Risk Retention Group Templates

A Risk Retention Group, also known as a risk retention group or RRG, is a type of insurance entity that provides liability coverage to its members who share similar risk profiles. These mutual insurance organizations are designed to enable businesses or individuals in the same industry or profession to pool their resources and collectively manage their risks.

If you are considering establishing or operating a Risk Retention Group, it is important to familiarize yourself with the necessary documentation and forms. These documents may vary depending on the state in which you operate, but common examples include:

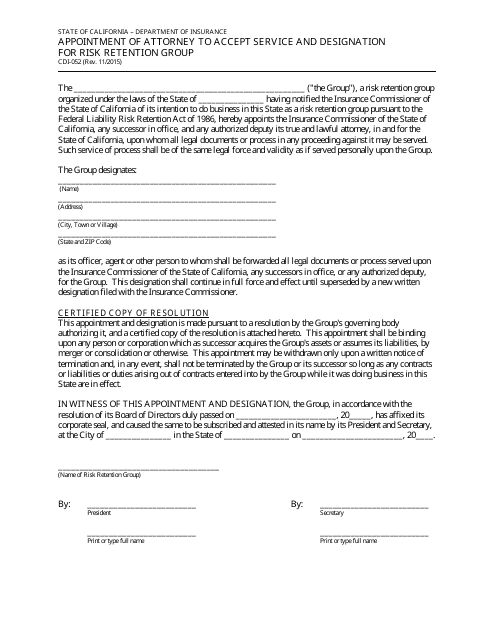

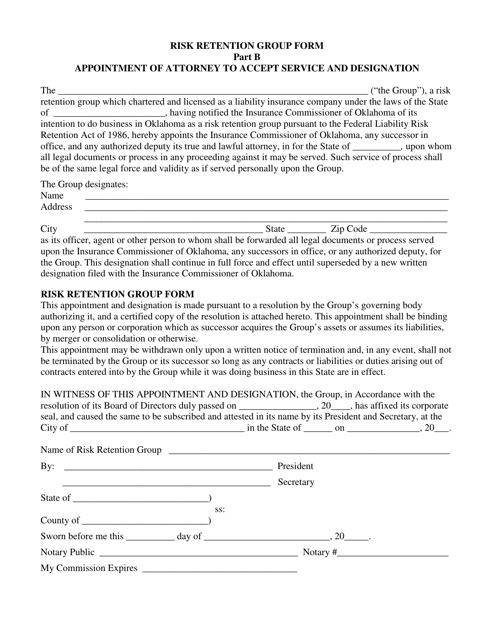

- Appointment of Attorney to Accept Service and Designation for Risk Retention Group

