HM Revenue and Customs Templates

At HM Revenue and Customs, we are dedicated to ensuring that individuals and businesses in the United Kingdom comply with tax and customs regulations. Our goal is to provide guidance and support in an efficient and transparent manner.

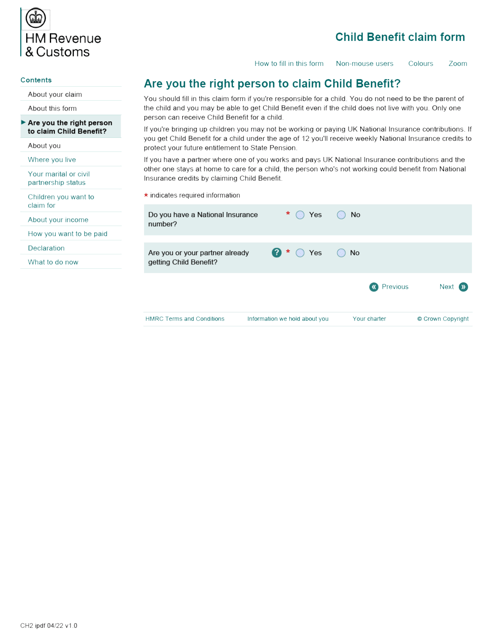

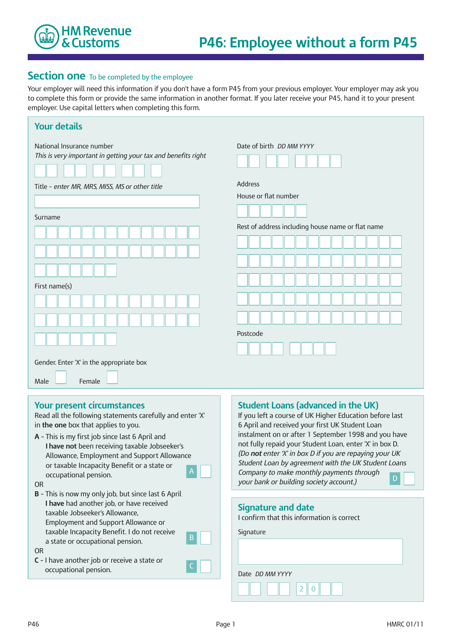

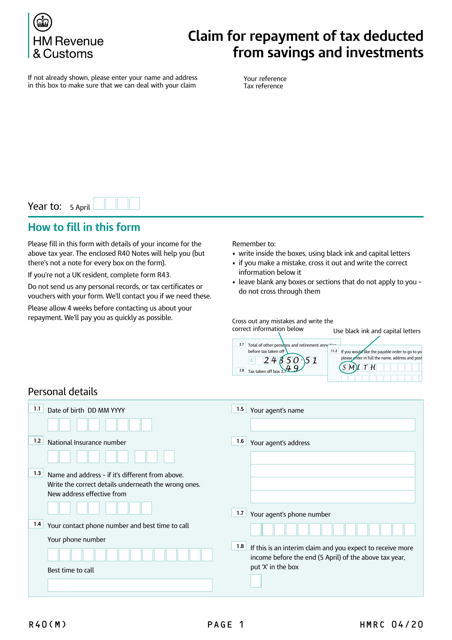

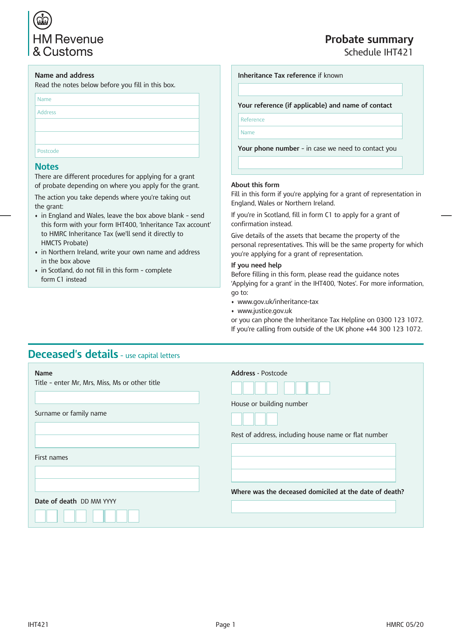

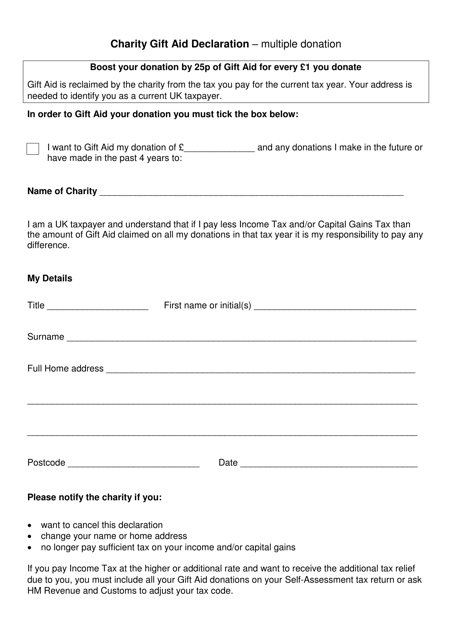

Whether you are a parent looking to claim child benefits with the Form CH2, an employer dealing with employees without a Form P45 and needing to use Form P46, or an individual seeking a refund for tax deducted from savings and investments with Form R40, we have the necessary resources to assist you. We also offer Schedule IHT421 for probate summaries and the Charity Gift Aid Declaration for multiple donations.

Our services go beyond just providing forms. We offer expert advice and assistance for a wide range of tax and customs matters. From understanding personal tax obligations to navigating complex business tax codes, our team of professionals is here to help.

Trust in HM Revenue and Customs for all your tax and customs needs. With our extensive resources and expertise, we are committed to ensuring a fair and efficient tax system that benefits everyone.

