Mortgage Lender Templates

Are you looking to secure a home loan from a trusted lending institution? Look no further than our comprehensive collection of mortgage lender resources. We understand that finding the right mortgage lender can be a daunting task, which is why we have carefully curated this collection to help streamline your search.

Our mortgage lender documents are designed to provide you with the information and tools you need to navigate the mortgage lending process with confidence. From templates for hardship letters to sample pre-approval letters, we have you covered at every step of the way.

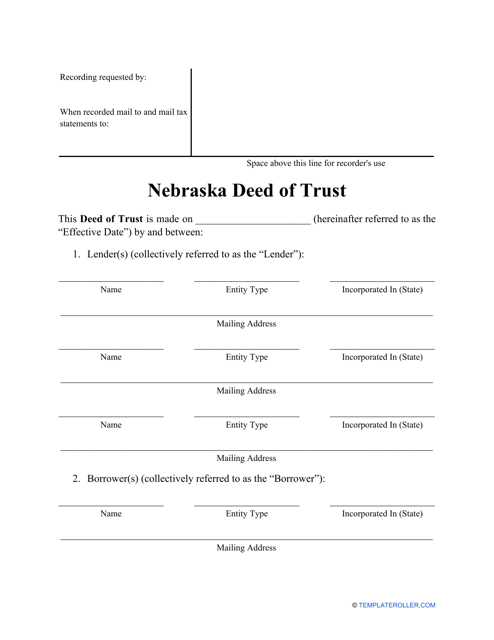

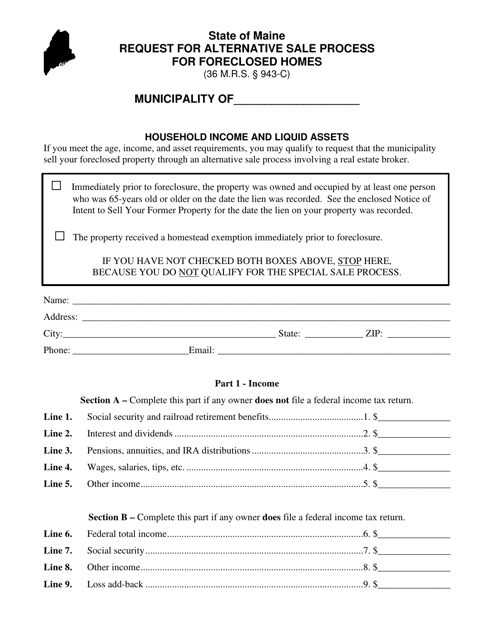

Whether you're a first-time homebuyer or someone looking to refinance, our mortgage lender documents are packed with valuable resources to guide you through the process. We also offer state-specific documents, such as the Mortgage Recovery Fund Application for Idaho and the Deed of Trust Form for Nebraska, to ensure that you have access to the most relevant and accurate information.

Don't waste your precious time searching the internet for scattered and unreliable resources. Trust our mortgage lender documents collection to provide you with the knowledge and tools you need to make informed decisions about your home loan.

Documents:

19

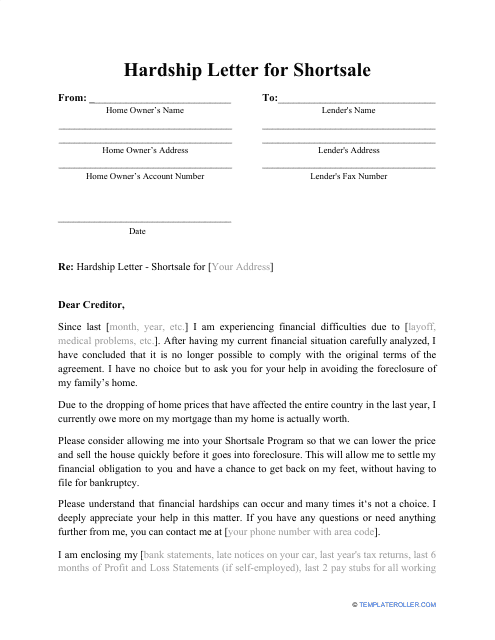

This is a typed or handwritten statement prepared by a borrower and sent to the lender to explain the circumstances that led to a payment delay and convince the lender of the necessity to sell the property at a lower price.

