Employer Benefits Templates

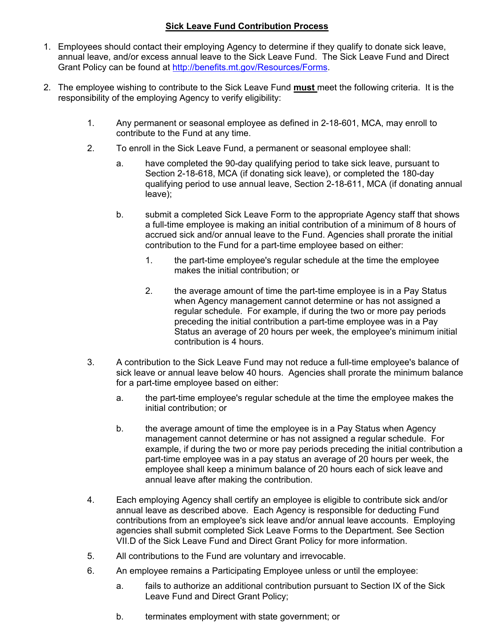

Employer Benefits, also known as Employment Benefits or Employer Benefits, are a crucial component of any employee compensation package. These benefits not only provide financial security, but also help to attract and retain top talent in today's competitive job market.

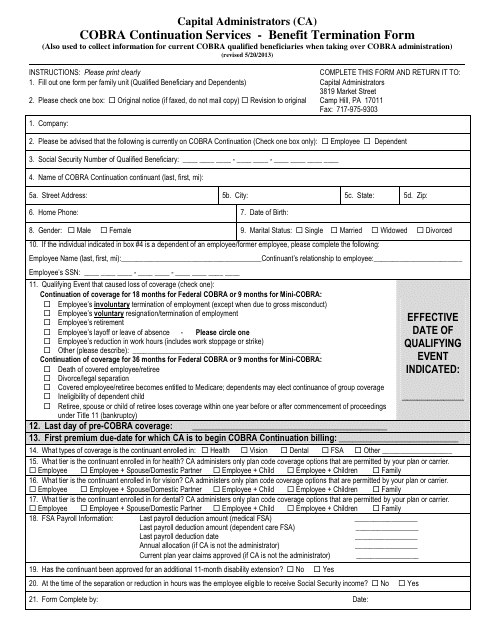

One important employer benefit is the ability to continue health insurance coverage through COBRA (Consolidated Omnibus Budget Reconciliation Act) Continuation Services. In the event of job loss or a qualifying life event, employees can take advantage of this benefit to ensure uninterrupted access to healthcare for themselves and their families.