- Risk Retention Group Checklist

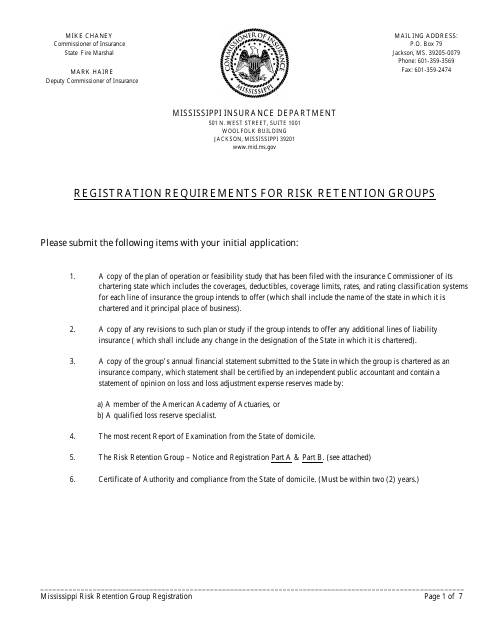

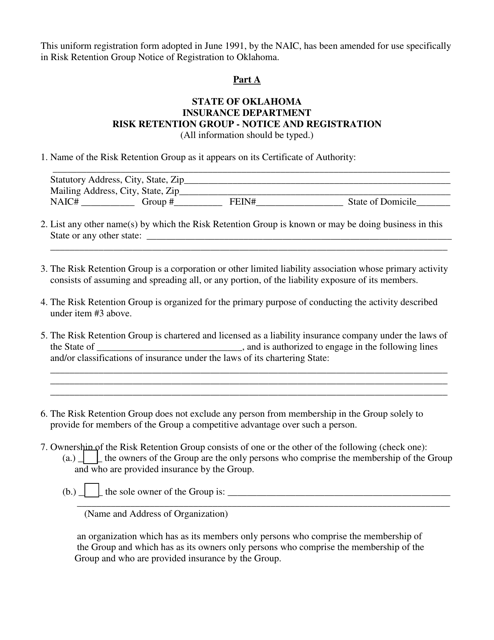

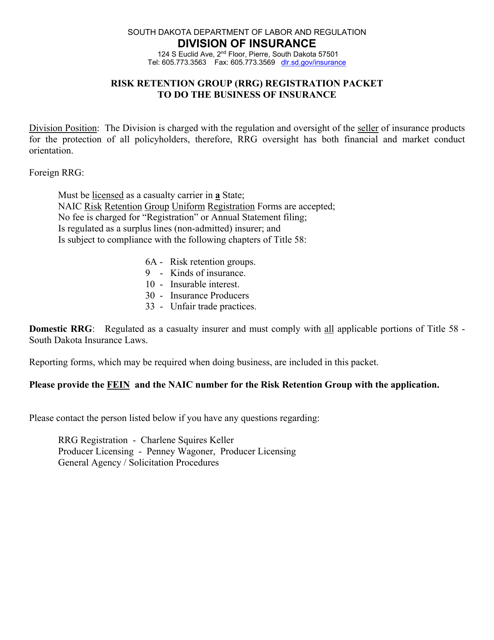

- RRG Registration Packet to Do the Business of Insurance

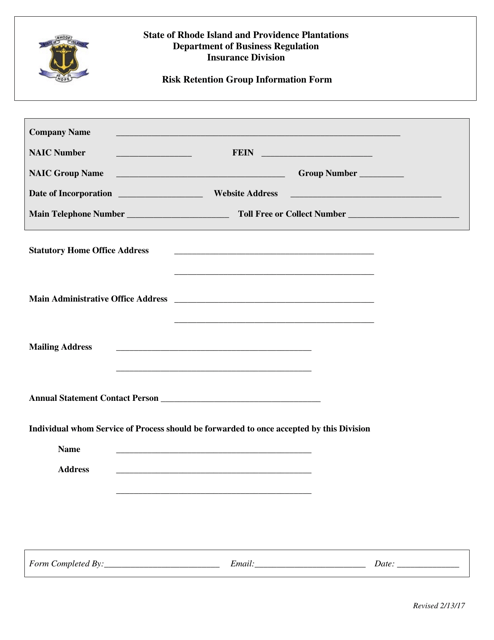

- Risk Retention Group Reporting Form

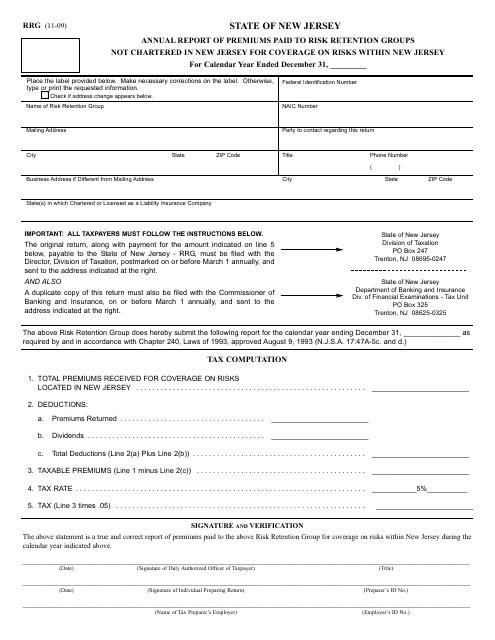

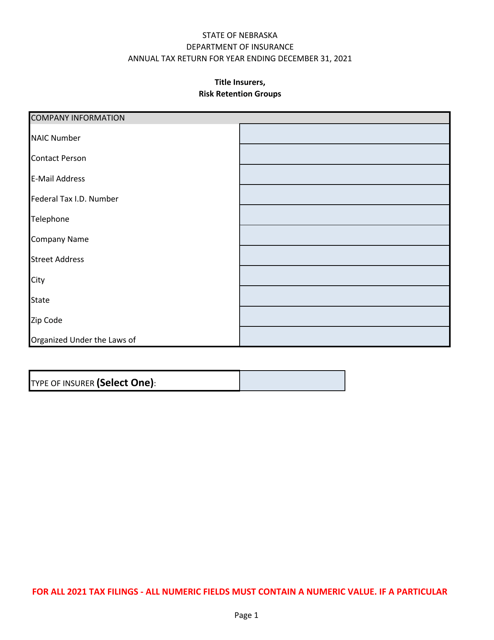

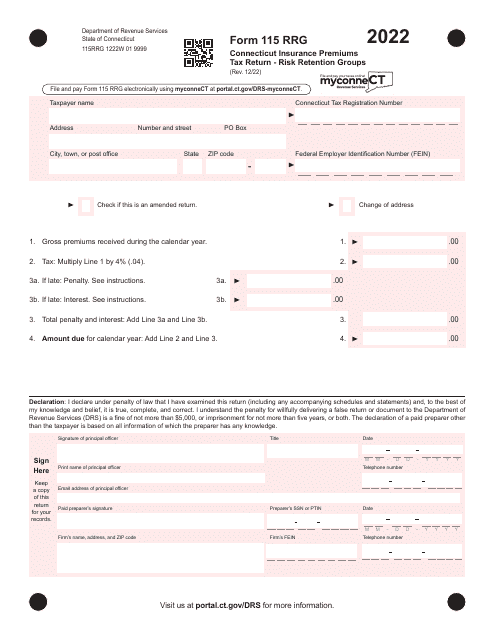

- Insurance Premiums Tax Return for Risk Retention Groups

These documents serve various purposes, such as ensuring compliance with state regulations, reporting financial information, and providing proof of authorized representation. They are essential in demonstrating the legitimacy and accountability of your Risk Retention Group.

Navigating the regulatory landscape of operating a Risk Retention Group can be complex, but with the right documentation and expertise, you can establish a successful and compliant organization. Our team is well-versed in the requirements and can assist you in preparing and submitting the necessary forms, ensuring a smooth and efficient process.

