Mortgage Loan Templates

Looking to finance your dream home? Look no further than our comprehensive collection of mortgage loans. Whether you're a first-time homebuyer or looking to refinance, our extensive range of mortgage loan options has got you covered.

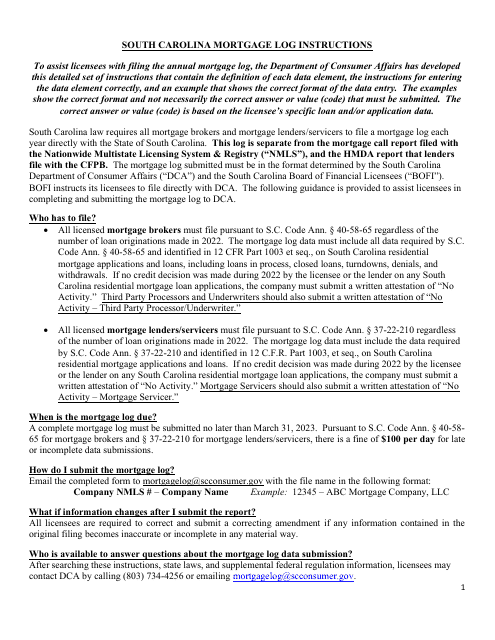

Our mortgage loan collection includes a variety of documents tailored to meet your specific needs. From the Formulario H-28(A) Mortgage Loan Transaction Loan Estimate (Spanish) for our Spanish-speaking customers to the Mortgage Loan Servicer Application Instructions - New York, we provide all the necessary resources to guide you through the mortgage process.

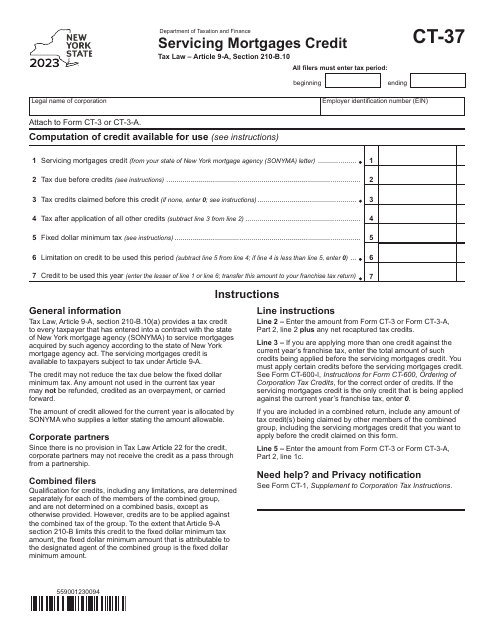

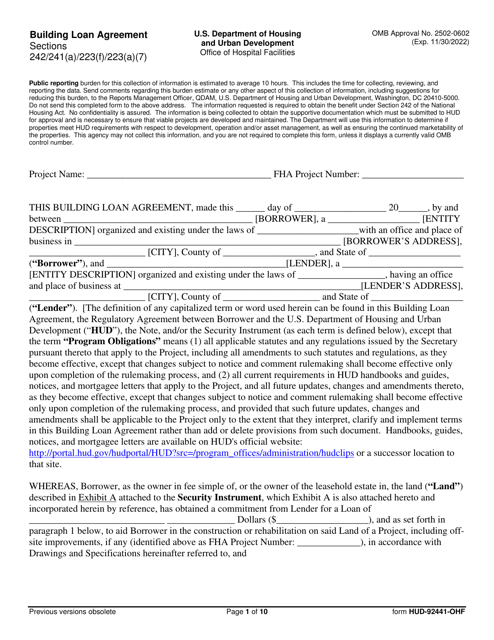

Are you a mortgage loan servicer? Our Mortgage Loan Servicer Volume of Servicing Report - New York and Form CT-37 Servicing Mortgages Credit - New York are designed to assist you in managing your mortgage loan portfolio efficiently and effectively. We also offer the Form HUD-92441-OHF Building Loan Agreement for those looking to secure financing for construction projects.

