Business Bonds Templates

Are you a business owner looking for a way to ensure trust and financial security in your professional endeavors? Look no further than our comprehensive collection of business bonds. Also known as business bond forms or simply business bonds, these essential documents guarantee compliance with legal regulations and safeguard the interests of all parties involved.

Our extensive selection covers a wide range of business bond requirements across various states. Whether you're in South Carolina, Arizona, North Carolina, Kentucky, Wisconsin, or any other state, we have the perfect bond for your specific needs.

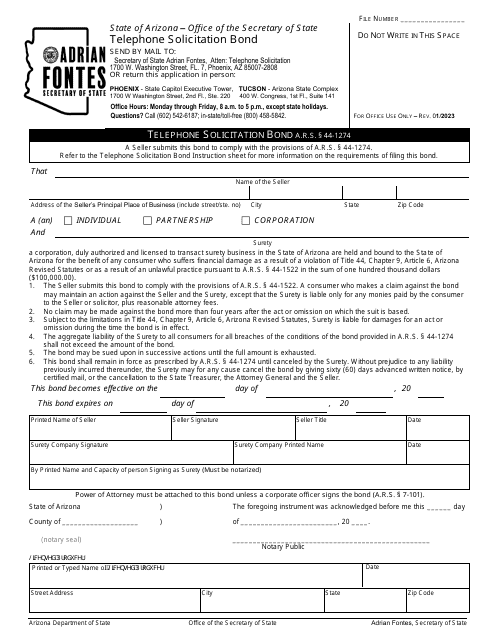

From Broker Bonds in South Carolina to Telephone Solicitation Bonds in Arizona, our business bond collection caters to diverse industries and circumstances. These bonds provide assurance to both customers and authorities that your business operates with integrity and adheres to all relevant laws and regulations.

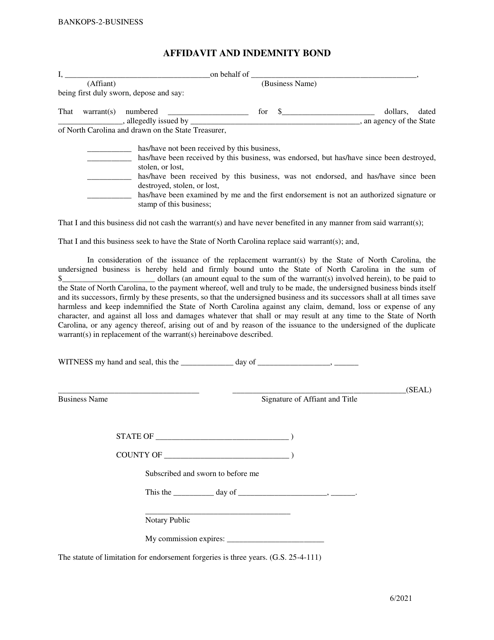

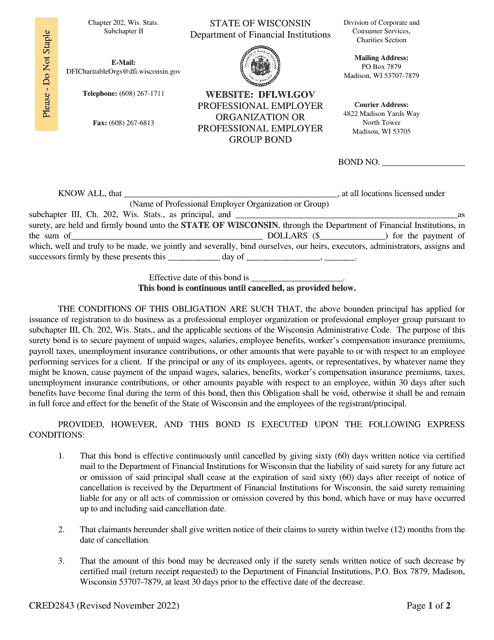

For businesses offering professional services, we offer bonds such as the Affidavit and Indemnity Bond for a Business in North Carolina and the Form CRED2843 Professional Employer Organization or Professional Employer Group Bond in Wisconsin. These bonds not only serve as a marker of professionalism but also protect your clients' interests and provide a safety net against any potential misconduct.

Don't let the lack of a business bond hinder your growth and success. Explore our vast array of business bonds, business bond forms, or business bonds collections, and find the perfect solution for your specific business needs. By investing in these bonds, you're investing in the trust and confidence of your customers, the market, and regulatory authorities.

Choose our business bonds today and take your business to new heights.

