Residency Status Templates

Residency Status

Welcome to our Residency Status

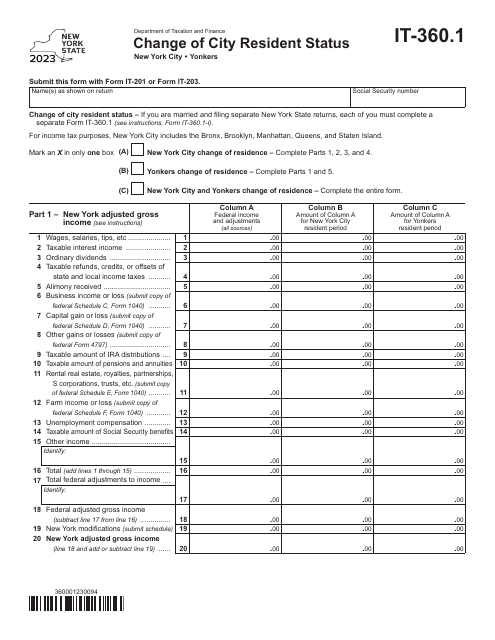

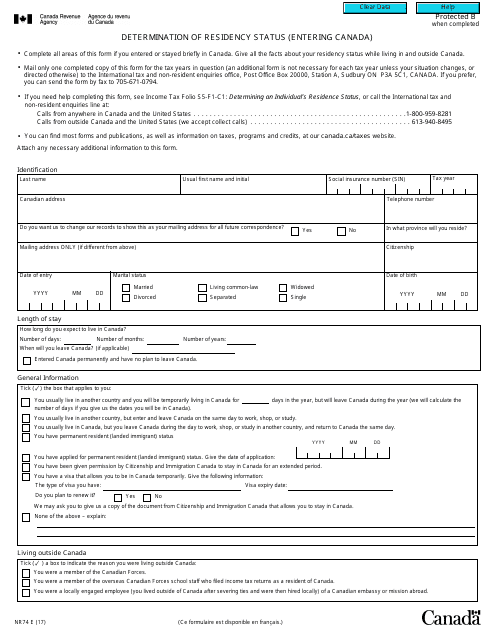

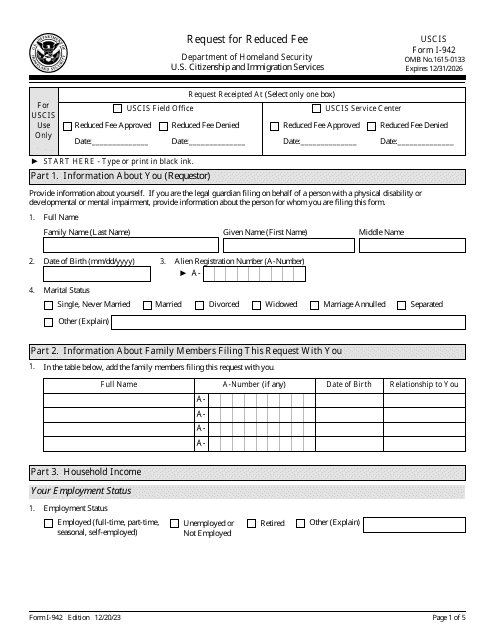

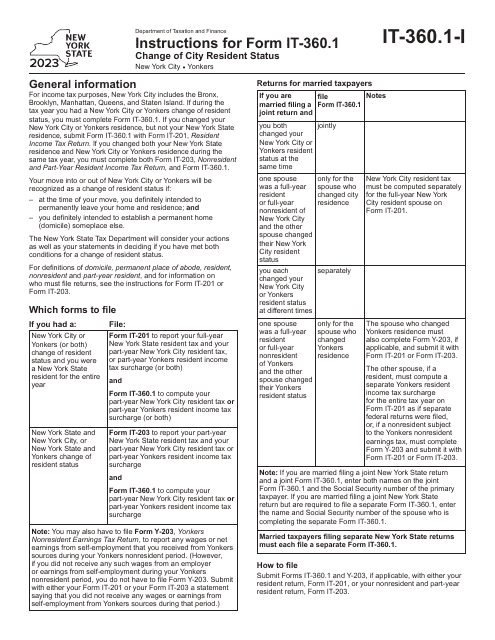

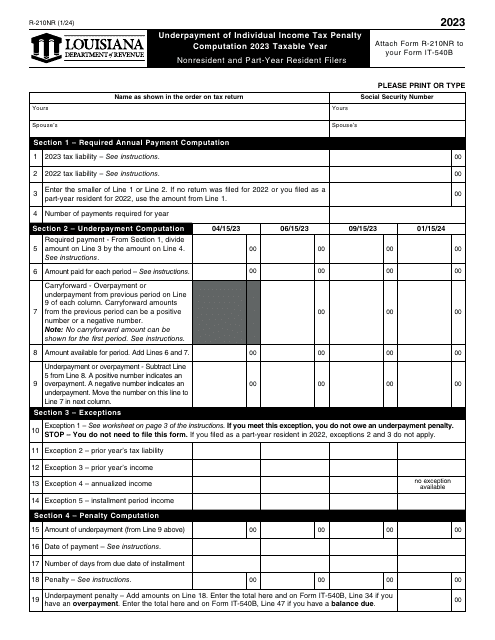

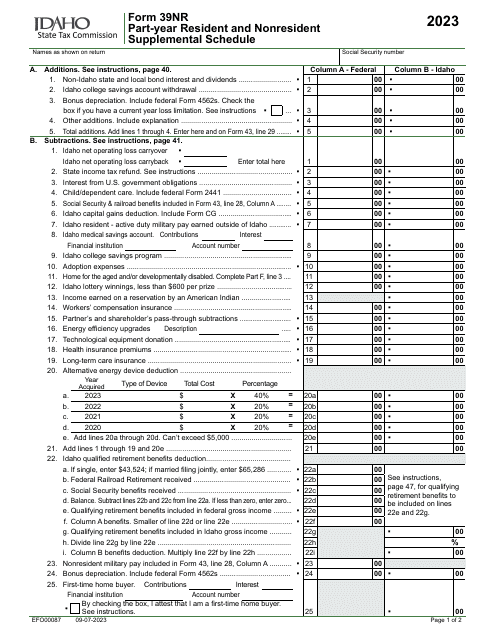

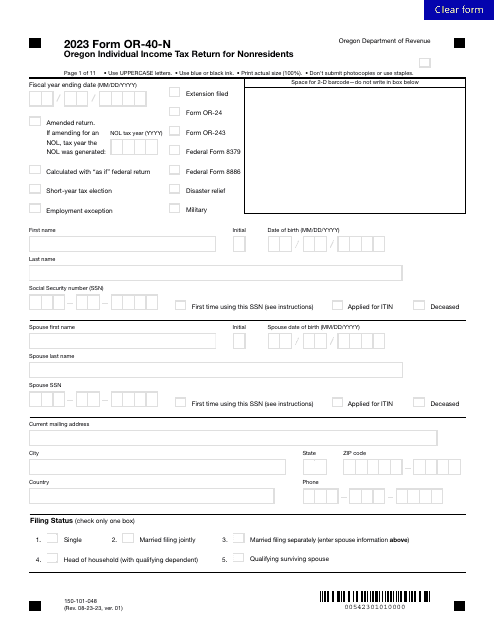

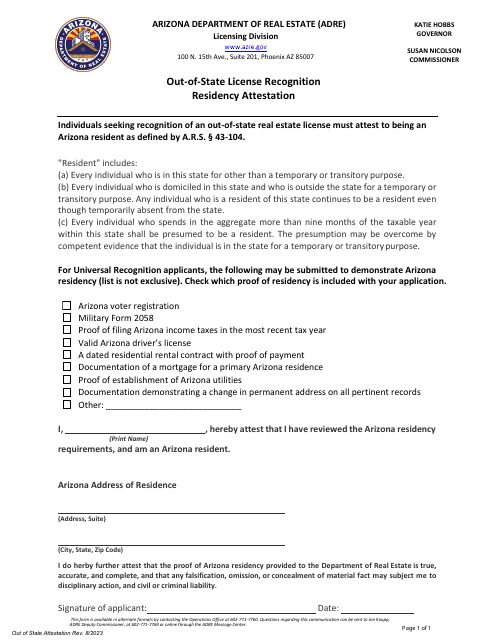

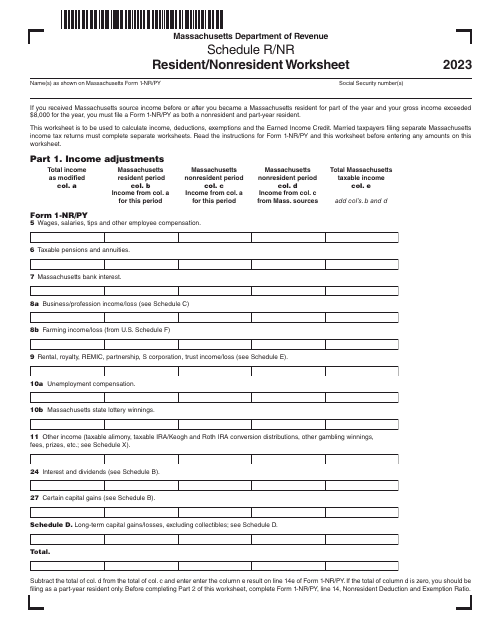

webpage, where you can find comprehensive information and resources related to residency status and its implications. Whether you are an individual or a business entity, understanding your residency status is crucial for tax and legal purposes.Also known as Resident Status, our collection of documents and forms provide guidance on how to establish, change, or