Tax Deadline Templates

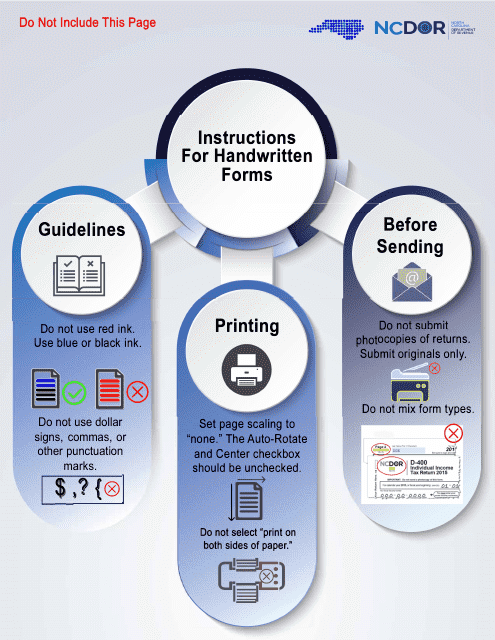

Are you feeling overwhelmed by tax season? Don't worry, we've got you covered. Our tax deadline services provide you with all the information you need to meet your tax obligations and avoid any penalties. Whether you're an individual, a partnership, or a corporation, our extensive collection of tax forms and instructions will guide you through the process.