Don't let the complexities of mortgage loans overwhelm you. Explore our comprehensive collection of mortgage loan documents today and find the perfect solution for your home financing needs.

Documents:

24

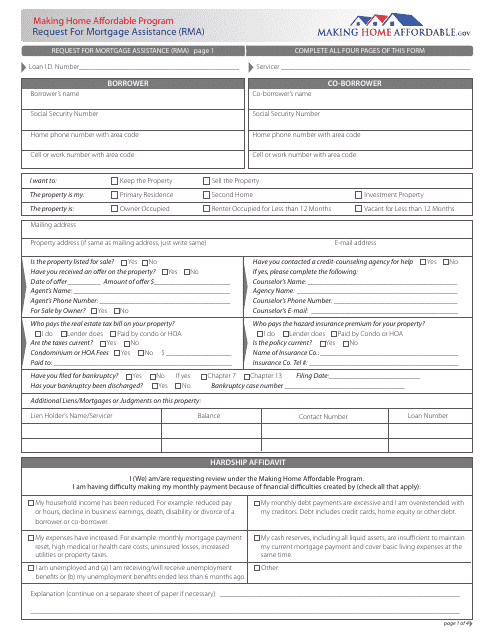

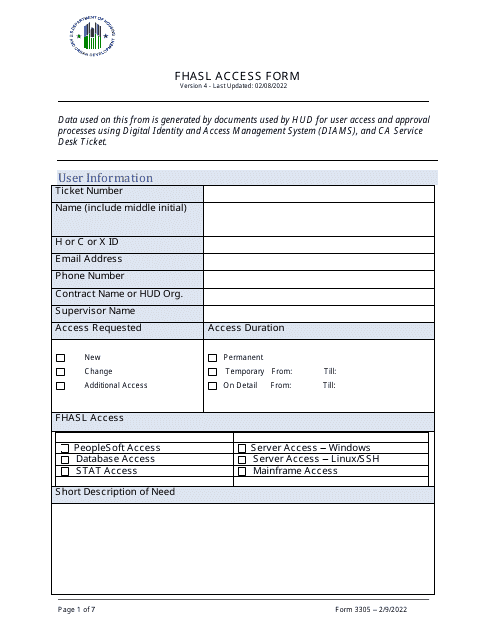

This form is used for requesting assistance with a mortgage. It contains important information and documentation that lenders require to evaluate eligibility for mortgage assistance programs.

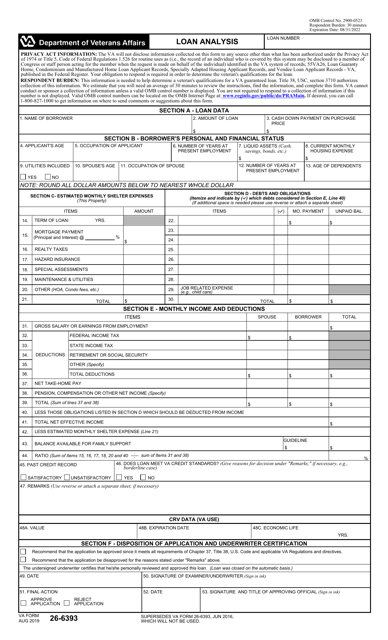

This Form is used for the Hud/VA Addendum to the Uniform Residential Loan Application.

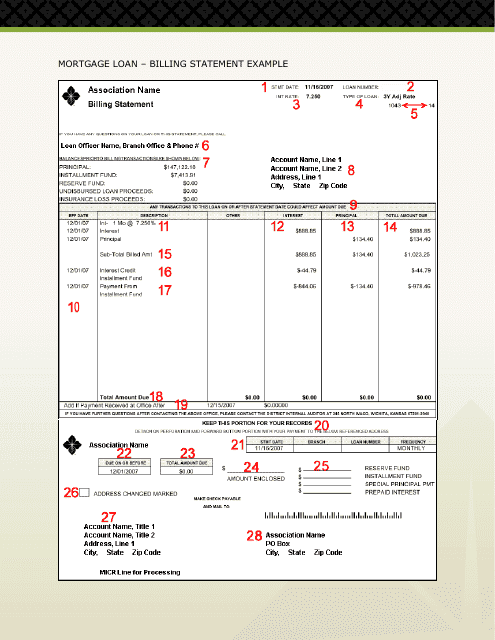

This document is a sample billing statement for a mortgage loan. It provides a breakdown of the amount due, including principal, interest, and any additional fees or charges.

