SEC Filings Templates

Are you interested in investing in publicly traded companies or want to stay informed about the financial status of the companies you are invested in? Look no further than SEC Filings. SEC Filings, also known as SEC Forms, provide a comprehensive record of important information about publicly traded companies filed with the U.S. Securities and Exchange Commission (SEC).

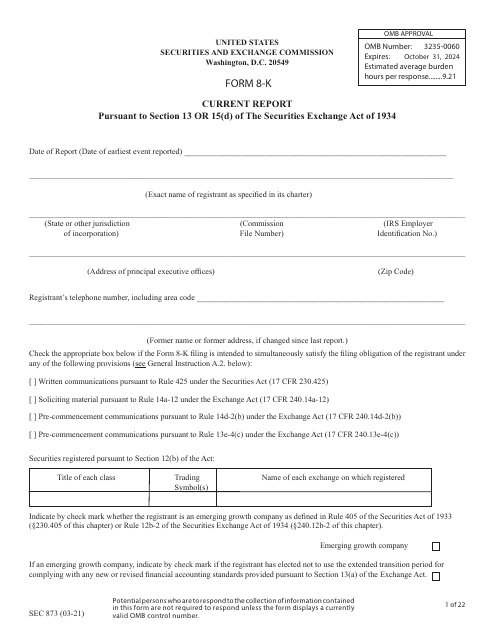

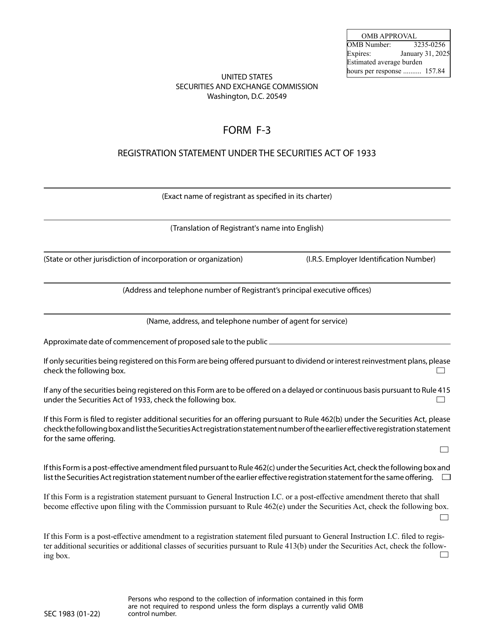

These documents are vital for investors and other stakeholders as they provide detailed and transparent insights into the financial operations and activities of the companies. They are typically required to be filed periodically or when certain events occur, such as an initial public offering (IPO) or a significant corporate event.

SEC Filings cover a wide range of documents, including Registration Statements, Annual Reports, Quarterly Reports, and Proxy Statements. Each filing serves a specific purpose and provides valuable information for investors, analysts, and regulators.

