Loan Closing Templates

When it comes to finalizing a loan agreement, the loan closing process plays a crucial role. This important stage ensures that all necessary paperwork, formalities, and legalities are completed before the funds are disbursed. At loan closing, all the tedious documentation and verification steps are finalized, paving the way for the loan to be officially completed.

Loan closing is sometimes referred to as "closing loans" or simply "close loans." This stage involves reviewing and signing various documents to legalize the loan and ensure all parties involved are in agreement. It is important to adhere to the guidelines and procedures outlined by the relevant authorities to ensure a smooth and efficient loan closing process.

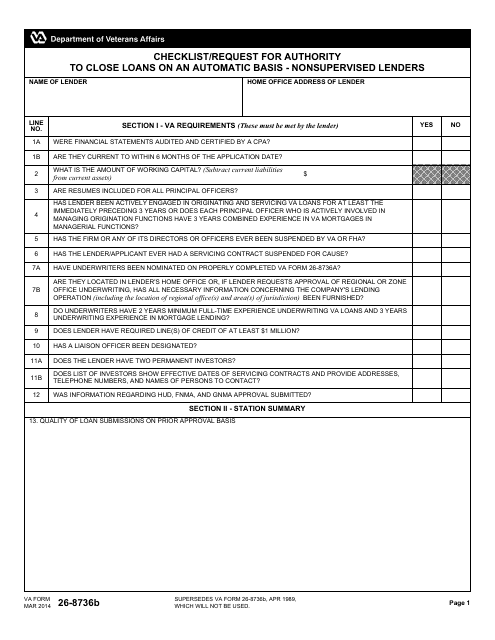

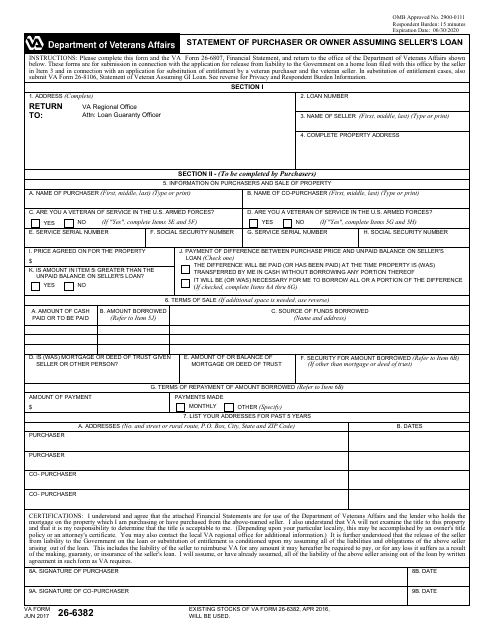

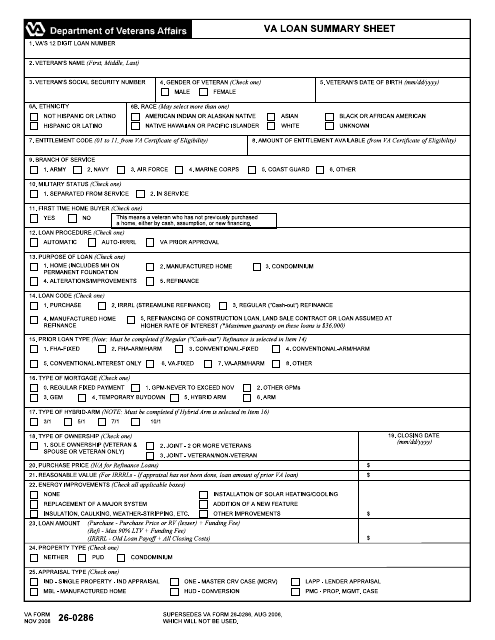

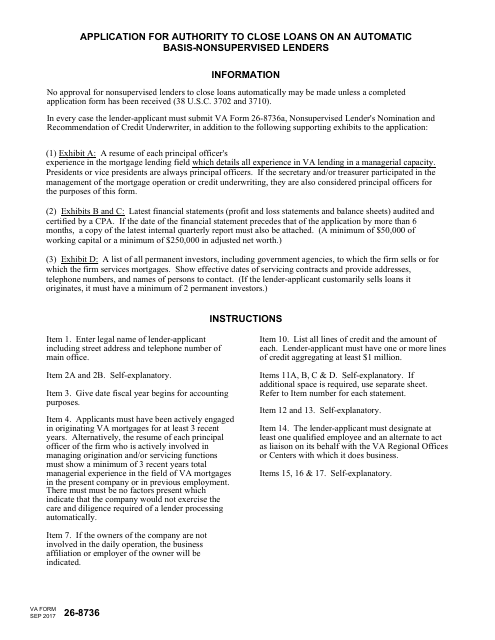

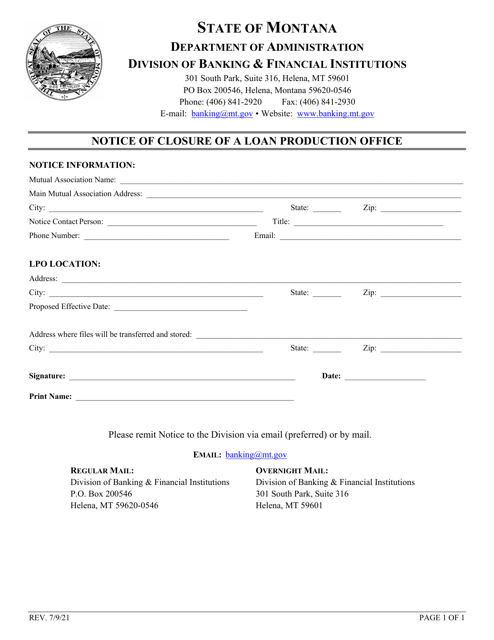

The loan closing documents may include the VA Form 26-0286 VA Loan Summary Sheet, VA Form 26-8736 Application for Authority to Close Loans on an Automatic Basis - Non Supervised Lenders, Notice of Closure of a Loan Production Office - Montana, Instructions for Form CRO-6100 Loan Proceeds Statement - North Carolina, and Form FHA-1022 FHA Legal Requirements for Closing, among others.

