Liquor Tax Templates

Are you looking for information about liquor tax or liquor tax forms? At our webpage, we provide comprehensive details and resources related to the taxation of liquor. Our collection of documents includes a wide range of forms and guides that deal with liquor tax compliance. You can find various documents such as exemption certificates, enforcement tax vouchers, financial responsibility bonds, and excise tax return instructions. These documents originate from different states, including Utah, Kansas, Illinois, and North Carolina.

Our liquor tax documents collection covers everything from registration applications to tax payment vouchers, ensuring that you have access to the necessary resources for adhering to liquor tax regulations. Whether you are a business owner in the liquor industry or an individual interested in understanding the tax obligations associated with liquor, our webpage provides the information you need.

Explore our extensive liquor tax documents collection to gain insights into the specific requirements and guidelines for each state. Stay informed, remain compliant, and save time and effort by accessing the necessary forms and instructions conveniently from one centralized location. Trust our webpage for all your liquor tax-related needs.

Documents:

33

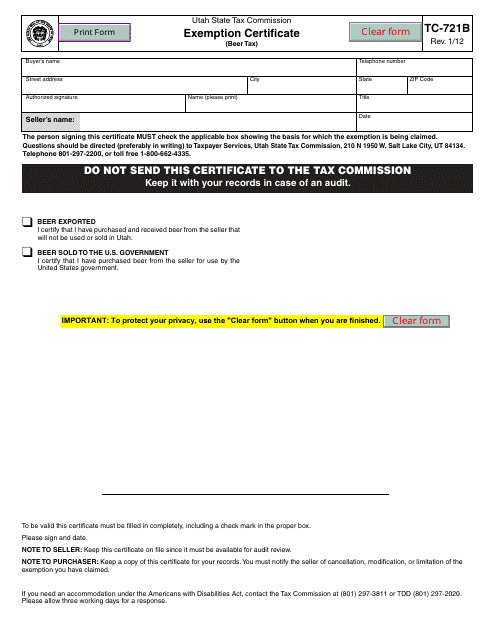

This form is used for claiming an exemption on beer tax in the state of Utah. Businesses can use this form to apply for a tax exemption on beer purchases.

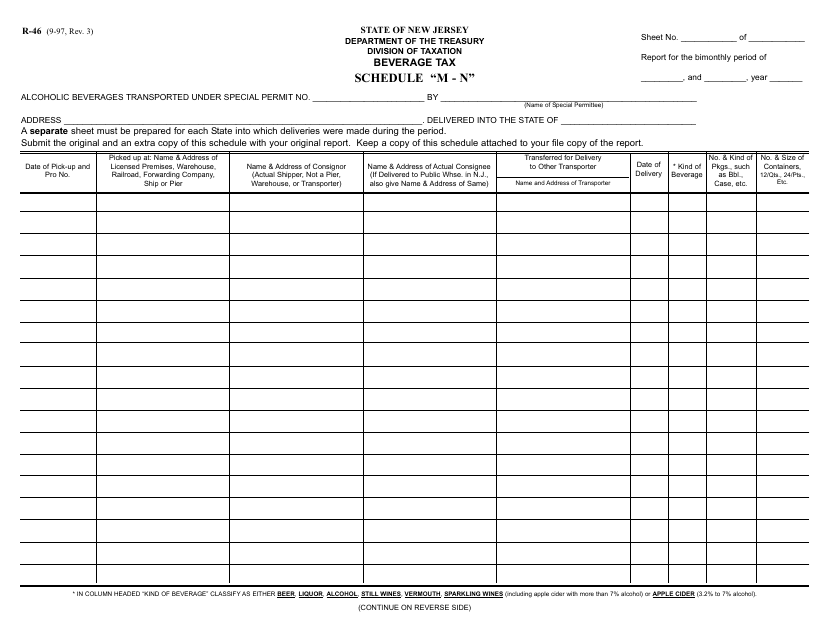

This form is used for reporting and paying alcohol beverage taxes in the state of New Jersey. It is specifically for Schedule M-N.

