Electronic Tax Filing Templates

Welcome to our webpage on electronic tax filing! Whether you refer to it as electronic tax filing or e-filing, this modern method of submitting your tax returns offers numerous advantages. With electronic tax filing, taxpayers can conveniently and securely submit their tax documents online, eliminating the need for paper forms and snail mail.

We understand that tax filing can be a complex and time-consuming task. That is why we offer a comprehensive guide to help you navigate through the process of electronic tax filing. Our guide covers a wide range of topics, from the benefits of e-filing to the necessary forms and declarations required by different states.

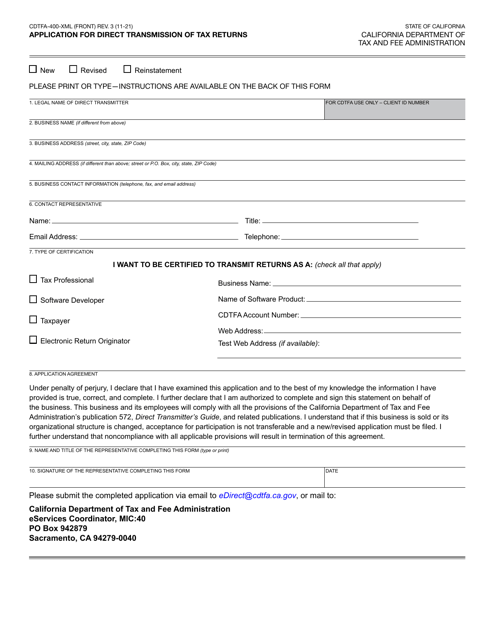

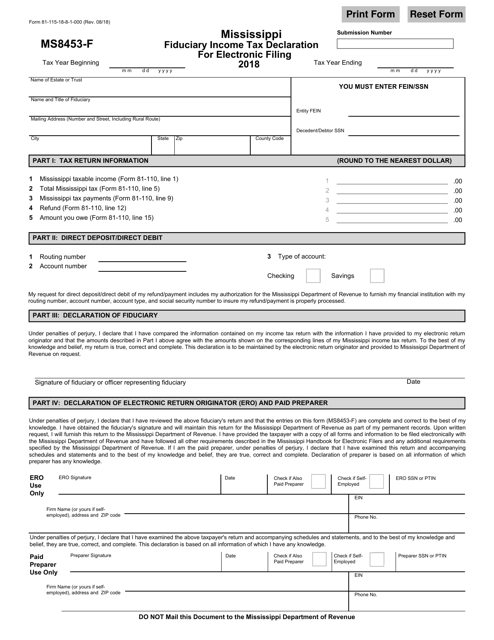

One of the key documents you may encounter during electronic tax filing is the Application for Direct Transmission of Tax Returns. For example, in California, you will come across the Form CDTFA-400-XML Application for Direct Transmission of Tax Returns. Similarly, in Mississippi, the Form 81-115-18-8-1-000 (MS8453-F) Fiduciary Income Tax Declaration for Electronic Filing is required.

