Exempt Property Templates

Exempt Property - Protecting Your Assets

Welcome to our comprehensive guide on exempt property, also known as property exemption or property exemption form. Here, we aim to provide you with a complete understanding of how exempt property works and how it can help protect your assets.

Exempt property refers to certain assets and possessions that are protected by law from being seized or liquidated to satisfy debts or legal obligations. These exemptions are designed to ensure that individuals and families can maintain a basic standard of living even in challenging financial circumstances.

At Templateroller.com, we understand the importance of exempt property in safeguarding your assets. Our expert team has curated a diverse range of documents to assist you in navigating the complex realm of property exemptions. Whether you're a homeowner, a senior citizen, or simply need to protect your family dwelling, we have the resources you need.

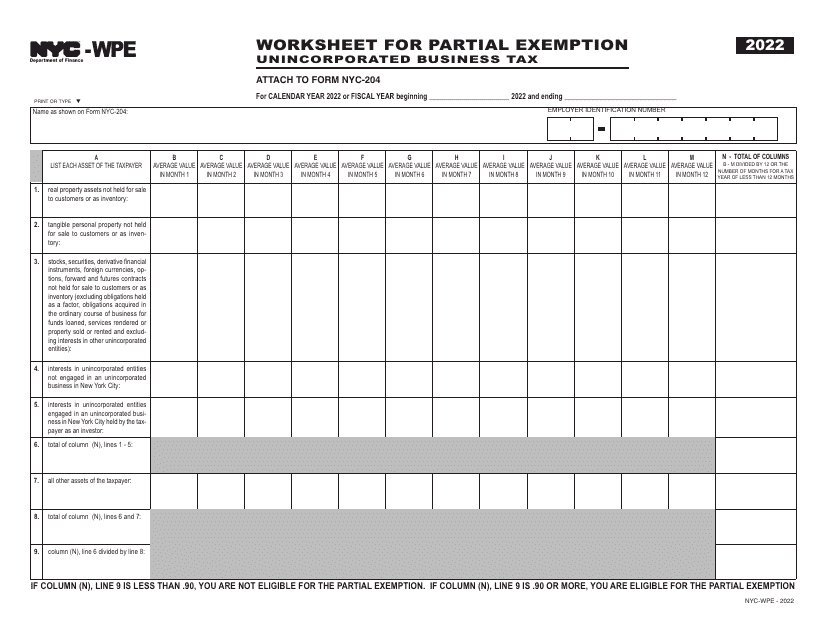

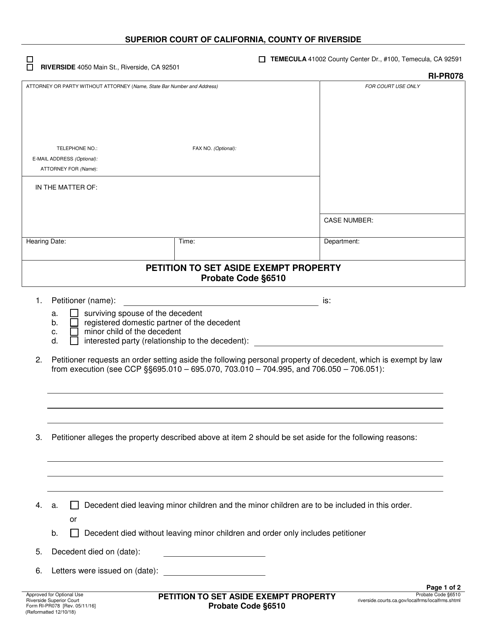

Among our document collection, you'll find essential forms such as the Form NYC-WPE Worksheet for Partial Exemption in New York City and the Form RI-PR078 Petition to Set Aside Exempt Property in Riverside County, California. These documents provide the necessary framework for applying for exemptions and ensuring that your property remains protected.