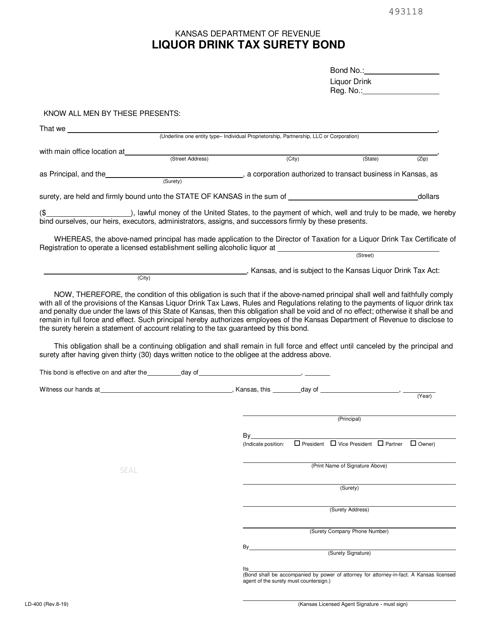

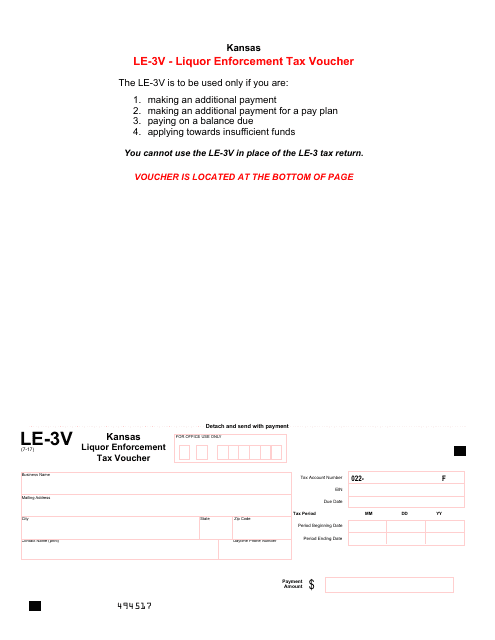

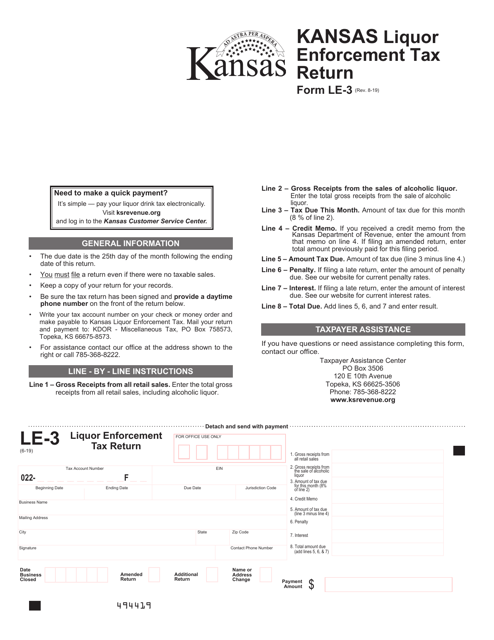

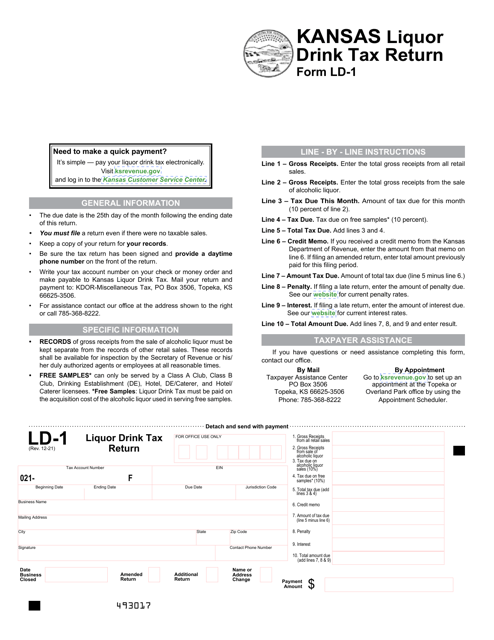

This form is used for the payment of Liquor Enforcement Tax in the state of Kansas.

