Rental Deductions Templates

Are you a property owner or a tenant looking to maximize your tax savings? Look no further than our comprehensive collection of rental deduction resources. Whether you refer to it as rental deductions, rental deduction, or rental deduction form, this category of documents is designed to help you take advantage of tax benefits related to rental properties.

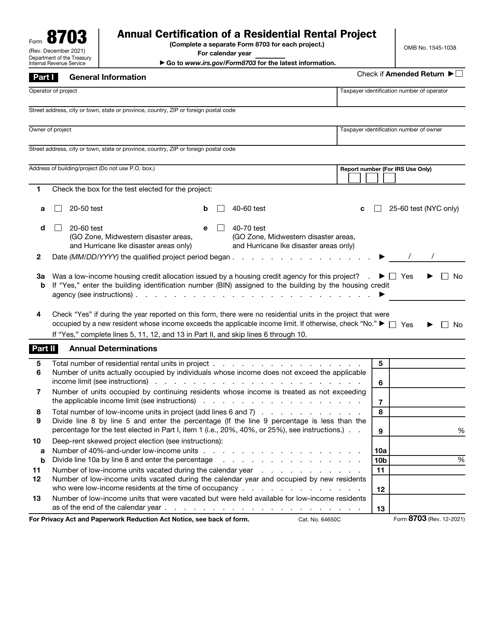

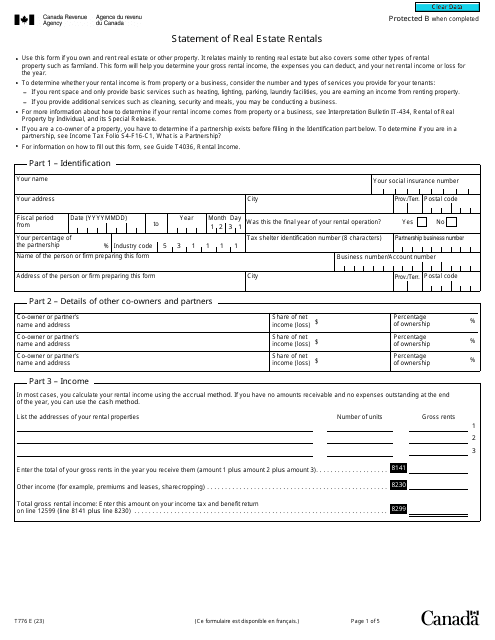

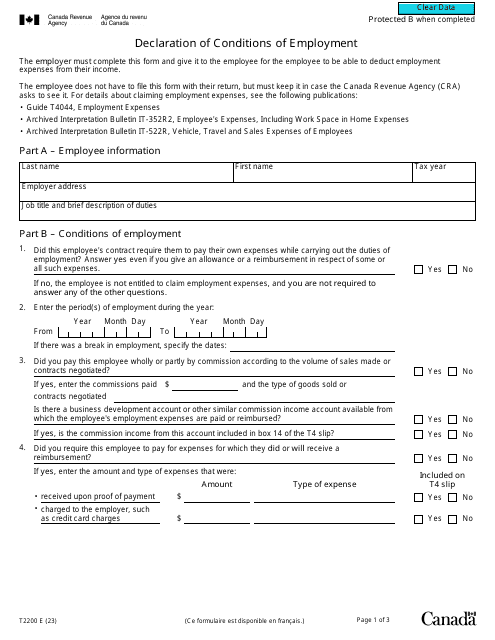

From the IRS Form 8703 Annual Certification of a Residential Rental Project to the Form I-017 Rent Certificate in Wisconsin, we have compiled a range of documents to cater to various jurisdictions. Our collection also includes resources from Canada, such as the Form T776 Statement of Real Estate Rentals and the Form T2200 Declaration of Conditions of Employment. These forms and certificates provide the necessary information to claim deductions on rental properties.

By utilizing these rental deduction resources, you can offset your rental income and lower your overall tax liability. This means more money in your pocket at the end of the year. Whether you are a seasoned investor, a first-time landlord, or a tenant with qualifying expenses, our rental deduction collection is an invaluable tool to help you navigate the complex world of tax deductions.

Take advantage of these rental deduction resources today and unlock the full potential of your rental property investments. Start saving money on your taxes and make the most of your investment by exploring our extensive library of rental deduction forms and certificates.

Documents:

6

The main purpose of this document is to serve as evidence for tenants who will claim homestead credit on their Wisconsin taxes - it will verify the amount of rent paid or property tax accrued.

The purpose of the document is to provide an employee with information about employment expenses that can be deducted from their income in Canada.