Injured Spouse Claim Templates

If you're married and filing taxes jointly with your spouse, but you're concerned about the impact of any outstanding debts or obligations they may have, you may qualify for an Injured Spouse Claim. This claim allows you to protect your share of the tax refund by allocating it to yourself rather than having it offset by your spouse's liabilities.

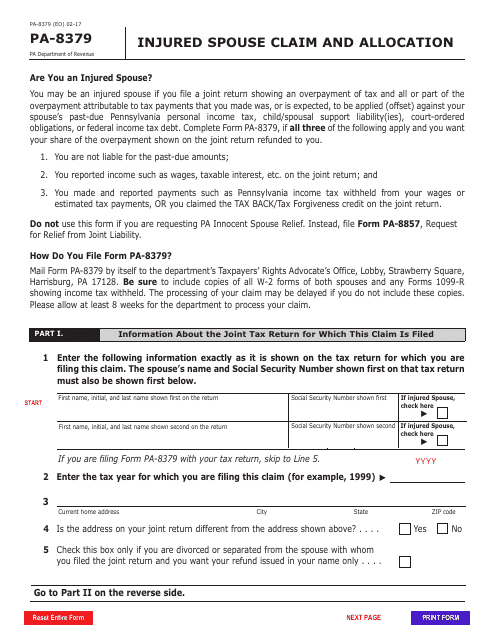

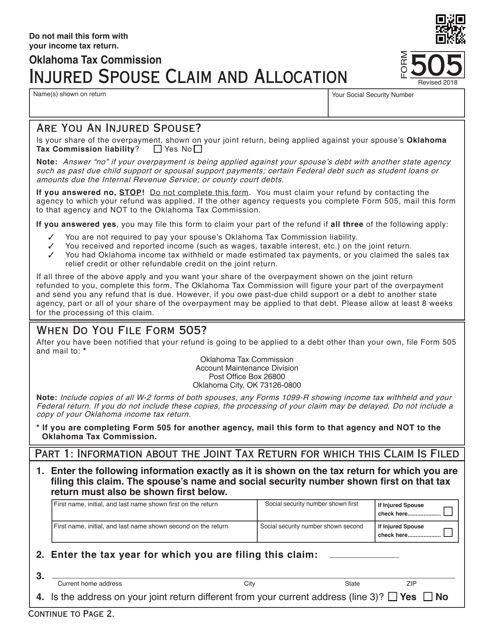

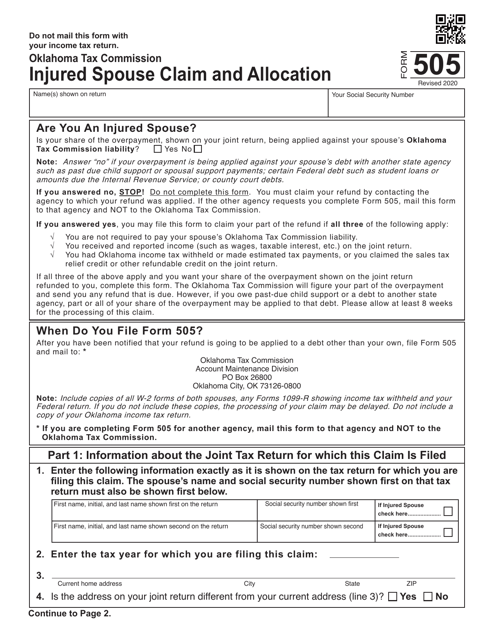

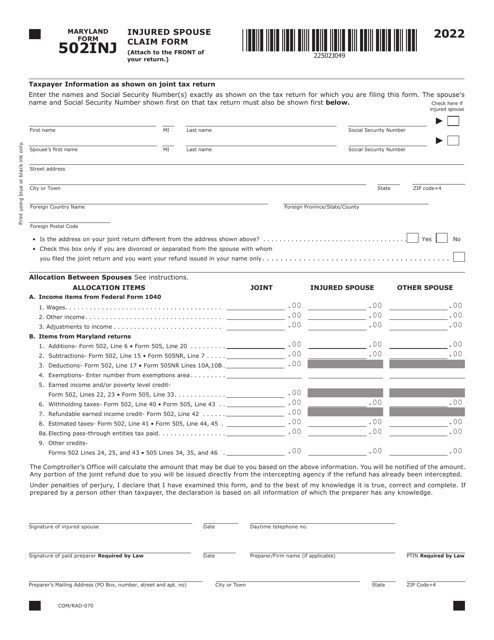

In order to submit an Injured Spouse Claim, you'll need to complete the necessary forms specific to your state. These forms, such as the Form PA-8379 in Pennsylvania, OTC Form 505 in Oklahoma, and Maryland Form 501INJ (COM/RAD070) in Maryland, ensure that you receive your fair portion of the tax refund.

By filing an Injured Spouse Claim, you can safeguard your share of the refund and prevent it from being applied to your spouse's debts. This can provide you with much-needed financial relief and peace of mind. Don't let your spouse's financial obligations affect your share of the tax refund - protect yourself with an Injured Spouse Claim.

Documents:

5

This form is used for spouses in Pennsylvania to file a claim and allocate any refunds due to them when their tax refund is being offset for their partner's debts.

This Form is used for Oklahoma residents who are filing an injured spouse claim and allocation.

This form is used for filing an injured spouse claim in Maryland. It helps spouses who have separate tax liabilities protect their portion of a joint refund from being applied to the other spouse's debts.