Tax Payer Templates

Are you a tax payer looking for information on tax forms and procedures? Our website is your one-stop resource for all things related to tax payer documents. Whether you need to file your taxes, request an installment agreement, or claim a refund, we have the forms and information you need.

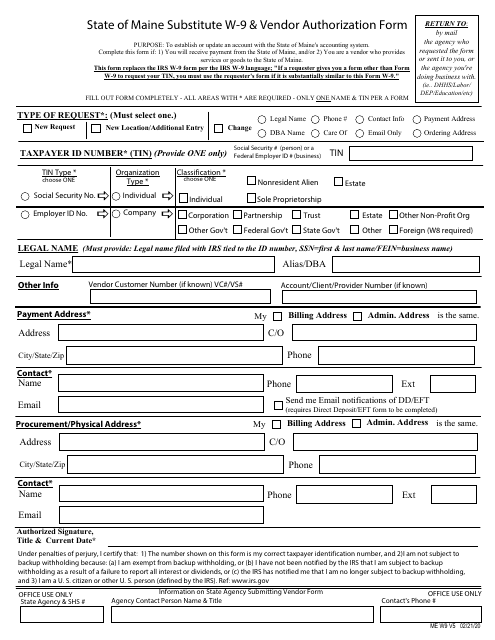

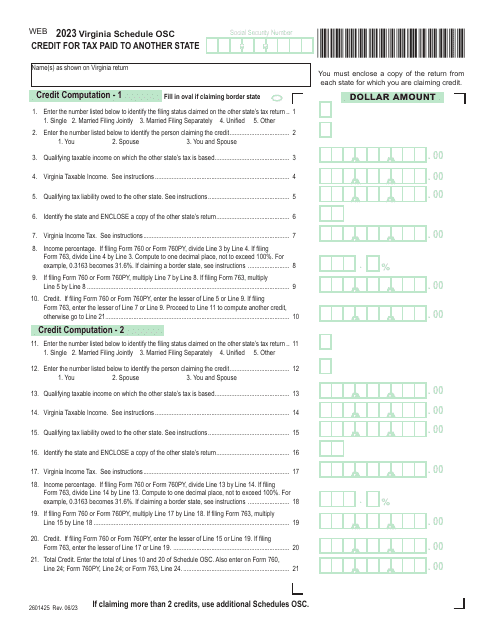

At our site, you can find a wide range of tax payer forms from various states, including the State of Maine, Delaware, Georgia, New York, and more. These forms cover a diverse range of topics, ensuring that you can find the right document for your specific situation.

In addition to providing access to tax payer forms, we also offer guidance and resources to help you navigate the tax filing process. Our experts have years of experience and are here to assist you with any questions or concerns you may have.

So whether you're an individual tax payer, a business owner, or a tax professional, our website is the ultimate destination for tax payer documents. Explore our collection today and take the stress out of tax season.

(Note: If you can provide more specific details about the purpose or focus of the tax payer documents, I can tailor the text accordingly.)

Documents:

25

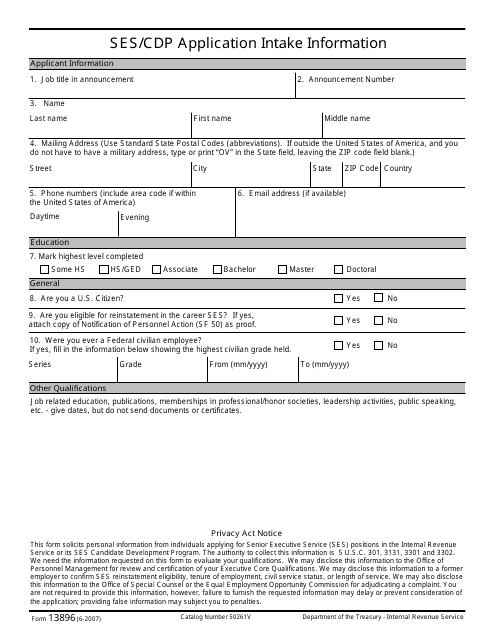

This form is used for applying for a Ses/Cdp Application Intake with the IRS.