Reach out to us today to learn more about Risk Retention Groups and how we can help you navigate the regulatory requirements and documentation. Don't let the paperwork deter you from reaping the benefits of this alternative risk management solution. Let us guide you through the process and set your Risk Retention Group on the path to success.

Documents:

24

This form is used for reporting the annual premiums paid to risk retention groups in the state of New Jersey. It provides information about the amount of premiums collected by these groups in the state.

This form is used for appointing an attorney to accept legal documents on behalf of a Risk Retention Group in California.

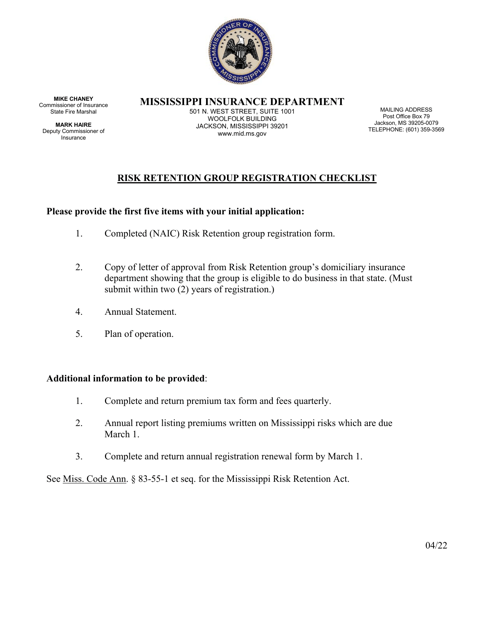

This Form is used for registering and notifying the state of Mississippi about a Risk Retention Group.

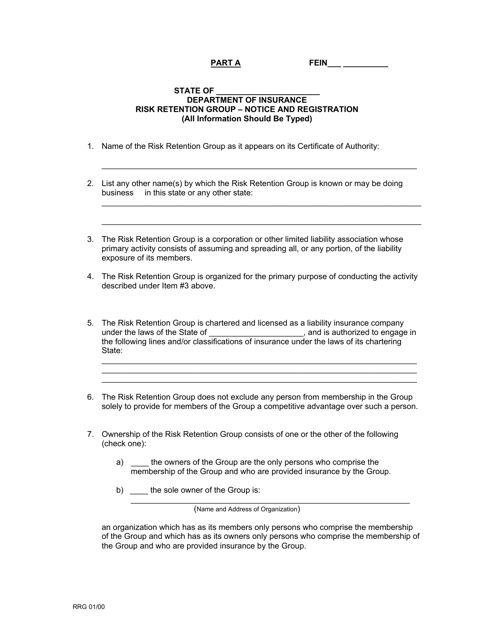

This Form is used for registering a Risk Retention Group in Ohio.

