Tax Provision Templates

Are you looking for information on tax provisions? Our webpage is the perfect resource for everything related to tax provisions. Tax provisions, also known as tax provision documents, are essential for individuals, businesses, and organizations to understand and comply with tax regulations.

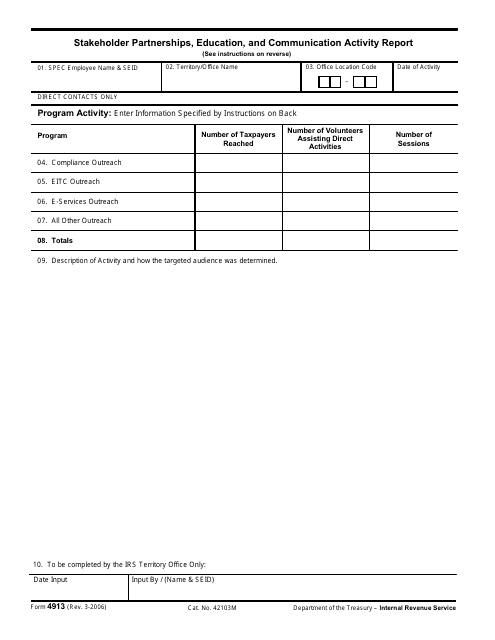

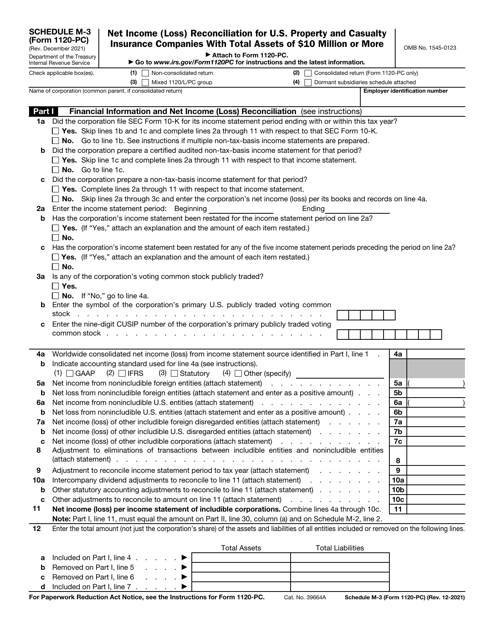

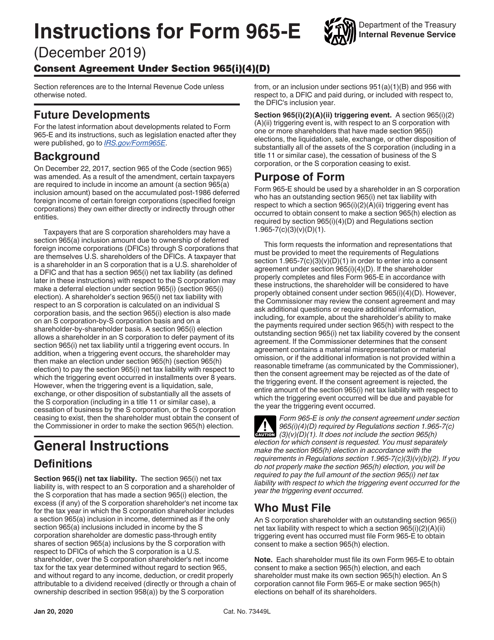

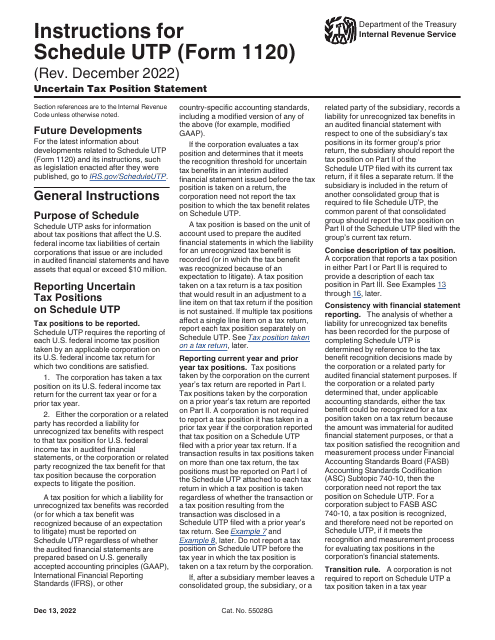

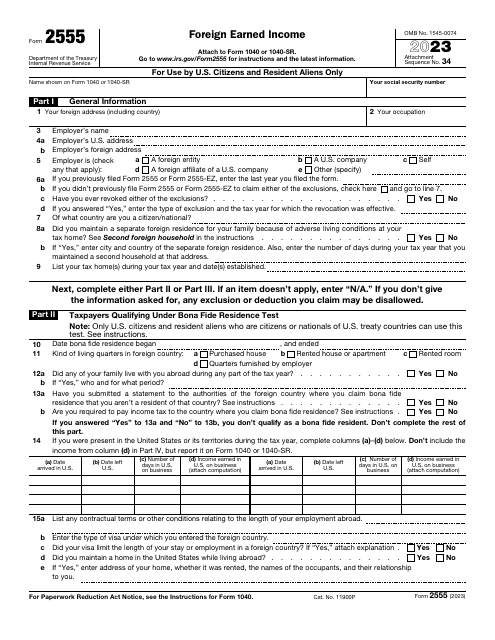

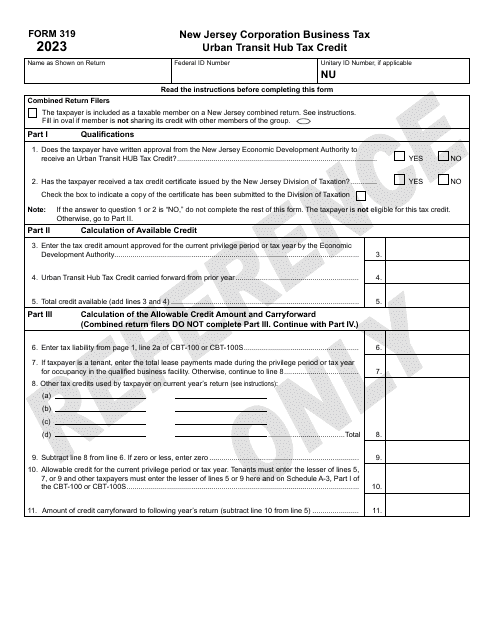

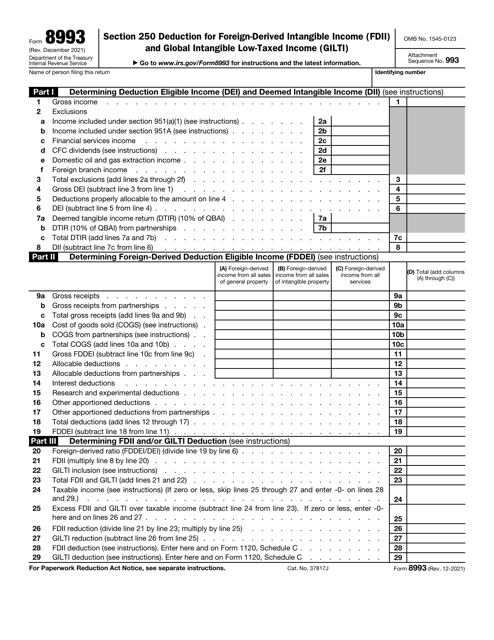

At our webpage, we provide comprehensive information on various tax provision documents, including IRS Form 1120-PC Schedule M-3 Net Income (Loss) Reconciliation for U.S. Property and Casualty Insurance Companies With Total Assets of $10 Million or More, Instructions for IRS Form 1120 Schedule UTP Uncertain Tax Position Statement, IRS Form 2555 Foreign Earned Income, Form 319 Urban Transit Hub Tax Credit - New Jersey, IRS Form 8993 Section 250 Deduction for Foreign Derived Intangible Income (Fdii) and Global Intangible Low-Taxed Income (Gilti), and many more.

We understand that navigating the complexities of tax provisions can be overwhelming. That's why our webpage offers clear explanations, step-by-step guides, and important insights into tax provisions. Whether you are an individual taxpayer, a business owner, or a tax professional, our webpage is your go-to source for understanding and keeping up-to-date with tax provision requirements.

Don't let tax provisions confuse you. Visit our webpage today and gain a better understanding of tax provisions. With our comprehensive resources and expert guidance, you can confidently navigate the world of tax provisions and stay compliant with tax regulations.

Documents:

7

This document is used for completing the IRS Form 965-E Consent Agreement under Section 965(I)(4)(D). It provides instructions on how to properly fill out the form and comply with the requirements.