Reverse Mortgage Templates

Are you considering a reverse mortgage? Discover how this unique financial tool can unlock the equity in your home, providing you with a tax-free source of income during your retirement years. Also known as reverse mortgages or equity conversion mortgages, this type of loan allows homeowners age 62 and older to convert a portion of their home's equity into cash without having to sell their property or make monthly mortgage payments.

With a reverse mortgage, you remain the owner of your home and can continue to live in it while receiving your loan proceeds. The amount you can borrow depends on factors such as your age, the value of your home, and current interest rates. The loan is typically repaid when you permanently move out of the home or pass away, at which point the home is sold, and the loan is repaid from the proceeds.

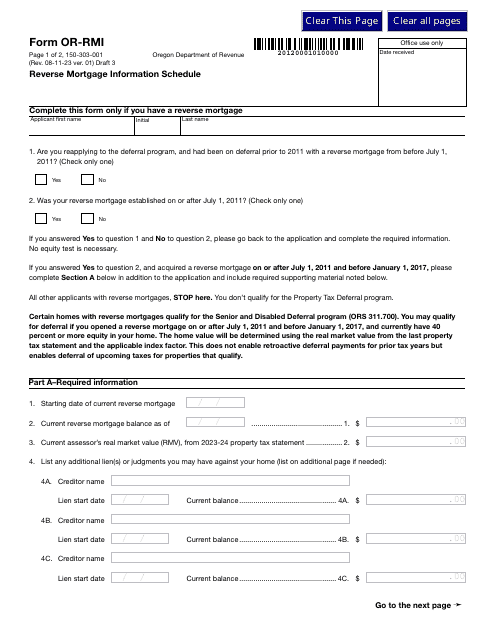

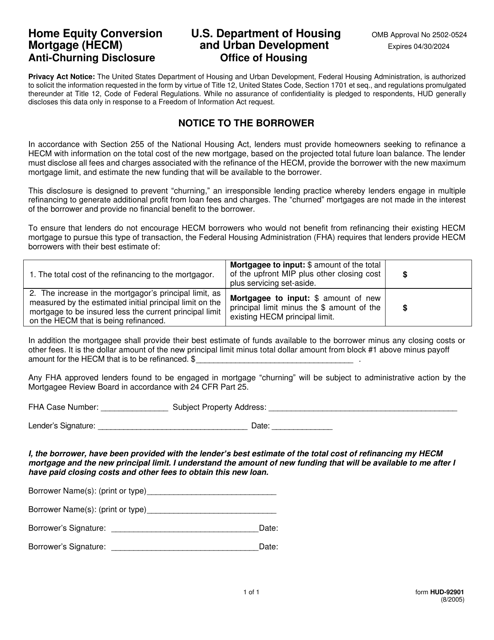

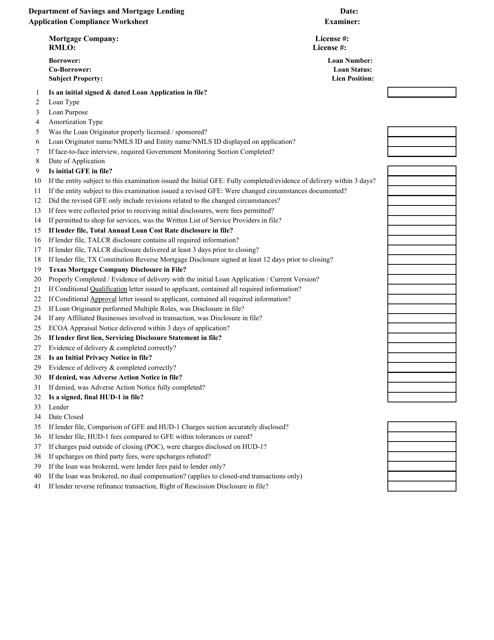

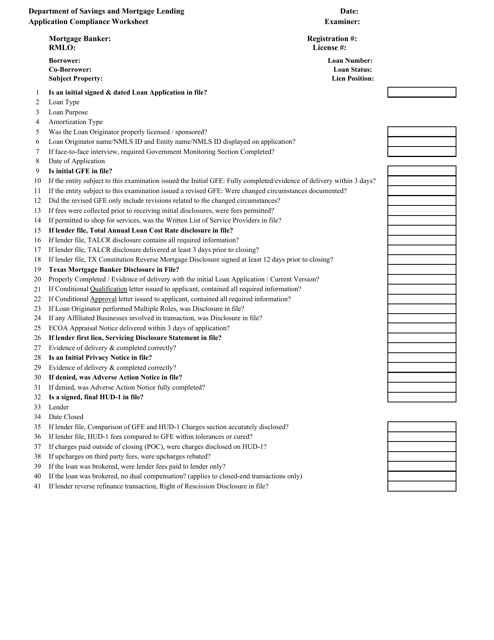

Our comprehensive collection of reverse mortgage documents, such as the Reverse Mortgage Information Schedule and the Home Equity Conversion Mortgage (HECM) Anti-churning Disclosure form, will guide you through the application process. Whether you are located in Oregon, Texas, New York, or anywhere else in the United States, our documents are tailored to meet regional requirements.

At USA, Canada, and other countries document knowledge system, we understand the importance of having access to the right documents when applying for a reverse mortgage. Our reverse mortgage documents, also referred to as reverse mortgages or equity conversion mortgages, provide clear and concise information to help you make informed decisions about your financial future.

Unlock the potential of your home and secure your retirement with a reverse mortgage. Explore our comprehensive collection of reverse mortgage documents today and take the first step towards financial freedom.

Documents:

7

This form is used for disclosing information related to anti-churning in Home Equity Conversion Mortgages (HECMs).

This document is used by a mortgage company in Texas to assess compliance with regulations for reverse mortgages. It helps ensure that all necessary documents and information are in order for the application process.

This Form is used for assessing the compliance of reverse mortgage applications by mortgage bankers in Texas.

This document is a checklist for a new application process for a company that has HECM (Home Equity Conversion Mortgage) lending authority in New York for reverse mortgages.