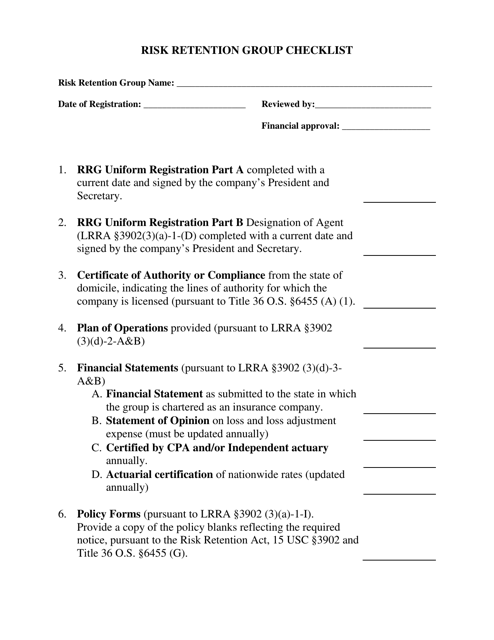

This document is a checklist for Risk Retention Groups operating in Oklahoma. It outlines the requirements and steps that need to be followed by Risk Retention Groups in order to comply with the state regulations.

This Form is used for appointing an attorney to accept service and designation for a Risk Retention Group in Oklahoma.

This Form is used for the Notice and Registration of a Risk Retention Group in Oklahoma.

This document provides information about Risk Retention Groups in Rhode Island. Learn about how these groups manage and retain risk.

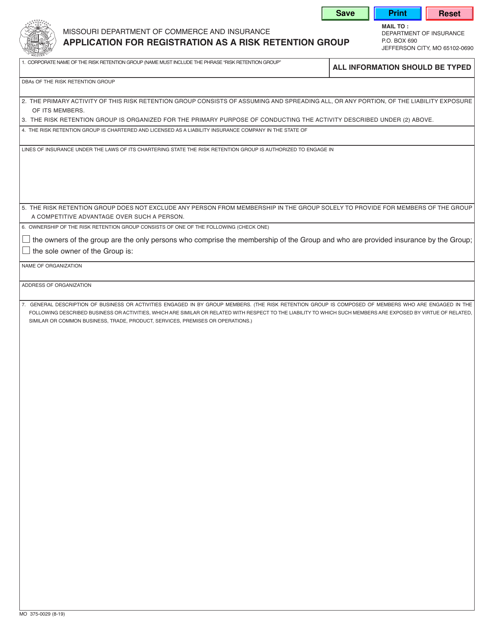

This Form is used for applying to register a Risk Retention Group in the state of Missouri.

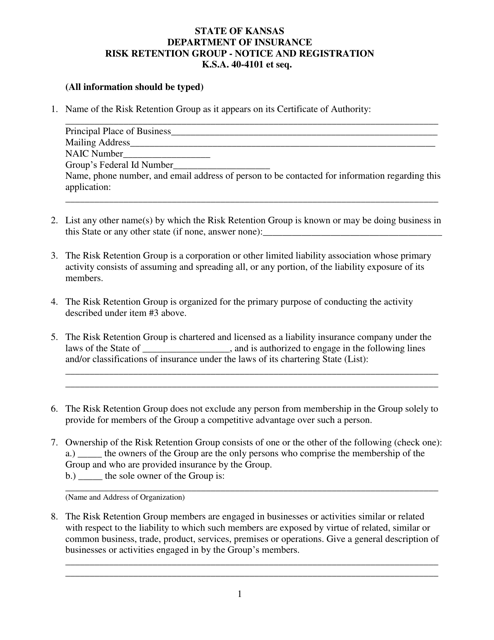

This document is for the Notice and Registration of a Risk Retention Group in Kansas. This form is used for notification and registration purposes for risk retention groups operating in the state of Kansas.

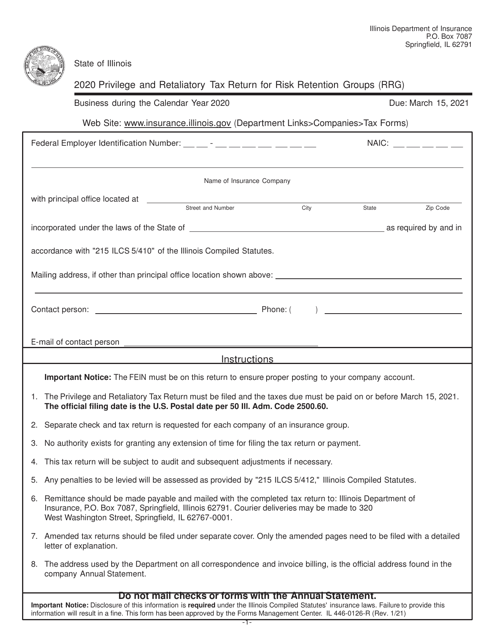

This form is used for filing the privilege and retaliatory tax return for Risk Retention Groups (RRG) in the state of Illinois. It is required for RRGs to report their tax liabilities and ensure compliance with state tax laws.