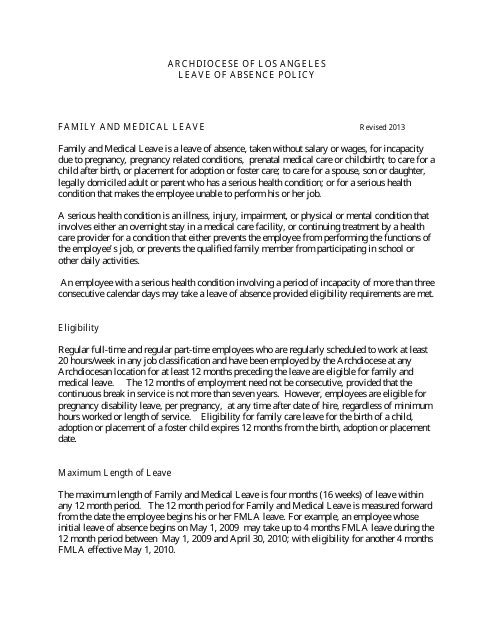

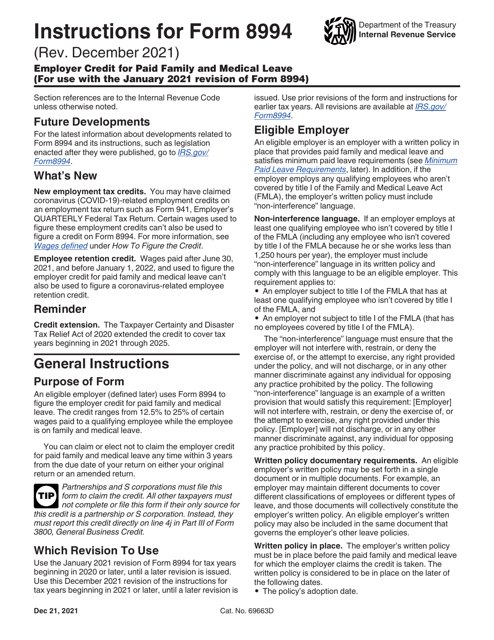

Another commonly offered employer benefit is Family and Medical Leave, which allows employees to take time off work for personal or family health reasons. Having this benefit in place offers peace of mind to employees, knowing that they can prioritize their health and family needs without fear of losing their job.

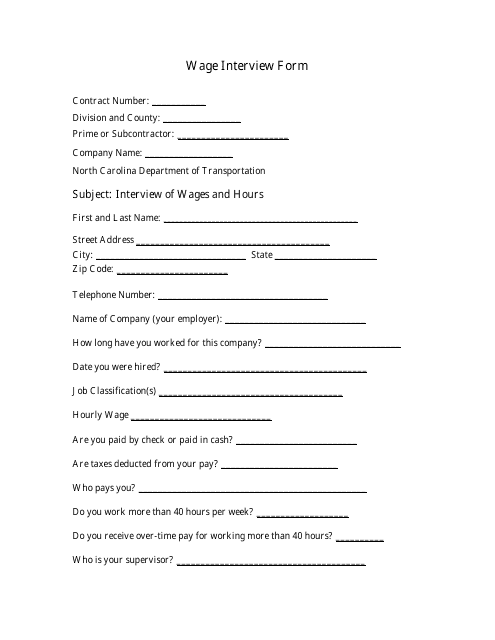

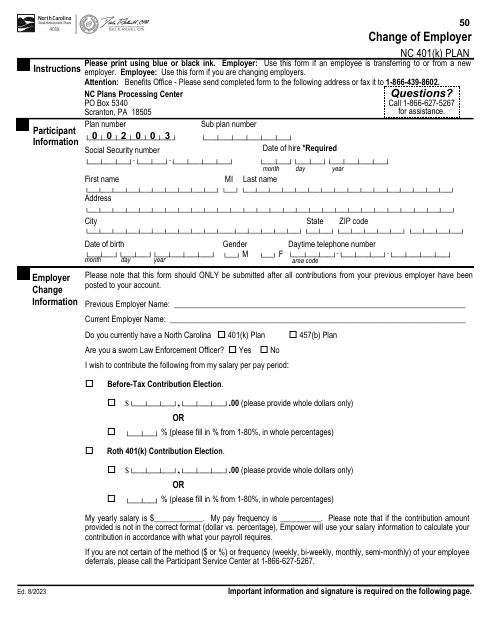

Employer benefits also extend to financial support, such as the provision of Wage Interview Forms. These forms help employees in North Carolina and other states to claim unemployment insurance benefits if they become unemployed through no fault of their own.