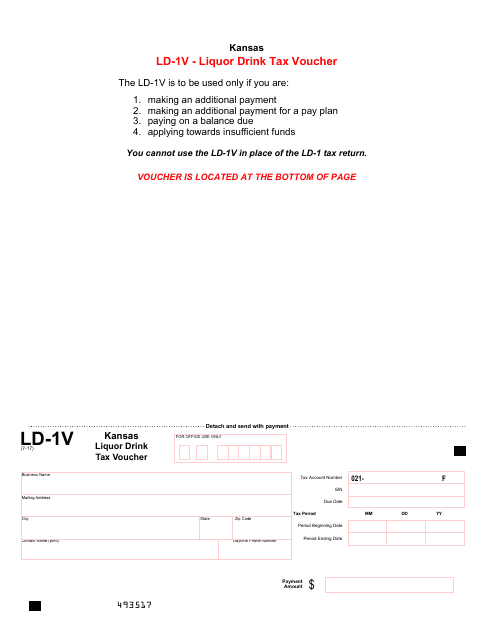

This form is used for submitting the Kansas Liquor Drink Tax payment voucher.

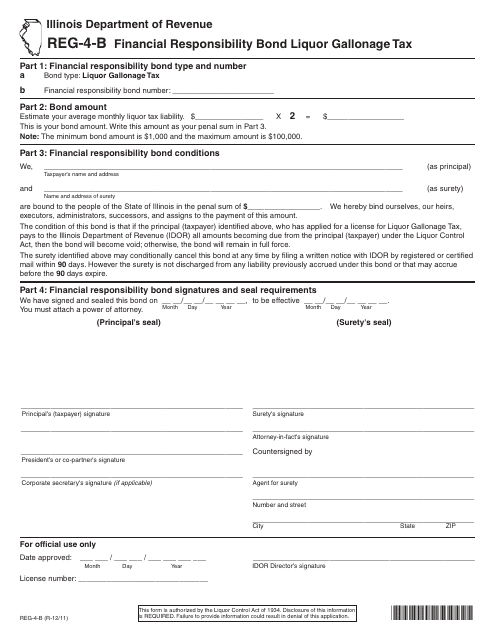

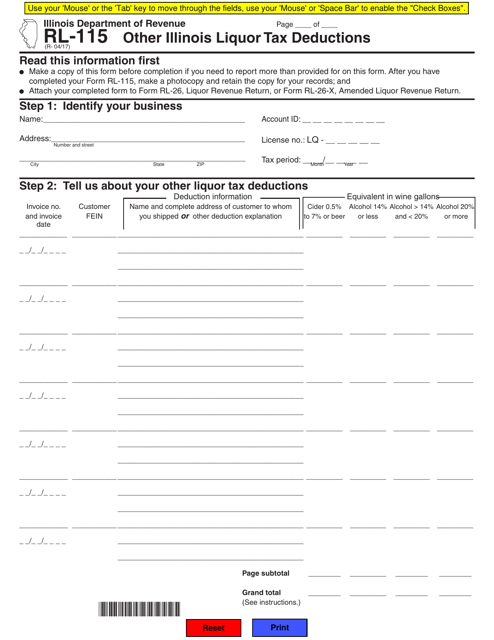

This form is used for obtaining a financial responsibility bond for paying the liquor gallonage tax in the state of Illinois.