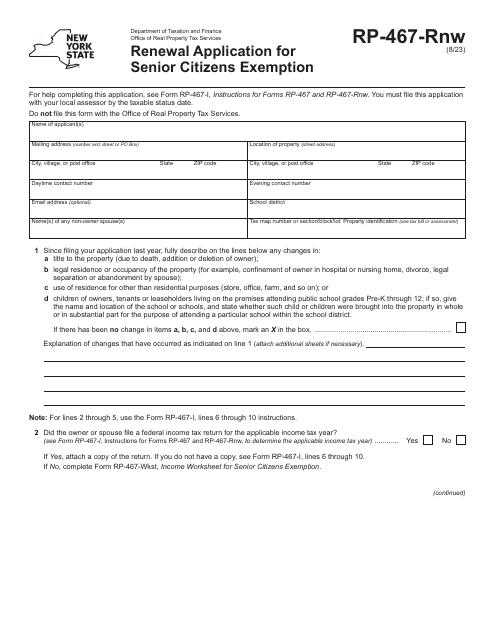

Furthermore, we offer valuable resources like the Form RP-467-RNW Renewal Application for Senior Citizens Exemption in New York. This document caters specifically to senior citizens seeking to renew their property tax exemptions, ensuring continued financial stability during their golden years.

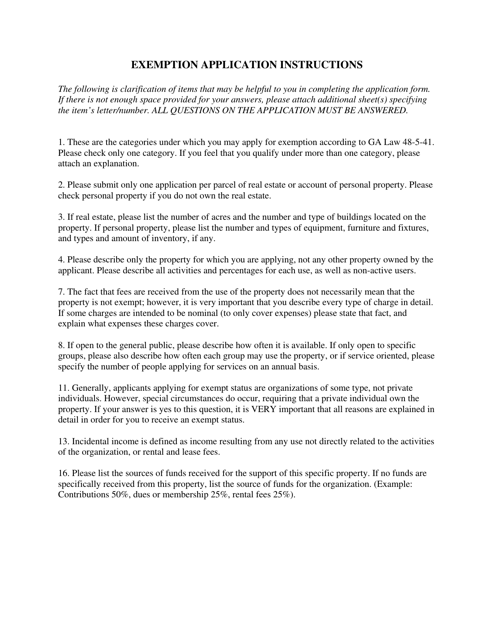

If you reside in DeKalb County, Georgia, our Exempt Property Application will guide you through the process of seeking exemptions tailored to your unique circumstances. This user-friendly form simplifies the application process, enabling you to secure the exemptions you need efficiently.

At Templateroller.com, we recognize that exempt property is not just a legal concept, but a means to ensure your financial well-being and peace of mind. Our dedicated team is committed to providing you with the information and resources necessary to protect your assets and maintain a stable foundation for the future.

Don't let financial burdens weigh you down. Explore our extensive collection of exempt property documents and take the first step towards securing your assets today.

Documents:

32

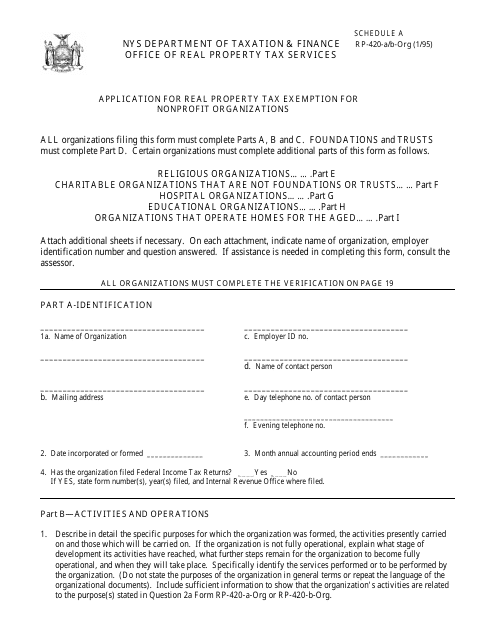

This Form is used for nonprofit organizations in New York to apply for a real property tax exemption.

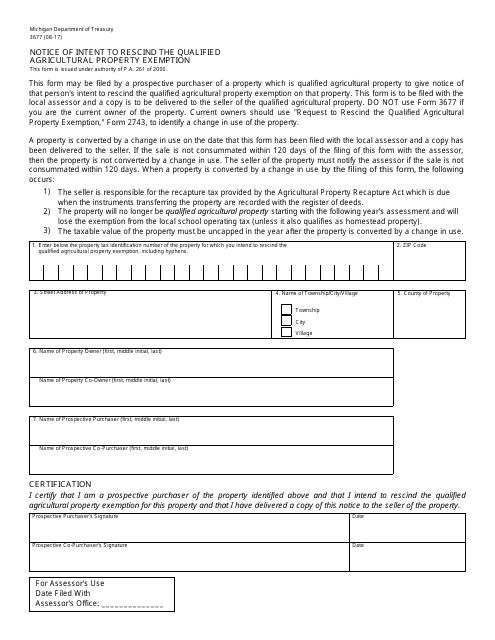

This form is used for notifying the Michigan government of the intent to rescind the qualified agricultural property exemption.