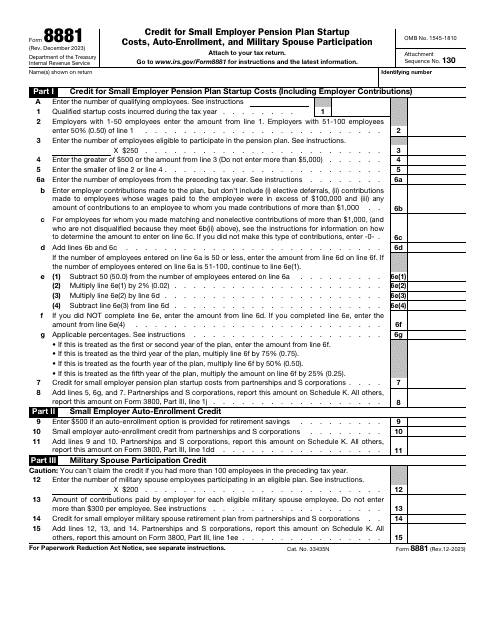

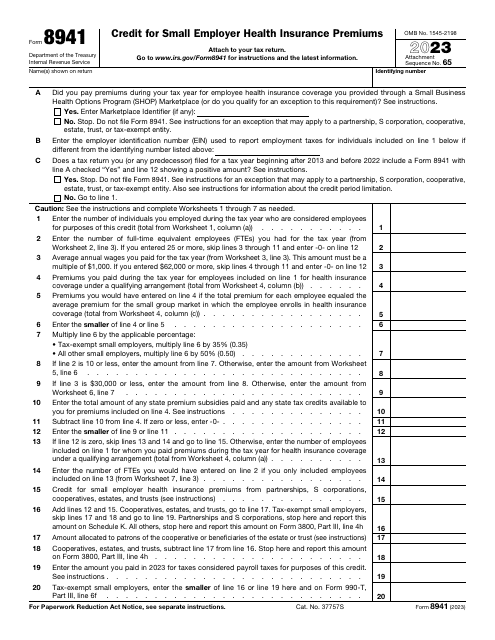

Additionally, employers can take advantage of tax credits by offering health insurance coverage to their employees. The IRS Form 8941 enables small employers to claim the Credit for Small Employer Health Insurance Premiums, thereby easing the financial burden of providing healthcare options to their workforce.

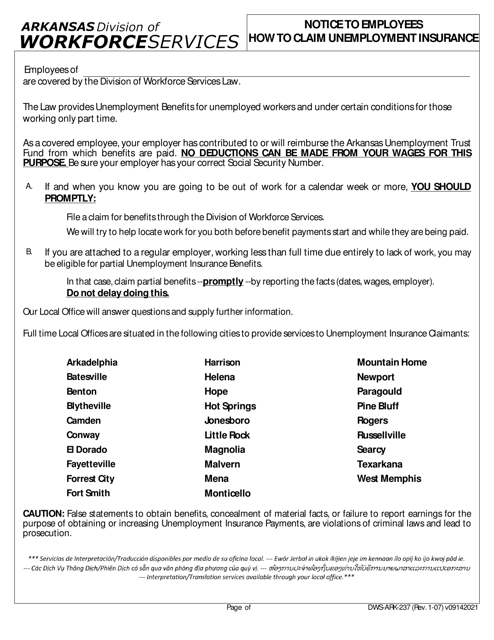

Employer benefits vary from state to state, and it is important for employers to stay informed and comply with local regulations. For example, in Arkansas, employers are required to provide employees with Form DWS-ARK-237, a Notice that outlines how to claim Unemployment Insurance.

In summary, employer benefits are a valuable resource that contribute to the overall well-being and satisfaction of employees. By offering essential benefits like COBRA continuation, family and medical leave, wage interview forms, and health insurance tax credits, employers can foster a positive work environment that attracts and retains talented individuals.

Documents:

22

This Form is used for terminating benefits with Cobra Continuation Services in California.

This Form is used for requesting Family and Medical Leave from the Archdiocese of Los Angeles in Los Angeles, California.

This Form is used for conducting wage interviews in North Carolina.

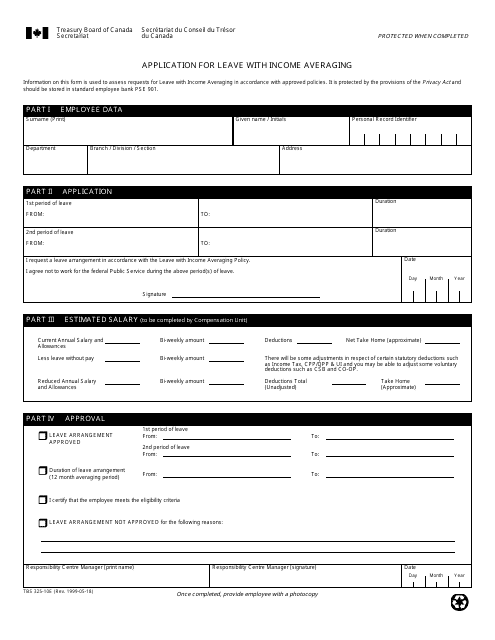

This form is used for Canadian employees to apply for leave with income averaging.