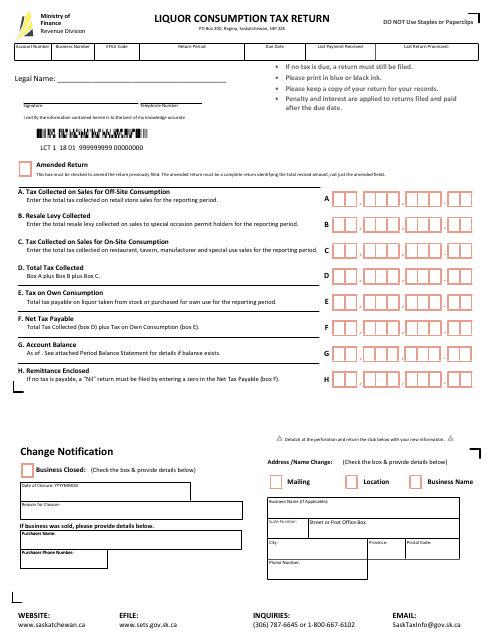

This Form is used for reporting and paying the liquor consumption tax in the province of Saskatchewan, Canada. It is to be filed by businesses that sell or serve alcoholic beverages.

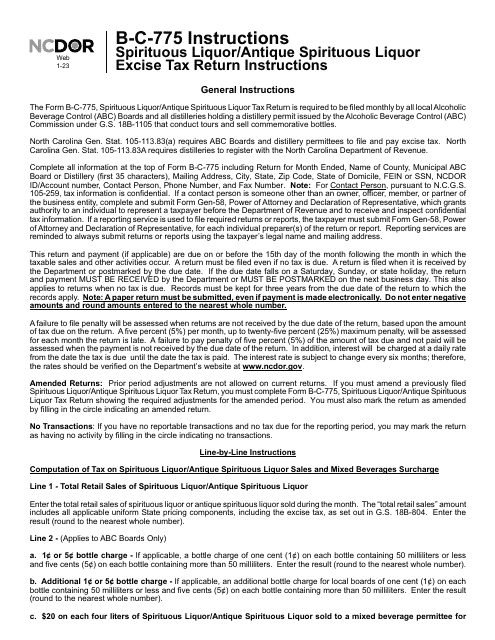

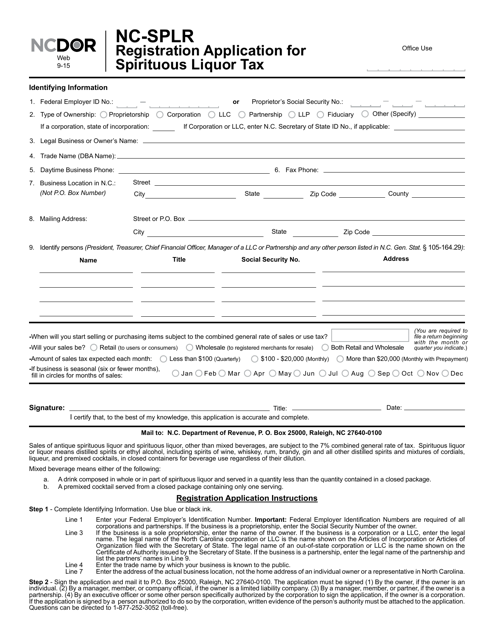

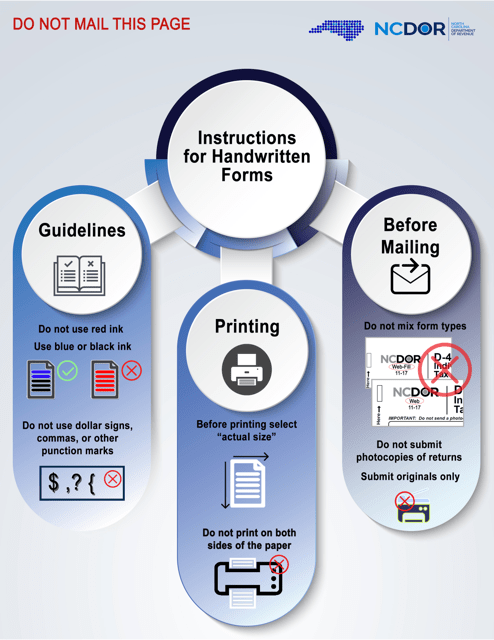

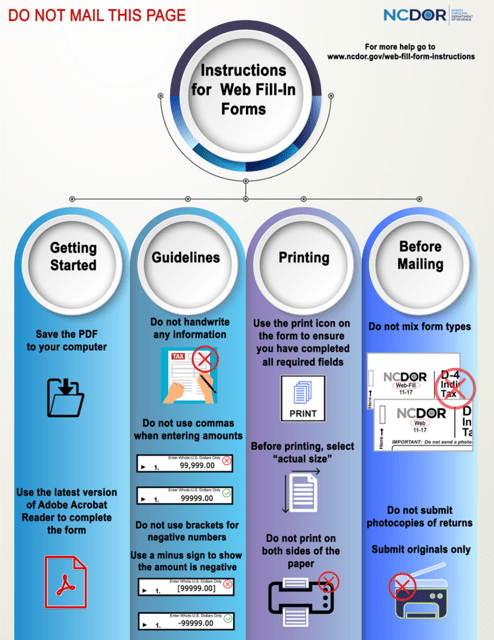