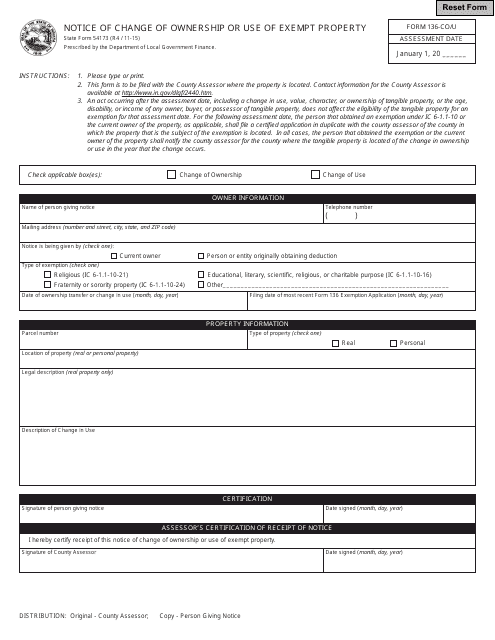

This form is used for notifying the state of Indiana about a change in ownership of exempt property. It is also known as Form 136-CO/U or State Form 54173.

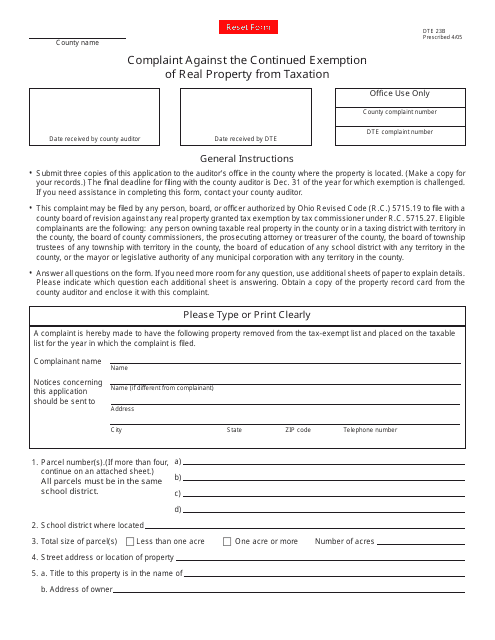

This form is used for filing a complaint against the continued exemption of real property from taxation in Ohio.

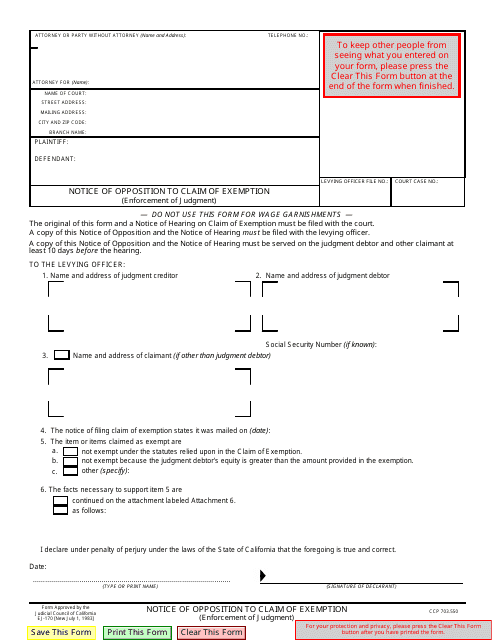

This document is used for opposing a claim of exemption in California regarding the enforcement of a judgment.

