Third Party Network Templates

Welcome to our webpage dedicated to Third Party Network Transactions. In the world of finance and tax reporting, transactions conducted through third-party networks are becoming increasingly popular. These transactions usually involve payments made through payment cards or other electronic means, facilitated by a third-party network.

At our website, you will find a comprehensive collection of documents providing instructions and guidance on reporting Third Party Network Transactions to the IRS and other relevant authorities. We understand that navigating the world of tax compliance can be challenging, especially when it comes to reporting these specific types of transactions. That's why we have gathered an extensive range of resources to assist both individuals and businesses in meeting their reporting obligations accurately.

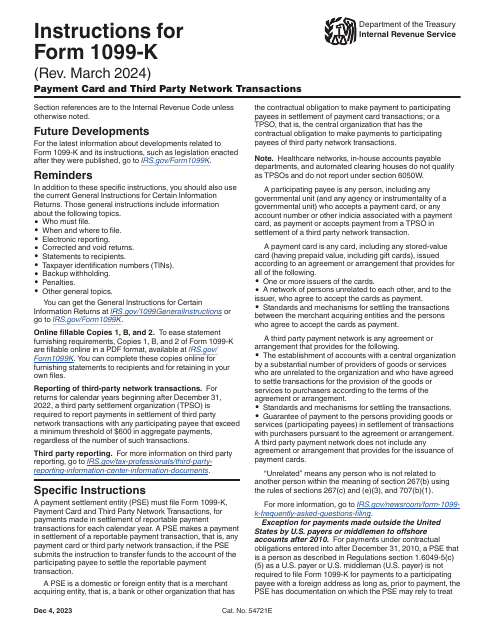

Our collection of documents includes instructions for completing IRS Form 1099-K, which is the primary form used to report Payment Card and Third Party Network Transactions to the Internal Revenue Service. These instructions will guide you through the process of accurately reporting your transactions, ensuring that you comply with the applicable tax laws and regulations.

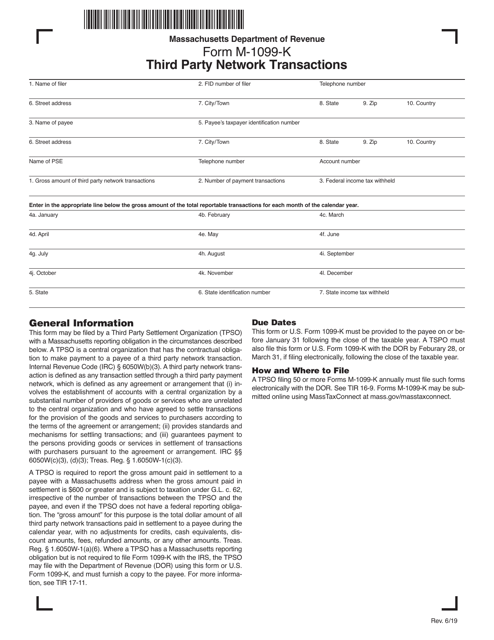

Furthermore, we also provide resources specific to certain states, such as the Form M-1099-K for Third Party Network Transactions in Massachusetts. These state-specific documents will help residents and businesses in Massachusetts understand the unique requirements and reporting obligations in their jurisdiction.

At our webpage, you will find everything you need to know about Third Party Network Transactions, including the legal requirements, reporting deadlines, and best practices for accurate reporting. Our aim is to simplify the complex world of tax compliance, providing you with the resources and guidance you need to fulfill your reporting obligations with confidence.

Whether you are an individual seller on an online marketplace or a business using third-party networks to facilitate transactions, our comprehensive collection of documents will help you navigate the realm of Third Party Network Transactions. Stay up to date with the ever-changing tax landscape and ensure your compliance by exploring our valuable resources today.

Documents:

5

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.