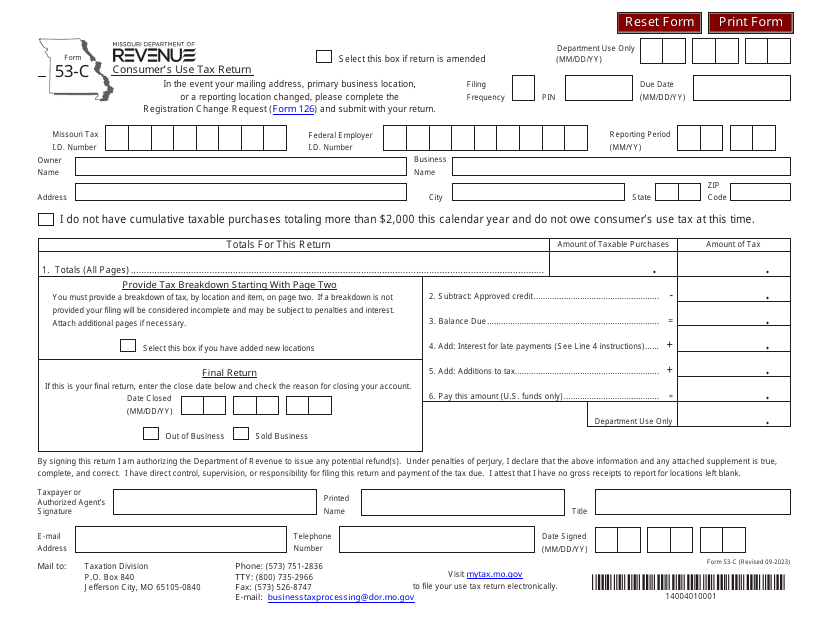

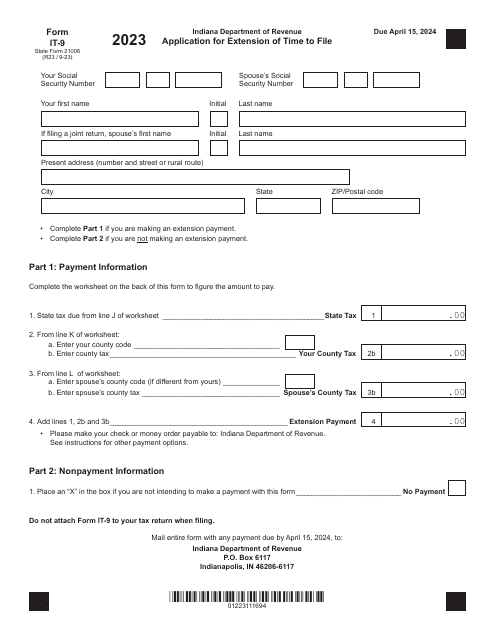

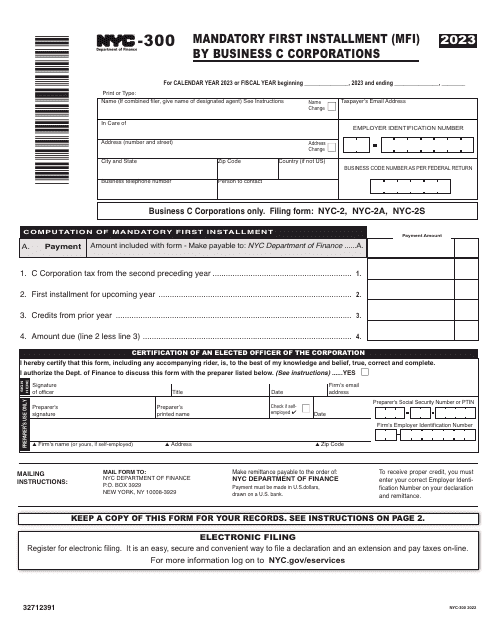

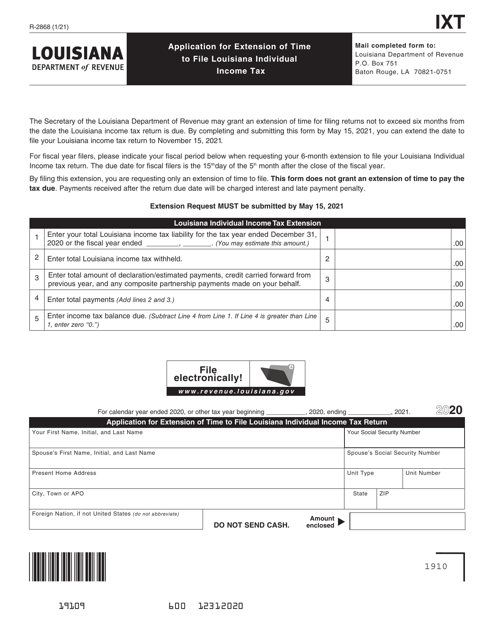

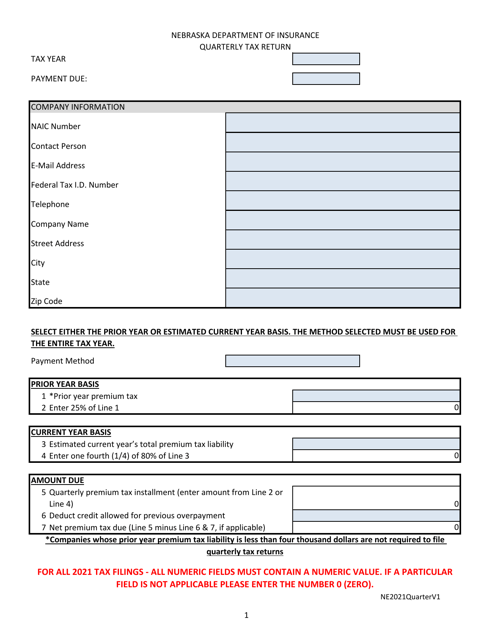

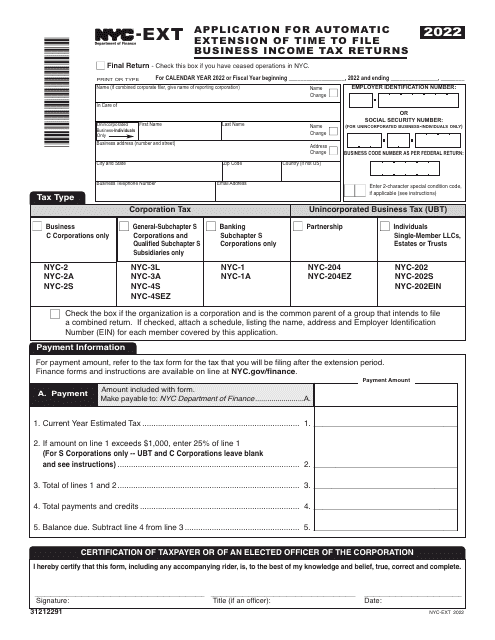

Our tax deadline resources include a variety of documents from different states, ensuring that you have access to the specific information you need for your location. With alternate names such as tax deadlines and tax form deadlines, you can easily find the documents you need to stay on track.

Don't let the stress of tax season get the better of you. Explore our tax deadline services today and maximize your chances of meeting your tax obligations on time. Let us take the hassle out of tax season so you can focus on what's important to you.

Related Articles

Documents:

