Wage Tax Templates

Are you looking for information about wage taxes? If so, you've come to the right place. Wage taxes are a type of tax that is withheld from an individual's wages or salary. This tax is typically used to fund government programs and services.

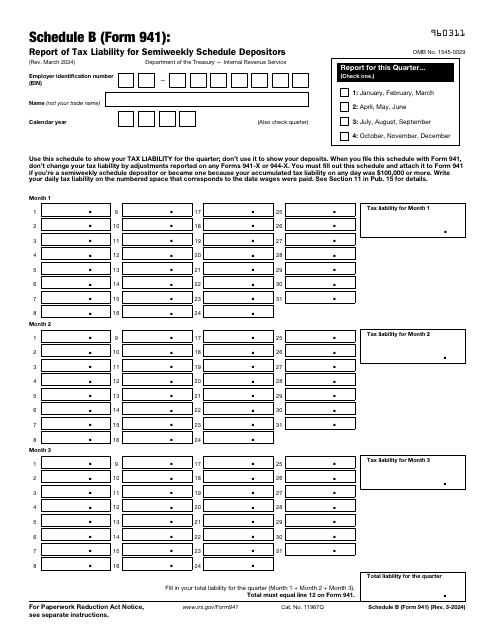

Wage taxes can vary depending on the country or state in which you live. In the United States, the Internal Revenue Service (IRS) collects and manages wage taxes. One example of a document related to wage taxes is the IRS Form 941 Schedule B, which is used to report tax liability for semiweekly schedule depositors.

