Foreign Assets Templates

Are you an individual or a business with foreign assets? Are you unsure about the tax rules and reporting requirements for these assets? Look no further. Our Foreign Assets document collection has got you covered.

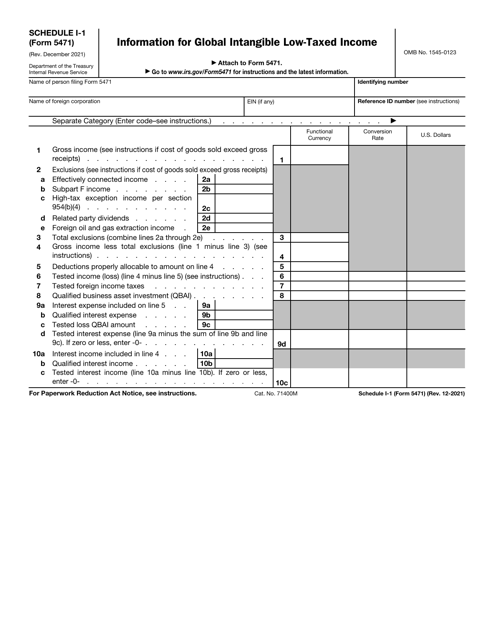

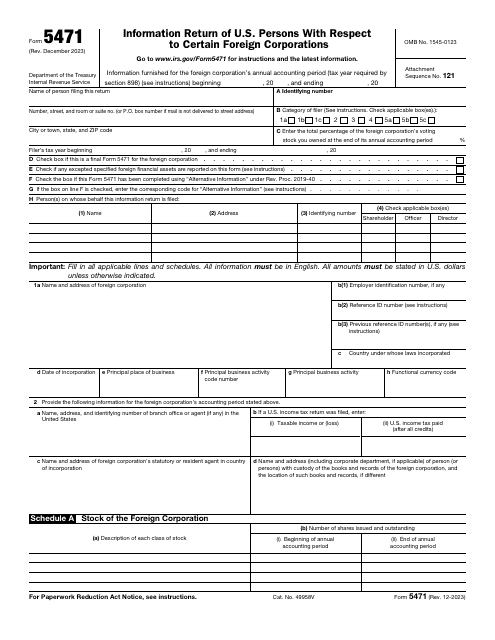

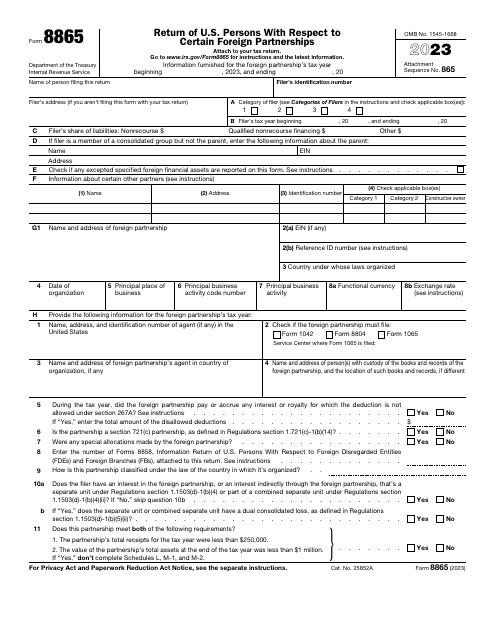

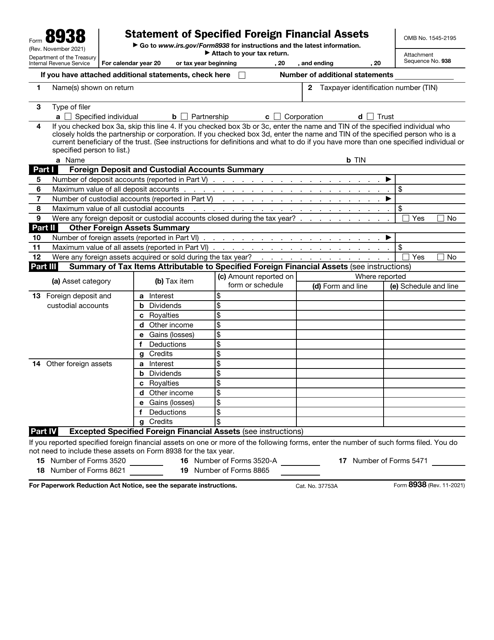

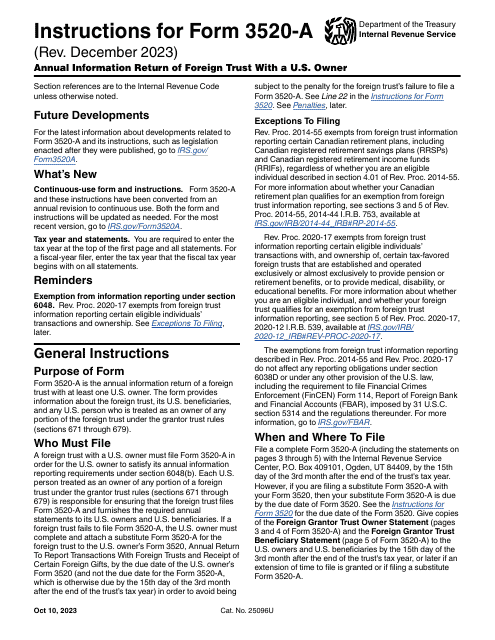

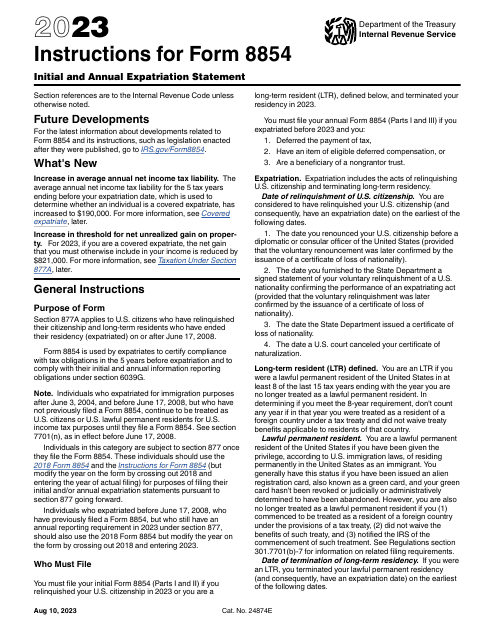