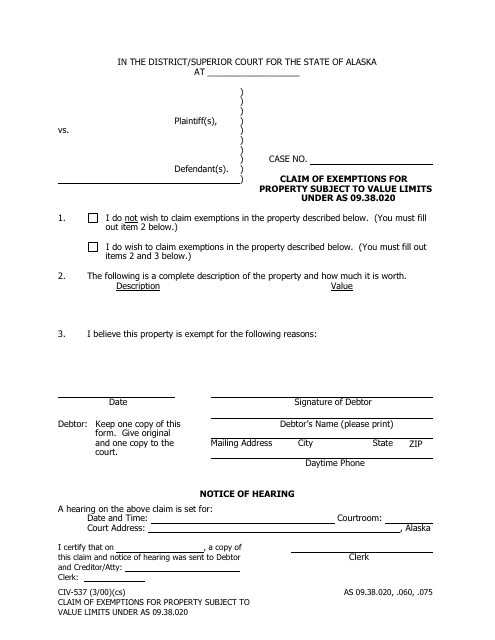

This form is used for claiming exemptions for property in Alaska that is subject to value limits.

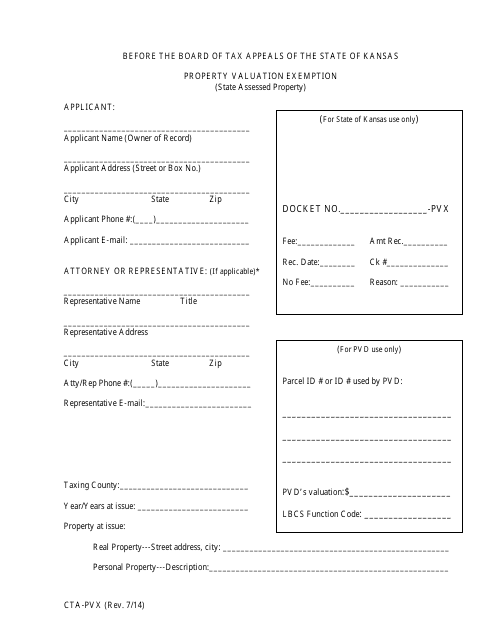

This form is used for applying for a property valuation exemption in Kansas. It is known as the CTA-PVX Form.

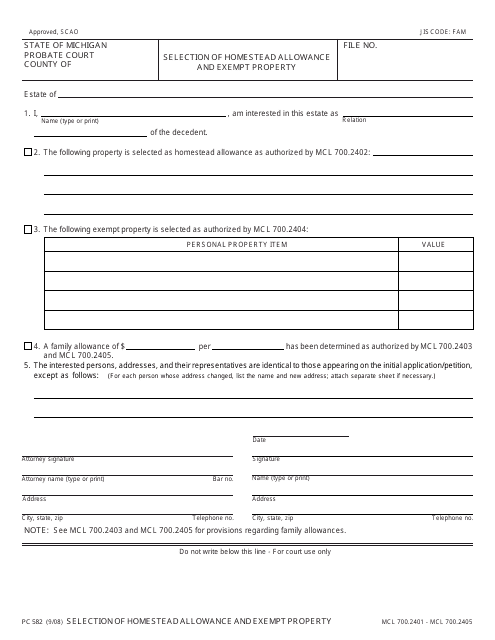

This Form is used for selecting your homestead allowance and exempt property in the state of Michigan. It ensures that certain assets are protected from creditors during bankruptcy proceedings.

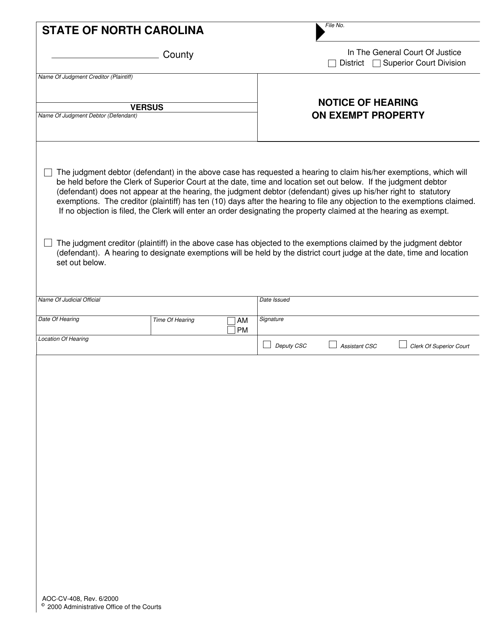

This form is used for filing a Notice of Hearing on Exempt Property in North Carolina. It is a legal document that notifies the court and parties involved about a scheduled hearing relating to exempt property.

