Capital Contribution Templates

When starting a business, it is essential to understand the concept of capital contribution. The term capital contribution refers to the funds or assets that individuals or partners invest in a company in exchange for ownership or partnership rights. These contributions play a crucial role in the financial stability and growth of a business.

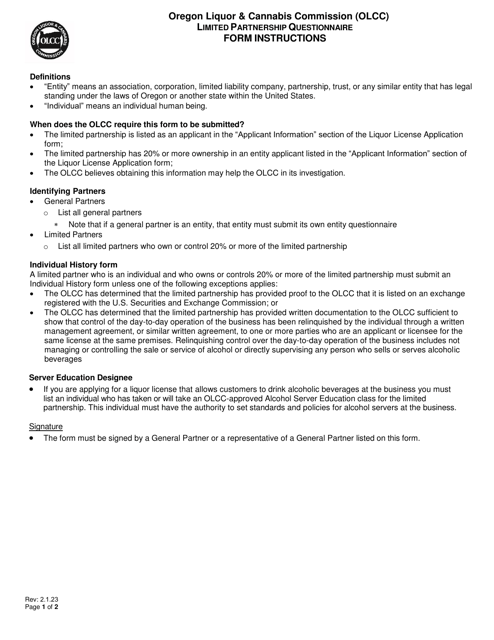

At USA, Canada and other countries document knowledge system, we understand the significance of capital contributions in the business world. We provide a comprehensive collection of documents that cover various aspects of capital contributions. Our document group includes templates such as the Limited Liability Company (LLC) Operating Agreement, Partnership Agreement, Single-Member LLC Operating Agreement, and Multi-Member LLC Operating Agreement.

These documents serve as legal agreements between business partners and outline the terms and conditions related to capital contributions. They provide a clear understanding of each partner's investment and the rights and responsibilities associated with the contributed capital.

Our range of documents caters to different business structures and jurisdictions, including Louisiana, Arkansas, and Kentucky. Whether you are forming an LLC, entering a partnership, or establishing a single-member company, our templates offer a structured and legally sound approach to managing capital contributions.

By using our capital contribution documents, you can ensure that your business operates smoothly, with transparent guidelines on how capital contributions are made, managed, and accounted for. These resources offer flexibility and customization options, enabling you to adapt them according to your specific business needs.

Trust USA, Canada and other countries document knowledge system to provide you with reliable and comprehensive documentation solutions related to capital contributions. Start your business venture on the right track by investing in the proper legal framework for managing capital contributions.

Documents:

11

This document is a legal agreement form used for forming a Limited Liability Company (LLC) in the state of Delaware. It outlines the rights, responsibilities, and obligations of the LLC members.

This document acts as the key legal agreement of any LLC and contains its contact details, describes the purpose of the business, outlines the financial relationship between the company members, and their rights and duties as business managers.

This is a legal contract signed by individuals who intend to become partners and form a company with the intent of making a profit.

This agreement is used in Arizona and should clearly lay out all of the information regarding the structure of a business and the daily business operations that occur.

This document is used in Delaware and contains all of the necessary information about the organizational structure of a business and any other relevant information relating to the business.

This type of agreement is designed for sole business owners that have their business registered in Louisiana.

This is a legally enforceable contract used in Arkansas and signed by several owners of the limited liability company who agree upon the most crucial elements of their commercial endeavors.

To be sure your limited liability company owned by two or more people conducts its business activities following its own rules residents of Kentucky should use this type of template.

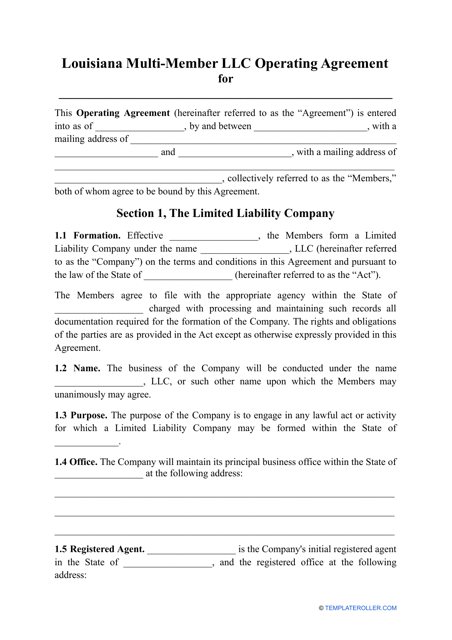

This is a document used in Louisiana that describes the basics of the company that has several owners and contains the rules to follow in the event of a disagreement between the members.

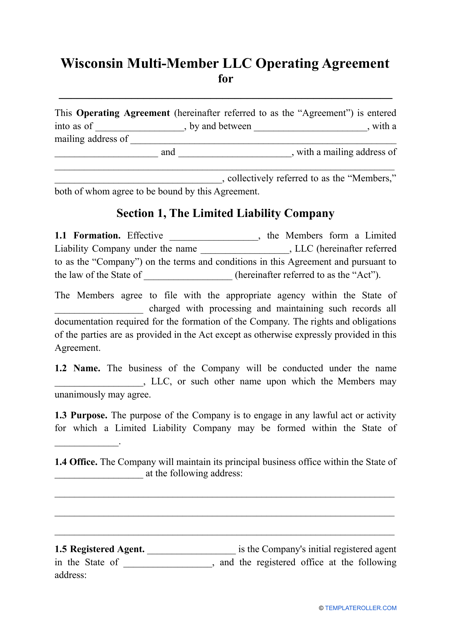

Spell out the terms and conditions all the owners of the limited liability company need to follow with the help of this type of template in the state of Wisconsin.