Ct Tax Credit Templates

Are you a business or individual in Connecticut looking to save on taxes? The CT Tax Credit program can help! Also known as CT Tax Credits or Connecticut Tax Credits, this program offers various credits and incentives to help reduce your tax liability.

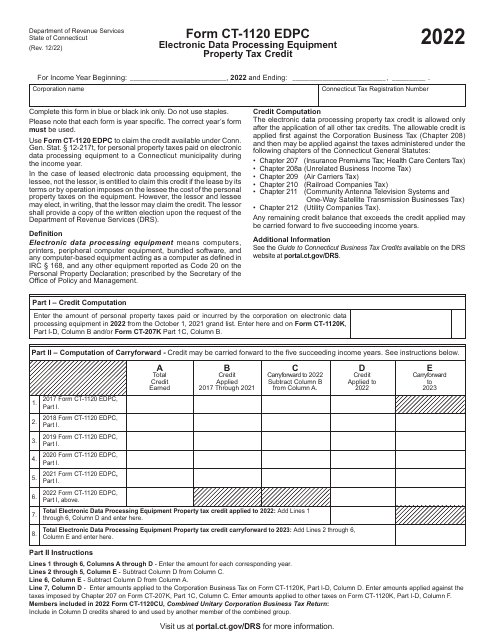

One of the available documents in this program is the Form CT-1120 EDPC Electronic Data Processing EquipmentProperty Tax Credit. This document outlines the eligibility criteria and requirements for businesses looking to claim a tax credit for their electronic data processing equipment.

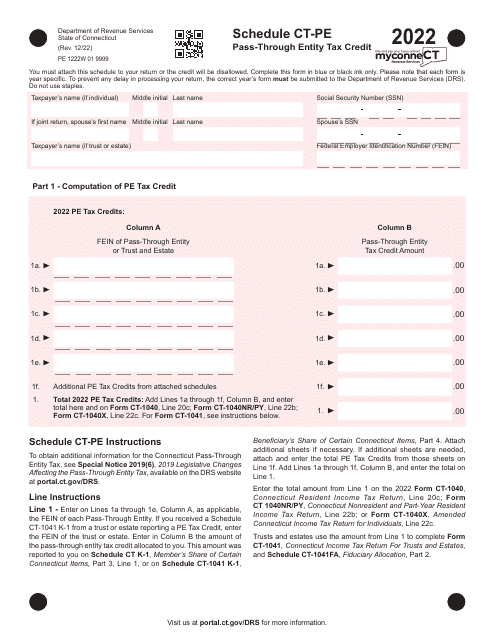

If you're a pass-through entity, you might be interested in the Schedule CT-PE Pass-Through Entity Tax Credit. This document provides information on how to claim tax credits for pass-through entities in Connecticut.

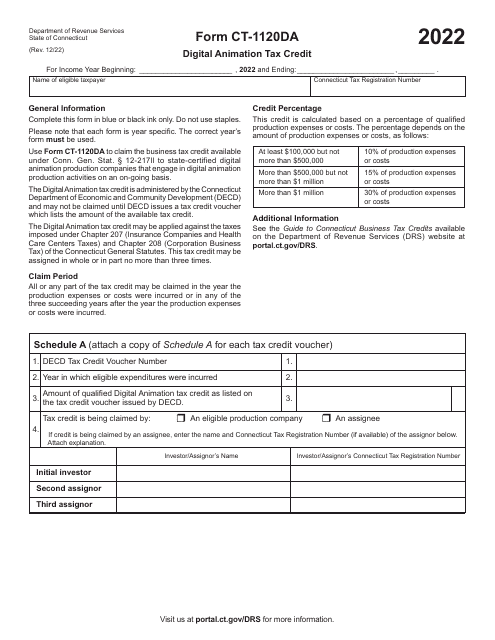

For those in the digital animation industry, the Form CT-1120DA Digital Animation Tax Credit could be of interest. This document explains the requirements and process for claiming a tax credit related to digital animation projects in Connecticut.

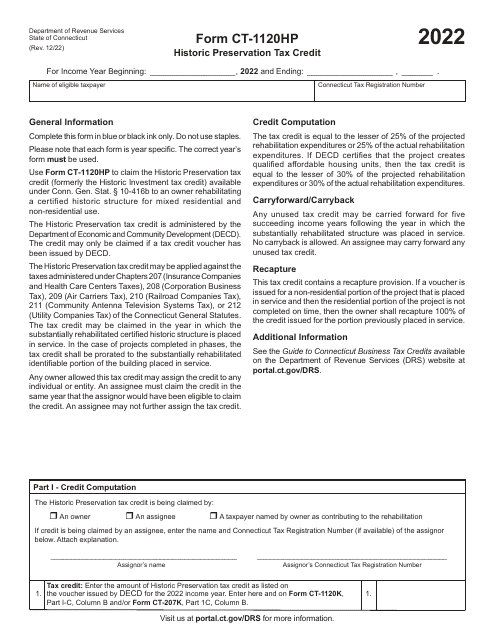

If you're involved in historic preservation, there's the Form CT-1120HP Historic Preservation Tax Credit. This document outlines the specific conditions and guidelines for claiming a tax credit for qualifying historic preservation projects in the state.

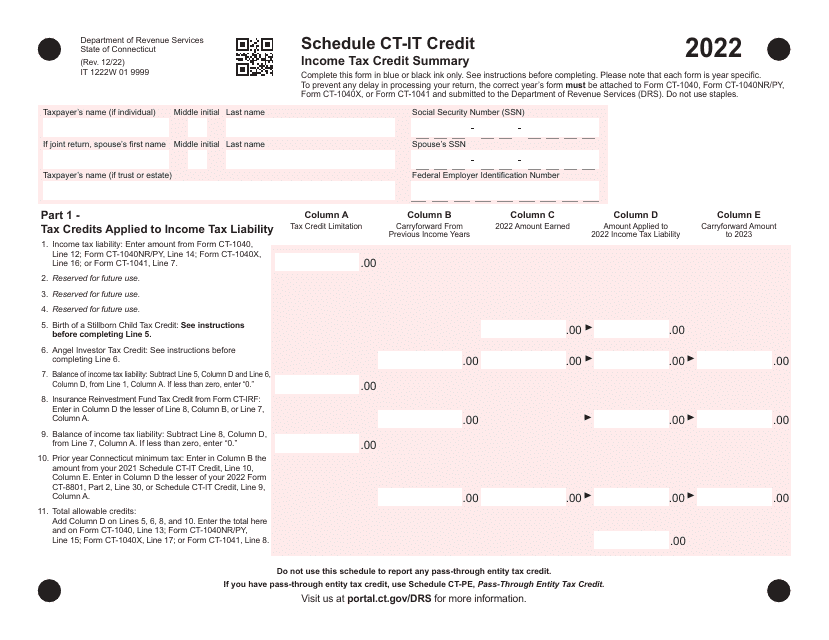

For a summary of all the income tax credits available in Connecticut, you can refer to the Schedule CT-IT CREDIT Income Tax Credit Summary. This document provides an overview of the various tax credits that individuals and businesses may be eligible for.

Whether you're a business owner or an individual taxpayer, taking advantage of the CT Tax Credit program can result in significant tax savings. Make sure to review the specific requirements and deadlines for each credit by referring to the appropriate documents.

Documents:

5