Non Profit Organizations Templates

Documents:

147

This is a formal instrument prepared and filed by an organization that wants the fiscal authorities to confirm its exemption from the obligation to pay income tax on a federal level.

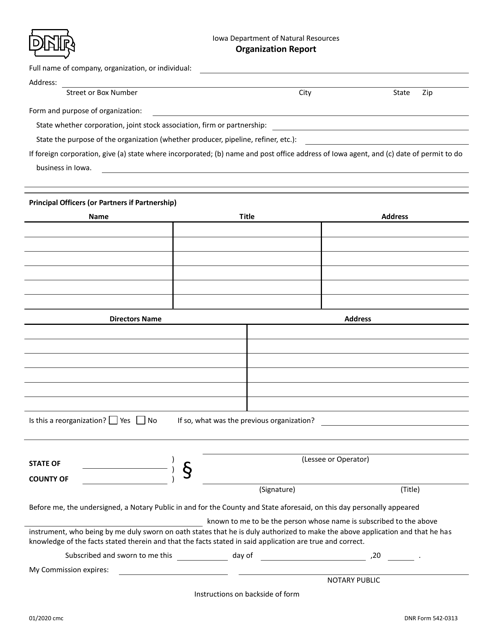

This document is used for reporting information related to a Do Not Resuscitate (DNR) order in Iowa. It includes details about the organization involved.

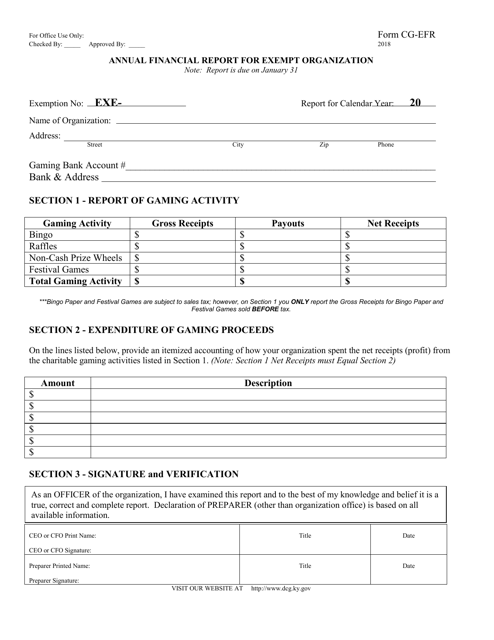

This Form is used for filing the Annual Financial Report for Exempt Organizations in the state of Kentucky.

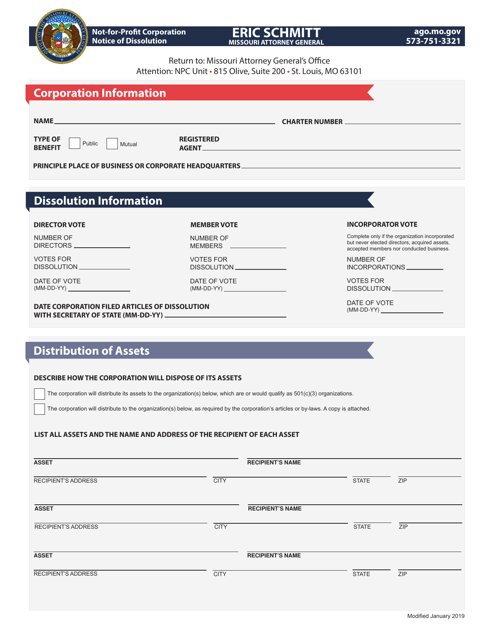

This type of document is used to notify the dissolution of a not-for-profit corporation in the state of Missouri.

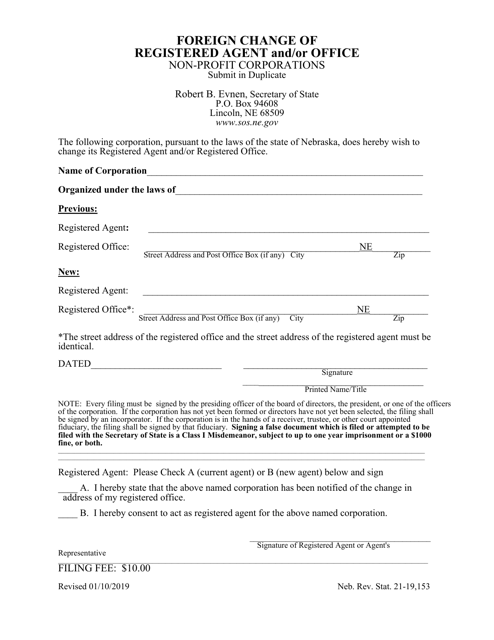

This document is used for non-profit corporations in Nebraska to request a change in their registered agent and/or office.