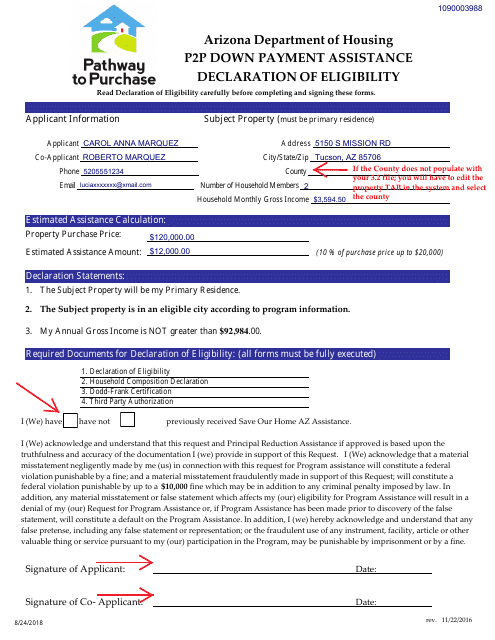

This document is for individuals in Arizona who are applying for down payment assistance through the P2p program. It is used to declare their eligibility for the program.

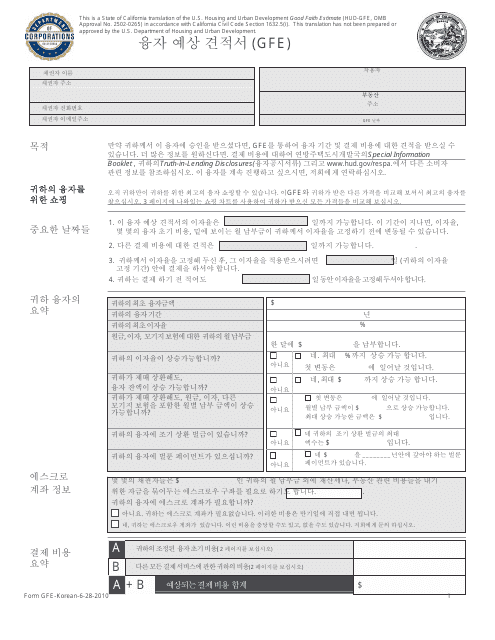

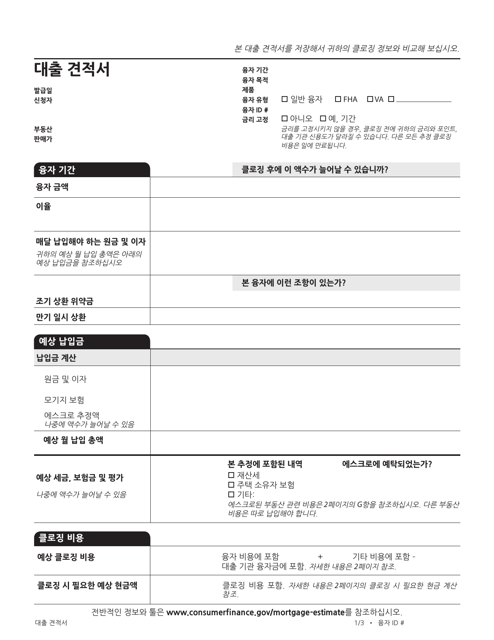

This type of document is used for providing an estimate of the closing costs for a mortgage loan in California. The form is available in Korean.