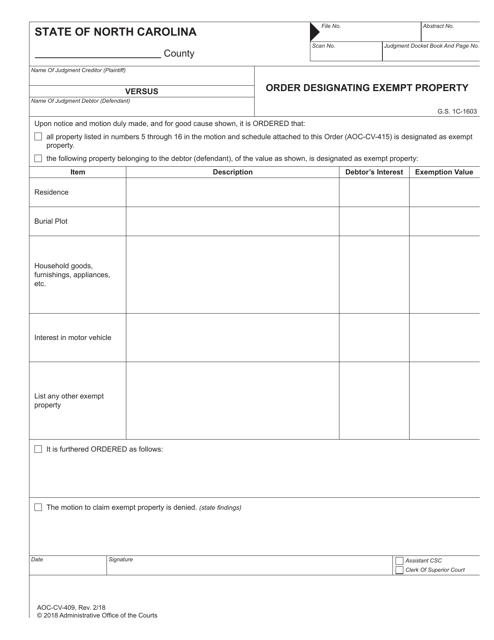

This form is used for the order that designates exempt property in North Carolina.

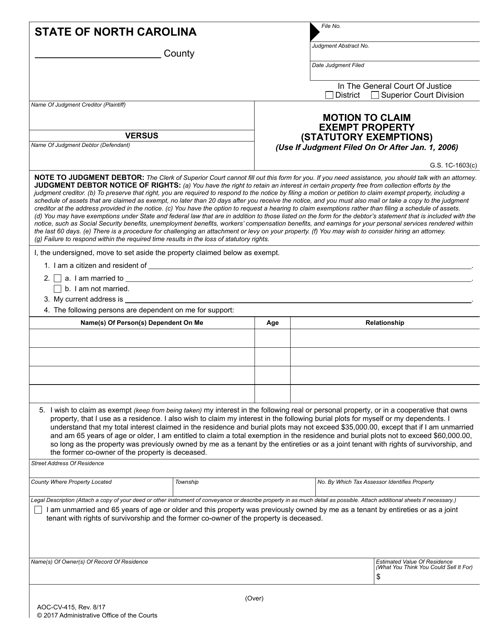

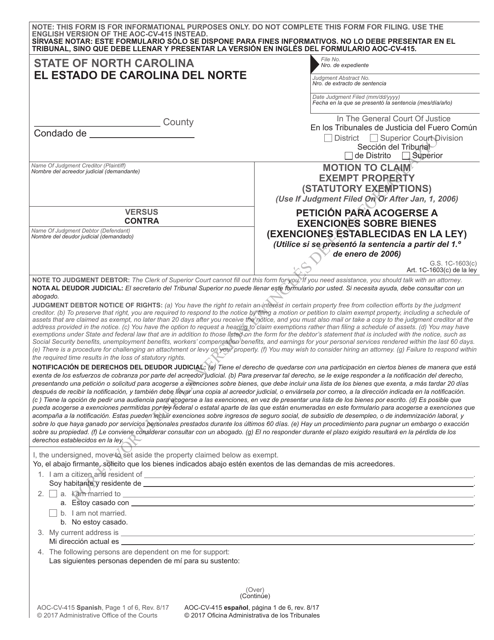

This form is used for filing a motion in North Carolina to claim exemptions for certain types of property that are protected from being taken by a creditor.

This form is used to file a motion to claim exempt property in North Carolina. It is available in both English and Spanish languages.

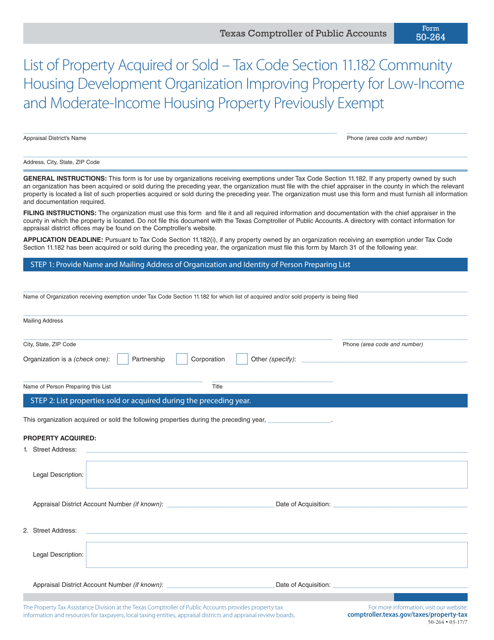

This form is used for reporting the list of properties that have been acquired or sold. It is specifically related to Tax Code Section 11.182 and pertains to the improvement of property for low-income and moderate-income housing. This document is applicable in the state of Texas.