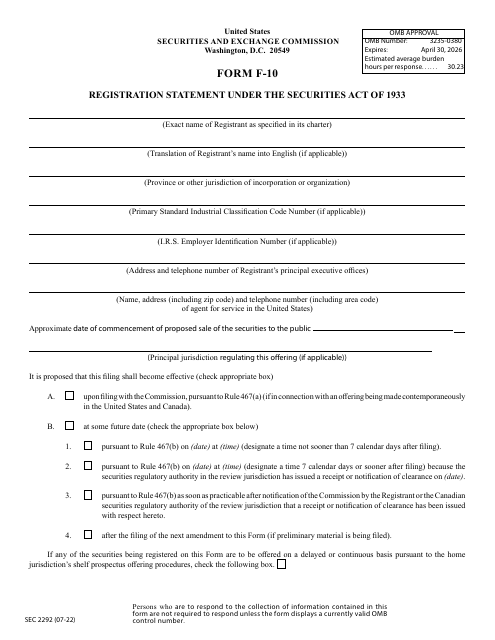

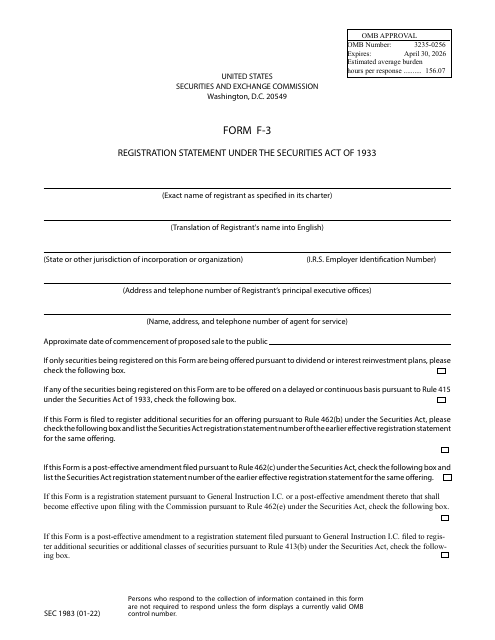

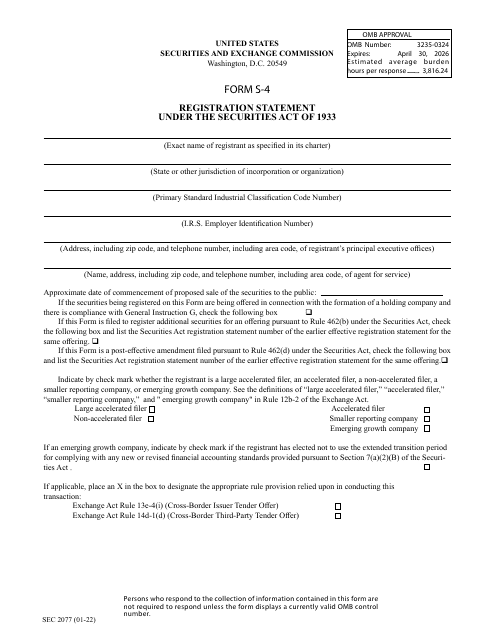

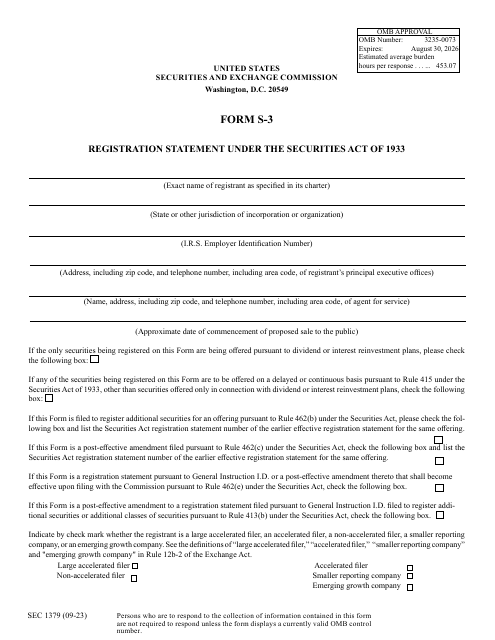

Registration Statements, also known as Form S-1 or Form 10, are filed when a company plans to go public. These documents contain detailed information about the company's business model, financials, risk factors, and more. They are essential for potential investors to make informed decisions about investing in the company.

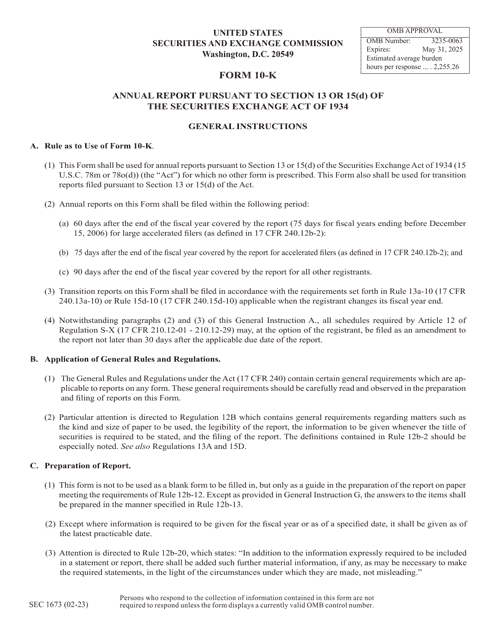

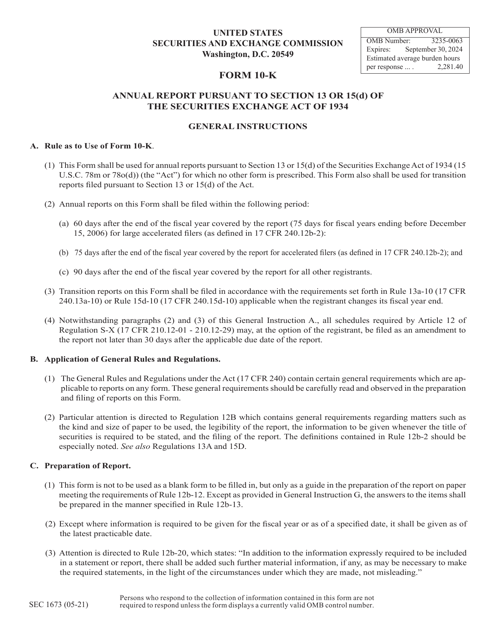

Annual Reports, also known as Form 10-K, provide a comprehensive overview of a company's financial performance, including its balance sheet, income statement, cash flow statement, and footnotes. These reports give investors an in-depth understanding of the company's financial health and its overall performance over the past year.

Quarterly Reports, or Form 10-Q, are filed every quarter and provide an update on the company's financial condition and operations. These reports include condensed financial statements, management discussion and analysis, and other relevant information.

Proxy Statements, or Form DEF 14A, are filed when a company holds its annual shareholders' meeting. These documents provide information about matters to be voted on, corporate governance, executive compensation, and more.