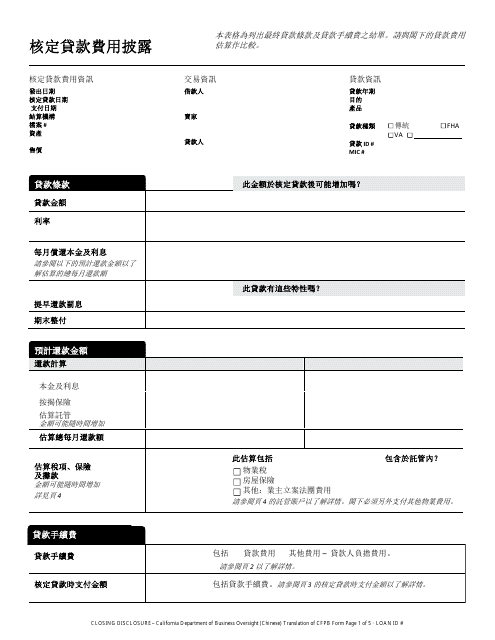

This document is used for providing closing details in a real estate transaction in California. It is available in Chinese language for convenience.

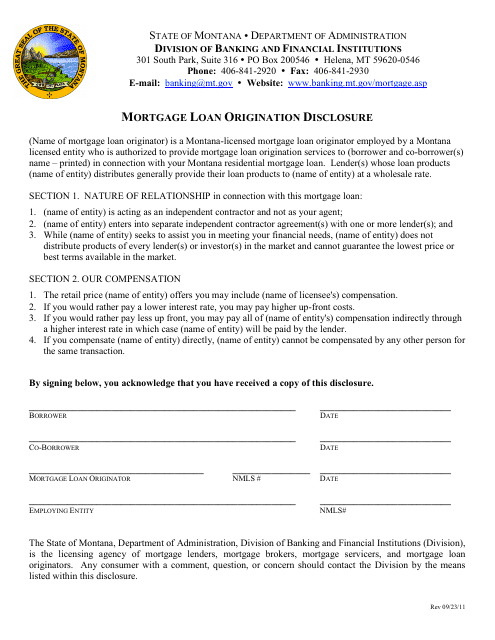

This form is used for disclosing important information about the mortgage loan origination process in Montana. It provides details about the terms, fees, and costs associated with obtaining a mortgage loan.

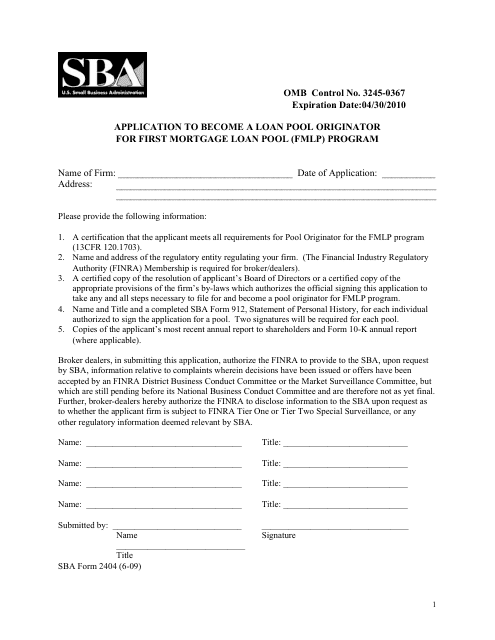

This Form is used for applying to become a Loan Pool Originator for the First Mortgage Loan Pool (FMLP) Program administered by the Small Business Administration (SBA).