confirm your residency status in various jurisdictions. These documents include the Certificate of Nonresidency, Form D-4A Certificate of Nonresidence, and Form IT-360.1 Change of City Resident Status, among others.

Establishing your residency status accurately is essential to determine your tax obligations and eligibility for certain benefits. For individuals, it affects your tax filing requirements, eligibility for government programs, and even your ability to vote. For businesses, residency status can determine your tax liability, eligibility for incentives, and compliance with local regulations.

Our Residency Status

webpage offers detailed explanations of residency rules and regulations in various jurisdictions, helping you navigate the complexities of residency status determinations. We provide step-by-step guides, FAQs, and resources to assist you in understanding the criteria and requirements for establishing your residency status.Whether you are a resident, nonresident, or part-year resident, our Residency Status

webpage is your go-to resource for all the necessary documentation and information you need to manage your residency status effectively. Stay informed, make informed decisions, and ensure compliance with all relevant laws and regulations.Please note that the information provided on our webpage is for general informational purposes only. It is always advisable to consult with a qualified tax advisor or legal professional to ensure your specific circumstances are properly addressed.

Documents:

25

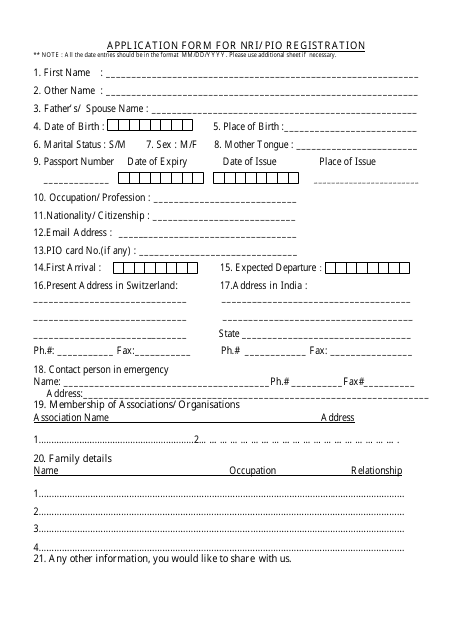

This Form is used for NRI/PIO Registration in India.