Documents:

14

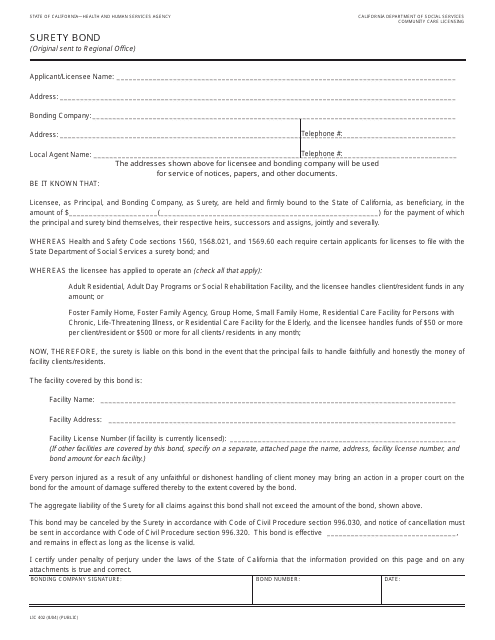

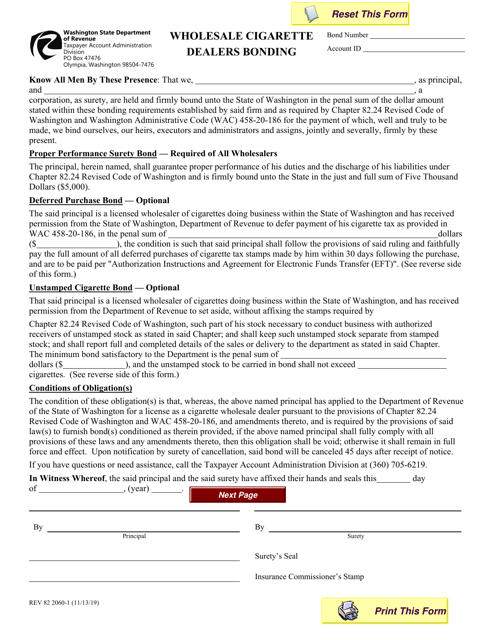

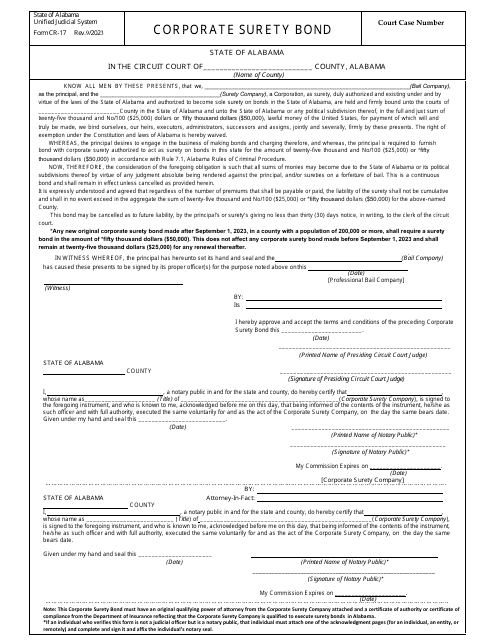

This Form is used for obtaining a surety bond in California. Surety bonds are a type of insurance that provides financial protection in case the party being bonded fails to fulfill their obligations. This document is required for various business activities in California.