This form is used for registering and applying for the Spirituous Liquor Tax in the state of North Carolina.

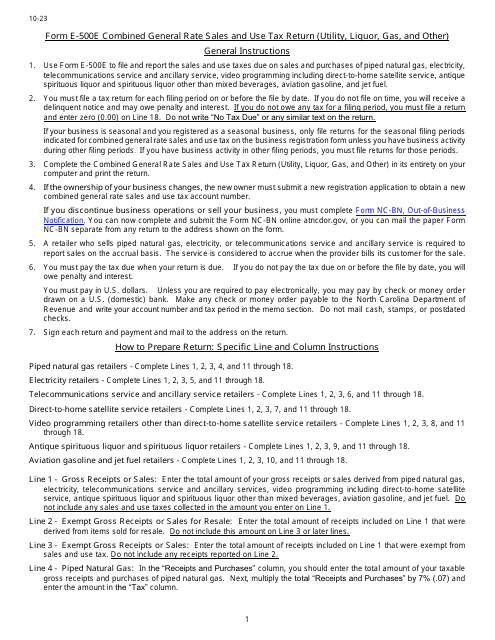

This Form is used for claiming a refund for the combined general rate of tax on utility, liquor, gas, and other items in North Carolina.

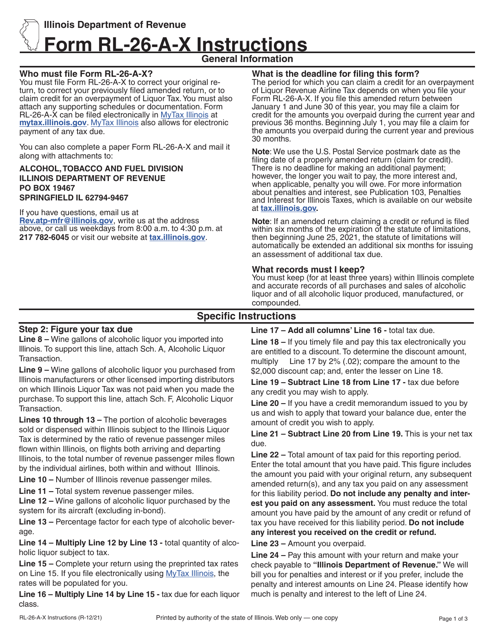

This form is used for reporting and claiming deductions on liquor taxes in the state of Illinois, other than the ones covered by Form RL-115.