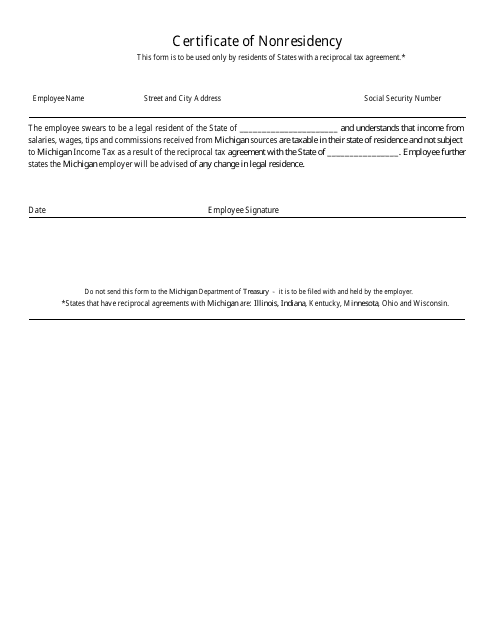

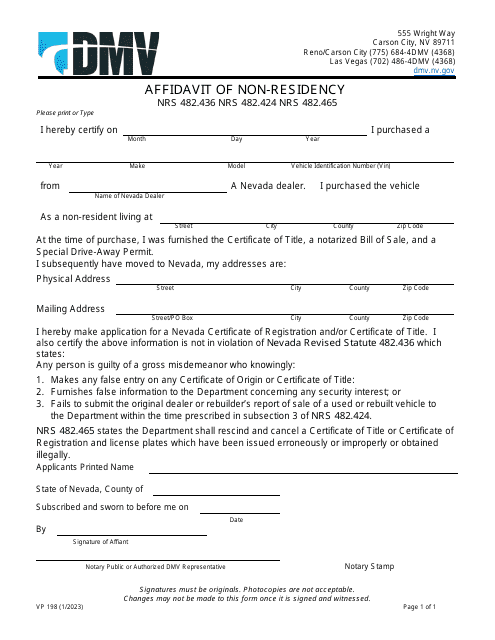

This document certifies that an individual does not reside in Michigan. It may be required for tax purposes or to show their nonresident status for certain benefits or privileges.

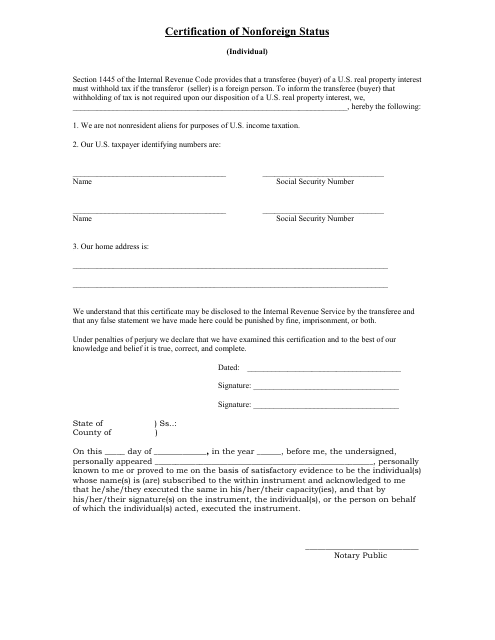

This form is used for certifying that an individual is a nonresident alien and not subject to certain taxes in the United States.