This document is used for registering a Risk Retention Group (RRG) in South Dakota to conduct insurance business. It includes the necessary forms and information required for the registration process.

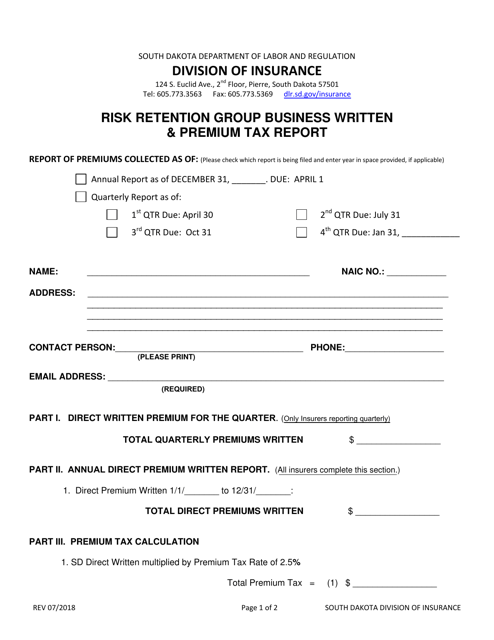

This document is a report used for reporting the written premiums and taxes paid by Risk Retention Groups in the state of South Dakota.

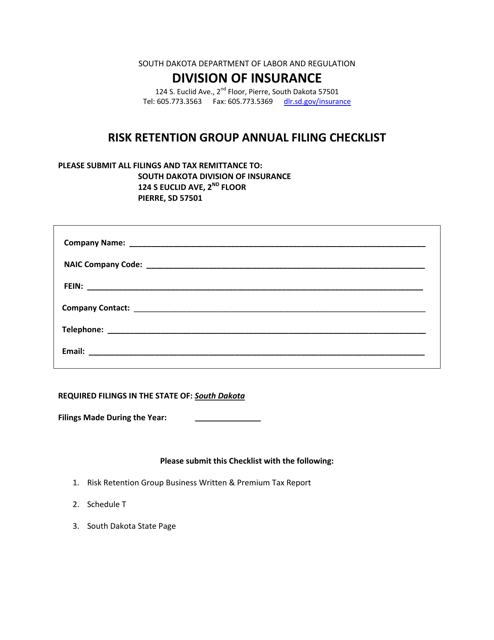

This document is a checklist for Risk Retention Groups in South Dakota to complete their annual filings. It outlines the necessary steps and requirements for filing.

This form is used for the notice and registration of a Risk Retention Group in Tennessee.

This form is used for submitting annual premium filings for Risk Purchasing Groups and Risk Retention Groups in the state of Mississippi.

This form is used for reporting by Risk Retention Groups in the state of Mississippi.

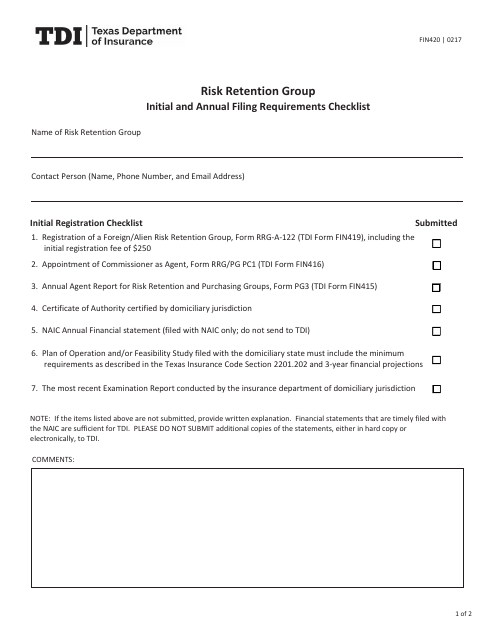

This form is used for the initial and annual filing requirements checklist for Risk Retention Groups in Texas. It outlines the necessary steps and documentation needed for compliance.