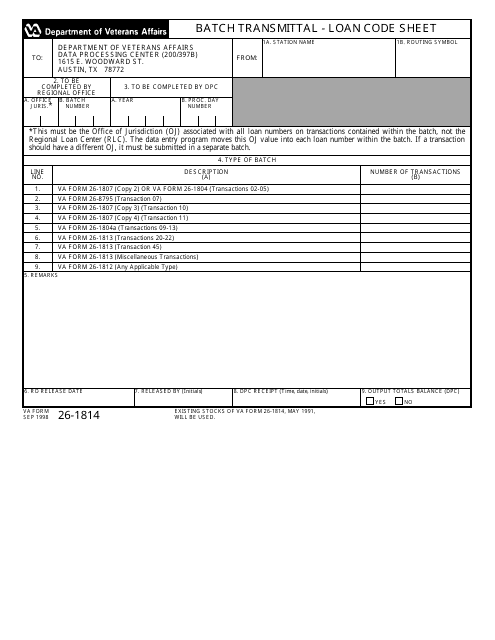

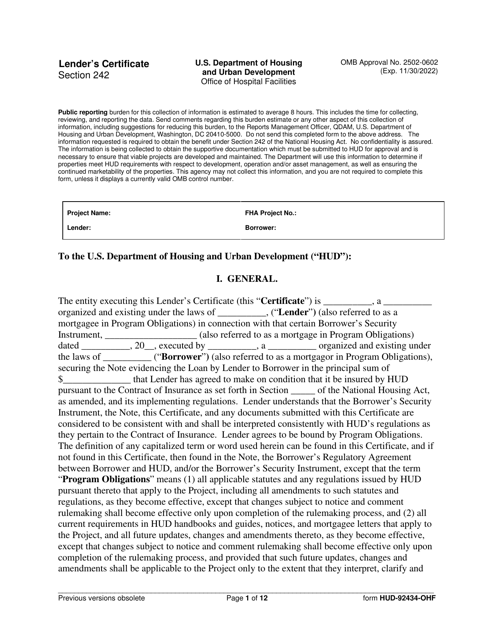

This document is used for transmitting batches of loan code sheets to the Department of Veterans Affairs (VA). It helps streamline the process of submitting loan codes for various VA loan programs.

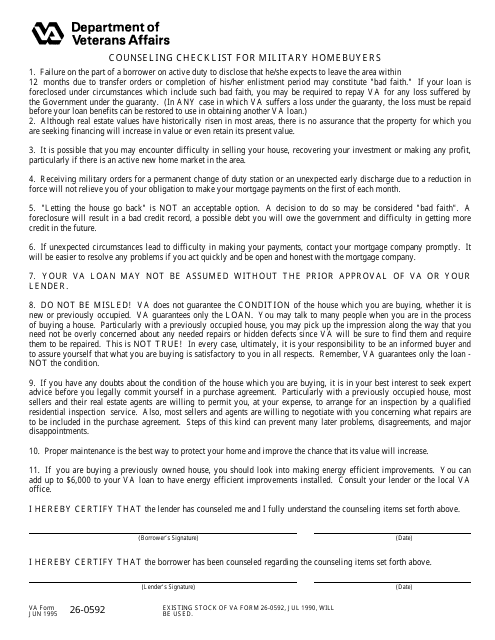

U.S. Servicemembers may use this VA checklist to obtain a loan with the help of the Federal Housing Administration.

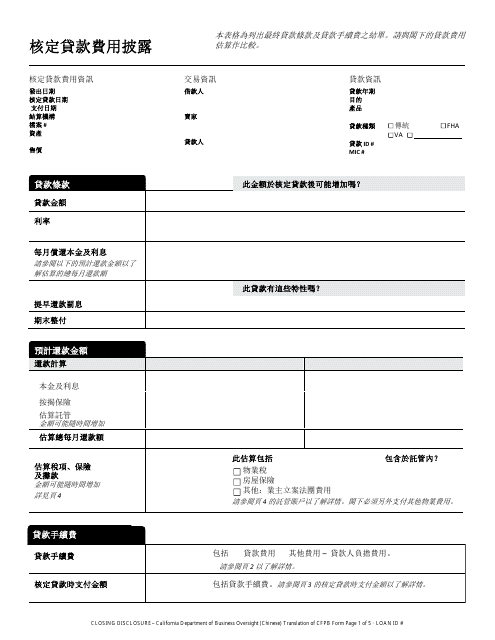

This document is used for providing closing details in a real estate transaction in California. It is available in Chinese language for convenience.