During the loan closing process, it is essential to carefully review all the documents and seek clarification on any terms or conditions that may be unclear. This helps to ensure that everything is accurately documented and that both the borrower and lender are fully aware of their rights and obligations with regards to the loan.

At loan closing, the legalities are finalized and funds are typically disbursed shortly thereafter. This marks the culmination of the loan application process, allowing the borrower to begin utilizing the funds for their intended purpose, whether it is purchasing a home, starting a business, or any other designated use.

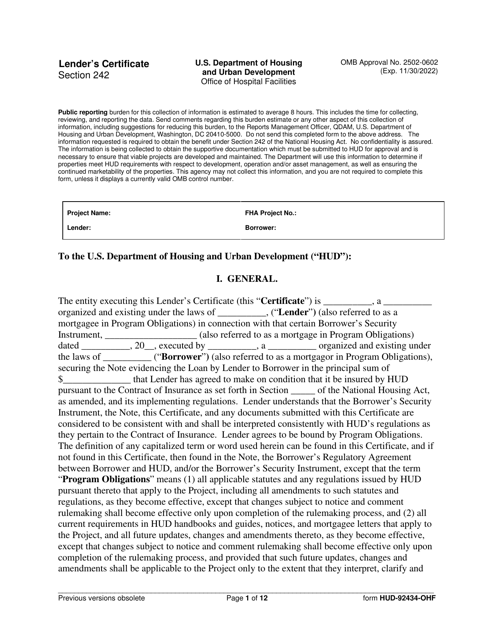

Overall, the loan closing stage is a critical step in the loan process, ensuring that all necessary paperwork is completed, reviewed, and signed. The loan closing documents, such as the VA Form 26-0286 VA Loan Summary Sheet and Form FHA-1022 FHA Legal Requirements for Closing, are vital in legalizing the loan and protecting the rights of all parties involved.

Documents:

9

This form is used for requesting authorization to close loans automatically for lenders who do not require supervision.

This Form is used for buyers or owners who are assuming the seller's loan.

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

This Form is used for non-supervised lenders to apply for authority to close loans on an automatic basis.

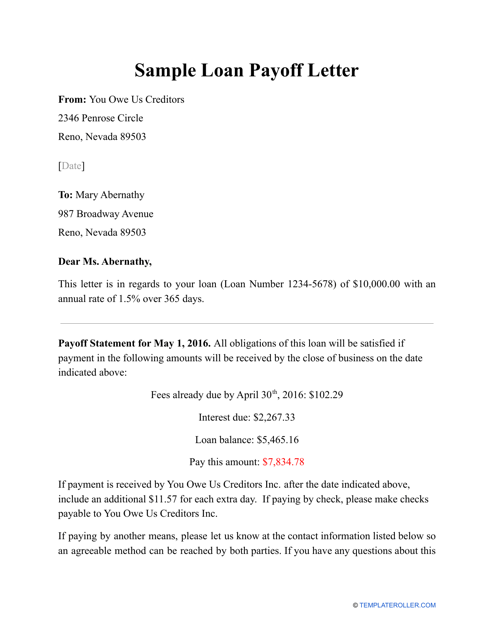

Check out this sample before drafting your own Loan Payoff Letter.

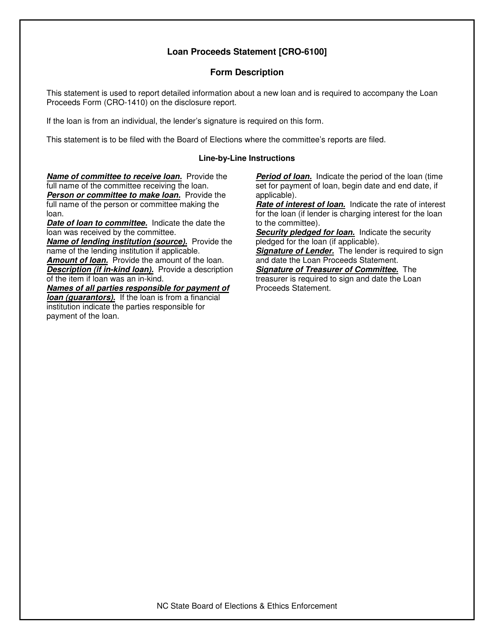

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

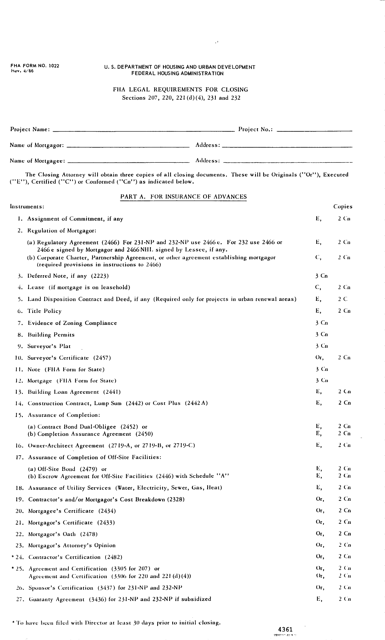

This form is used for demonstrating the legal requirements for closing an FHA loan. It provides a checklist of the necessary documents and steps needed to satisfy the Federal Housing Administration's guidelines.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.