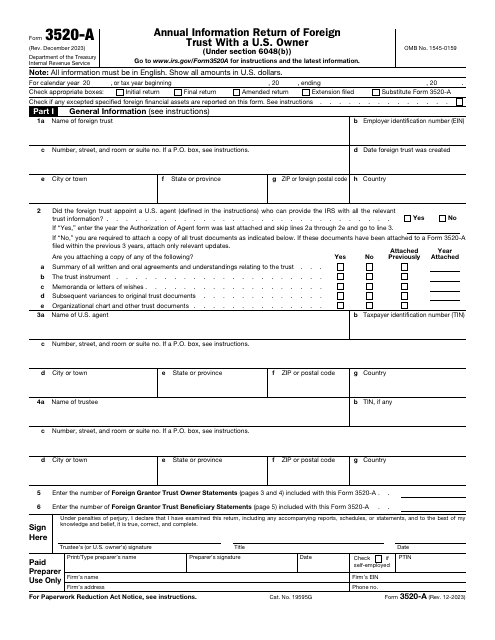

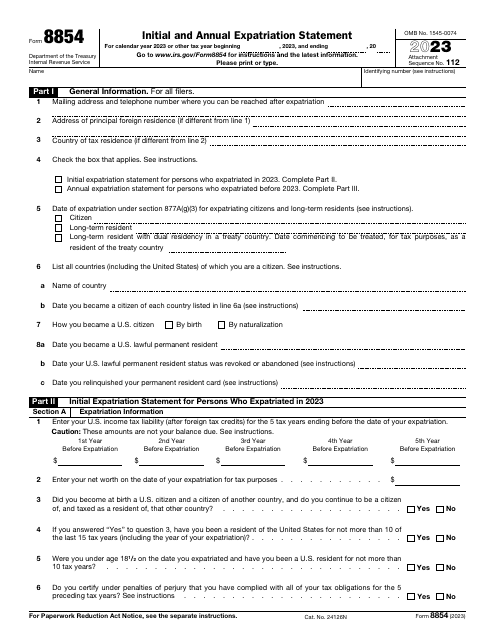

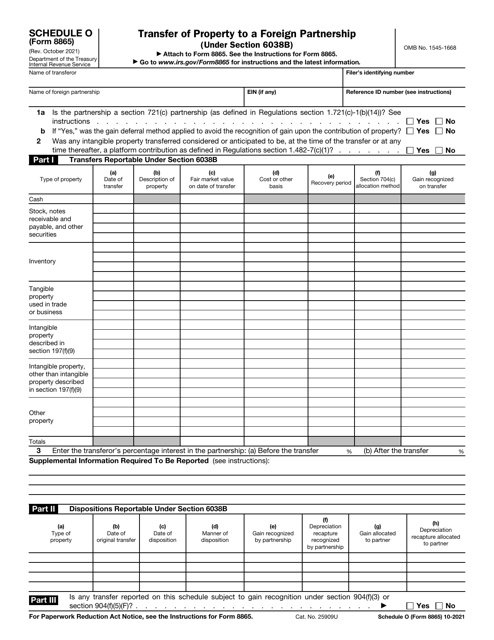

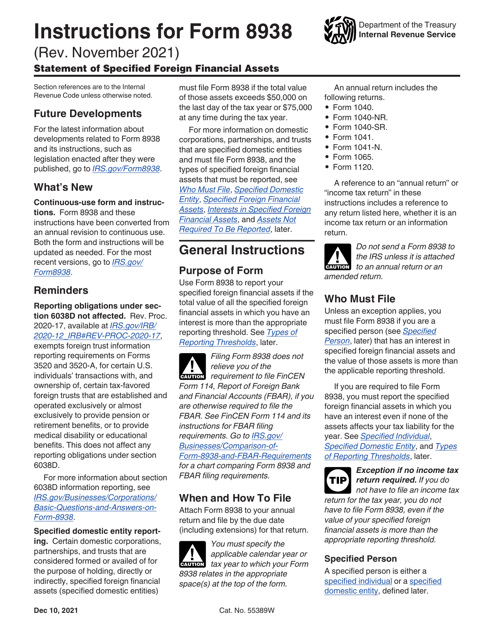

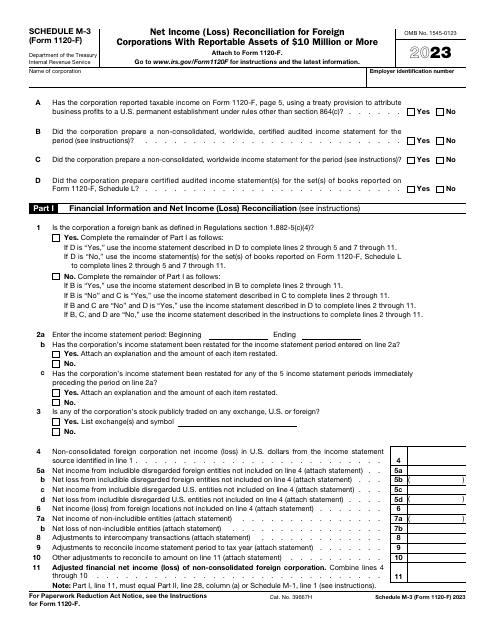

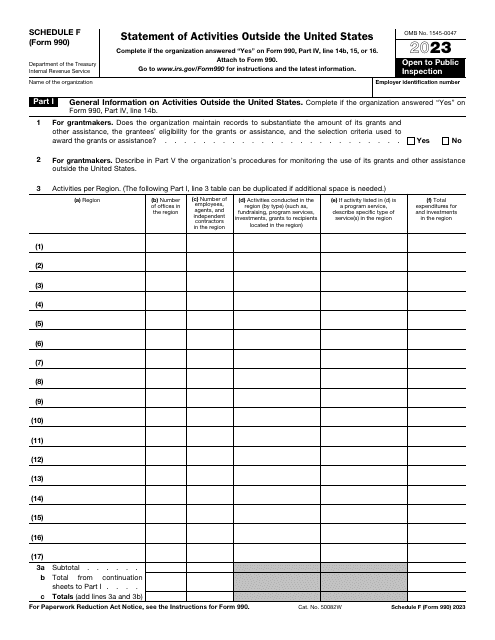

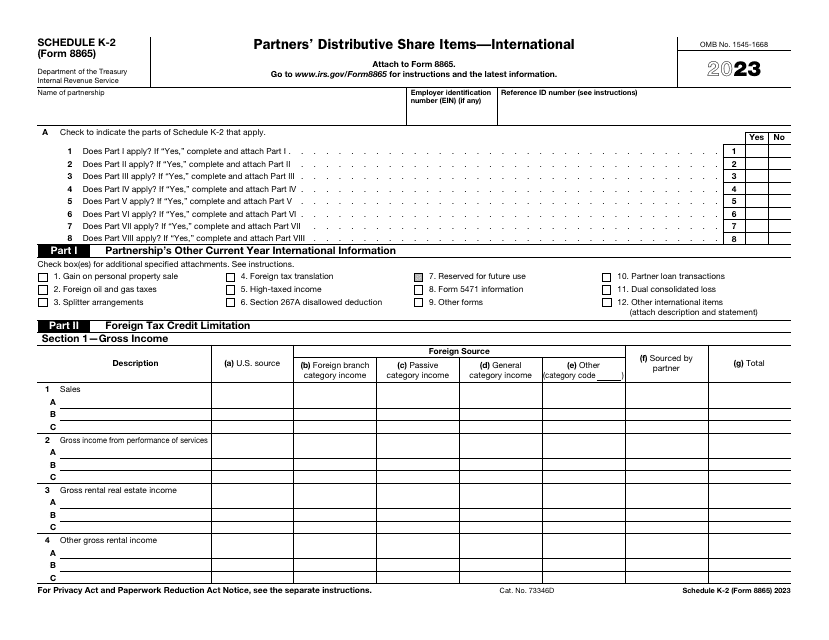

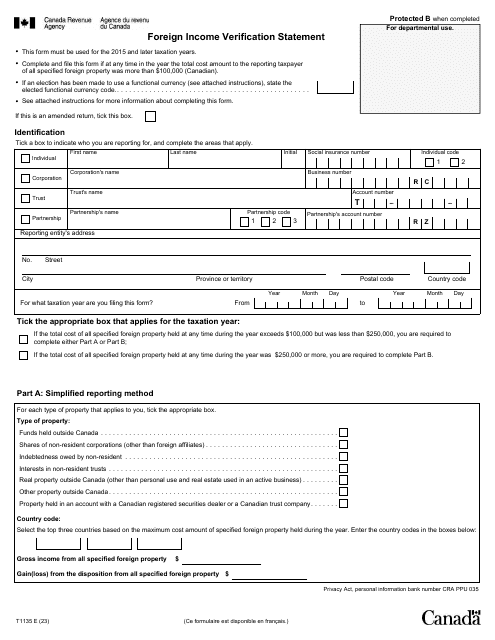

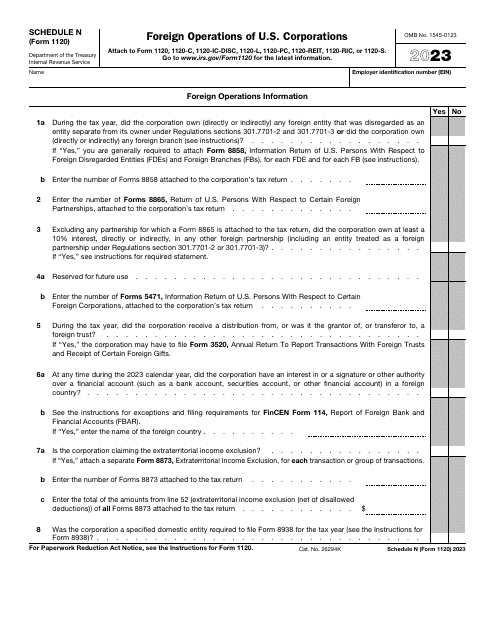

Our extensive collection of documents provides valuable information and instructions on various forms such as IRS Form 3520-A, IRS Form 5471, IRS Form 8938, and more. These forms are essential for reporting and disclosing foreign trusts, foreign corporations, and specified foreign financial assets.

With our user-friendly instructions and clear explanations, you will be able to navigate the complex world of foreign assets reporting with ease. Stay compliant with tax laws and regulations, and avoid penalties and unnecessary audits.

Whether you are a U.S. owner of a foreign trust, a U.S. person with foreign corporation holdings, or have other specified foreign financial assets, our Foreign Assets document collection is your go-to resource.

Don't let the complexity of reporting foreign assets overwhelm you. Let our comprehensive collection of documents guide you through the process, ensuring you meet all the necessary requirements. Protect your financial interests and ensure compliance with the IRS.

Browse through our Foreign Assets document collection today and gain the knowledge and confidence you need to effectively manage your foreign asset reporting.