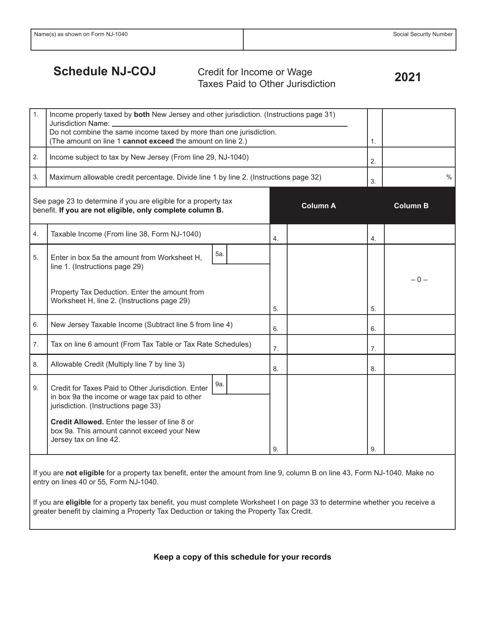

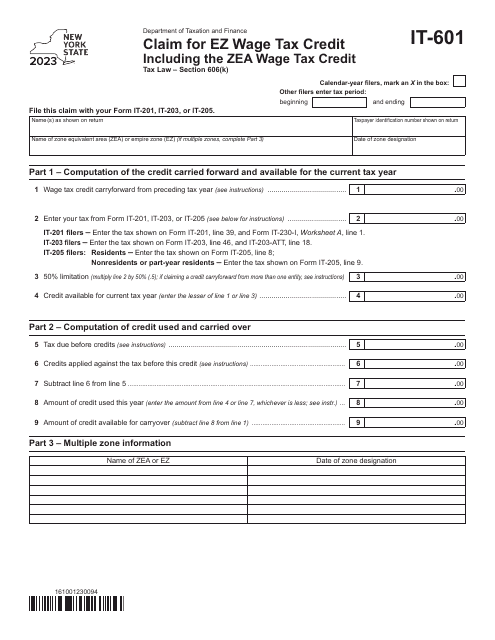

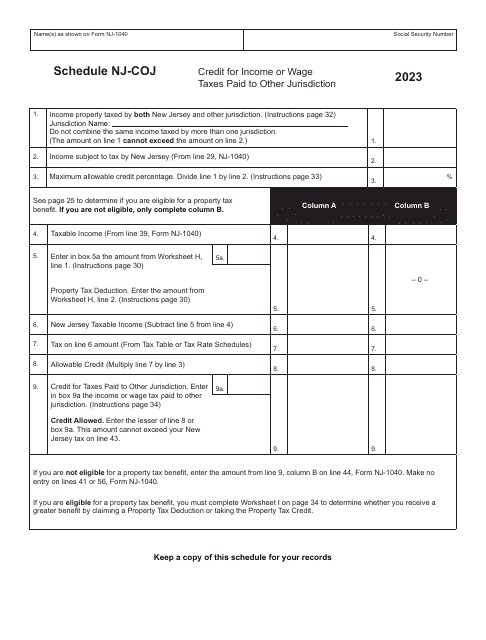

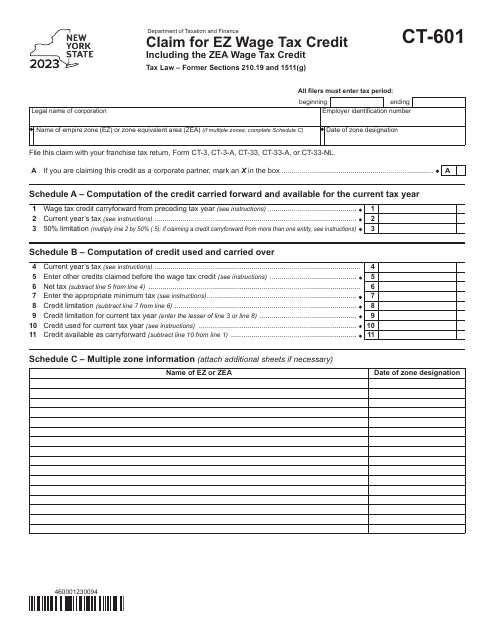

Different states may also have their own wage tax requirements. For example, in New York, individuals can claim the Ez Wage Tax Credit, which is outlined in Form IT-601. Similarly, residents of New Jersey may be eligible for the Credit for Income or Wage Taxes Paid to Other Jurisdiction, which can be claimed using Schedule NJ-COJ.

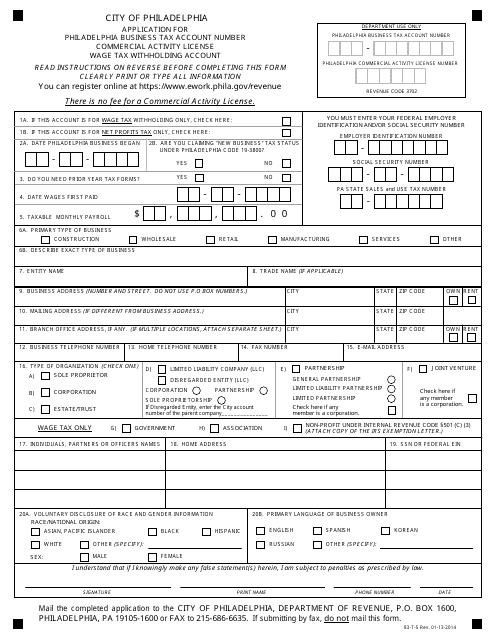

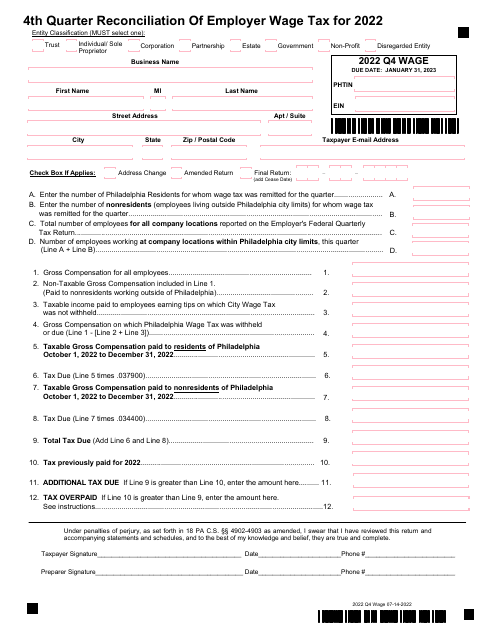

Wage taxes are not only collected at the federal and state levels but also at the local level. For instance, the City of Philadelphia in Pennsylvania requires employers to reconcile their wage taxes on a quarterly basis using the 4th Quarter Reconciliation of Employer Wage Tax form.

