Net Income Loss Templates

Welcome to our webpage dedicated to net income loss documents.

Here you will find a comprehensive collection of documents related to net income loss, also known as financial statements, which are essential for various entities including corporations, partnerships, and insurance companies.

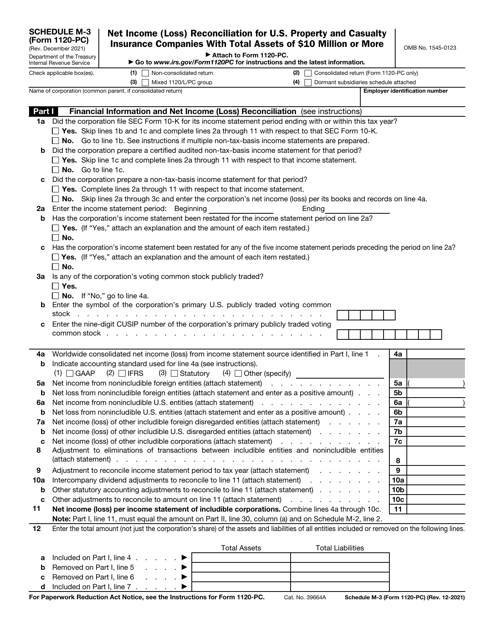

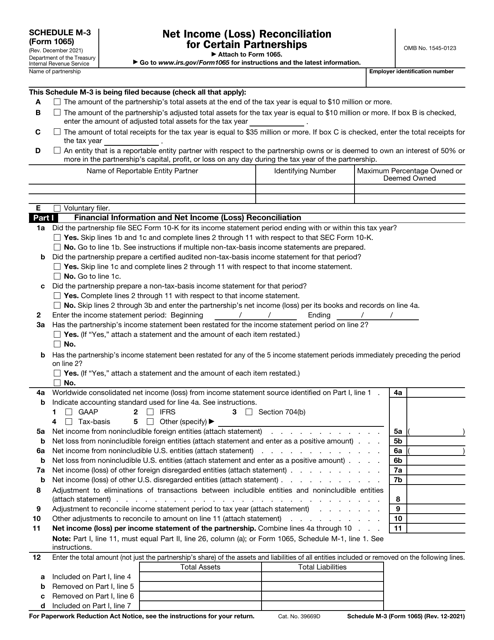

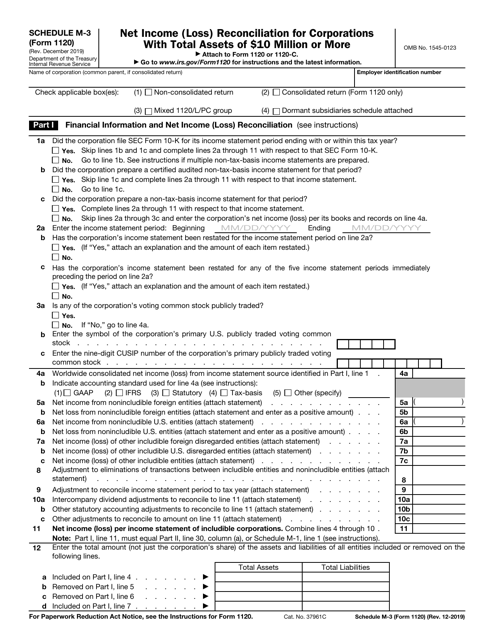

Our extensive library includes IRS Forms such as 1120-PC Schedule M-3 Net Income (Loss) Reconciliation for U.S. Property and Casualty Insurance Companies With Total Assets of $10 Million or More, 1120 Schedule M-3 Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More, and 1065 Schedule M-3 Net Income (Loss) Reconciliation for Certain Partnerships.

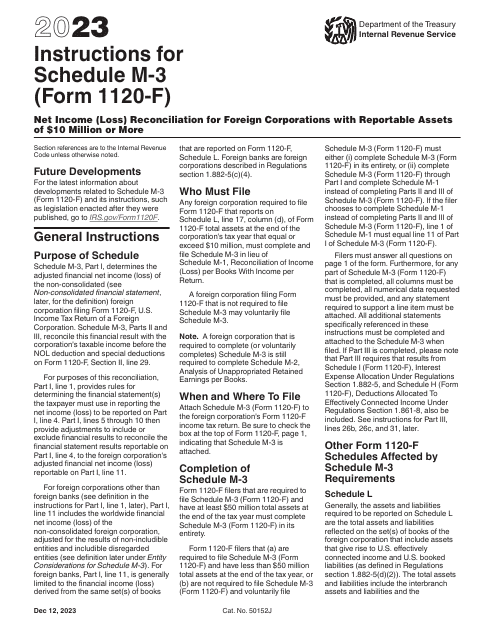

For foreign corporations, we provide detailed instructions for IRS Form 1120-F Schedule M-3 Net Income (Loss) Reconciliation for Foreign Corporations With Reportable Assets of $10 Million or More.

These documents serve as a crucial tool for accurately measuring and reporting net income loss, allowing businesses and organizations to effectively evaluate their financial performance and make informed decisions.

By utilizing these documents, entities can gain insights into their revenue, expenses, and overall profitability, enabling them to navigate financial challenges and optimize their operations.

At our webpage, we strive to provide comprehensive and up-to-date resources for net income loss documents, ensuring that businesses have the necessary tools to assess their financial health and meet regulatory requirements.

Browse through our extensive collection and access the resources you need to effectively manage net income loss.

Documents:

6