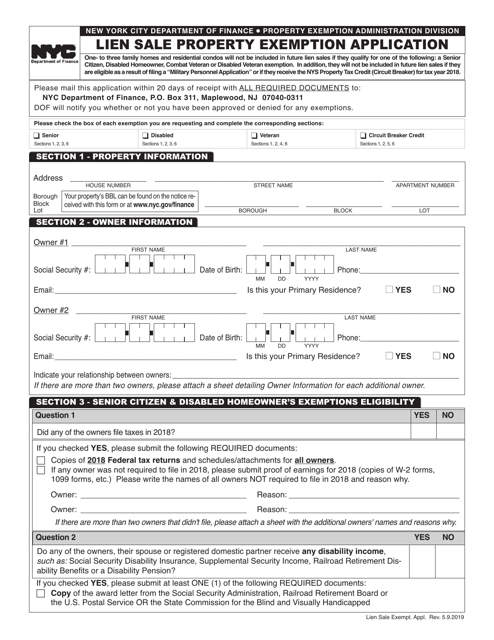

This document is for applying for an exemption on a property being sold through a lien sale in New York City.

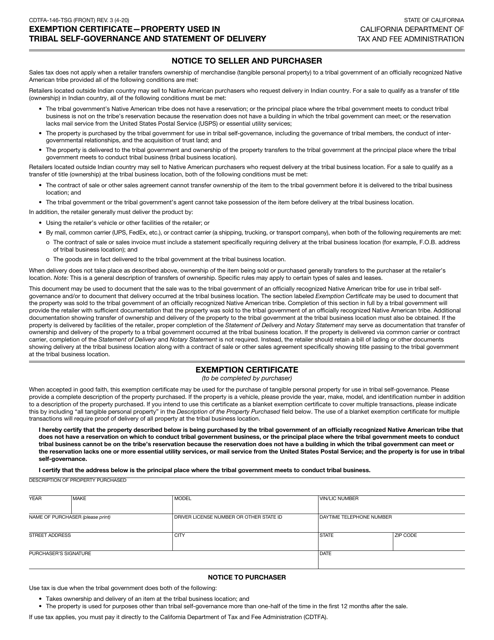

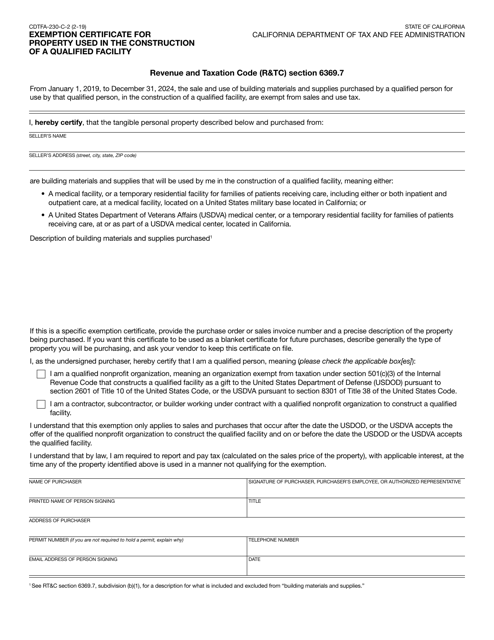

This form is used for requesting an exemption certificate for property that will be used in the construction of a qualified facility in California.

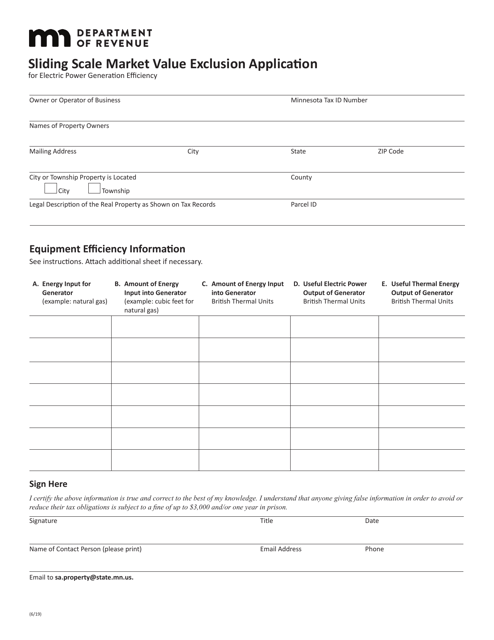

This form is used to apply for the sliding scale market value exclusion in Minnesota.