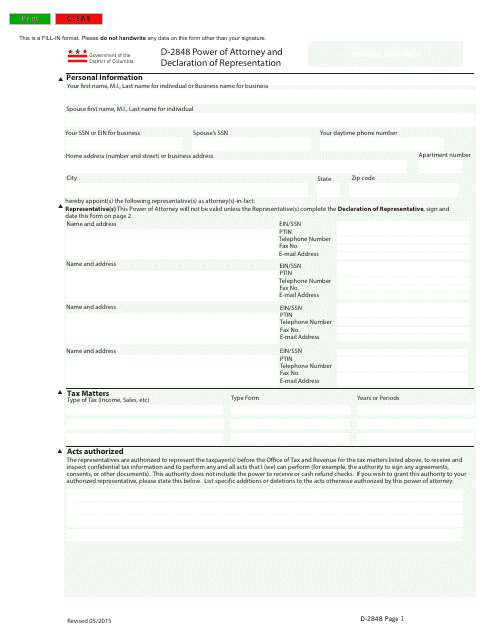

This form is used for granting someone the power of attorney and declaring representation in Washington, D.C.

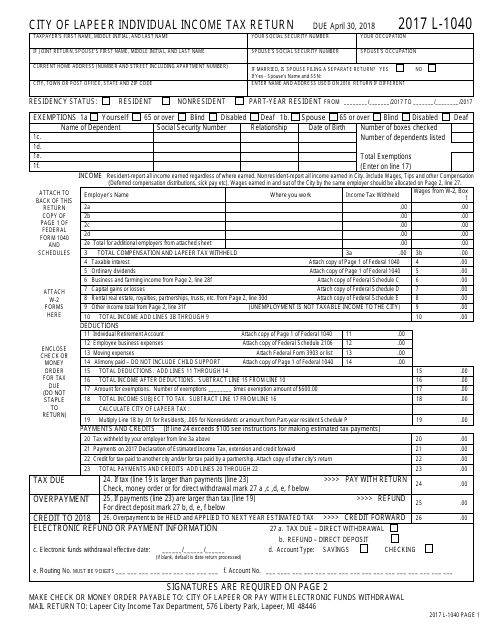

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

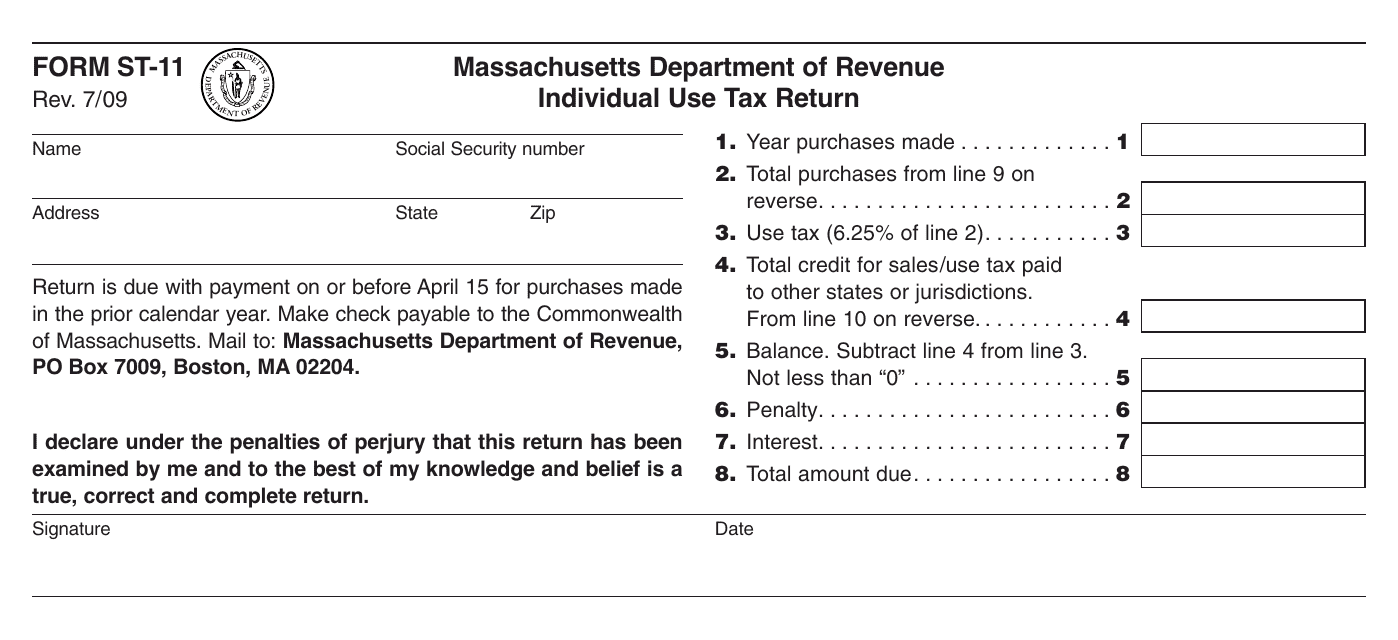

This form is used for reporting and paying use tax by individuals in Massachusetts. Use tax is a tax on goods purchased outside the state of Massachusetts for use within the state.