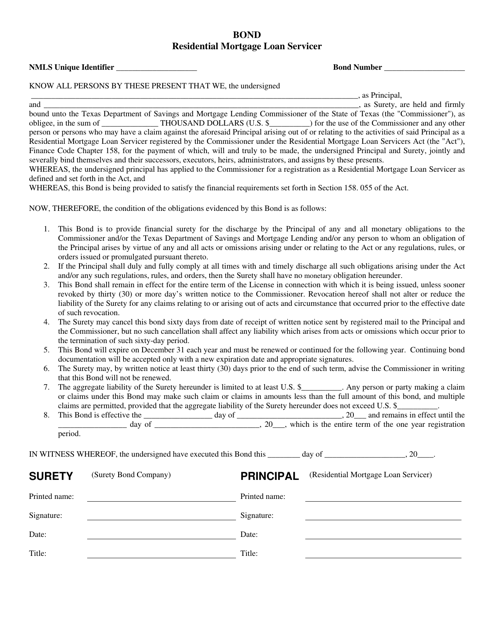

This document is for the Bond Residential Mortgage Loan Servicer in the state of Texas. It pertains to the responsibilities and regulations of mortgage loan servicing in Texas.

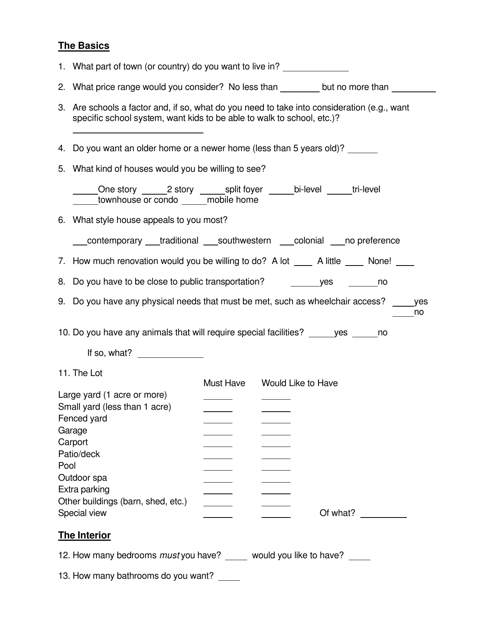

This document is used to create a wishlist for buying a home. It helps you organize and prioritize the features and characteristics you want in your future home.

This document provides a loan estimate form from the Consumer Financial Protection Bureau specifically for residents of California who speak Korean. The form is used to understand the terms and costs associated with a loan.

This document is a Loan Estimate form for a mortgage loan transaction, written in Spanish. It provides information about the loan terms, estimated closing costs, and other important details related to the loan.

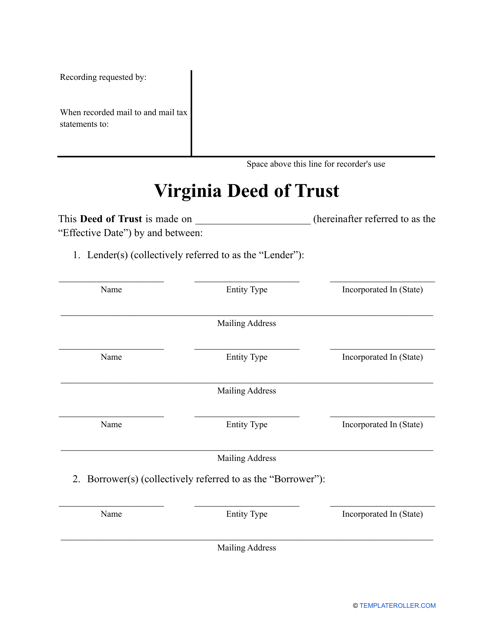

Transferring property in the state of Virginia? This printable Deed of Trust can be used to protect a real estate transaction when a loan is involved.

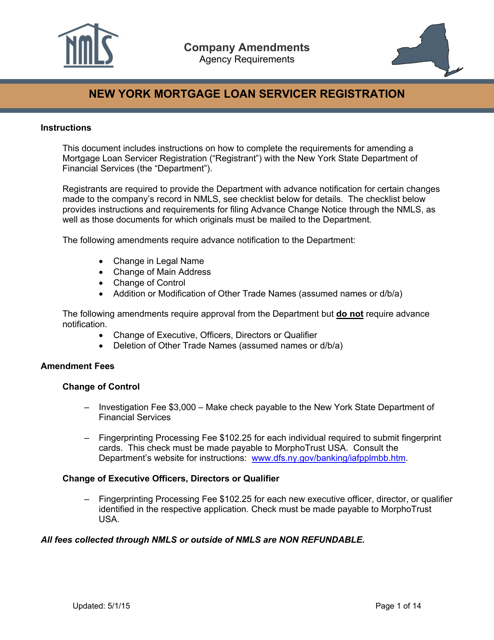

This document provides instructions for applying to become a mortgage loan servicer in New York. It guides you through the application process and helps you understand the requirements.