SEC Filings are an invaluable resource for investors, analysts, and researchers as they provide access to accurate and up-to-date information about publicly traded companies. Analyzing these filings can help investors make informed decisions, assess risks, and evaluate the financial standing of a company.

Stay on top of the latest financial disclosures and gain a deeper understanding of the companies you invest in with our comprehensive collection of SEC Filings. Discover the wealth of information contained within these documents and make more informed investment decisions.

Documents:

38

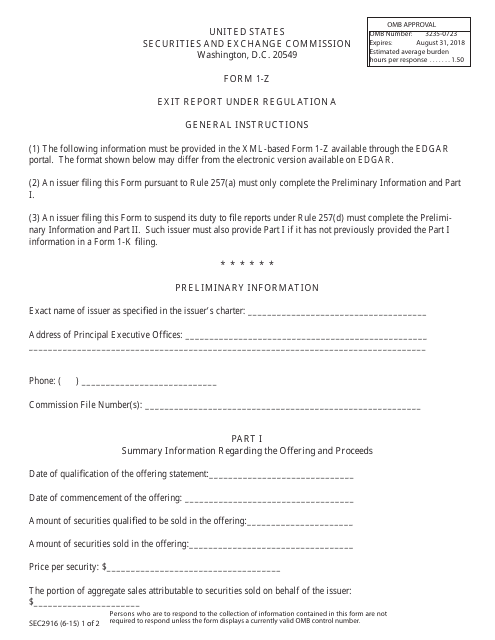

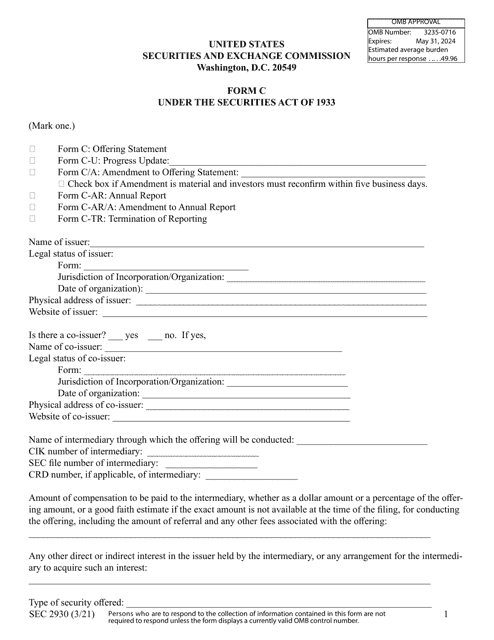

This document is used for filing an exit report under Regulation A with the Securities and Exchange Commission (SEC).

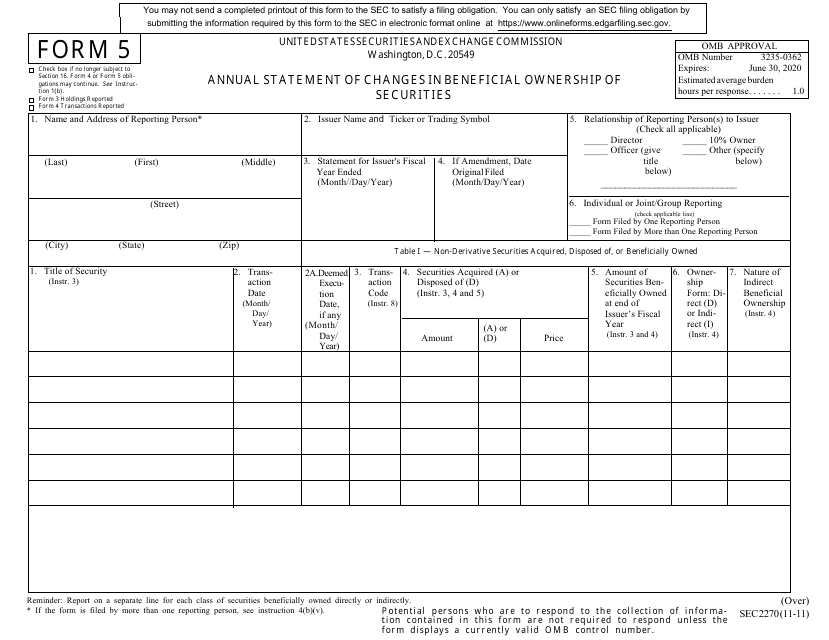

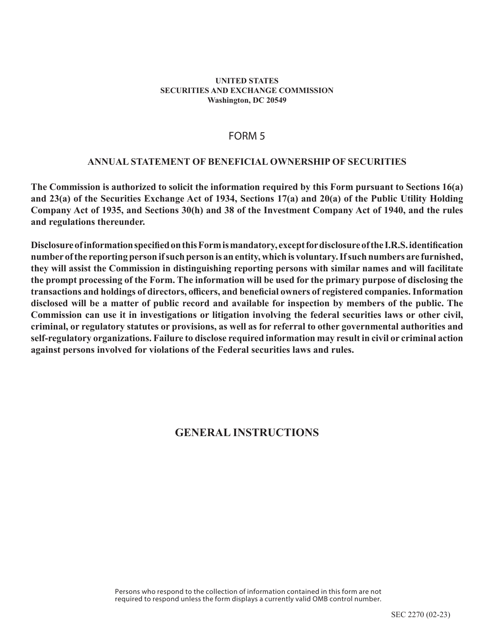

This form is used for providing an annual statement of changes in beneficial ownership of securities as required by the Securities and Exchange Commission (SEC).