52

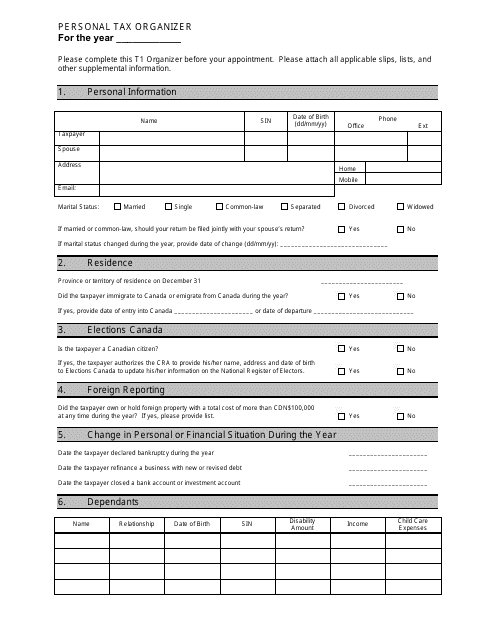

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

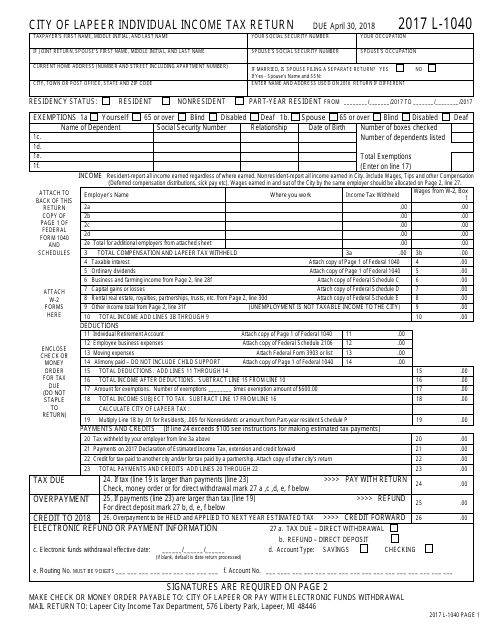

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

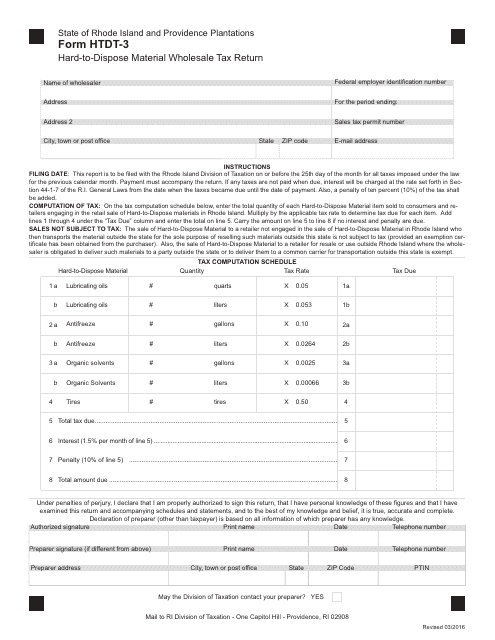

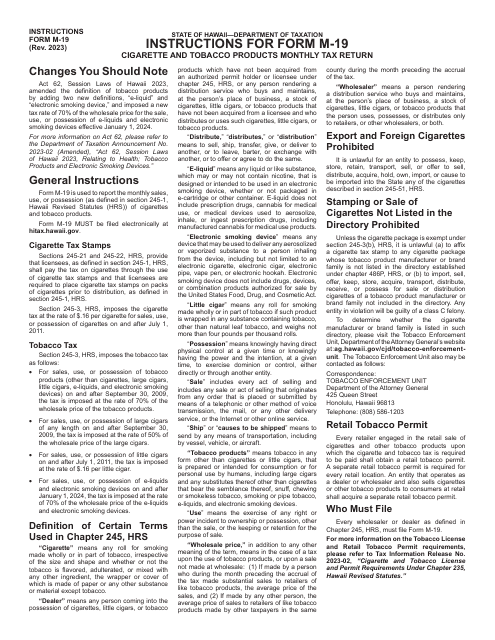

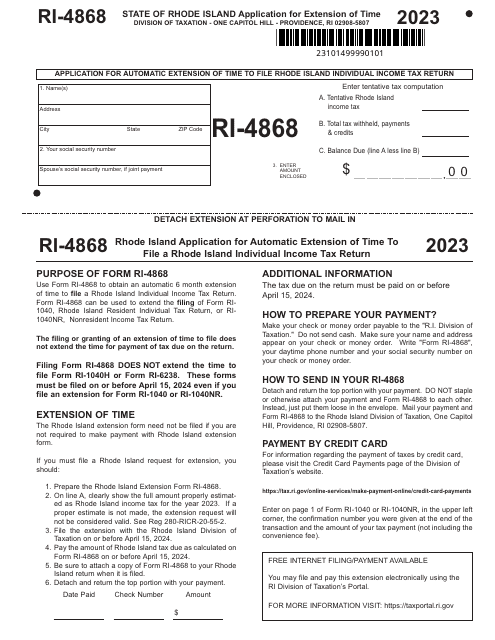

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

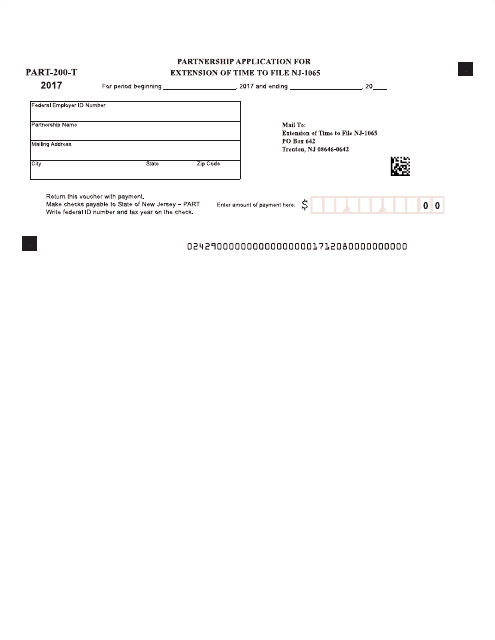

