Farmland Assessment Templates

Welcome to our webpage dedicated to farmland assessment, also known as agricultural land assessment or greenbelt assessment.

Farmland assessment is a process by which the value of agricultural land is determined for the purpose of property taxation. This assessment helps ensure that farmers and landowners are not burdened with excessive taxes on their productive farmland.

Our webpage provides valuable information and resources on various aspects of farmland assessment. Whether you are a farmer, a landowner, or a taxpayer interested in understanding the benefits and requirements of farmland assessment, you will find the information you need here.

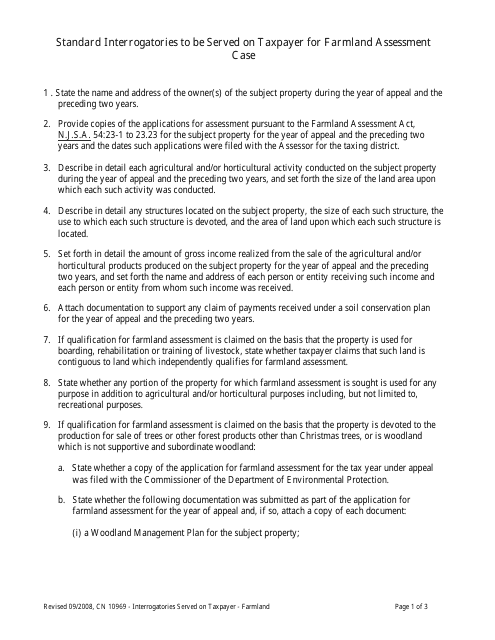

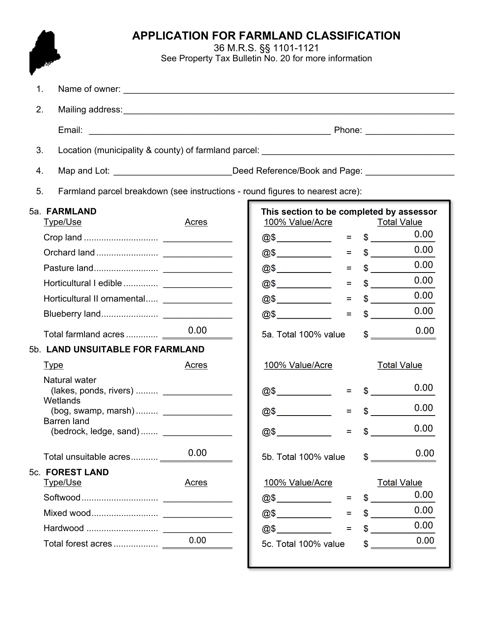

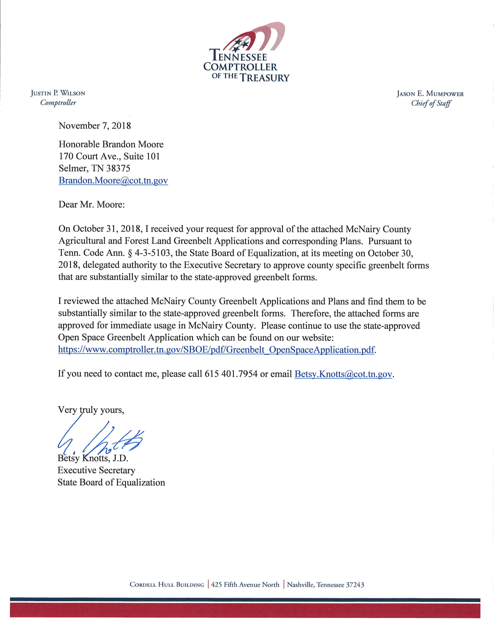

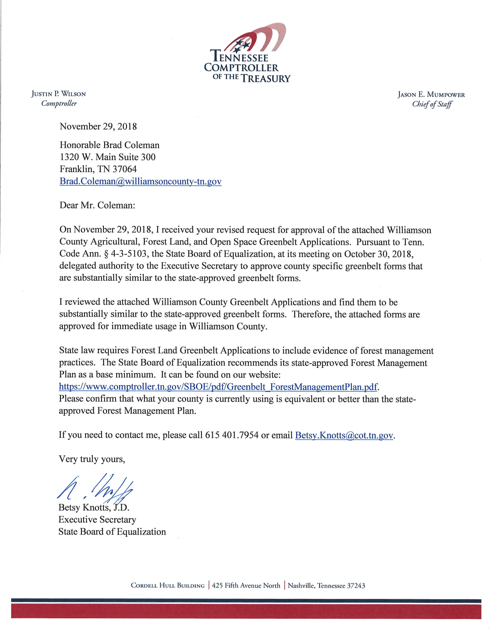

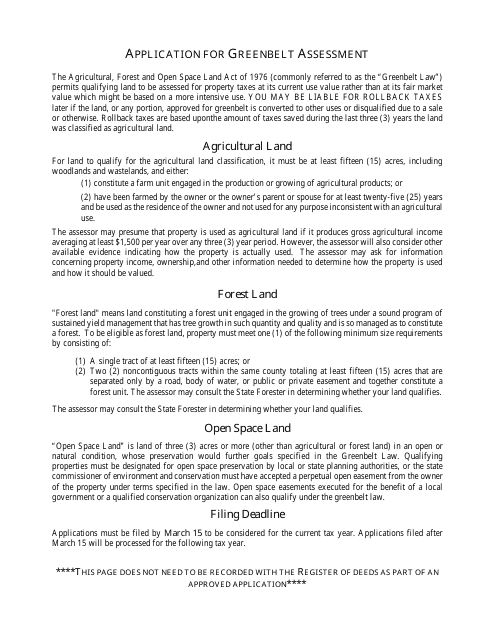

We offer guidance on how to complete the necessary applications for farmland assessment in different states and counties, such as the Form 10969 Standard Interrogatories to Be Served on Taxpayer for Farmland Assessment Case in New Jersey, the Application for Farmland Classification in Maine, and the Application for Greenbelt Assessment in Tennessee's McNairy and Williamson Counties.

Additionally, our webpage provides insights into the eligibility criteria for farmland assessment, the benefits of participating in such programs, and the importance of maintaining proper records to support your application. You will also find resources that explain the differences in farmland assessment programs across different states and jurisdictions.

Our goal is to empower farmers and landowners with the knowledge and tools necessary to navigate the farmland assessment process with ease. By taking advantage of farmland assessment, you can contribute to the preservation of agricultural land and ensure its continued productivity for generations to come.

Explore our webpage to discover more about farmland assessment and how it can benefit you.

Documents:

5

This form is used for serving standard interrogatories on a taxpayer involved in a farmland assessment case in New Jersey. It helps gather information related to the assessment of farmland for tax purposes.

This form is used for applying for a greenbelt assessment in McNairy County, Tennessee. Greenbelt assessment is a program that provides property tax incentives for landowners who maintain agricultural or forested land. By applying for this assessment, landowners can potentially lower their property taxes.

This document is used for applying for a Greenbelt Assessment in Williamson County, Tennessee.