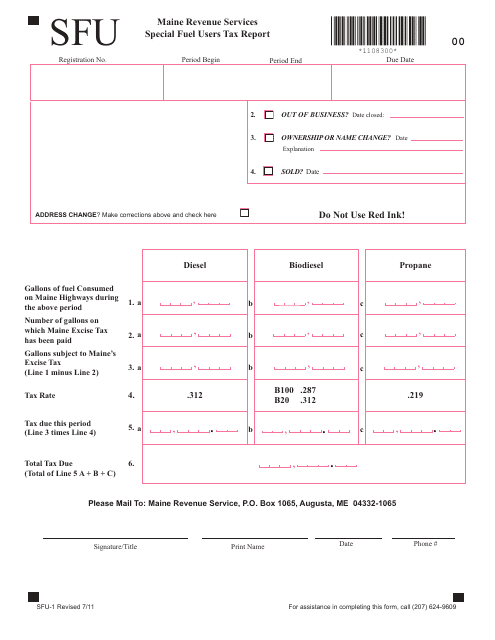

This form is used for reporting taxes on special fuel usage in the state of Maine. It is mandatory for businesses and individuals who use special fuel for their operations to file this report.

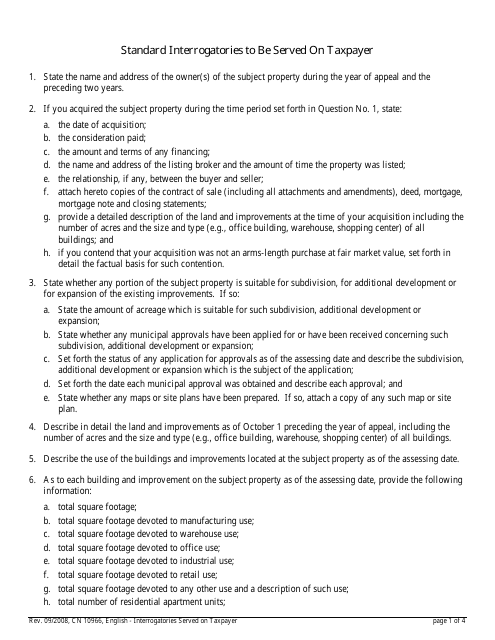

This form is used for requesting information from taxpayers in New Jersey during a tax investigation. It contains standard questions that the taxpayer must answer under oath.