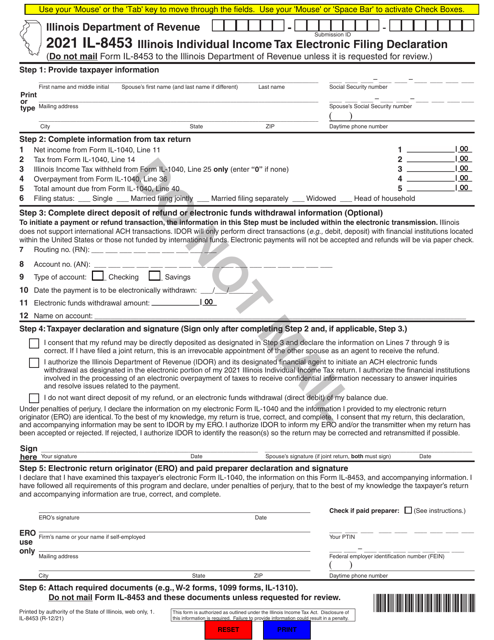

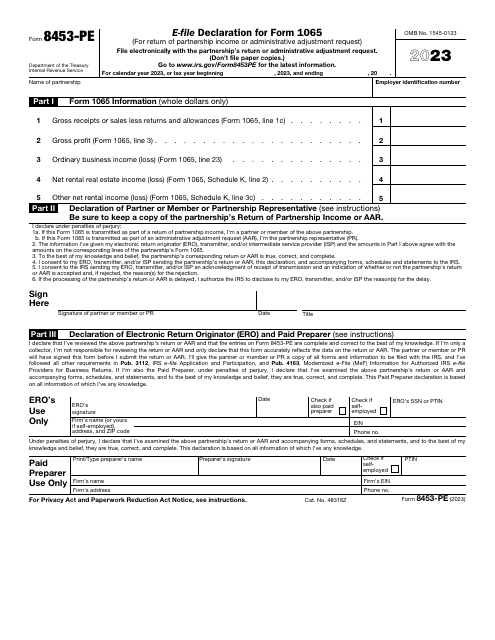

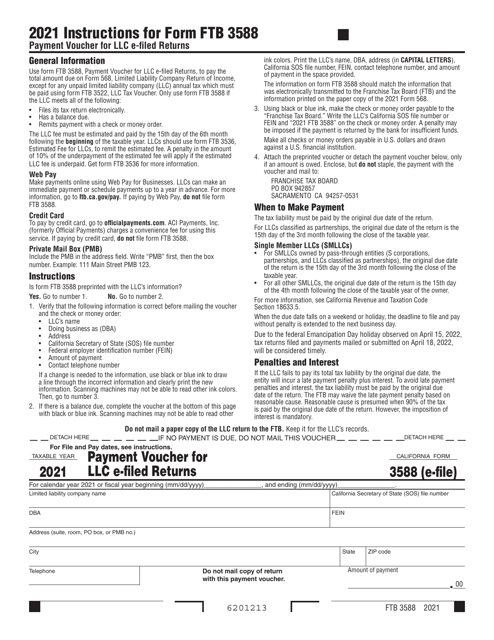

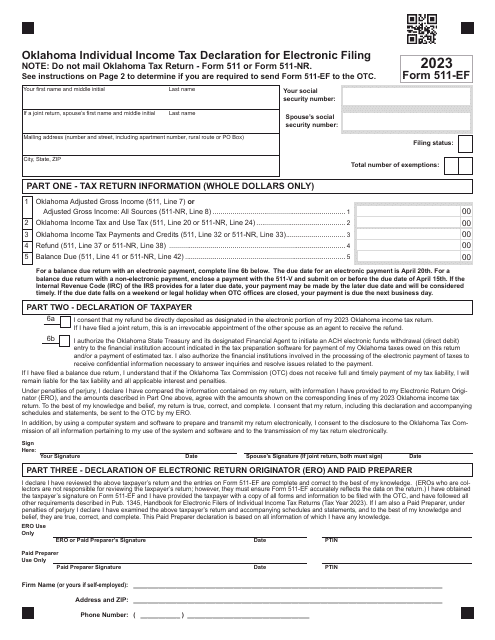

Apart from state-specific forms, there are also federal forms to consider. For instance, the Form IL-8453 is essential in Illinois for individual income tax electronic filing. Additionally, you will come across forms like Form FTB3588 Payment Voucher for LLC E-Filed Returns in California and Form 511-EF Oklahoma Individual Income Tax Declaration for Electronic Filing in Oklahoma.

To ensure a seamless electronic tax filing experience, it is crucial to have a clear understanding of the necessary forms and declarations. Our webpage provides comprehensive information and resources to answer all your questions about electronic tax filing. With our guidance, you can complete your tax returns efficiently and accurately, saving you valuable time and minimizing stress.

Don't let the daunting task of tax filing overwhelm you. Embrace the convenience and efficiency of electronic tax filing today, and let our webpage be your go-to resource for all your e-filing needs.

Documents:

7

This Form is used for filing the fiduciary income tax declaration electronically in the state of Mississippi. It is also known as form 81-115-18-8-1-000 (MS8453-F).