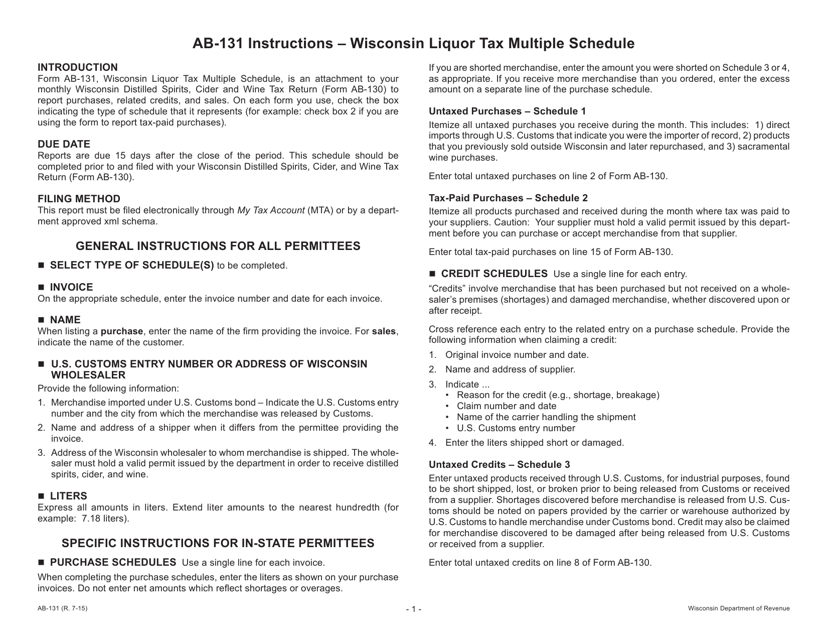

This Form is used for reporting liquor taxes in Wisconsin. It includes multiple schedule options for different types of liquor.

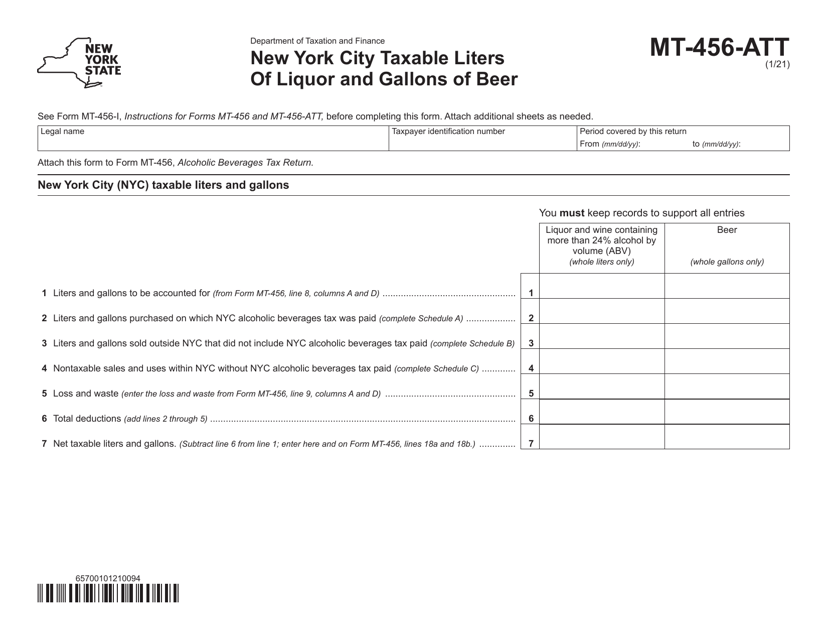

This form is used for reporting the taxable liters of liquor and gallons of beer in New York City for tax purposes.

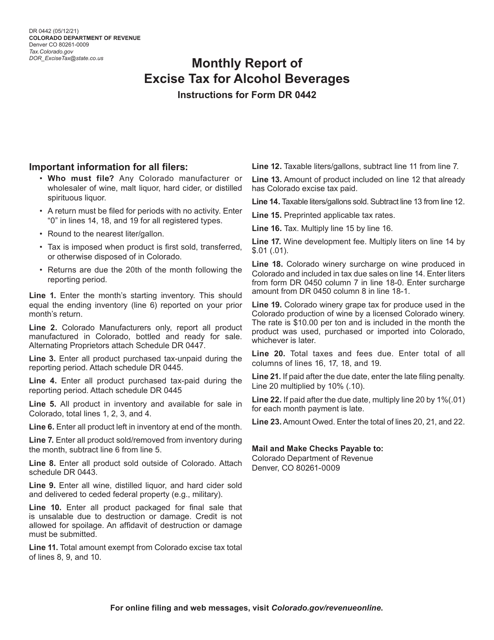

This form is used for reporting monthly excise tax on alcohol beverages in Colorado. It helps the state government track and collect taxes from alcohol sales.