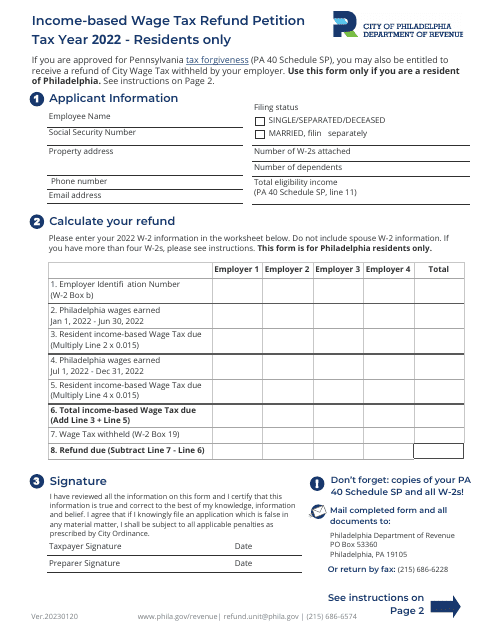

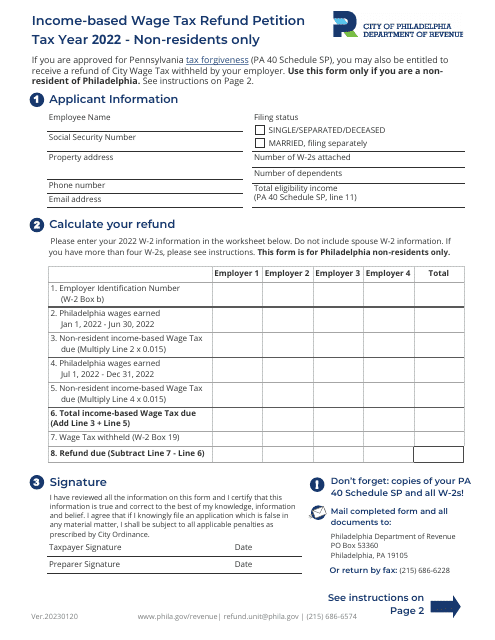

If you are a non-resident of Philadelphia, you may also be eligible to petition for an income-based wage tax refund. This document is specifically designed for non-residents and can be obtained from the City of Philadelphia.

Whether you need to file your wage taxes with the IRS or claim a tax credit in your state, it's essential to have the right documentation. Understanding the different forms and requirements is crucial to ensuring compliance with wage tax regulations.

At our website, you can find more information about wage taxes and the various documents associated with them. We aim to provide you with a comprehensive resource on all things related to wage taxes, including step-by-step guides, frequently asked questions, and additional resources to make the process as straightforward as possible.

So, if you're looking for information on wage taxes, be sure to explore our website and find the resources you need.

Documents:

16

This form is used for applying for a business tax account number, commercial activity license, and wage tax withholding account in the City of Philadelphia, Pennsylvania.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This document is used for reconciling employer wage tax for the 4th quarter in the City of Philadelphia, Pennsylvania.

This document is for non-residents of Philadelphia, Pennsylvania to petition for a refund of income-based wage tax.

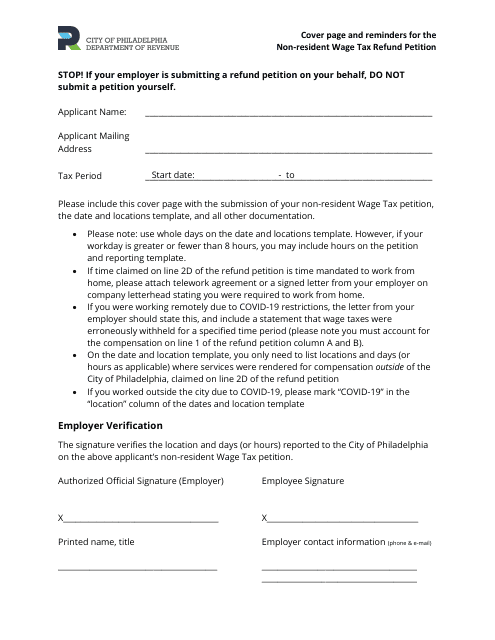

This document provides information about the dates and locations for non-residents to claim their wage tax refund in the City of Philadelphia, Pennsylvania.