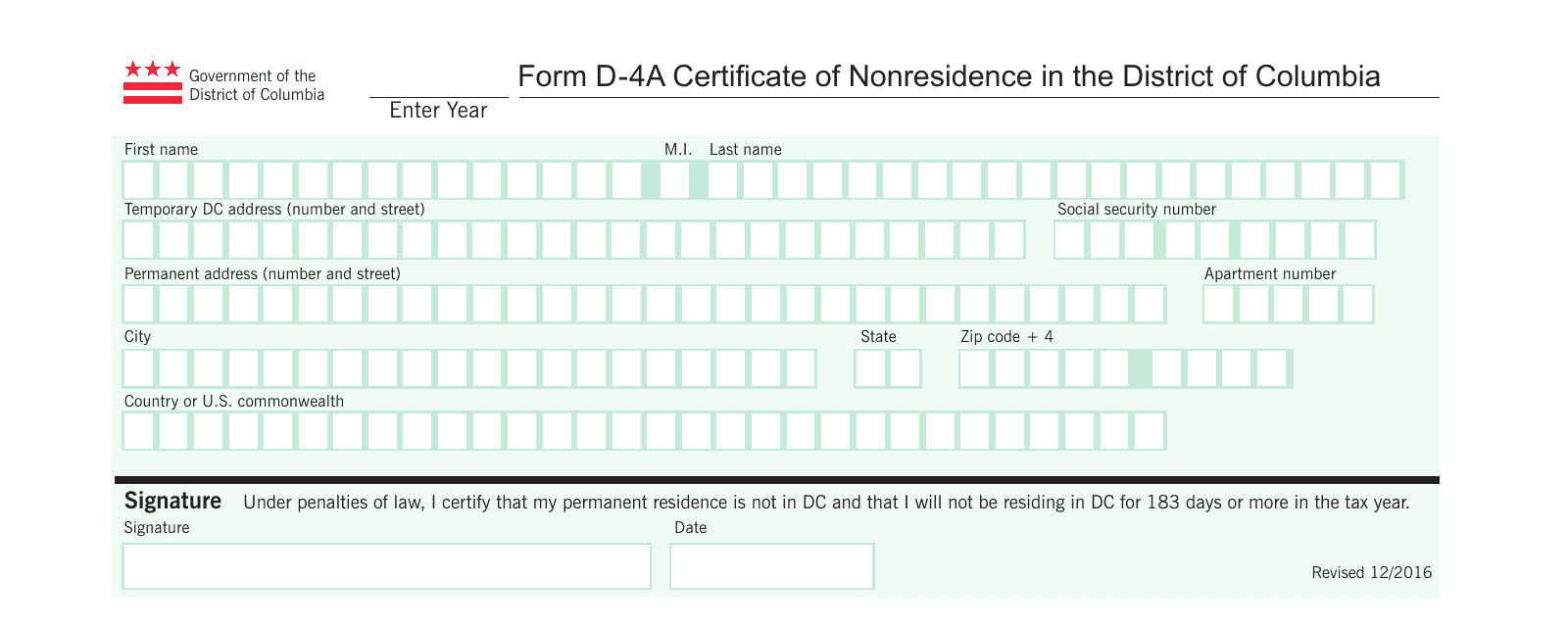

This Form is used for declaring nonresidence status in the District of Columbia for tax purposes.

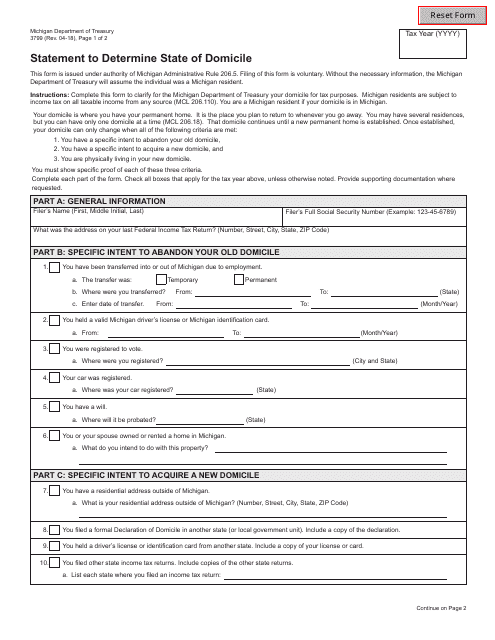

This form is used for determining an individual's state of domicile in Michigan.