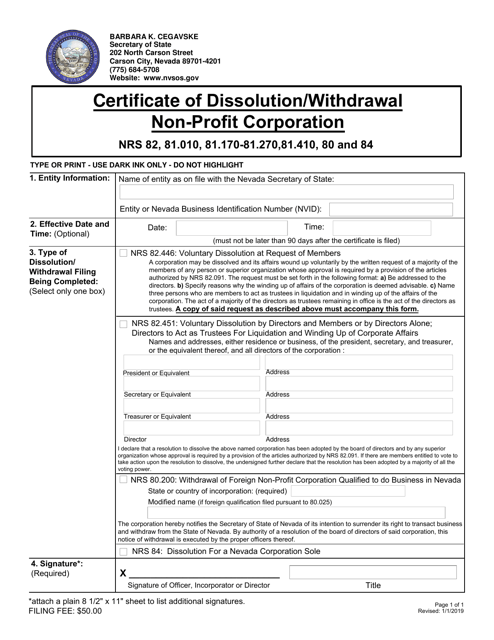

This document is used for officially dissolving or withdrawing a non-profit corporation in the state of Nevada. It confirms the termination of the corporation's legal existence.

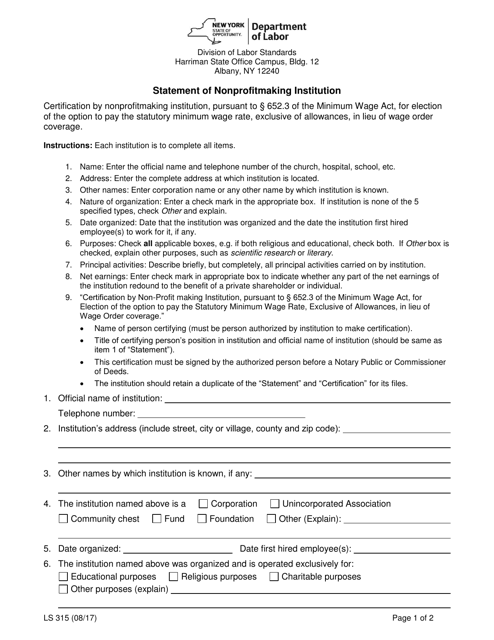

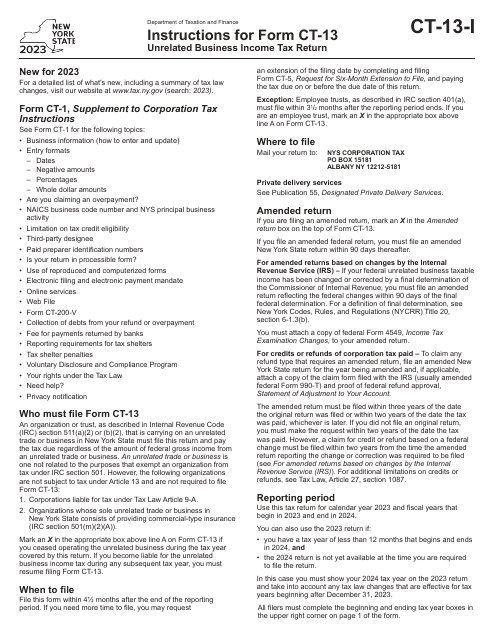

This form is used for reporting the financial status of a nonprofit organization in New York that does not make a profit. It provides information about the institution's revenues, expenses, and assets.

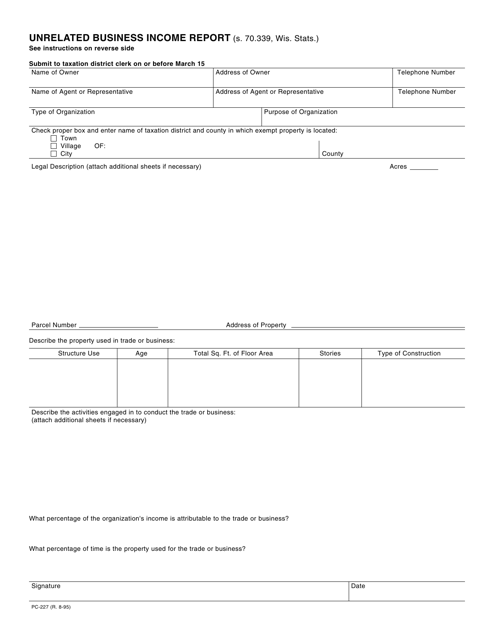

This Form is used for reporting unrelated business income in the state of Wisconsin.

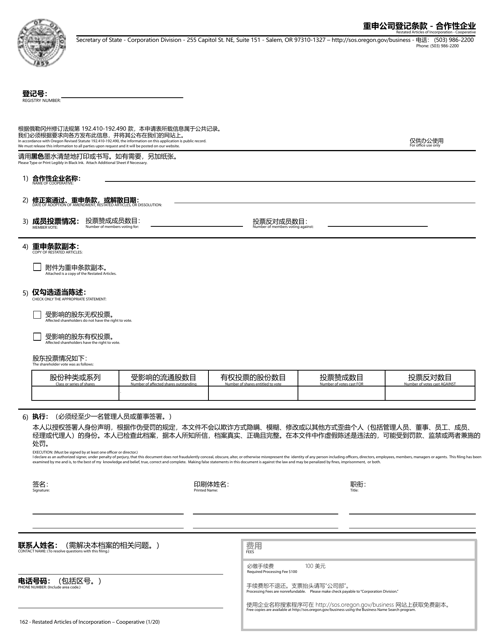

This document is used for filing the restated Articles of Incorporation for a cooperative in Oregon. It is available in both English and Chinese languages.