Documents:

7

The parent or future adoptive parent of a child may use this form to request a Child Tax Benefit.

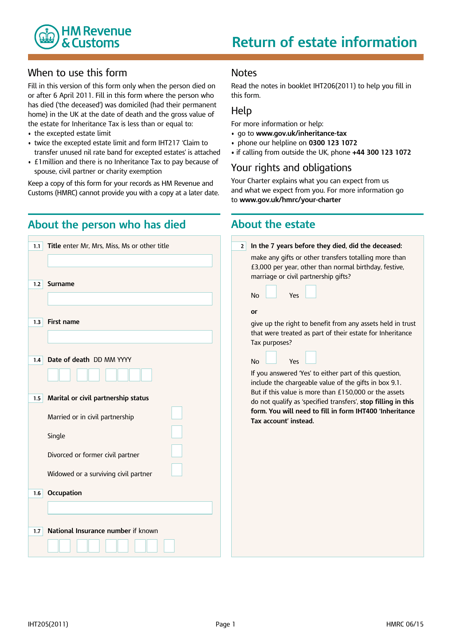

Individuals may prepare this supplemental document when they file an application for a grant of probate or a grant of letters of administration and have to confirm there is no inheritance tax due on the estate.

This is an outdated document that was completed for new employees to find out the correct amount of income tax to withhold.

This is a document that may be used when an individual wants to claim a repayment of tax on their savings interest.

This form allows people responsible for the estates of deceased individuals to confirm the monetary value of those estates and apply for a grant of representation.

This document is used for multiple donations in the United Kingdom to declare Gift Aid and maximize the value of charitable contributions.

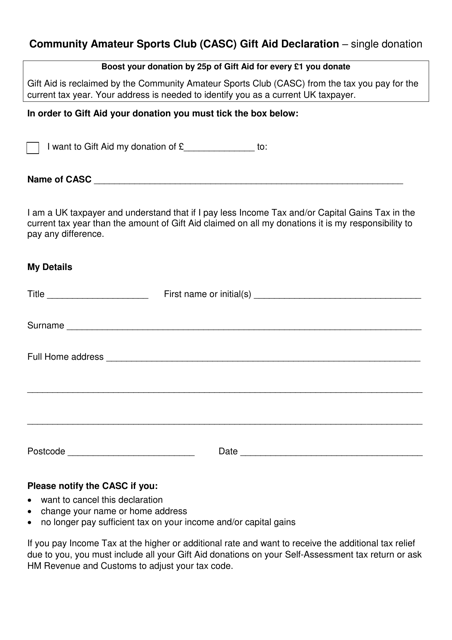

This document is a gift aid declaration specifically for single donations made to a Community Amateur Sports Club (CASC) in the United Kingdom. It enables the CASC to claim gift aid on the donation, which provides financial benefits to the club.