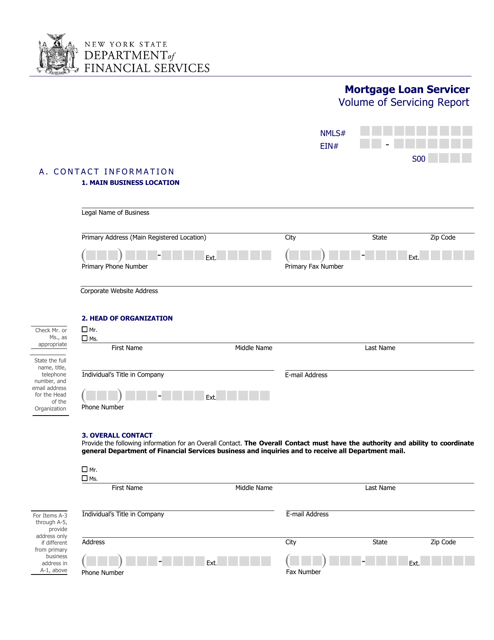

This document provides a report on the volume of mortgage loans serviced by a loan servicer in New York.

This document is a Building Loan Agreement form (Form HUD-92441-OHF) used by the U.S. Department of Housing and Urban Development (HUD) for financing the construction or rehabilitation of affordable housing projects.

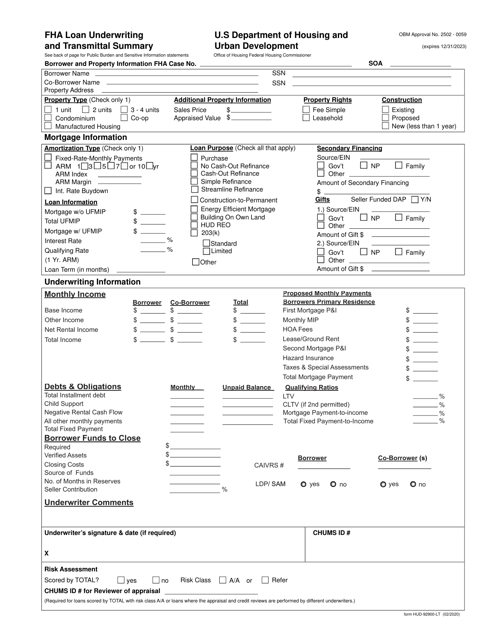

This form is used for summarizing and transmitting the underwriting information for an FHA loan.

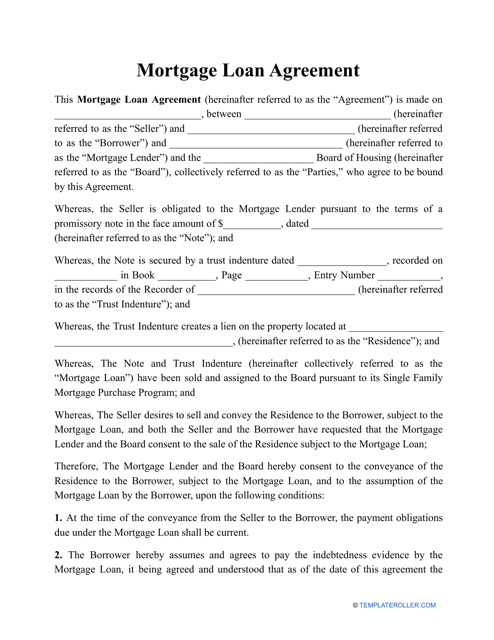

Upon signing this type of template, this legal instrument gives the latter access to the lender's money creating a lien on the real estate.