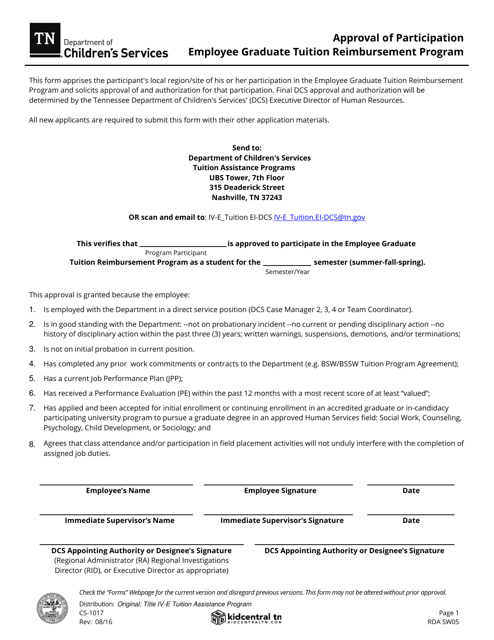

This Form is used for employees in Tennessee to request approval to participate in the Graduate Tuition Reimbursement Program.

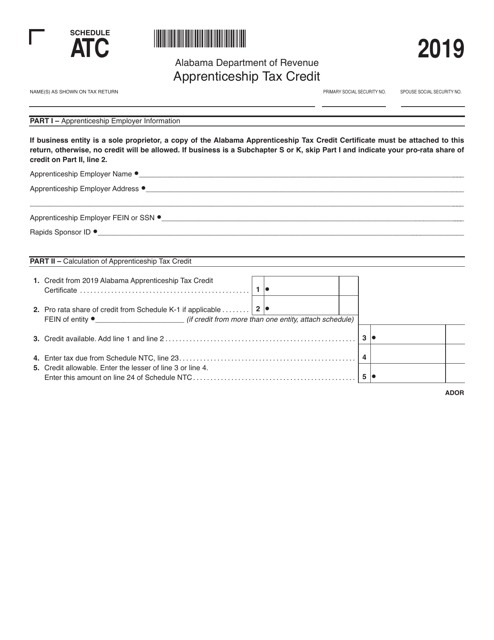

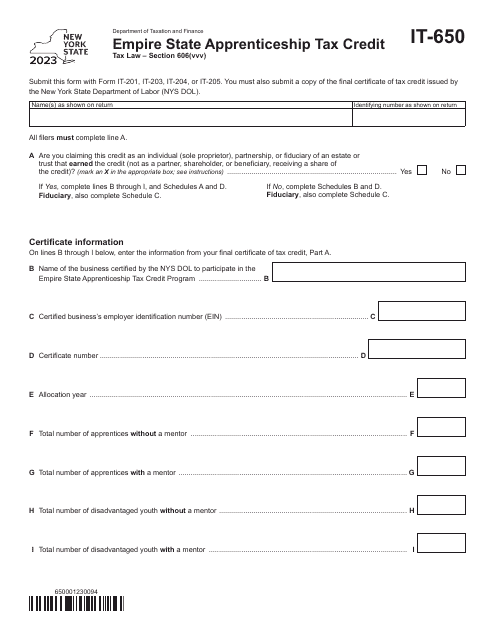

This document is a schedule for claiming the ATC Apprenticeship Tax Credit specific to the state of Alabama. It provides information on how to calculate and claim tax credits related to apprenticeship programs.

This document provides essential information for employees about their health benefits under COBRA. It covers topics such as eligibility, coverage duration, and the rights and responsibilities of employees.