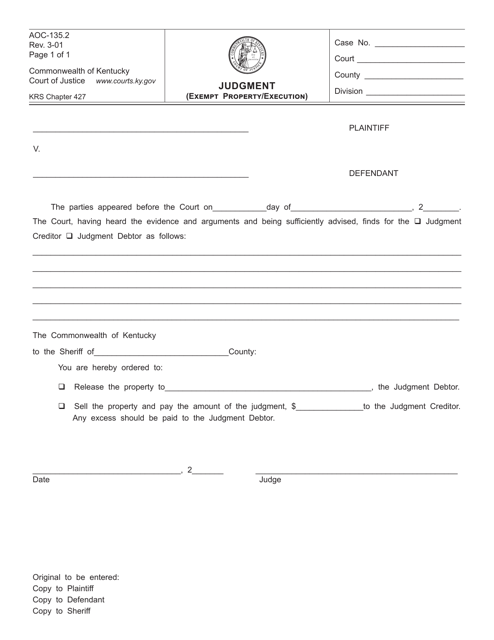

This Form is used for recording a judgment related to exempt property and execution in the state of Kentucky.

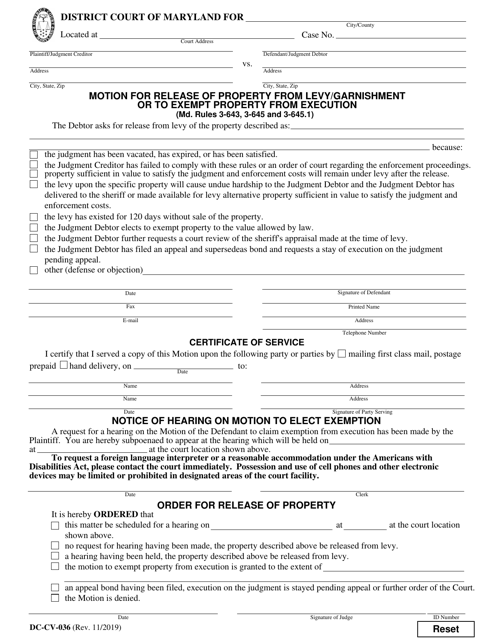

This form is used for requesting the release of property that has been subjected to a levy or garnishment in Maryland. It can also be used to claim exemptions for certain types of property from execution.

This Form is used for filing a petition in Riverside County, California to request the court to exempt certain property from being seized by creditors.

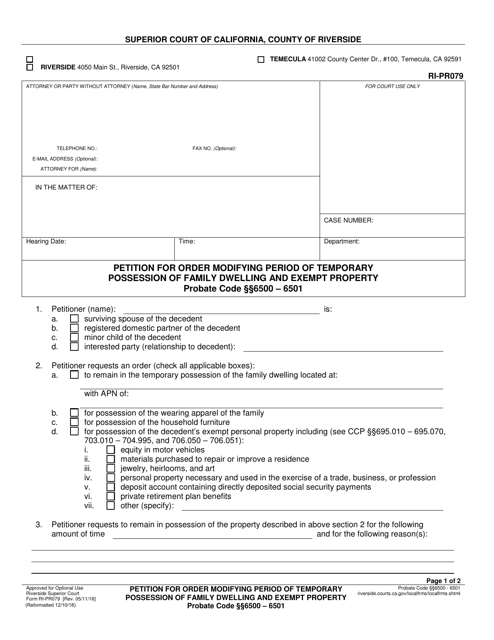

This Form is used for filing a petition to modify the period of temporary possession of a family dwelling and exempt property in Riverside County, California.

This Form is used for applying for property exemptions in DeKalb County, Georgia.