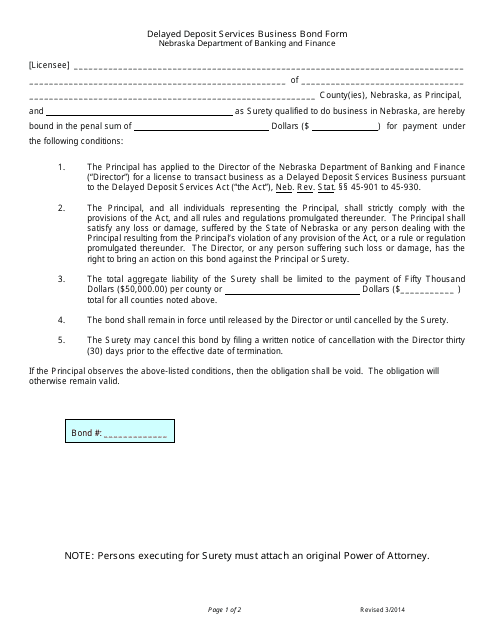

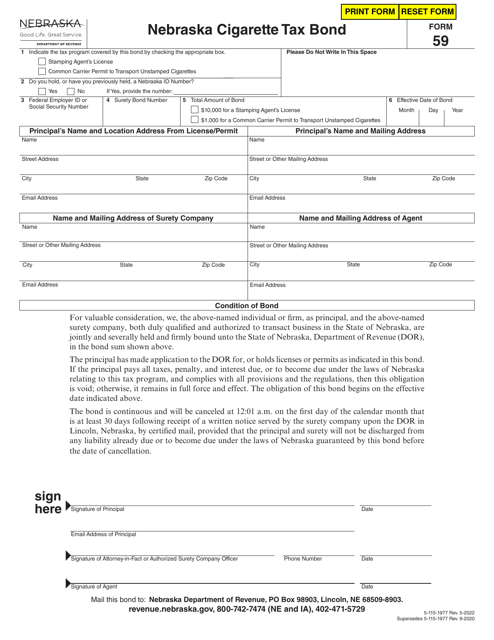

This Form is used for obtaining a business bond for the operation of a delayed deposit services business in Nebraska.

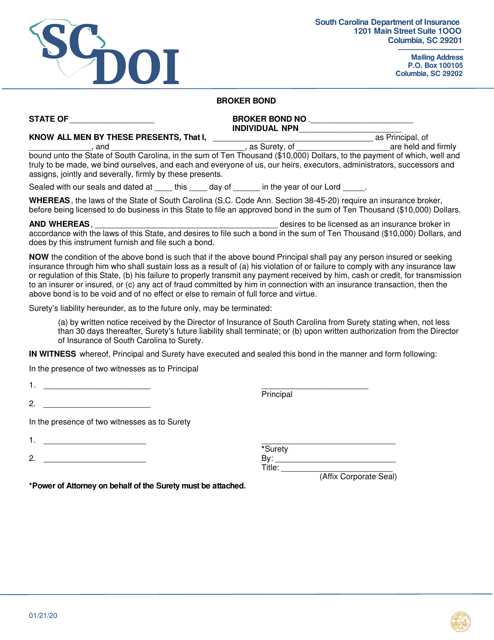

This type of document is a surety bond required for brokers in South Carolina. It provides financial protection to clients in case the broker fails to fulfill their obligations.

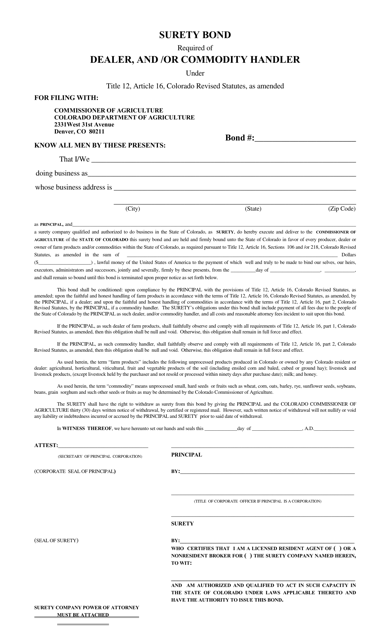

This type of document is a surety bond required by the state of Colorado for dealers and/or commodity handlers. It ensures that the dealer or handler follows the state's regulations and protects consumers from financial loss.

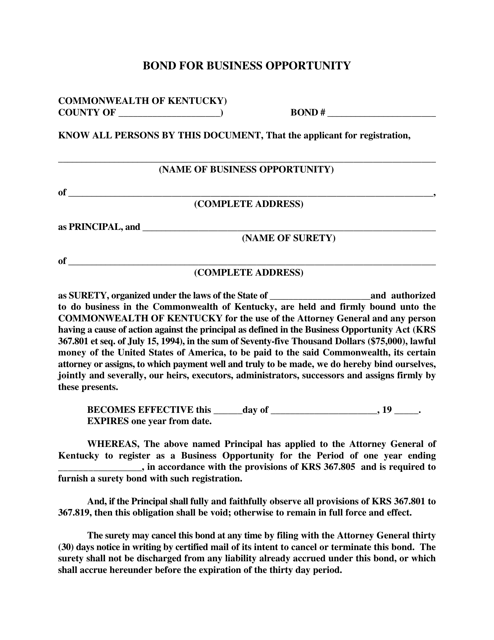

This document is a bond used for a business opportunity in Kentucky. It is a type of contract that ensures financial protection for the parties involved in the business venture.

This form is used for obtaining a bond for a Professional Employer Organization or Professional Employer Group in the state of Wisconsin.