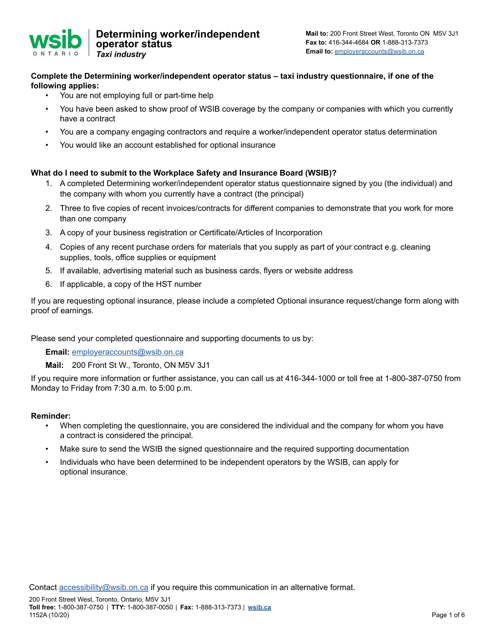

This form is used for determining the worker/independent operator status in the taxi industry in Ontario, Canada.

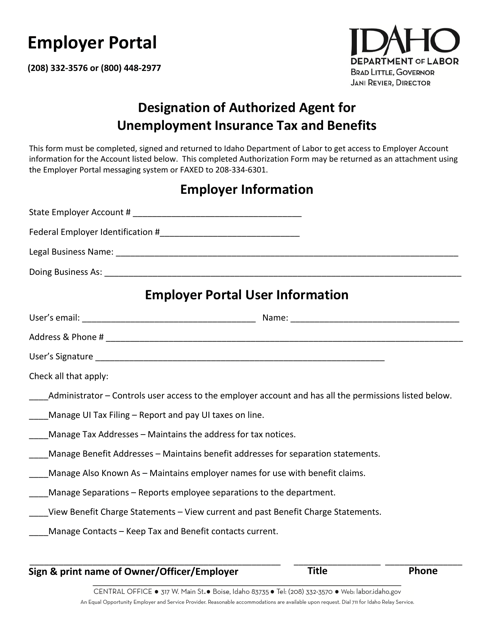

This document is used for designating an authorized agent to handle unemployment insurance tax and benefits in the state of Idaho.

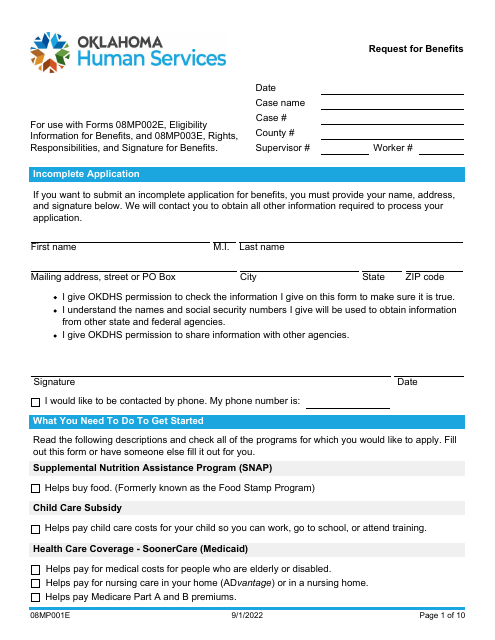

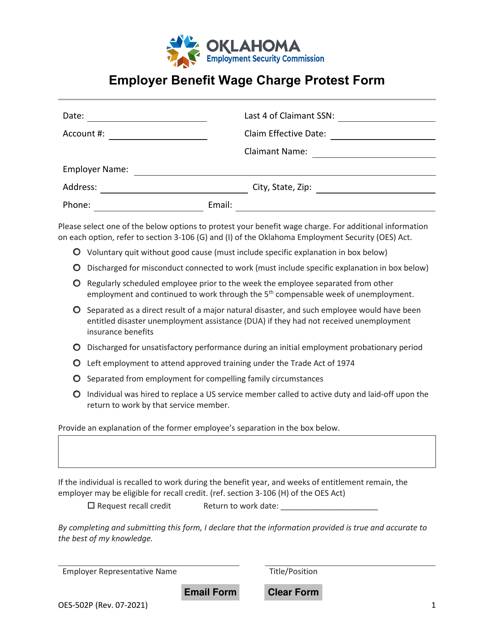

This Form is used for protesting employer benefit wage charges in Oklahoma.

