Property Tax Protest Templates

Are you tired of paying high property taxes? It's time to take action and file a property tax protest. The property tax protest, also known as the property tax protest form, is your opportunity to challenge the assessed value of your property and potentially lower your tax burden.

In states like Texas, property owners have the right to file a protest to dispute their property tax assessment. By filing a property tax protest, you are requesting a review of your property's value by the appraisal district. This process allows you to present evidence and arguments to support your claim that your property is overvalued.

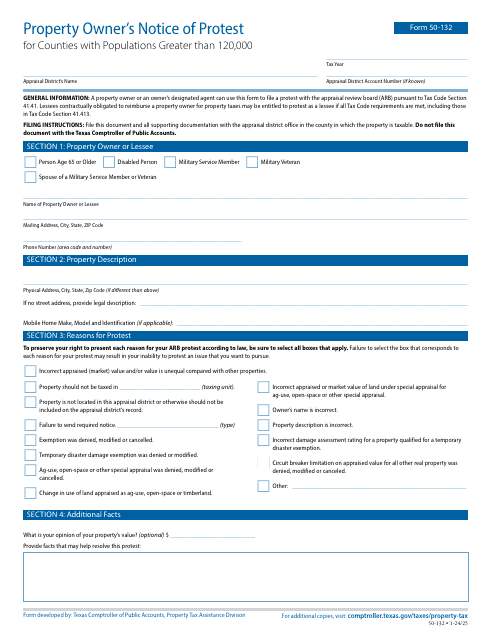

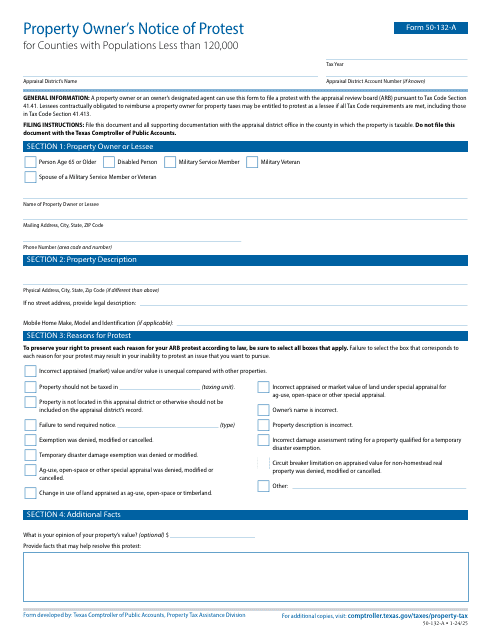

Form 50-132 Property Owner's Notice of Protest - Texas is just one example of the documents associated with the property tax protest. This form is used to officially notify the appraisal district of your intent to protest your property's assessment. Another variation of this form, Form 50-132-A Property Owner's Notice of Protest - Texas, may also be used for the same purpose.

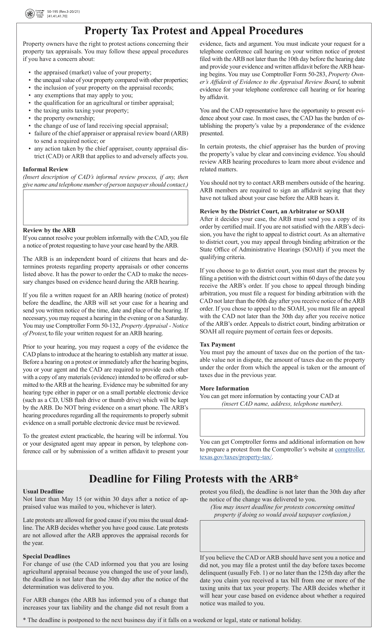

In addition to the notice of protest form, you may come across Form 50-195 Property Tax Protest and Appeal Procedures - Texas. This document provides guidance on the protest and appeal procedures, offering valuable information on the steps to follow and the deadlines to meet.

Filing a property tax protest can be a complex process, but it is worth the effort to potentially save money. Keep in mind that each state may have its own specific forms and procedures for property tax protests, so it's important to familiarize yourself with the requirements in your jurisdiction.

Don't let high property taxes drain your resources. Take advantage of the opportunity to file a property tax protest and potentially reduce your tax burden. Empower yourself with the knowledge of the property tax protest process and start defending your rights as a property owner today!

Documents:

7

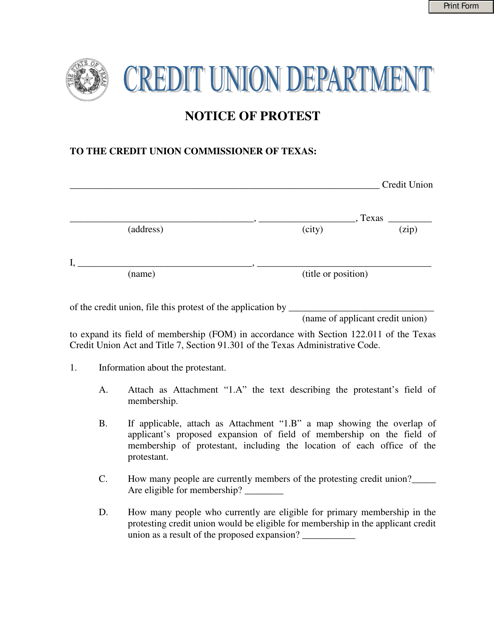

This document is used to file a formal protest in the state of Texas.

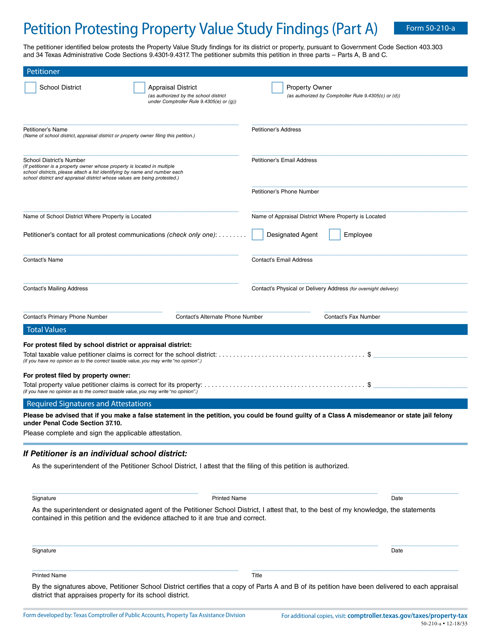

This form is used for filing a petition to protest the findings of a property value study in Texas. It is part A of the petition.

This form is used for property owners in Texas to protest or appeal their property tax assessment. It provides information and procedures for contesting the assessed value of the property.