Cancellation of Debt Templates

Are you struggling with debt that you cannot repay? Don't worry, we have the solution for you. Our collection of documents on cancellation of debt is designed to help you navigate the complex process of resolving your debt issues.

Our cancellation of debt documents include the IRS Form 1099-C Cancellation of Debt, which provides important information about the debt that has been cancelled or forgiven. This form is crucial for reporting the cancelled debt to the IRS and ensures that you are in compliance with tax laws.

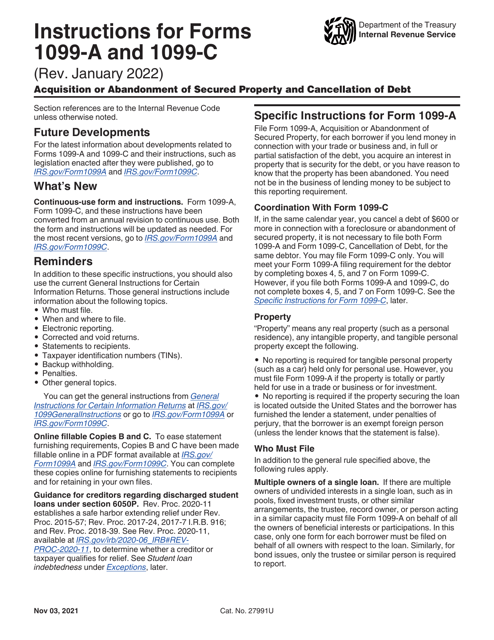

In addition to the IRS Form 1099-C, we also provide detailed instructions for IRS Form 1099-A, 1099-C Acquisition or Abandonment of Secured Property and Cancellation of Debt. This document will guide you through the process of reporting any secured property that has been abandoned and the associated cancellation of debt.

Our comprehensive collection of cancellation of debt documents is essential for individuals, businesses, and organizations navigating debt forgiveness and cancellation. Whether you've had a mortgage debt forgiven, settled a credit card debt, or reached a settlement on any other type of debt, our documents will ensure that you have all the necessary paperwork in order.

Don't let the stress of debt overwhelm you. Explore our collection of cancellation of debt documents today and take the first step towards a debt-free future.

Documents:

9

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

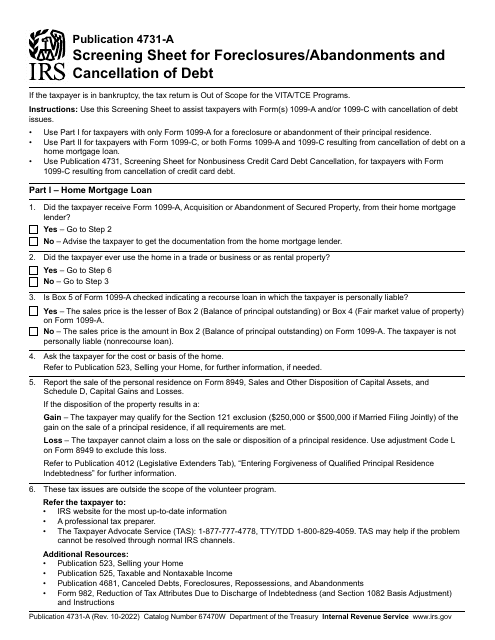

This form is used for screening foreclosures/abandonments and cancellation of debt for tax purposes.