Nicotine Products Templates

Are you a retailer or distributor of nicotine products? Looking for information on taxes, registrations, and licensing requirements for selling these products? Look no further! Our comprehensive collection of documents provides all the resources you need to navigate the complex world of nicotine products.

From tax registration forms, such as the Form TPT-R Tobacco and Nicotine Products Tax Registration in New Jersey, to tax return forms like the Form DR0226 Nicotine Products Tax Return for Non-licensed Distributors in Colorado, our documents cover it all. We understand that each state and country may have different requirements, which is why we have included forms specific to different jurisdictions.

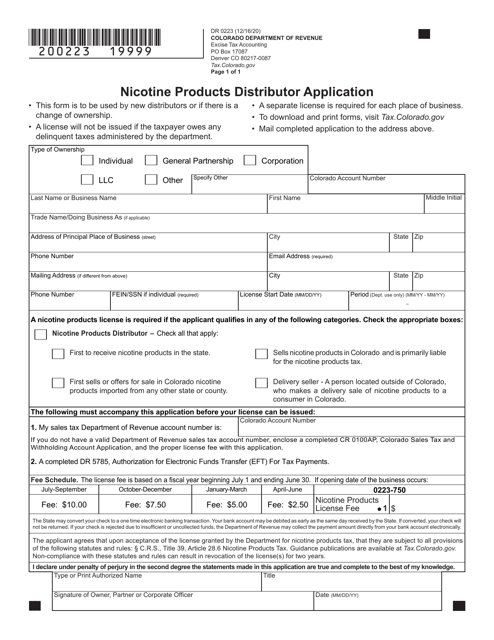

For those looking to start a business in the nicotine products industry, we have included application forms like the Form DR0223 Nicotine Products Distributor Application in Colorado. These forms will guide you through the process of obtaining the necessary licenses and permits to operate legally.

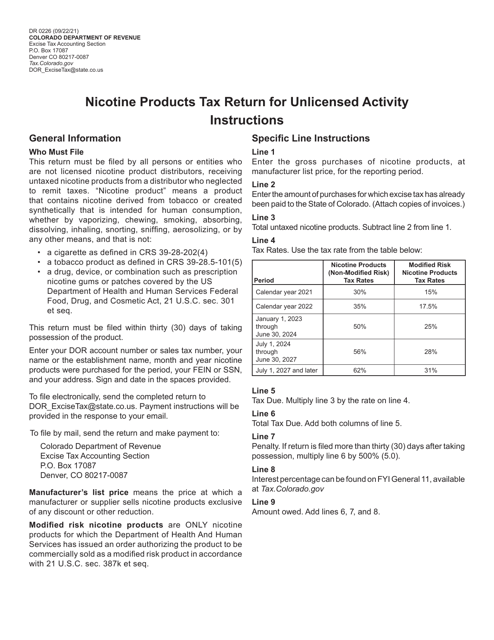

Even if you are not yet licensed or registered, our collection has resources for you too. Take a look at the Form DR0226 Nicotine Products Tax Return for Unlicensed Activity in Colorado, which provides guidance on reporting and paying taxes for unlicensed activity.

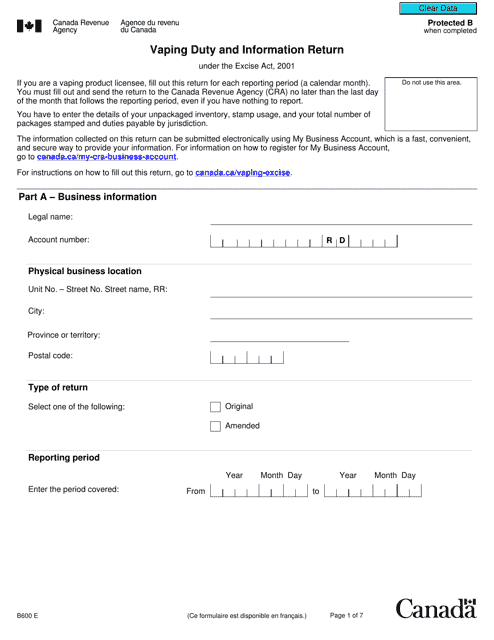

Our collection is not limited to the United States; we also have resources for our Canadian neighbors. The Form B600 Vaping Duty and Information Return in Canada is included for those who need to comply with Canadian regulations and taxation laws.

Whether you are a retailer, distributor, or someone interested in entering the nicotine products industry, our documents have been carefully curated to provide you with the information you need. Start exploring today and ensure compliance with the regulations and requirements of your jurisdiction.

Documents:

5

This form is used for applying as a nicotine products distributor in Colorado.

This form is used for reporting vaping duty and providing information to the Canadian government.