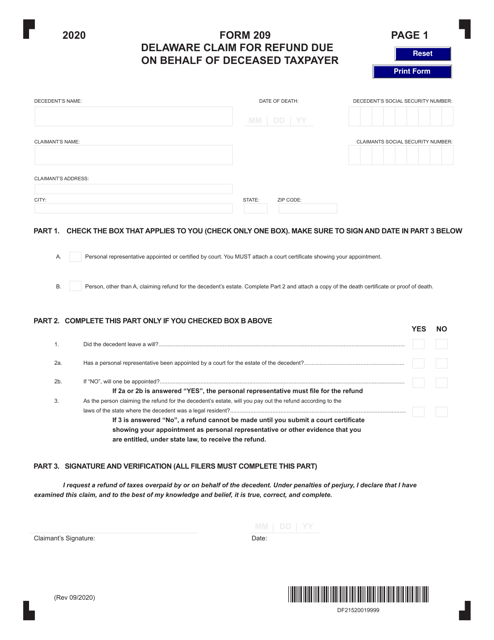

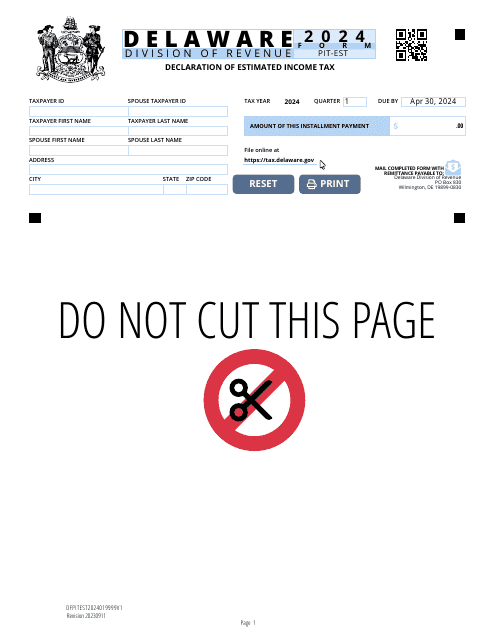

This Form is used for claiming a refund on behalf of a deceased taxpayer in the state of Delaware.

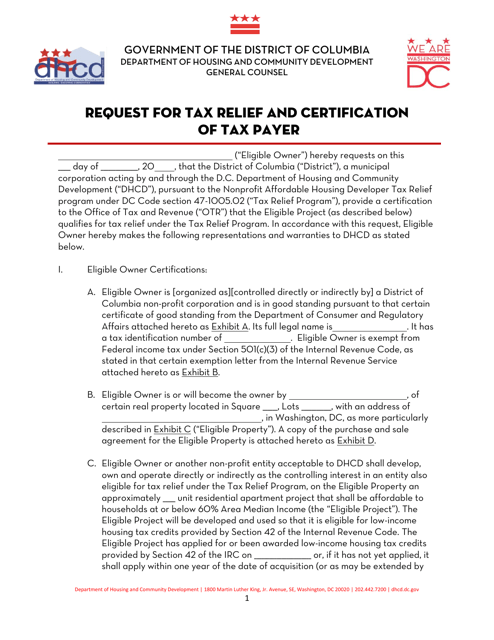

This document is used for requesting tax relief and obtaining certification as a taxpayer in Washington, D.C.