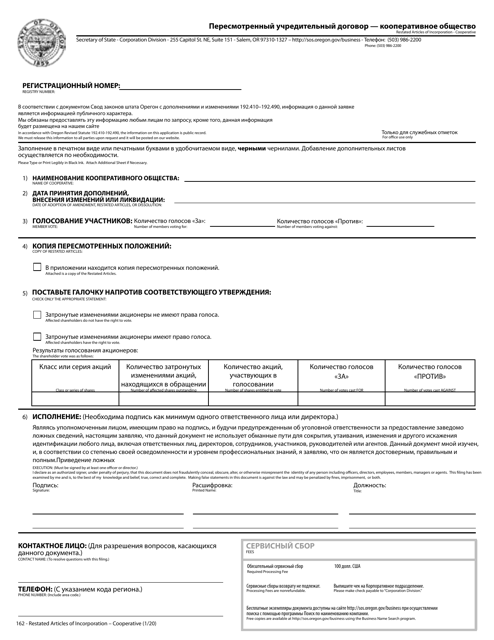

This document is a restatement of the articles of incorporation for a cooperative in Oregon. It is available in both English and Russian.

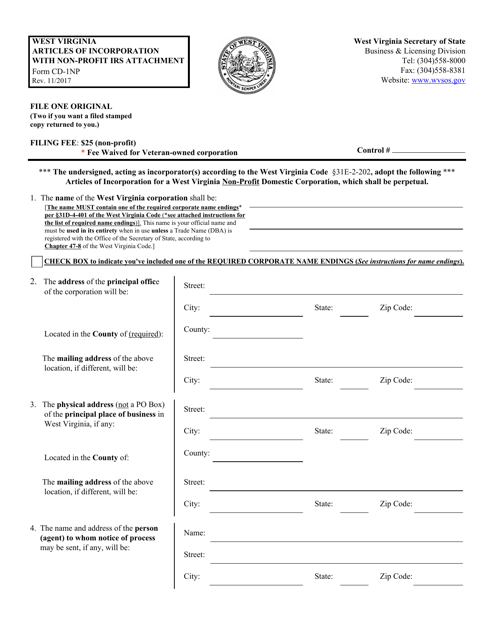

This Form is used for filing Articles of Incorporation with Non-profit IRS Attachment in West Virginia for organizations seeking non-profit status.

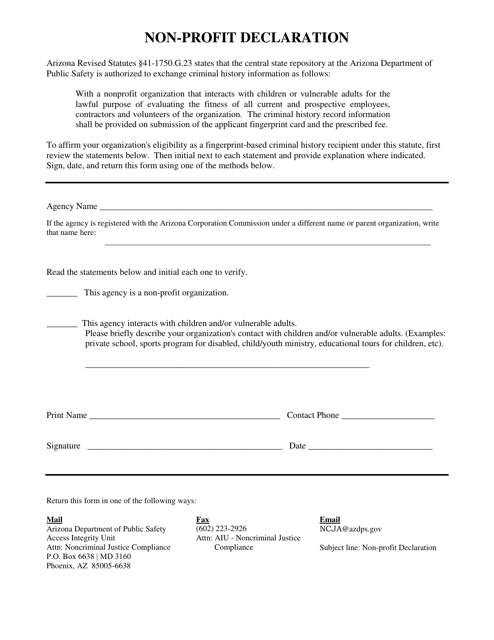

This document is used to declare a non-profit organization in the state of Arizona. It provides the necessary information and forms to establish the organization's tax-exempt status.

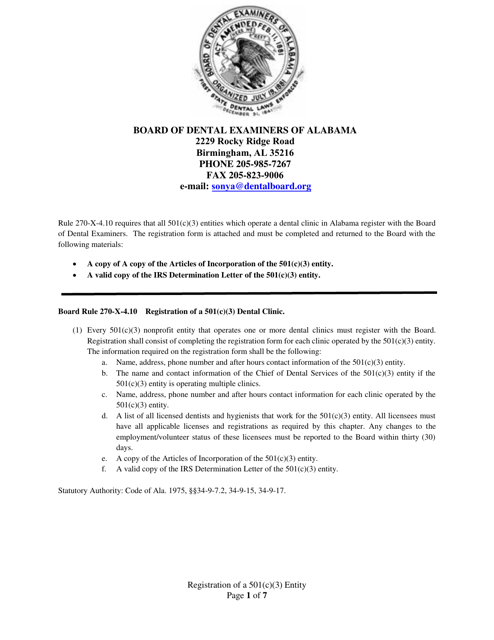

This document is for the registration of a 501(c)(3) nonprofit organization in the state of Alabama. It outlines the necessary steps and requirements for obtaining tax-exempt status.