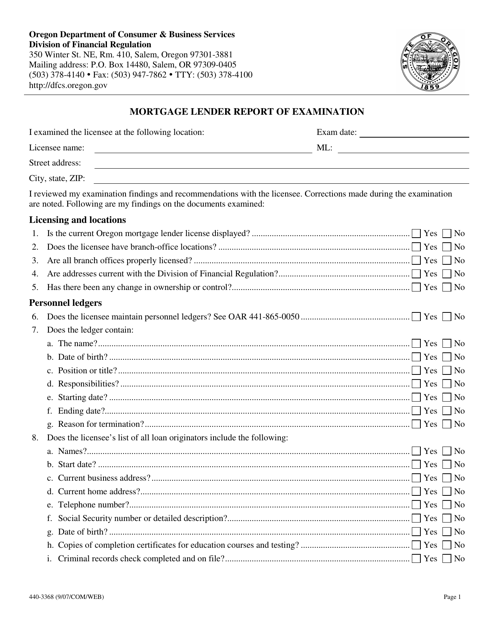

This form is used for mortgage lenders in Oregon to report the results of their examination.

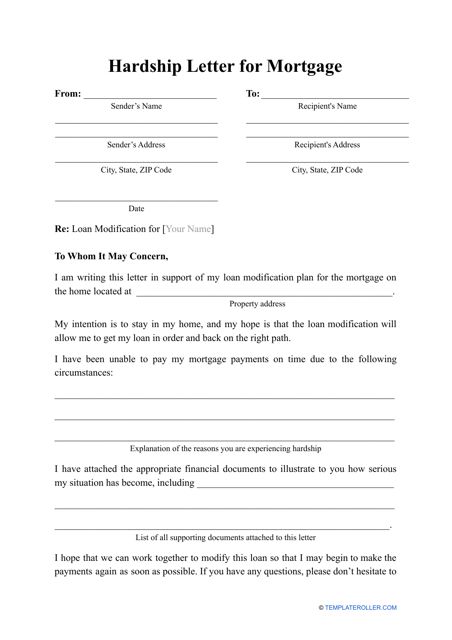

Complete this ready-made template to explain to the bank why you're defaulting on your mortgage.

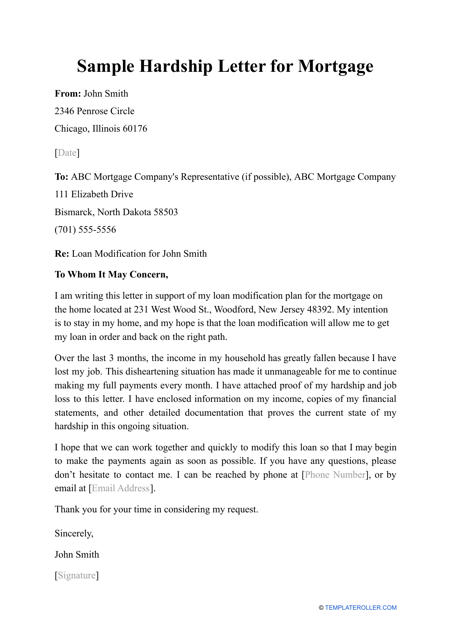

Use this sample as a reference when drafting your own Hardship Letter for Mortgage.

This document describes the changes in the Canadian mortgage market and its impact.

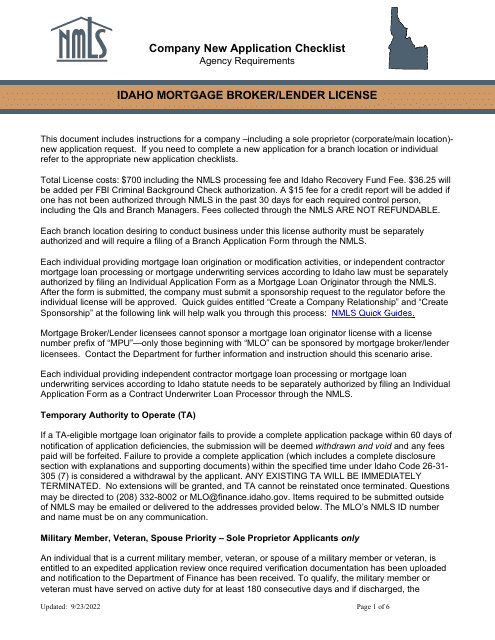

This document is used for applying to the Mortgage Recovery Fund in Idaho.