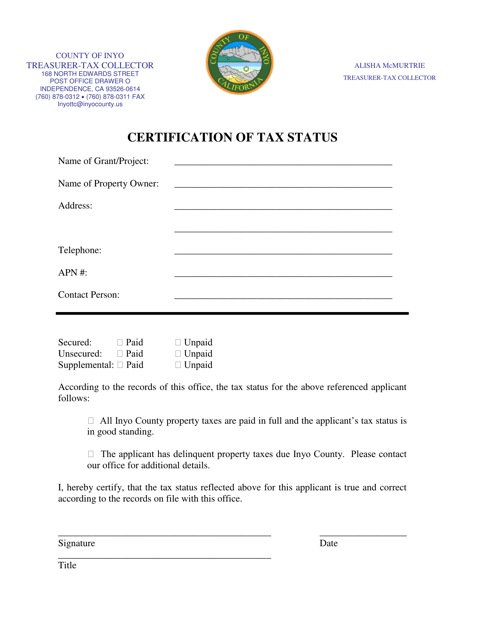

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

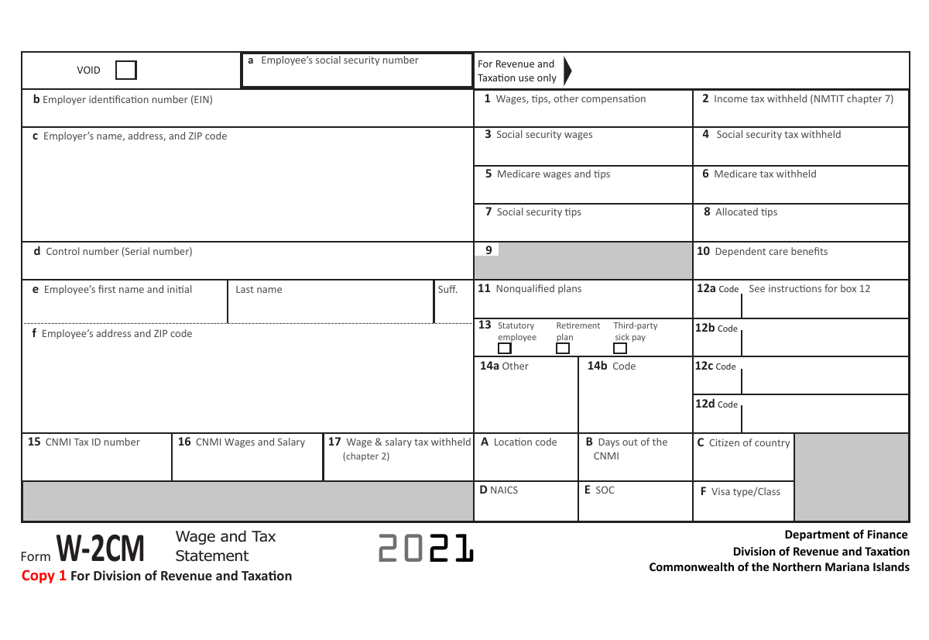

This Form is used for reporting wages and taxes in the Northern Mariana Islands.

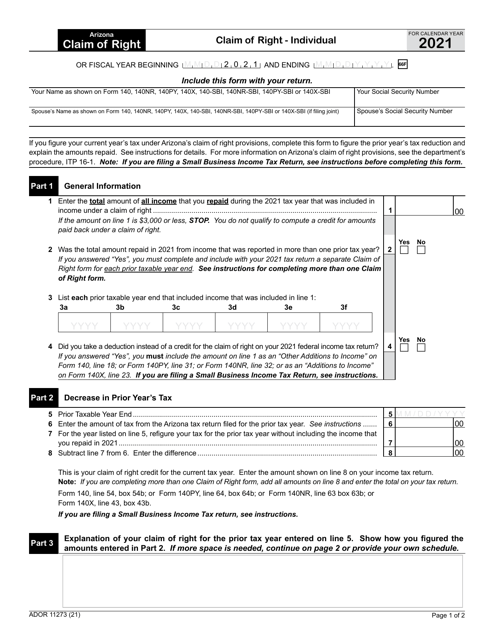

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.

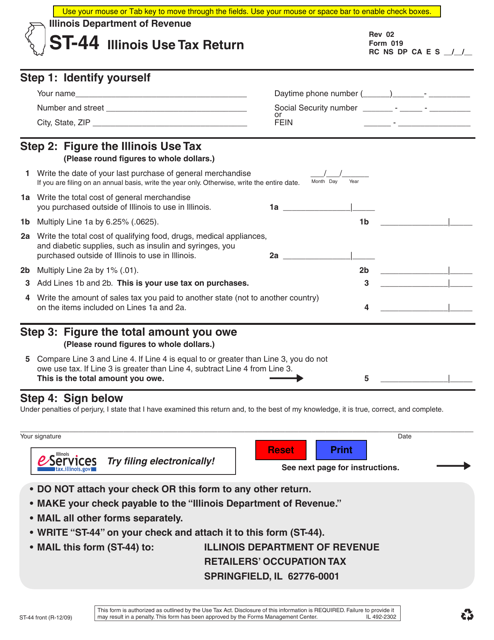

This document is the Use Tax Return Form (ST-44) for the state of Illinois. It is used to report and pay use tax on purchases made from out-of-state retailers when sales tax was not collected.

