institutions in Rhode Island.

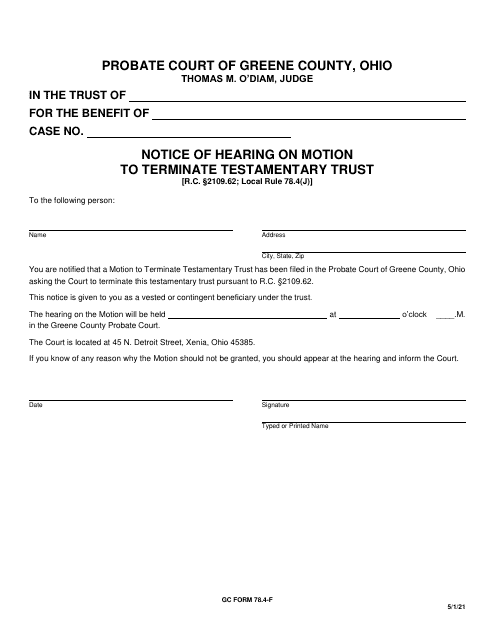

This form is used for notifying the parties involved about a hearing for terminating a testamentary trust in Greene County, Ohio.