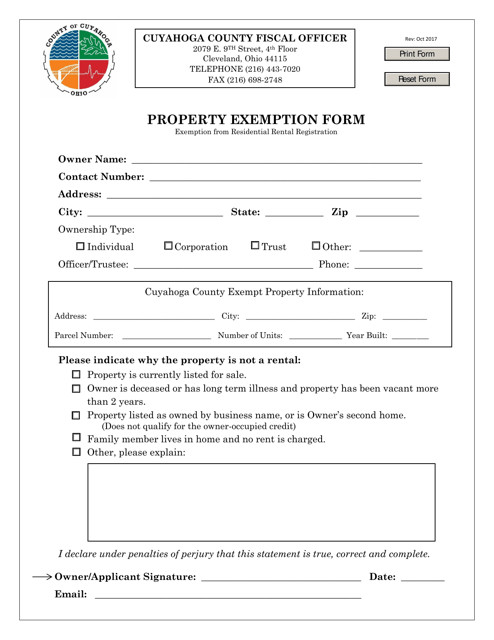

This Form is used for applying for exemption from residential rental registration in Cuyahoga County, Ohio.

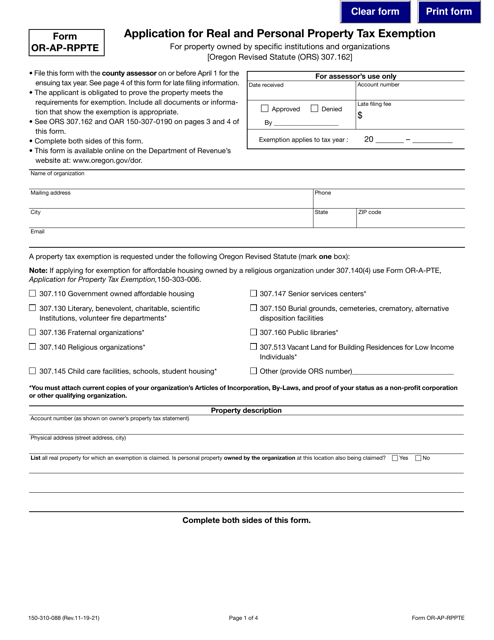

This form is used for applying for a real and personal property tax exemption in the state of Oregon for certain institutions and organizations that own property.

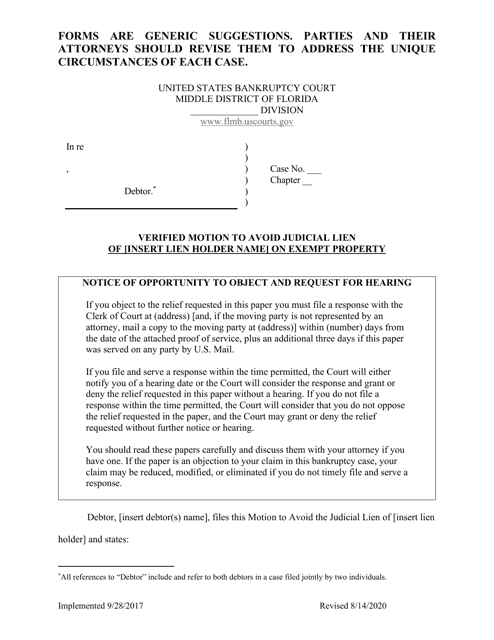

This document is for filing a motion in Florida to get rid of a judicial lien on property that is exempt from being seized.

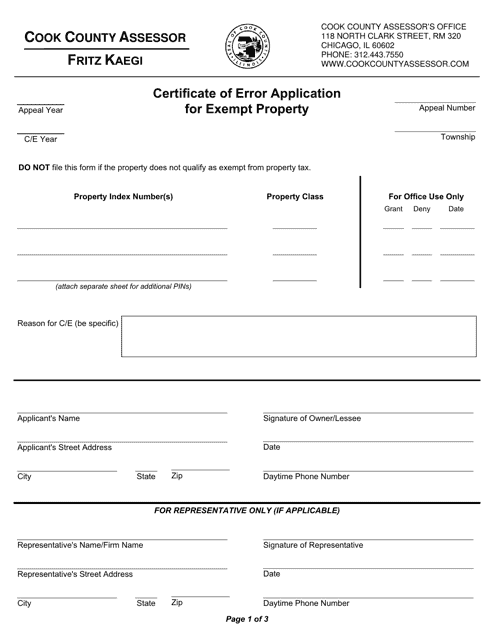

This document is used to apply for a Certificate of Error for exempt property in Cook County, Illinois. It is used when there is an error in the assessment of a property that has been designated as exempt, such as a nonprofit organization or government entity. The application is filed with the Cook County Assessor's Office to request a correction in the property's assessment value for tax purposes.