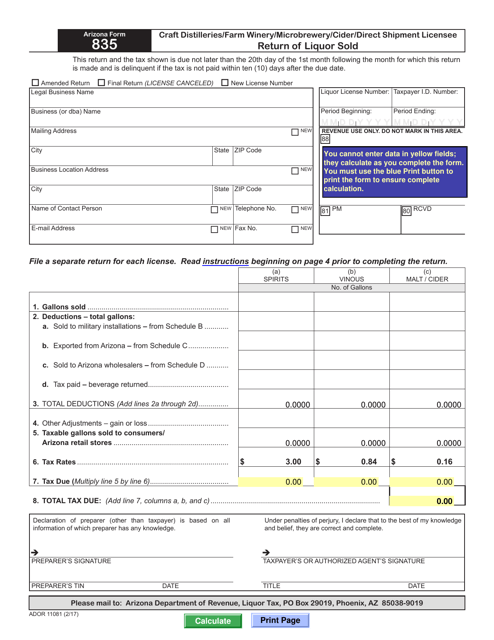

This document is used for reporting and paying taxes on liquor sold by craft distilleries, farm wineries, microbreweries, cider producers, and direct shipment licensees in Arizona.

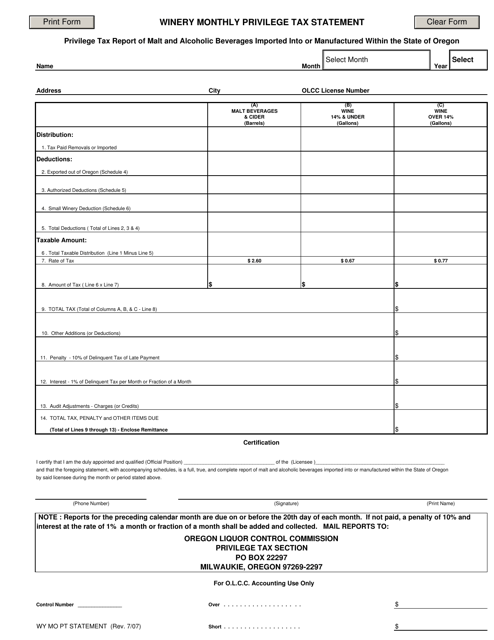

This document is used for reporting and paying monthly privilege tax for wineries in Oregon.

This Form is used for remitting the consumer liquor excise and use tax in the state of Wyoming.

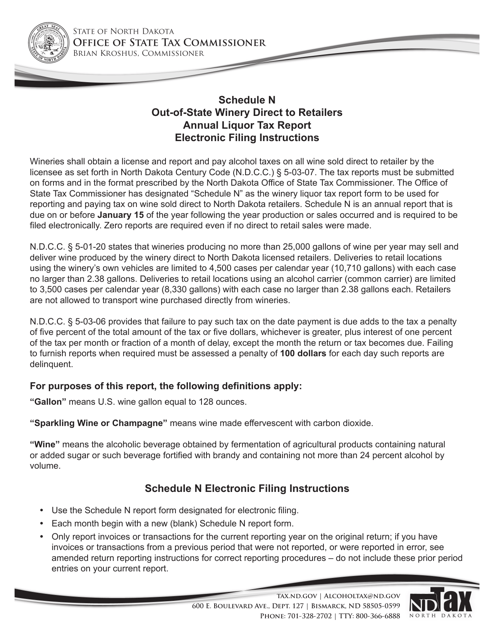

This Form is used for submitting an annual liquor tax report by out-of-state wineries selling directly to retailers in North Dakota.