Research and Development Costs Templates

Are you a business owner engaged in research and development activities? Are you unsure of how to track and report your R&D costs? Look no further! Our collection of documents on research and development costs provides the guidance and resources you need to stay compliant with regulations and maximize your tax benefits.

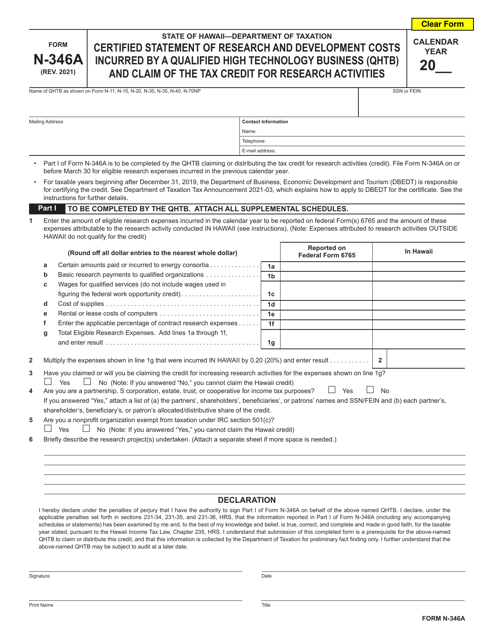

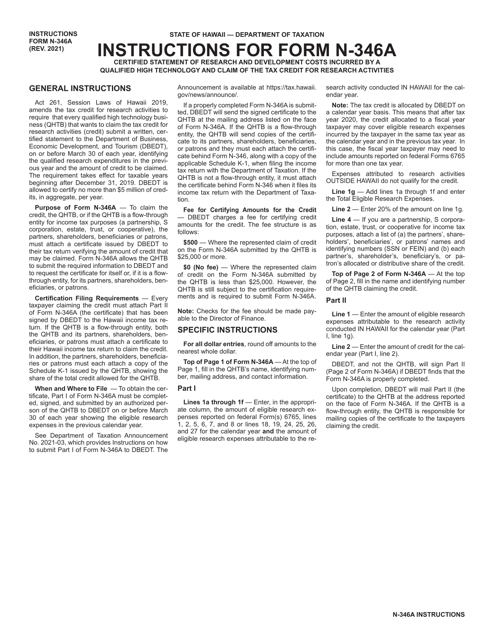

Our documents cover a wide range of topics related to research and development costs. From forms for reporting your expenses to instructions on how to complete them accurately, we have everything you need to streamline your reporting process. Whether you're a qualified high technology business in Hawaii or operate in other states, our documents are designed to meet the specific requirements of your location.

We understand that navigating the world of research and development costs can be challenging. That's why we have created this collection of documents to simplify the process for you. Our resources are packed with valuable information that will help you better track, manage, and report your R&D expenses. By following our guidelines and utilizing the provided forms, you can ensure that your business remains compliant and take full advantage of potential tax credits available to you.

Whether you're looking for a certified statement of R&D costs incurred by your business or need assistance in claiming tax credits for your research activities, our documents have got you covered. With clear instructions and user-friendly forms, you can easily compile the necessary information and submit it to the appropriate authorities.

Don't let the complexities of research and development costs overwhelm you. Explore our collection of documents today and gain the peace of mind that comes with having a streamlined process in place. With our resources by your side, you'll be able to focus on what matters most – driving innovation and growing your business.

Documents:

5