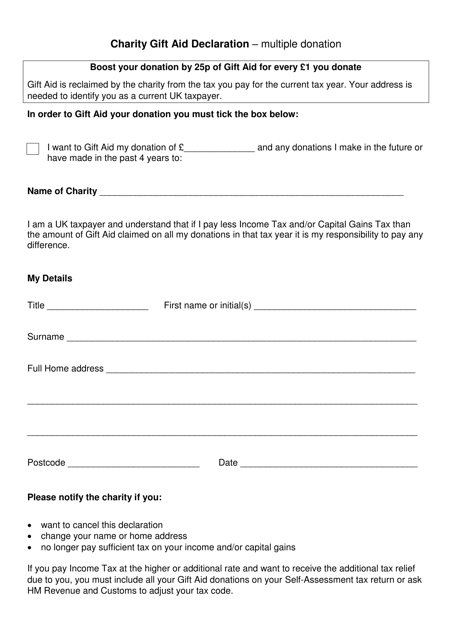

This document is used for multiple donations in the United Kingdom to declare Gift Aid and maximize the value of charitable contributions.

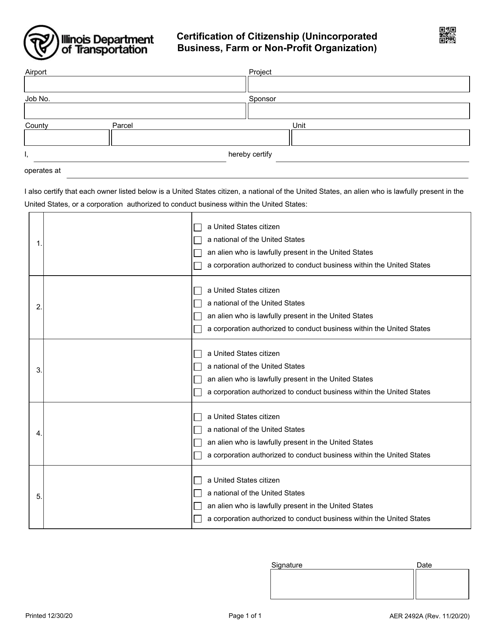

This form is used for certifying the citizenship of unincorporated businesses, farms, or non-profit organizations in the state of Illinois.

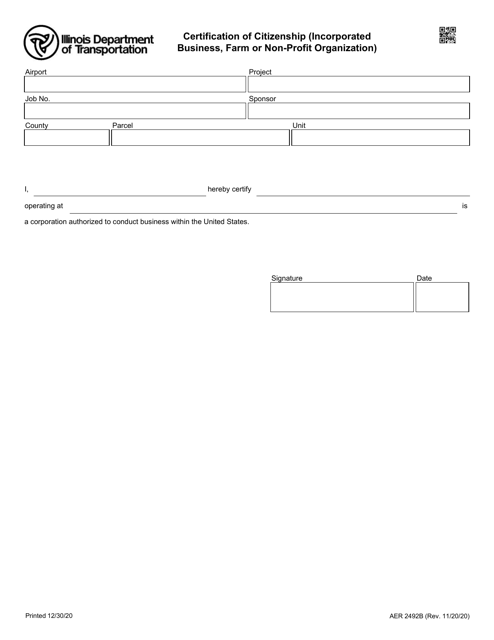

This form is used for certification of citizenship for incorporated businesses, farms, or non-profit organizations in the state of Illinois.