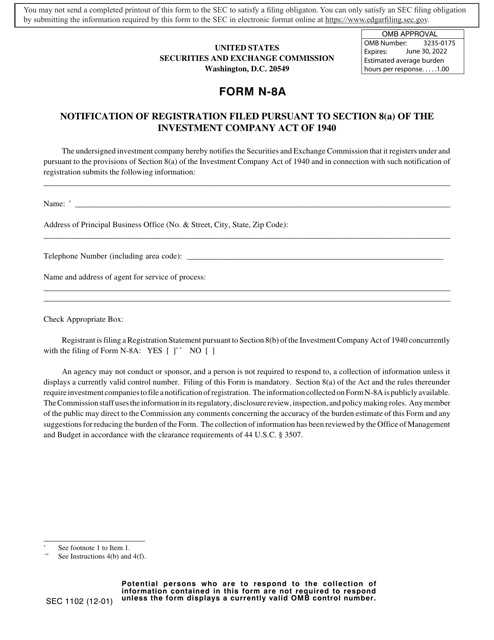

This form is used for notification of registration filed by investment companies under Section 8(A) of the Investment Company Act of 1940.

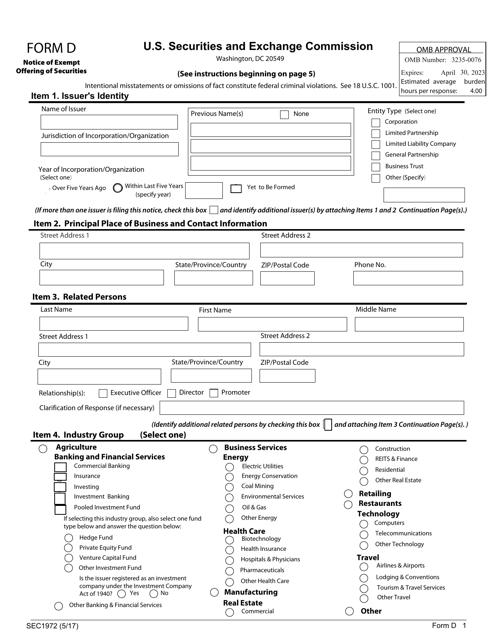

This Form is used for filing a notice with the Securities and Exchange Commission (SEC) to inform about an exempt offering of securities.