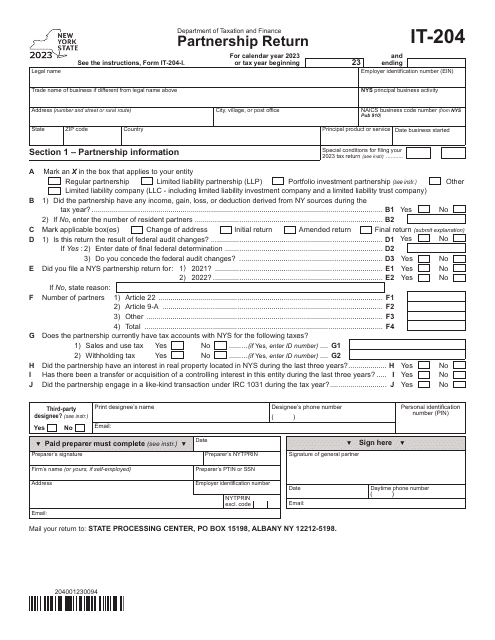

This Form is used to request an extension of time to file the New Jersey Partnership Return (Form NJ-1065).

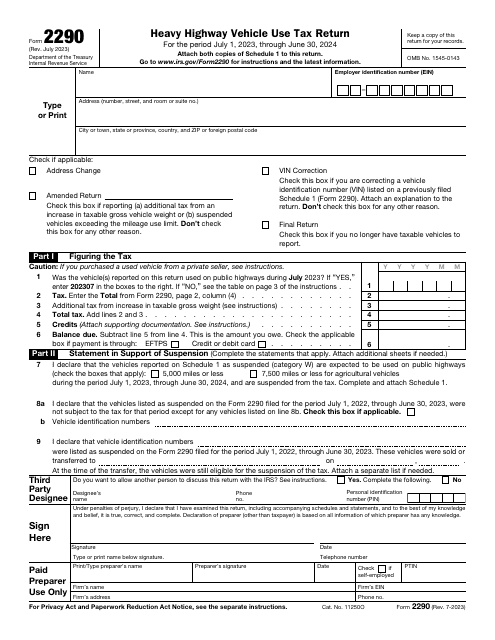

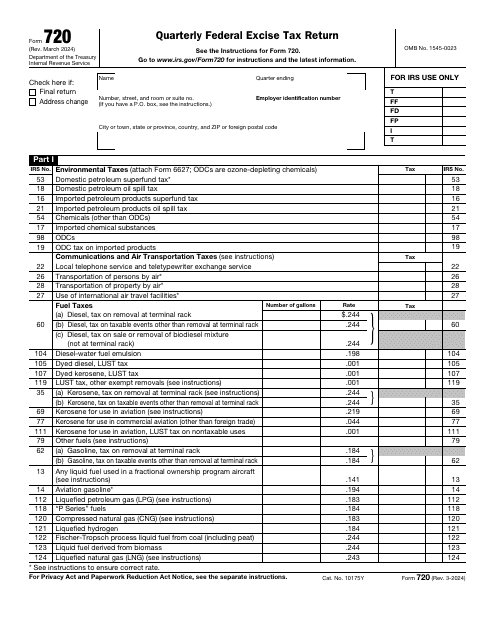

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

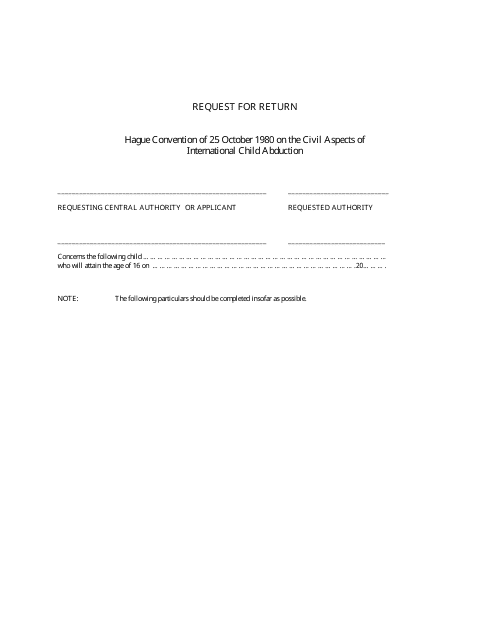

This document is used to request a return in the province of Saskatchewan, Canada.