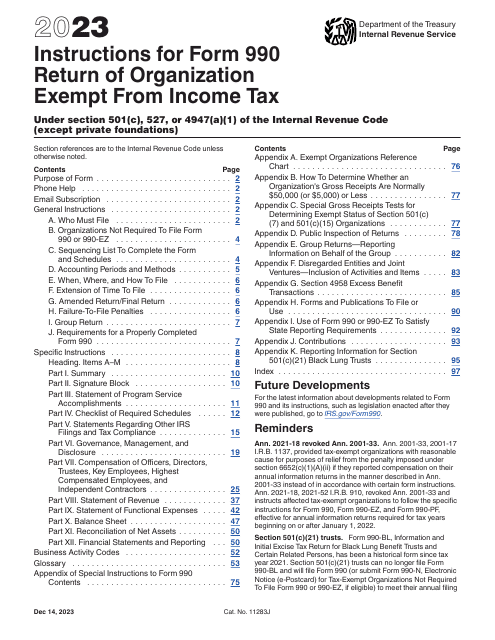

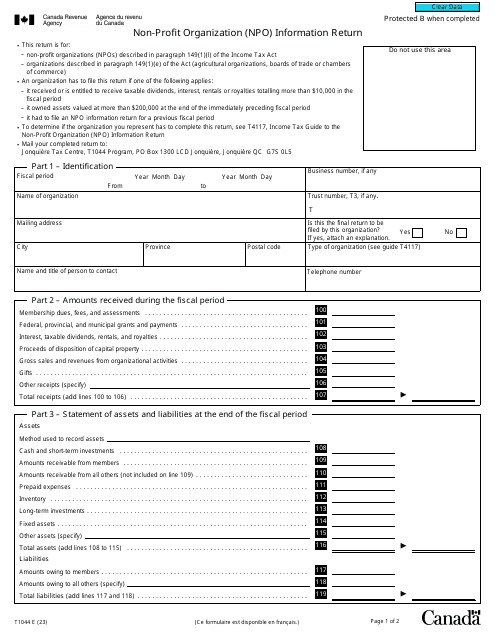

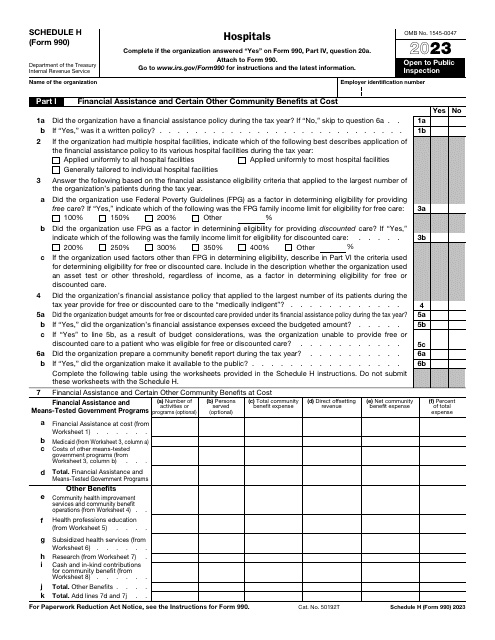

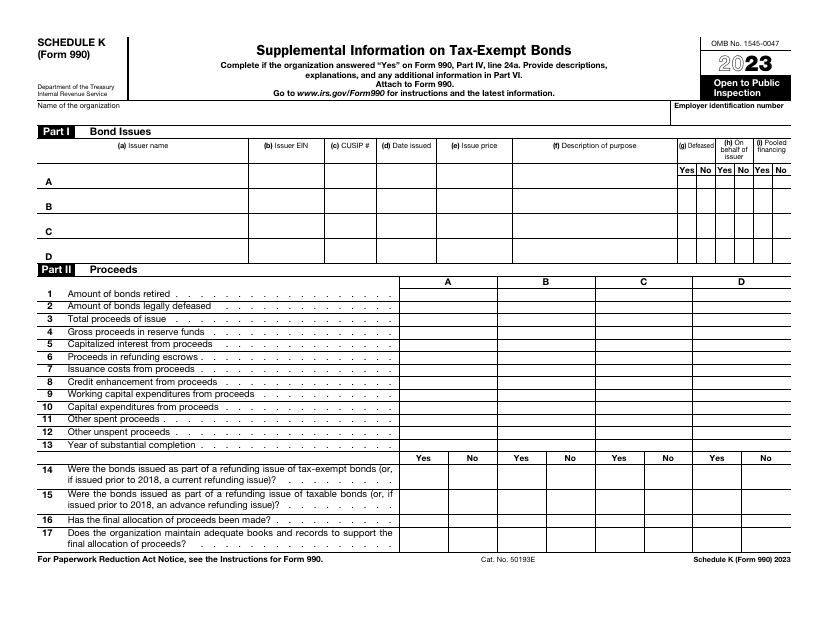

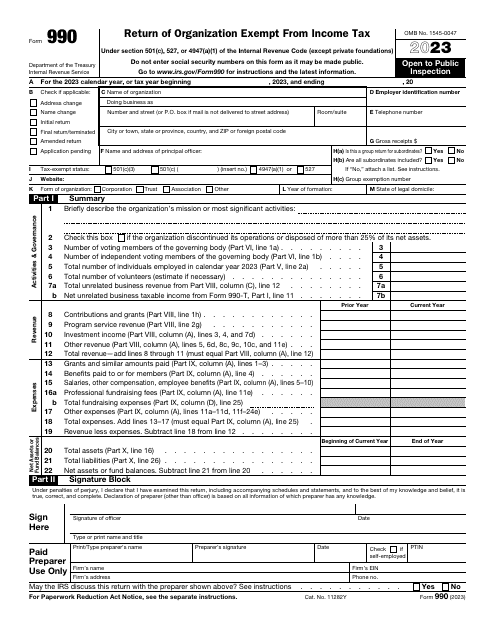

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

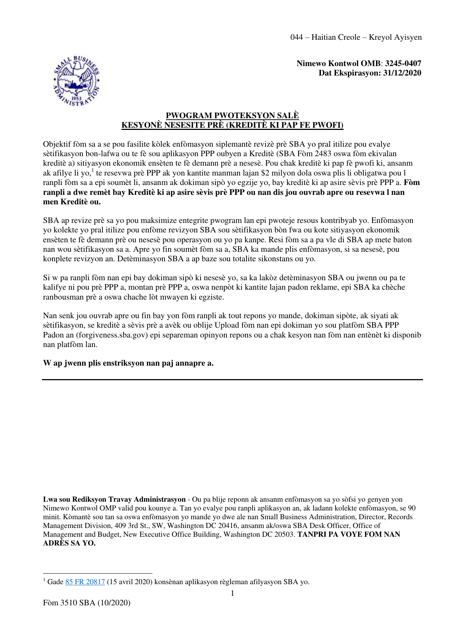

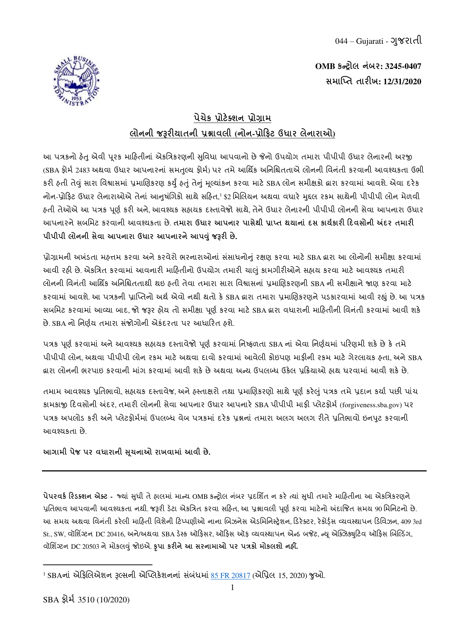

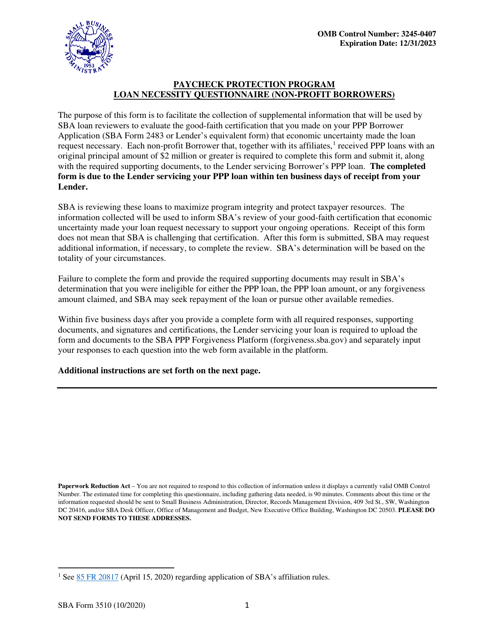

This document is used for non-profit borrowers who have received a Paycheck Protection Program loan and need to fill out a questionnaire regarding the necessity of the loan.

This form is used by non-profit borrowers to complete the Paycheck Protection Program Loan Necessity Questionnaire. It is available in Korean language.