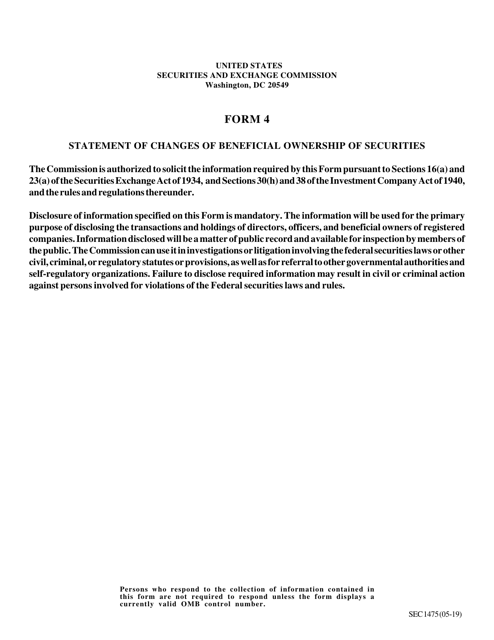

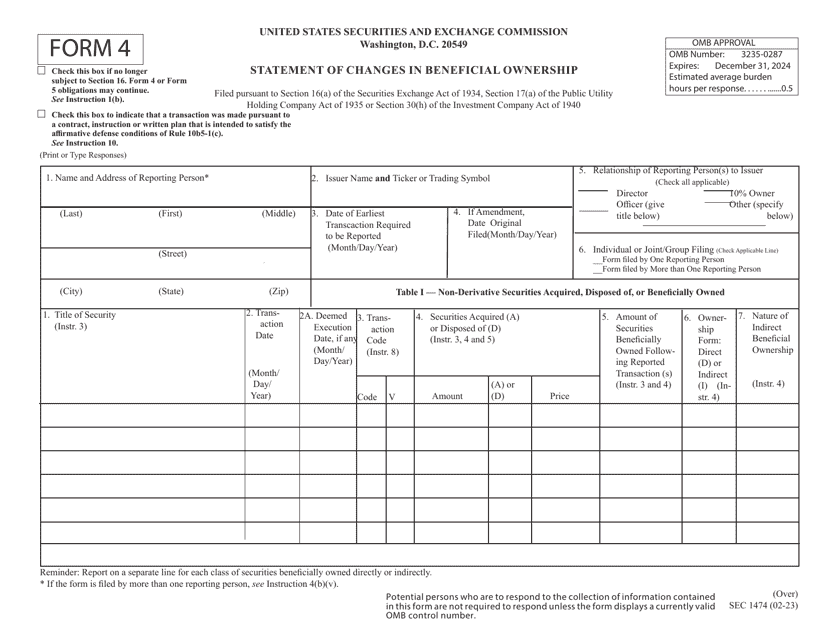

This form is used for reporting any changes in beneficial ownership of securities. It helps investors and the Securities and Exchange Commission (SEC) track ownership changes and ensure transparency in the financial markets.

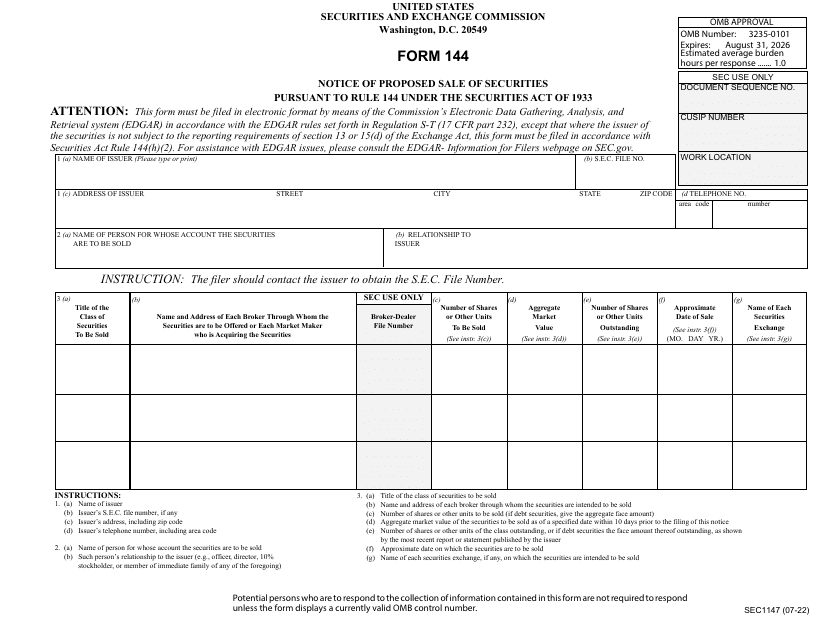

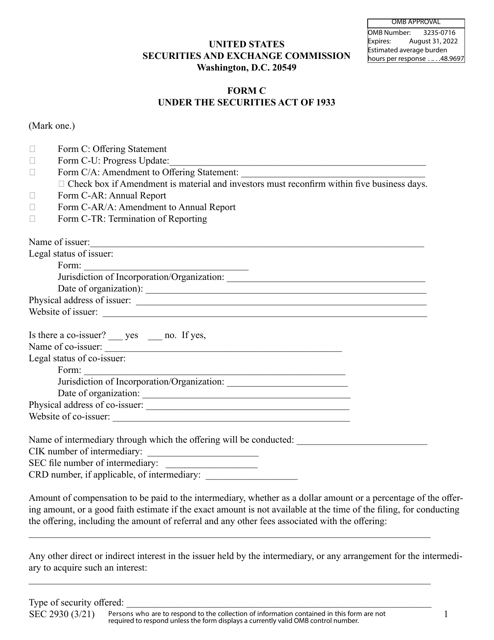

This document is used for reporting certain transactions under the Securities Act of 1933.

This Form is used for filing an annual report by public companies to the Securities and Exchange Commission (SEC). It provides detailed financial information and disclosures about the company's business operations, including its financial statements, management discussion and analysis, and other relevant information.

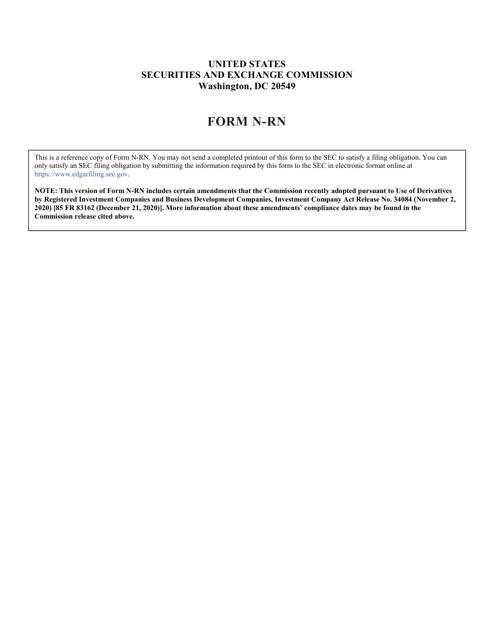

This document is used for filing a current report for registered management investment companies and business development companies with the Securities and Exchange Commission.

