Corporation Tax Calculation Templates

Corporation Tax Calculation Documents

Welcome to our comprehensive collection of corporation tax calculation documents. We understand that calculating corporation tax can be a complex task, but worry not - our extensive library of resources is here to assist you every step of the way.

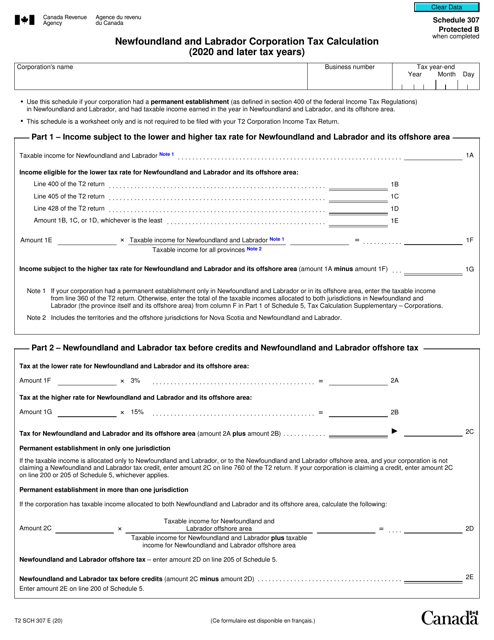

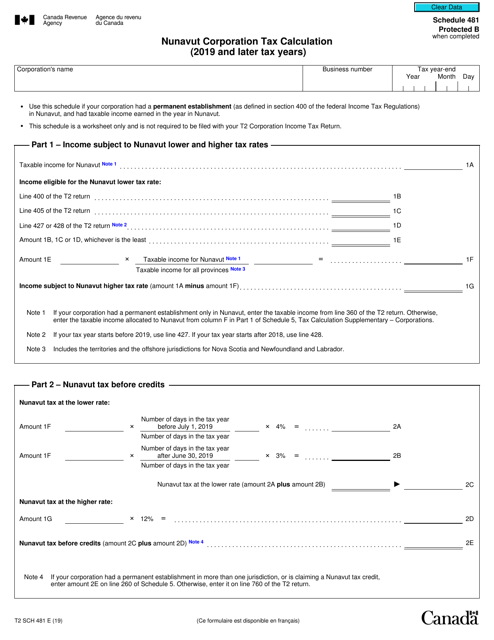

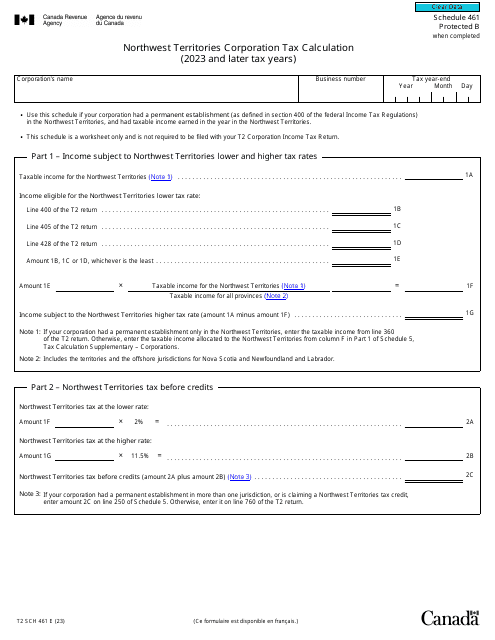

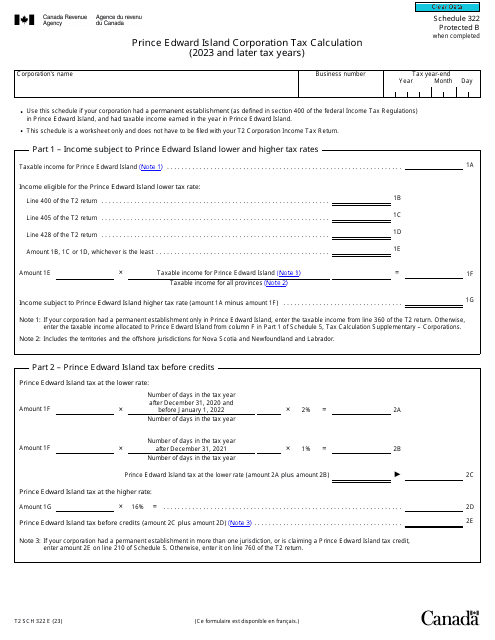

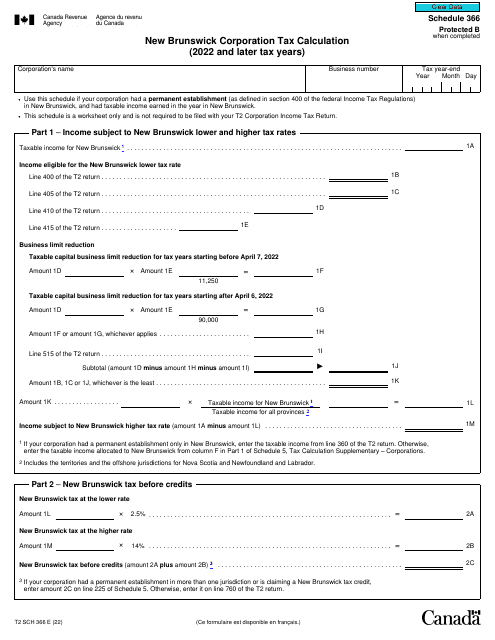

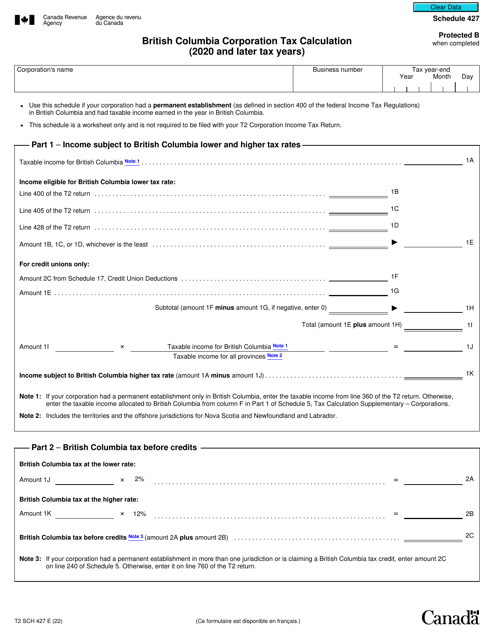

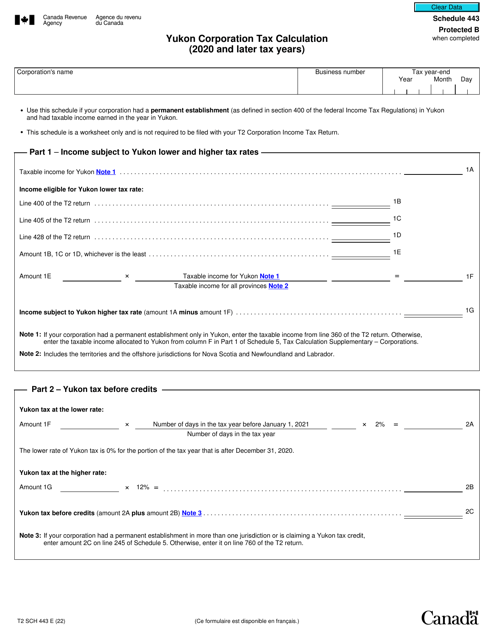

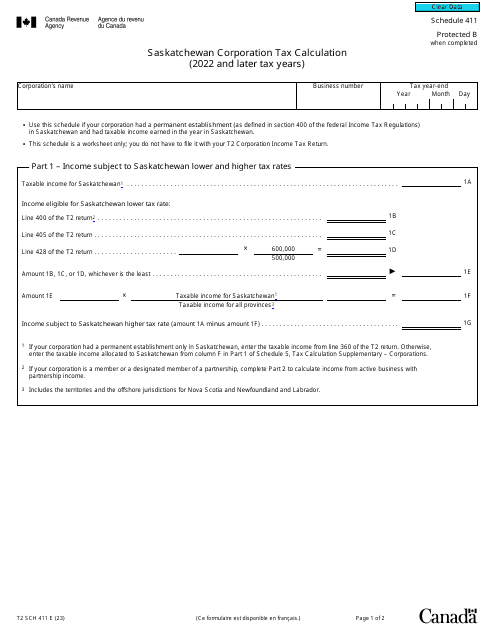

Our documents cover a wide range of jurisdictions, including Canada and other countries, ensuring that both local and international businesses can find the information and guidance they need. Whether you are in Prince Edward Island, British Columbia, Yukon, Northwest Territories, or Saskatchewan, there are tax calculation forms specifically designed for your region.

These documents provide detailed instructions and guidelines on how to accurately calculate corporation tax for different tax years. They outline the various factors and components that need to be considered, ensuring compliance with tax regulations and maximizing tax savings opportunities.

Navigating through the complexities of corporation tax calculation can be challenging, especially when tax laws and regulations are subject to change. Our up-to-date and comprehensive documents ensure that you have access to the most current guidelines, making the process easier and more efficient for your business.

Don't let the intricacies of corporation tax overwhelm you. With our corporation tax calculation documents, you can confidently calculate your tax liability and fulfill your obligations. Explore our extensive collection today and simplify the process of calculating corporation tax.

Documents:

12

This form is used for calculating the Nunavut Corporation Tax for Nunavut, Canada.