This document is for non-profit borrowers participating in the Paycheck Protection Program. It is the SBA Form 3510, which is a questionnaire regarding the necessity of the loan. It is specifically for Italian borrowers.

This document provides an introduction to accounting practices specifically designed for not-for-profit organizations in order to maintain accurate financial records.

This form is used for non-profit organizations applying for the Paycheck Protection Program loan. It includes a questionnaire to assess the necessity of the loan.

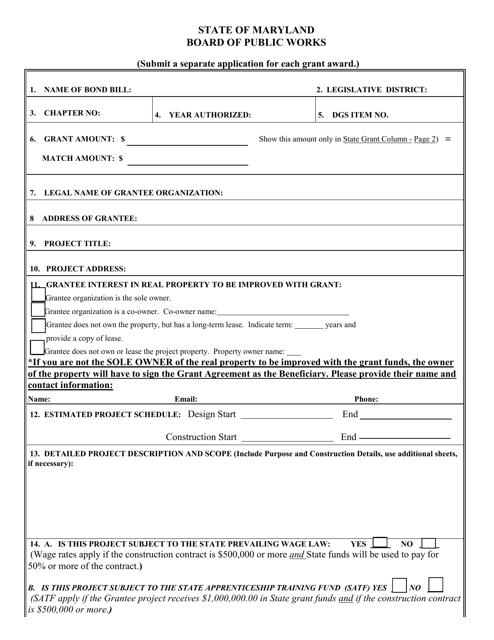

This document is a grant application for capital projects in the state of Maryland. It is used to request funding for infrastructure and facility improvements.