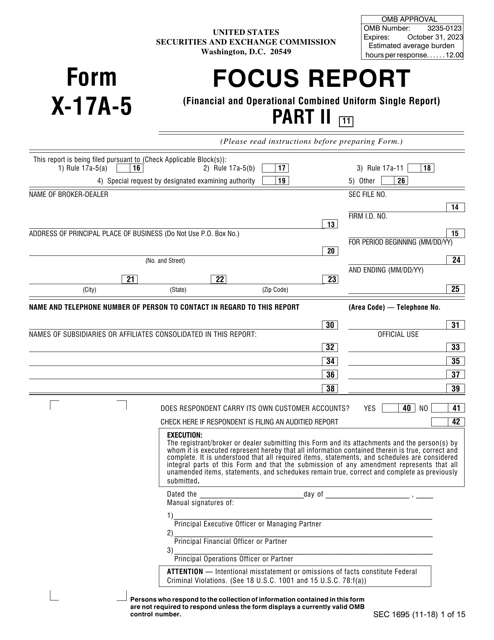

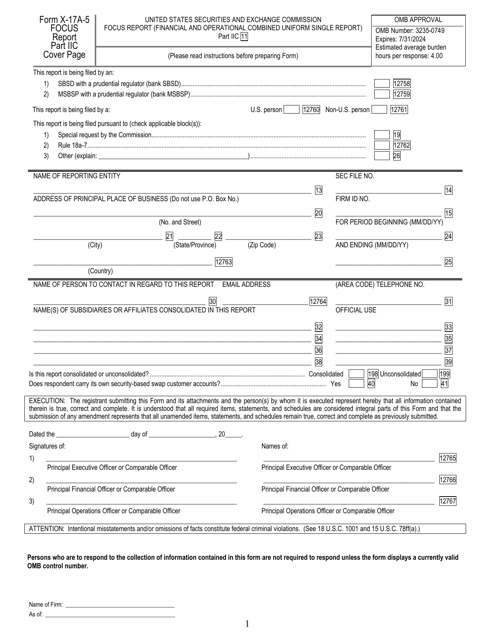

This Form is used for filing financial and operational information by broker-dealers in the United States to regulatory authorities.

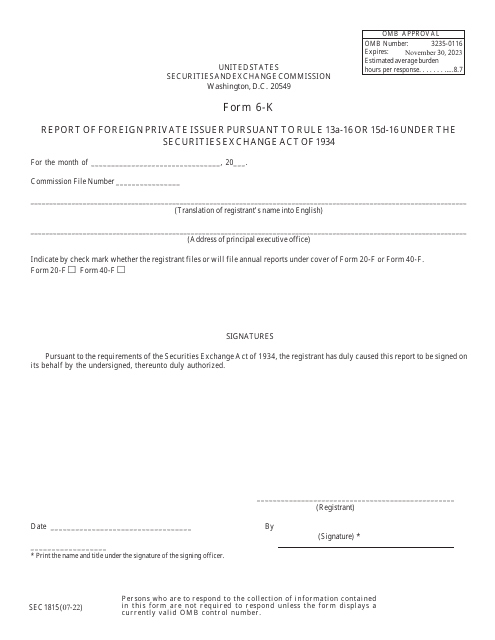

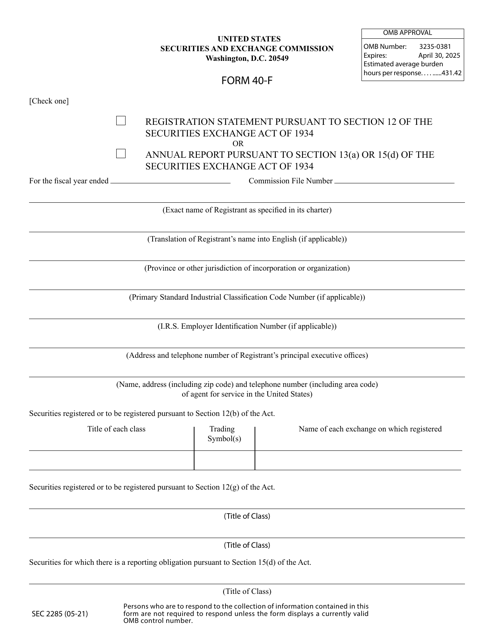

This Form is used for registering securities or filing an annual report with the U.S. Securities and Exchange Commission (SEC). It is used by foreign private issuers to comply with Section 12 or to submit annual reports under Section 13(A) or 15(D) of the Securities Exchange Act of 1934.