Documents:

26

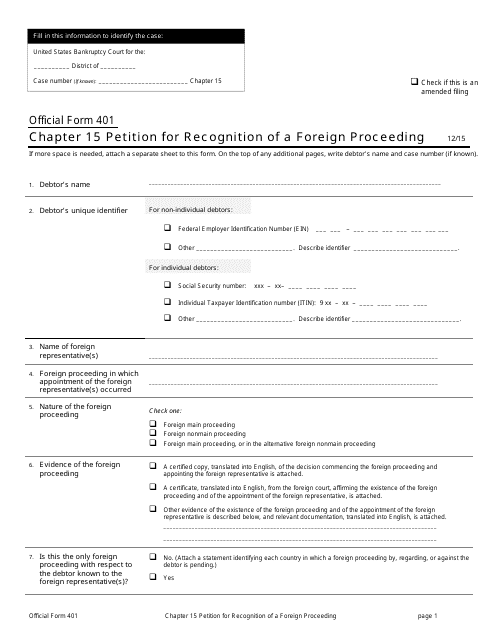

This Form is used for petitioning the court to recognize a foreign proceeding.

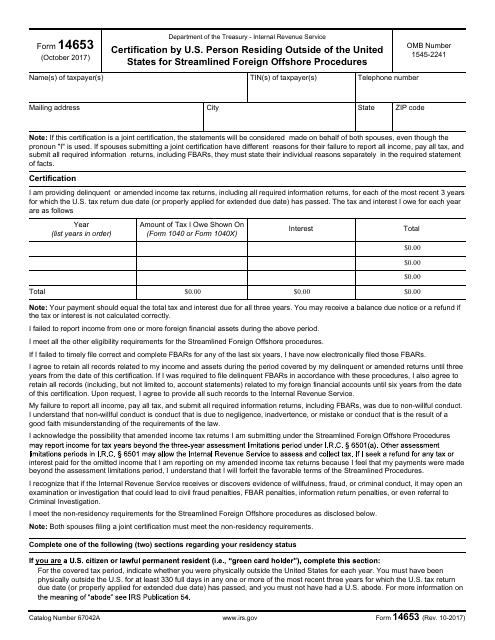

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.

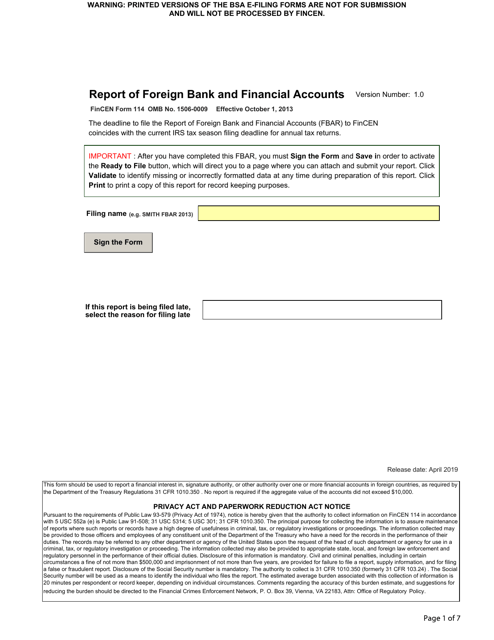

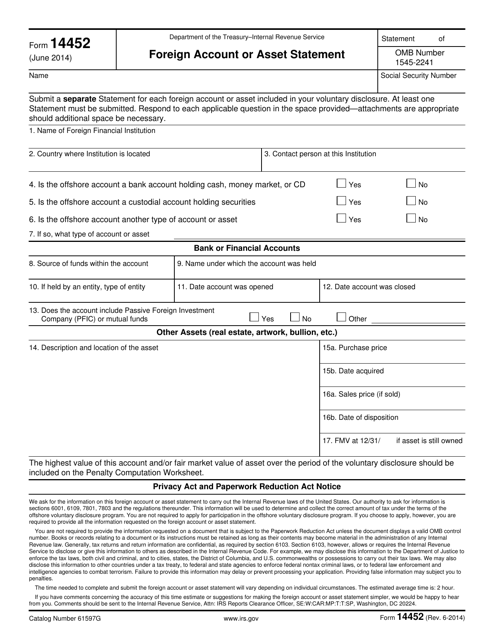

Use this document if you have a financial interest in any foreign financial account or signature authority over it. The term "financial account" includes a brokerage account, bank account, trust, mutual fund, or any other foreign financial account.

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.