Writing an efficient Loan Modification Hardship Letter is crucial to the success of modifying a home loan .

This document is for lenders in Arkansas who want to participate in the Mortgage Credit Certificate (MCC) Program. The MCC Program provides eligible homebuyers with a tax credit on a portion of their mortgage interest.

This type of deed is used to protect a real estate transaction when a loan is involved in the state of Nebraska.

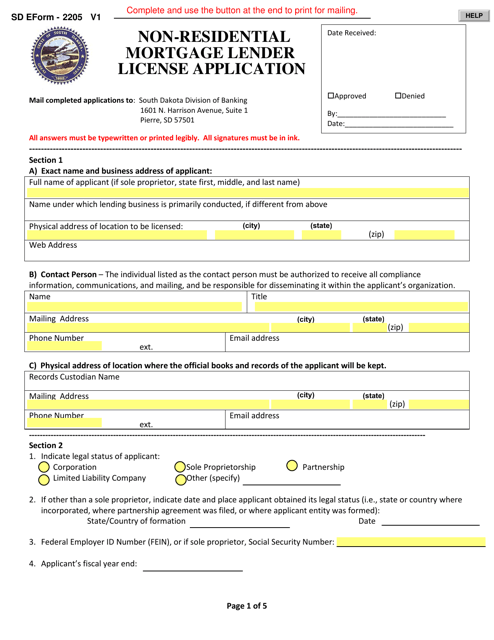

This form is used for applying for a non-residential mortgage lender license in South Dakota.

This letter can be used as a reference to show that a customer has maintained a good credit history and has saved the necessary funds that will later help them qualify for a mortgage loan.

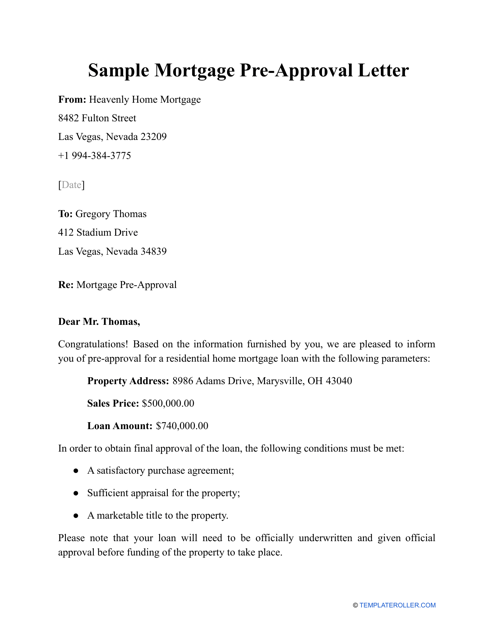

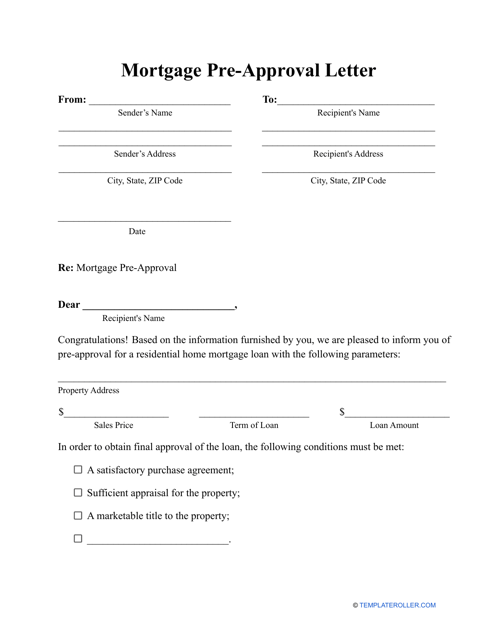

This is a written statement composed by a lender and sent to a borrower to notify the latter their mortgage application has been evaluated and approved subject to certain conditions the borrower must adhere to.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.