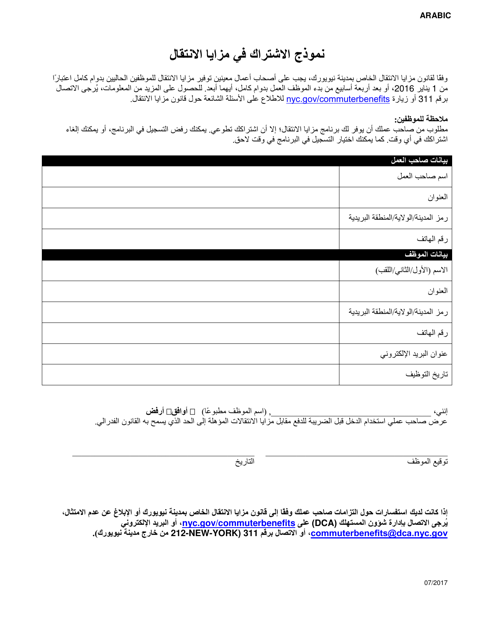

This document is a form that allows participants in New York City to apply for commuter benefits. It is available in Arabic language.

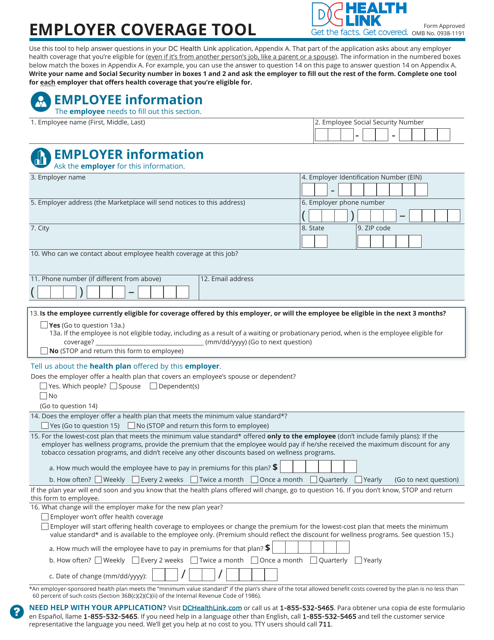

This Form is used for determining if a Washington, D.C. employer offers health insurance coverage to its employees.

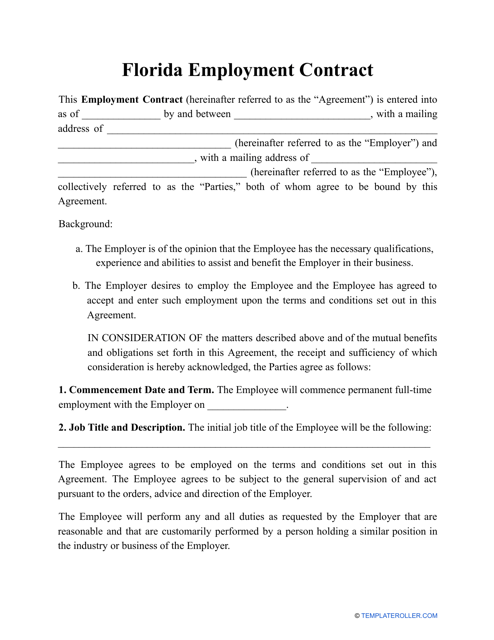

This is a contract used in Florida that is signed by both an employee and their legal employer when they secure a job offer within a business and agree to start working there.

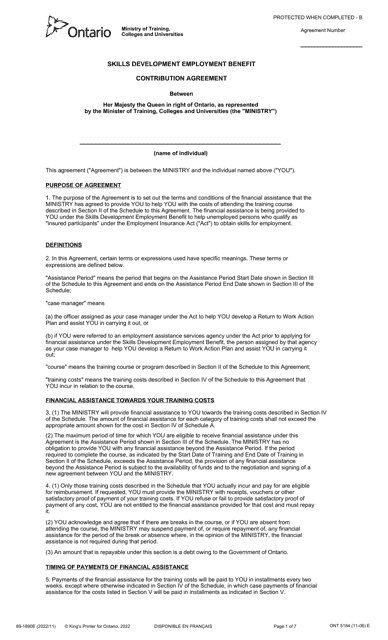

This Form is used for the Skills Development Employment Benefit Contribution Agreement in Ontario, Canada.