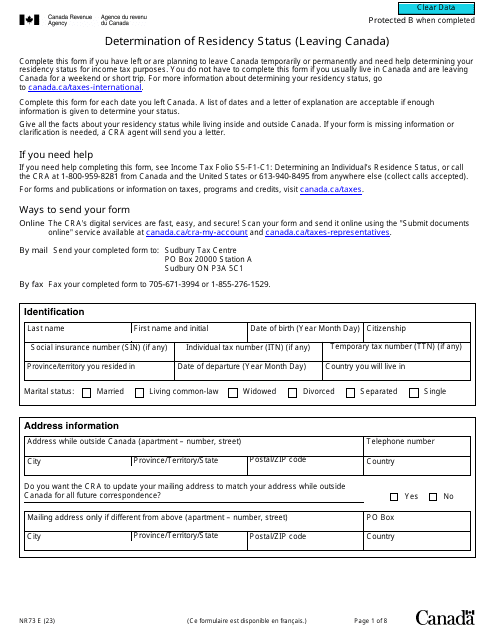

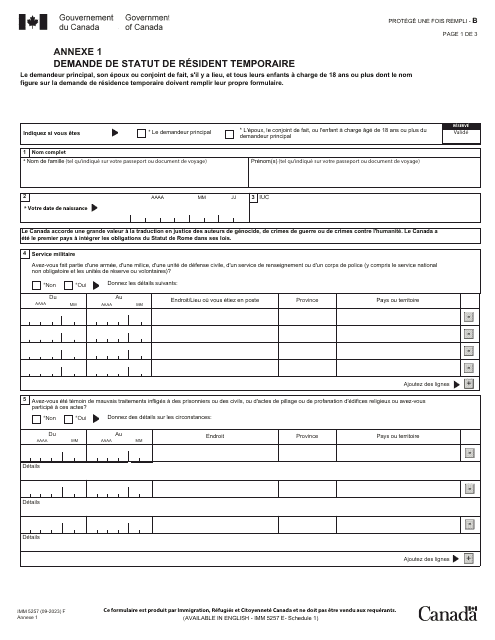

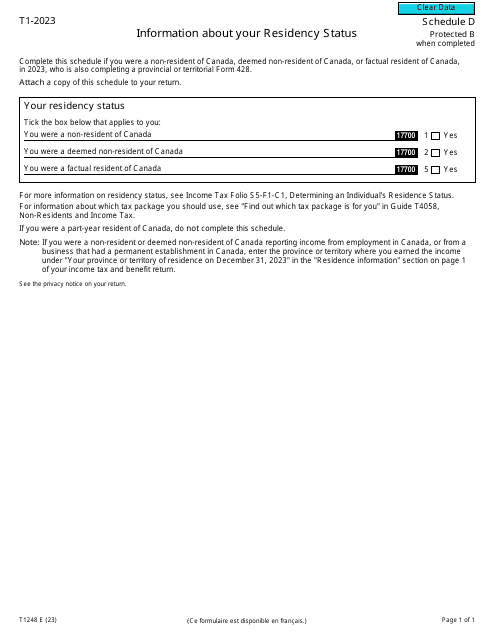

This form is used for determining an individual's residency status when entering Canada. It helps Canadian authorities determine whether the person should be classified as a resident or non-resident for tax purposes.