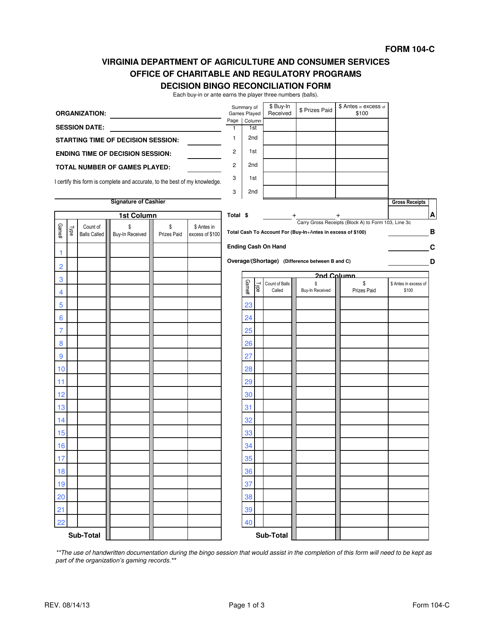

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

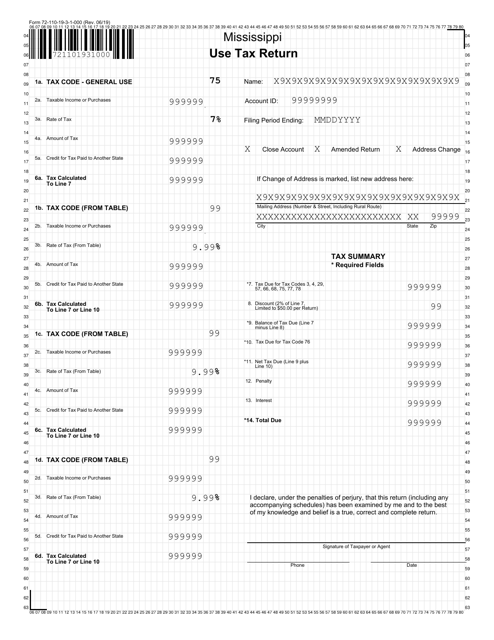

This form is used for reporting and paying use tax in the state of Mississippi. Use tax is a tax on goods and services purchased outside of the state but used within Mississippi.