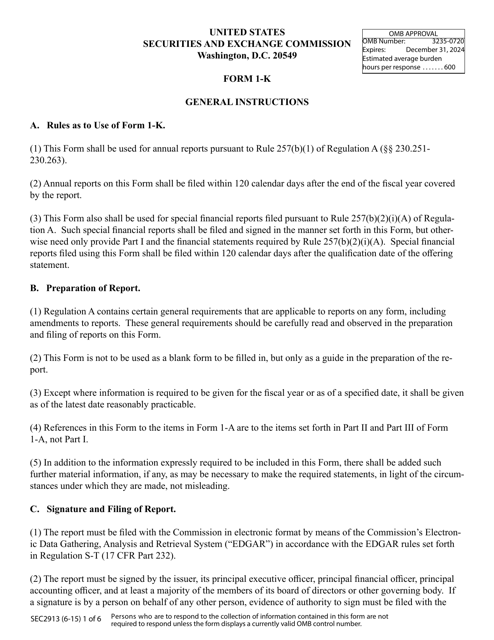

This Form is used for filing annual reports and special financial reports with the Securities and Exchange Commission (SEC) in the United States. It provides important financial information about a company to the public and investors.

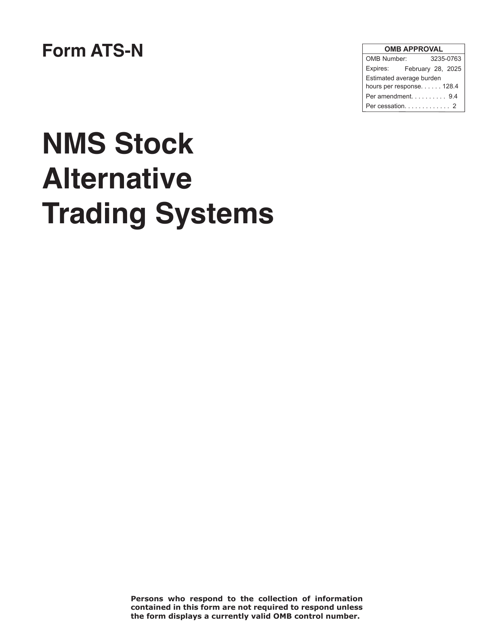

This document is used for registering a stock alternative trading system with the Securities and Exchange Commission (SEC). It provides information about the trading platform and its operations.

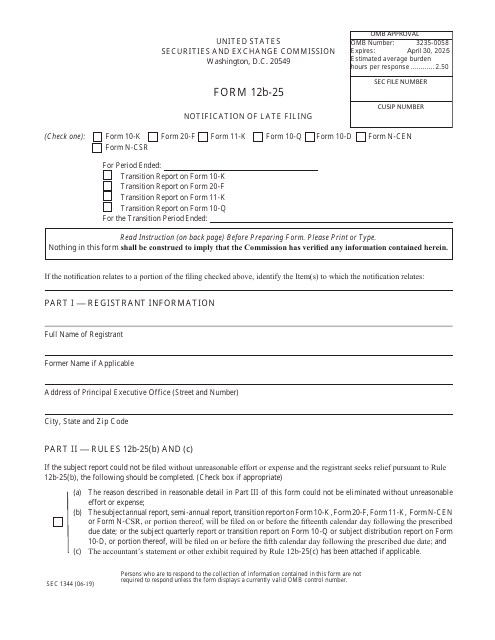

This form is used for notifying the Securities and Exchange Commission (SEC) of a late filing.

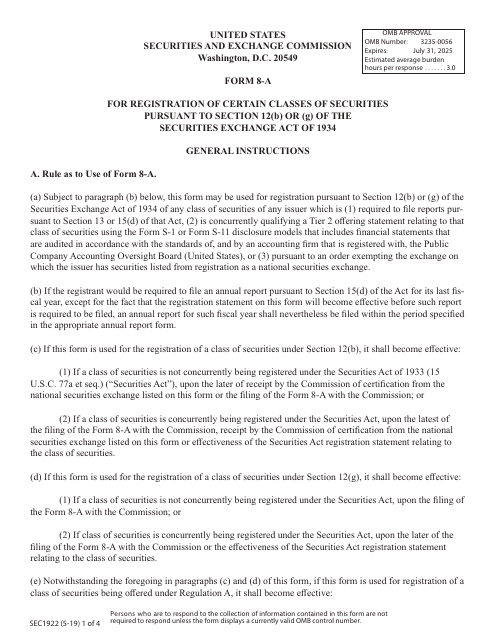

This Form is used for registering certain classes of securities under the Securities Exchange Act of 1934.