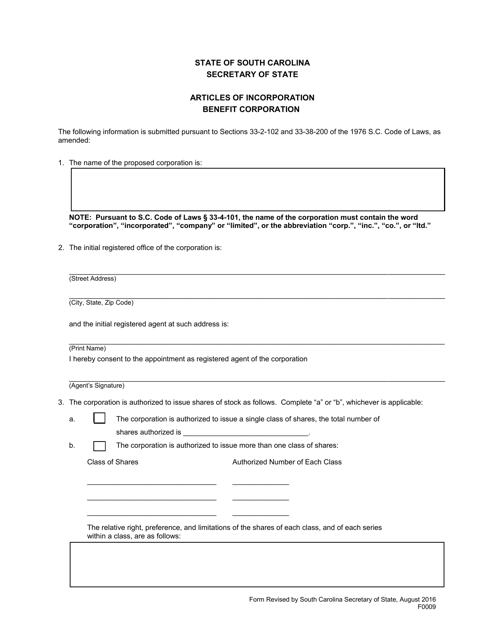

This document is used for filing Articles of Incorporation for a Benefit Corporation in South Carolina.

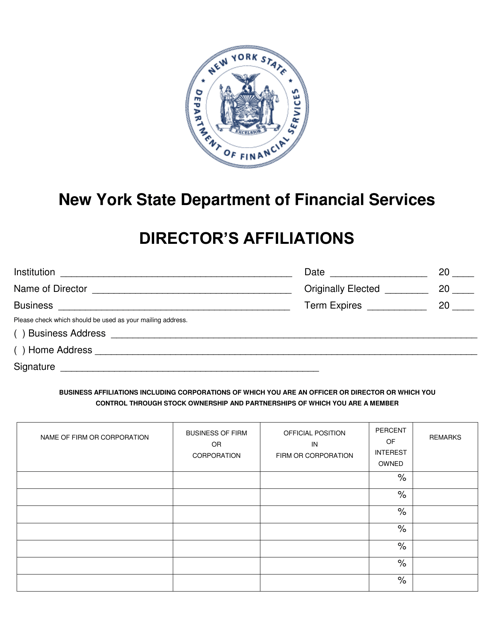

This document provides information about the affiliations of a company director in New York. It lists the other organizations and businesses with which the director is associated.

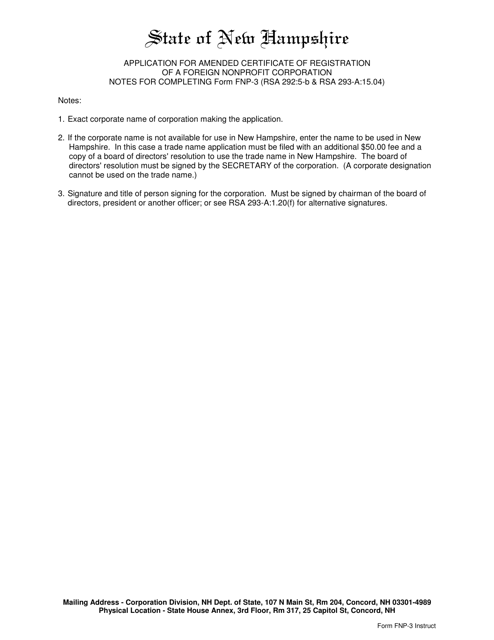

This form is used for applying to amend the certificate of registration of a foreign nonprofit corporation in the state of New Hampshire. It allows the corporation to update information such as name, address, or purpose.

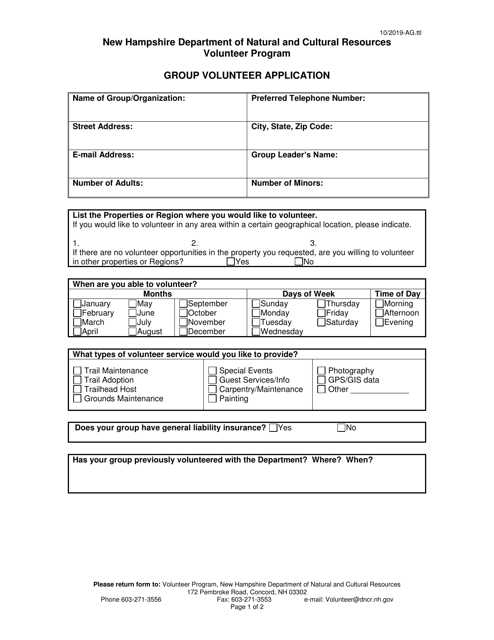

This document is used for applying to volunteer as a group in New Hampshire.

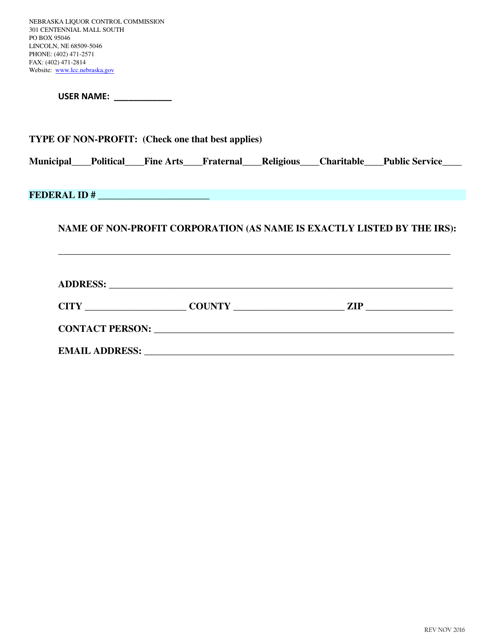

This Form is used for the non-profit Step 2 process in Nebraska. It helps organizations apply for tax-exempt status.