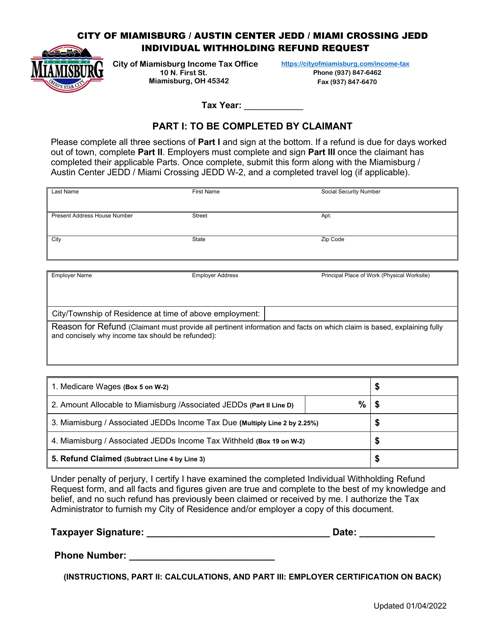

This document is used for requesting a refund of individual withholding taxes paid to the City of Miamisburg, Ohio.

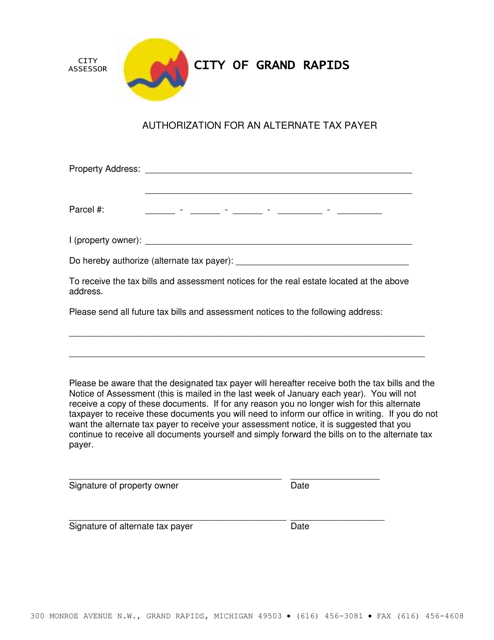

This document is used to authorize an alternate taxpayer in the City of Grand Rapids, Michigan. It allows someone else to file taxes on behalf of the taxpayer.

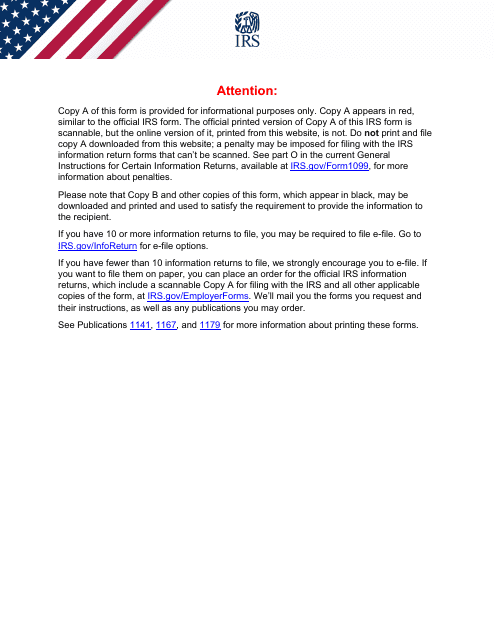

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

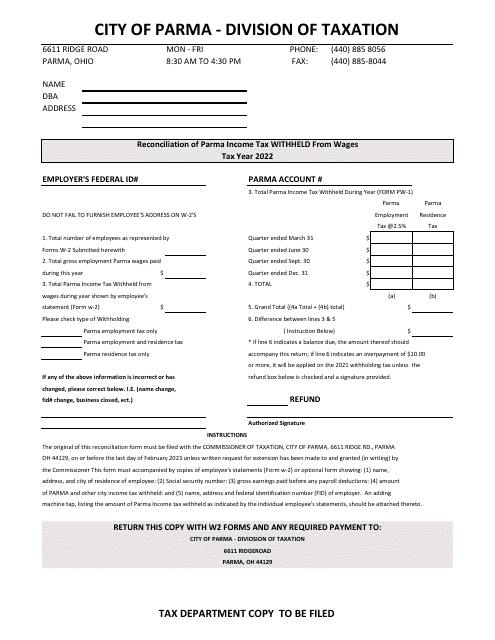

This form is used for reconciling the income tax withheld from wages in the City of Parma, Ohio.