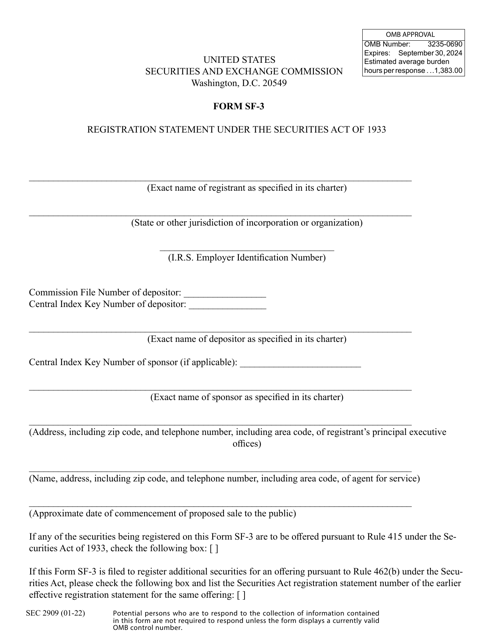

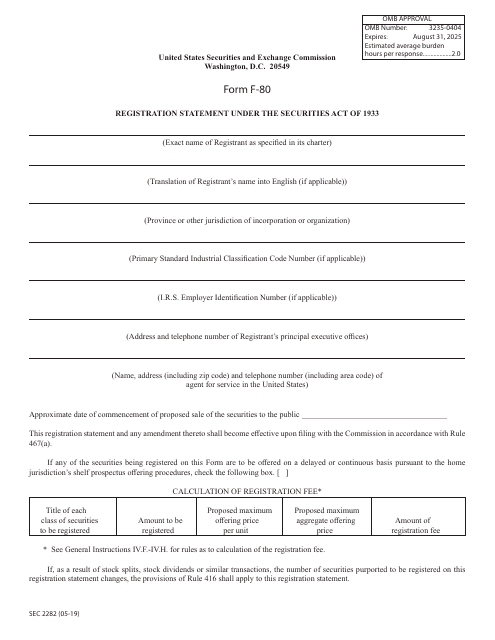

This form is used for registering securities offerings under the Securities Act of 1933.

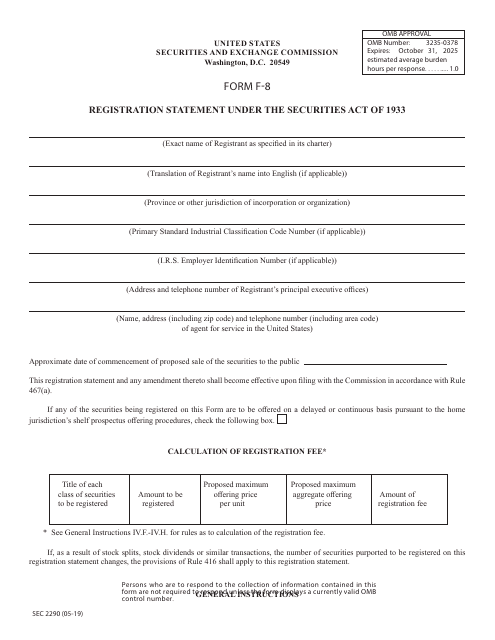

This form is used for completing the Registration Statement under the Securities Act of 1933, specifically for SEC Form 2290. It is an important document for companies looking to register securities with the Securities and Exchange Commission (SEC).

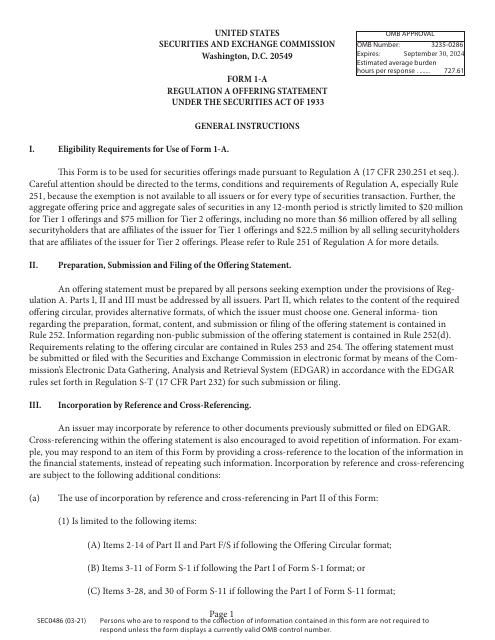

This Form is used for filing an offering statement under the Securities Act of 1933.

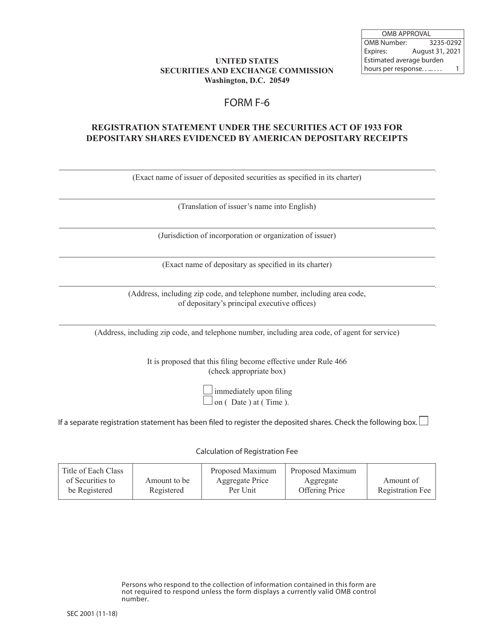

This Form is used for filing a Registration Statement with the Securities and Exchange Commission (SEC) under the Securities Act of 1933. It is also referred to as SEC Form 2292. This document is required by companies that are preparing to offer securities to the public.