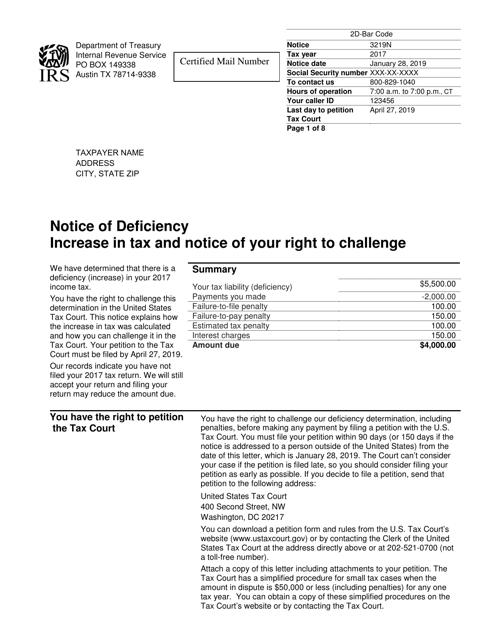

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

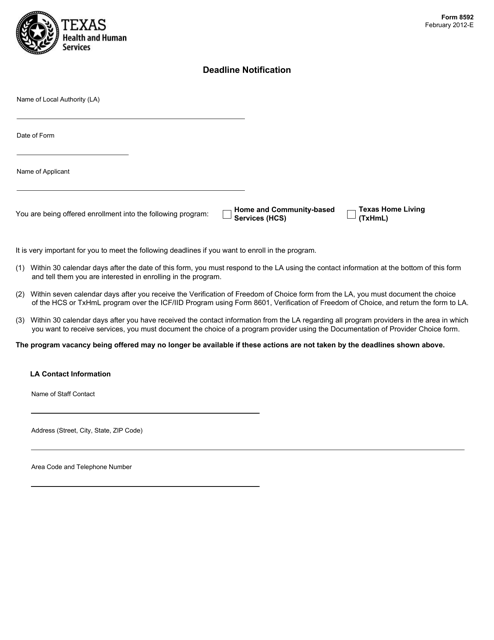

This form is used for notifying the deadline for Form 8592 in the state of Texas.

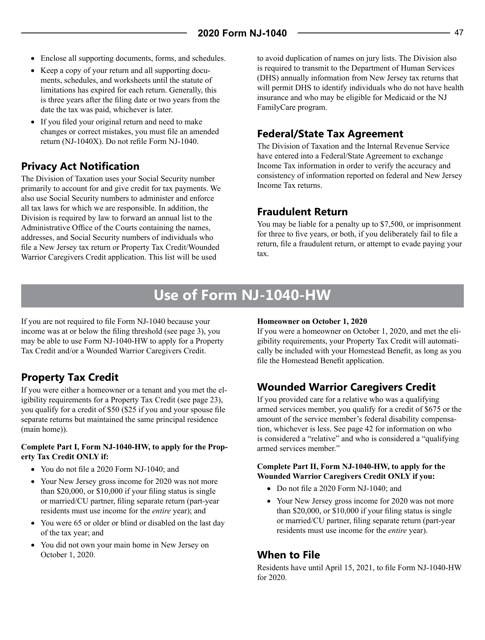

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.

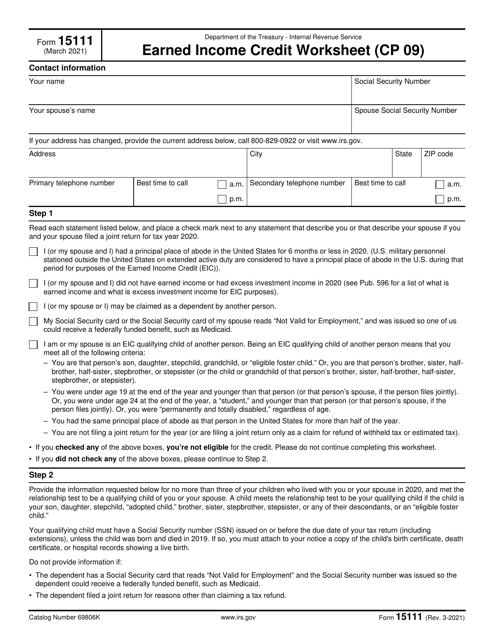

This form is used to calculate the Earned Income Credit for eligible taxpayers.

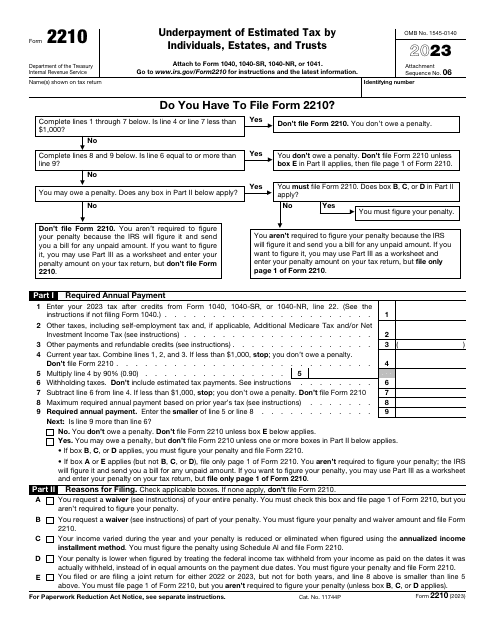

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.