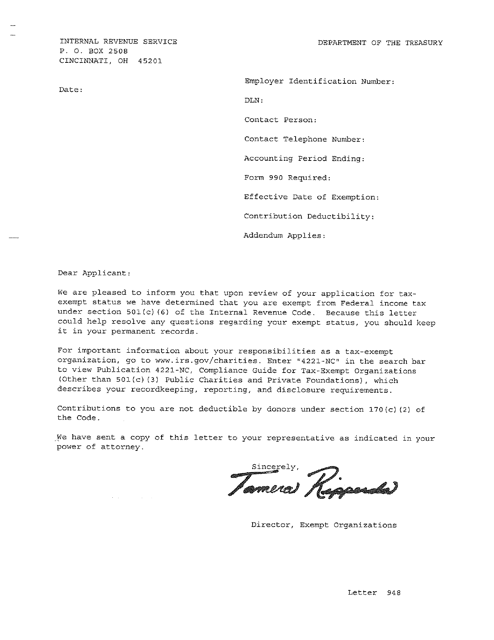

Obtain this letter from the IRS in order to be recognized as a nonprofit organization that offers employees company-sponsored retirement, medical, vacation, or other benefit plans.

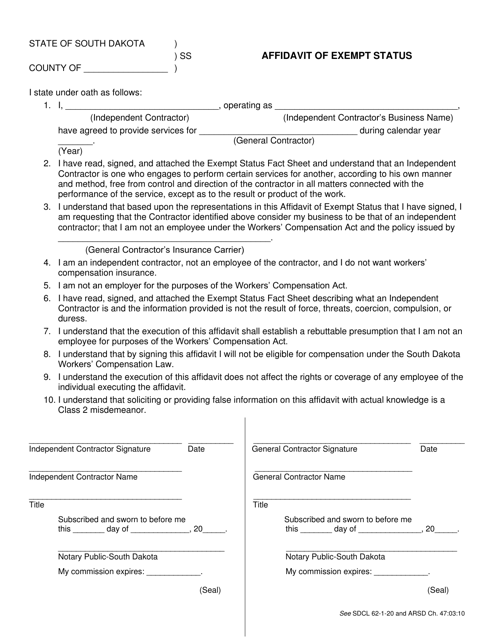

This form is used to declare exempt status for tax purposes in South Dakota.

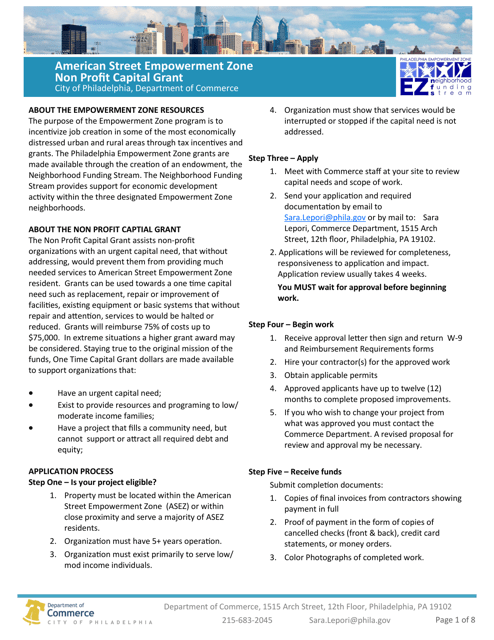

This document describes the American Street Empowerment Zone Non Profit Capital Grant, which is available in the City of Philadelphia, Pennsylvania. It provides funding and support for non-profit organizations located in the American Street Empowerment Zone to enhance their facilities and services. This grant aims to empower and revitalize the community through financial assistance.

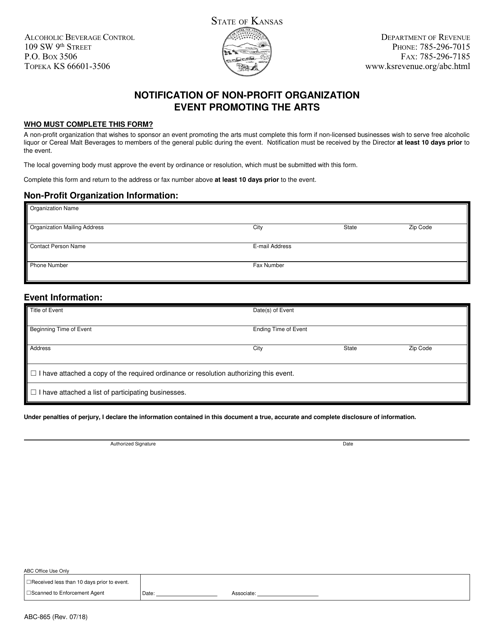

This Form is used for notifying the Kansas government about a non-profit organization event promoting the arts.