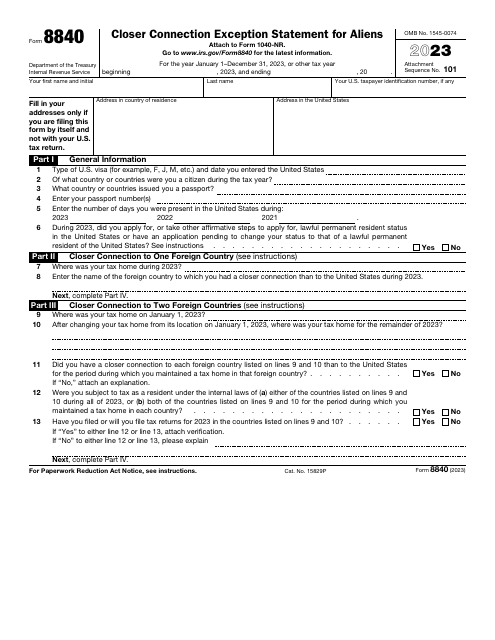

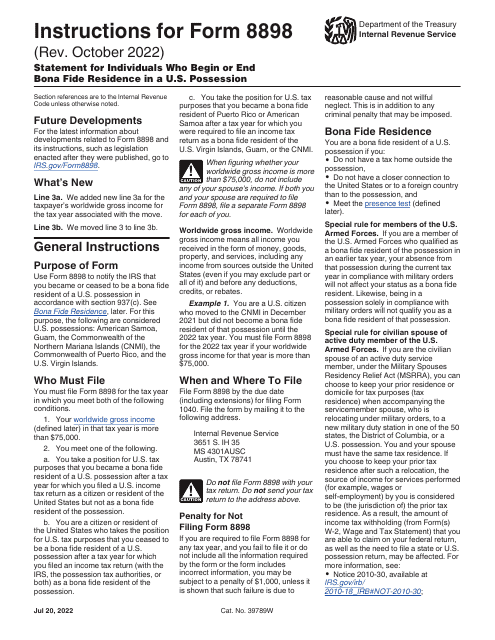

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

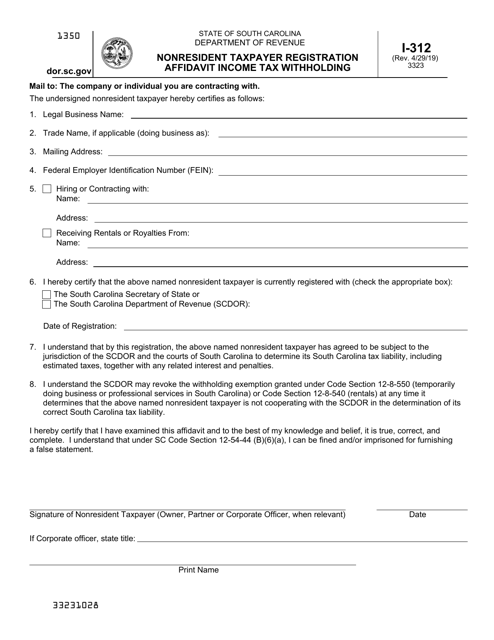

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

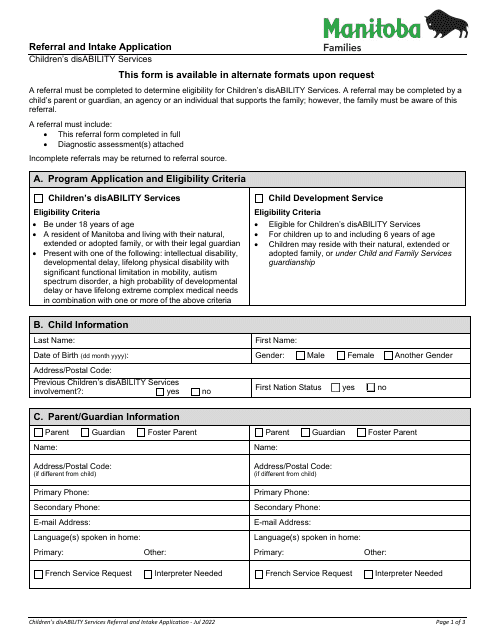

This form is used for submitting a referral and intake application in Manitoba, Canada. It is an initial step for accessing certain services or programs offered in the province.