Common Law Partner Templates

A common law partner, also known as a common-law partner, refers to a person who lives with another person in a marriage-like relationship. Although not legally married, common law partners have similar rights and responsibilities as married couples in many areas of the law.

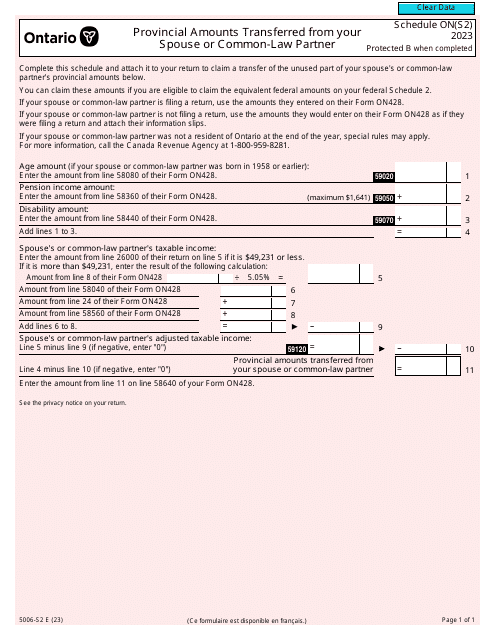

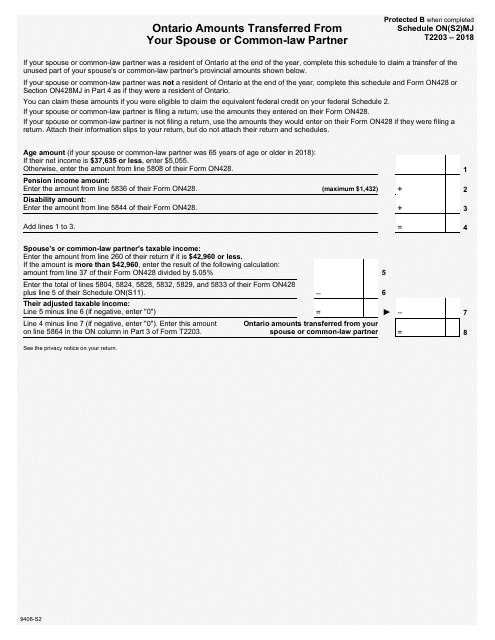

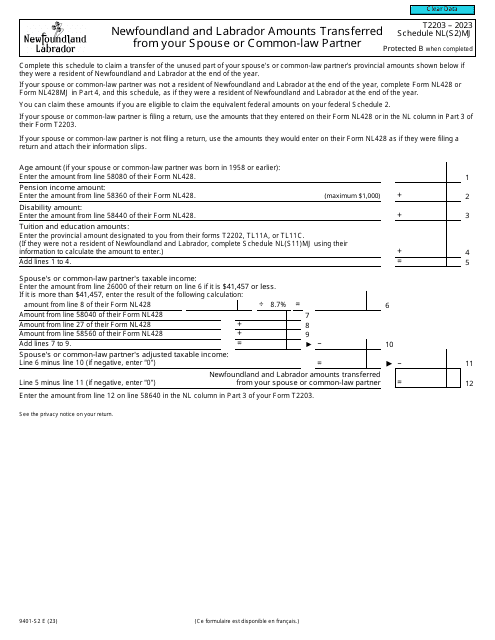

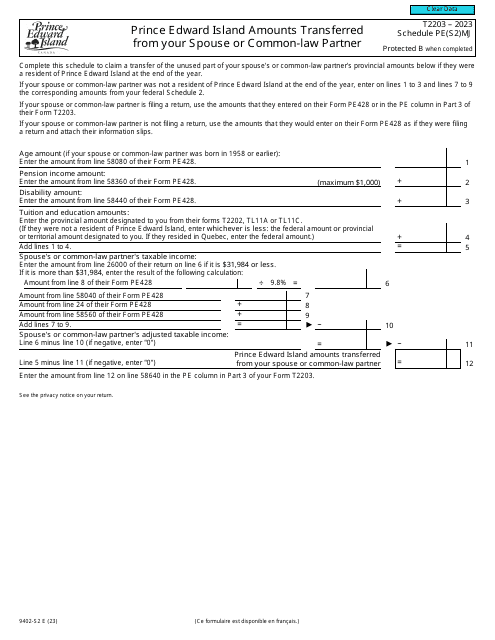

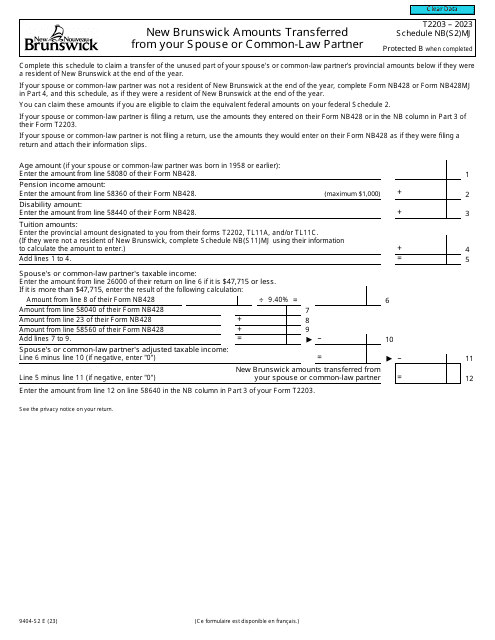

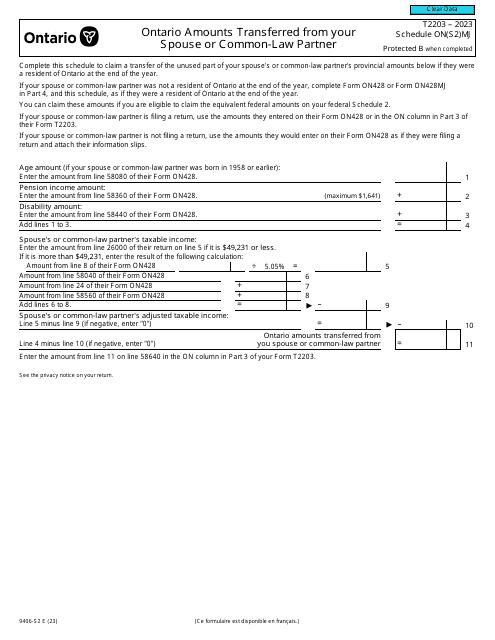

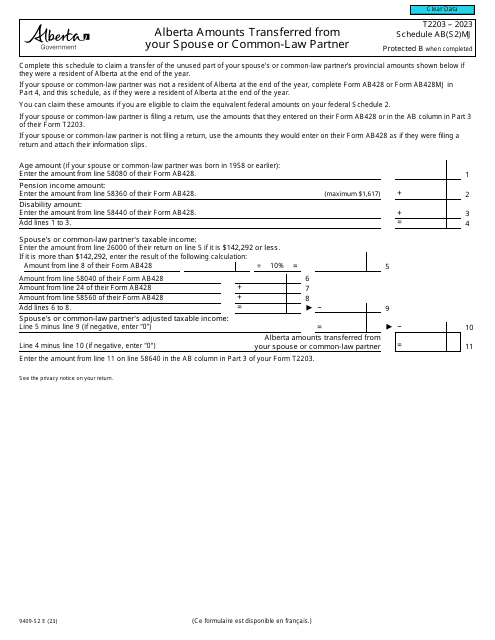

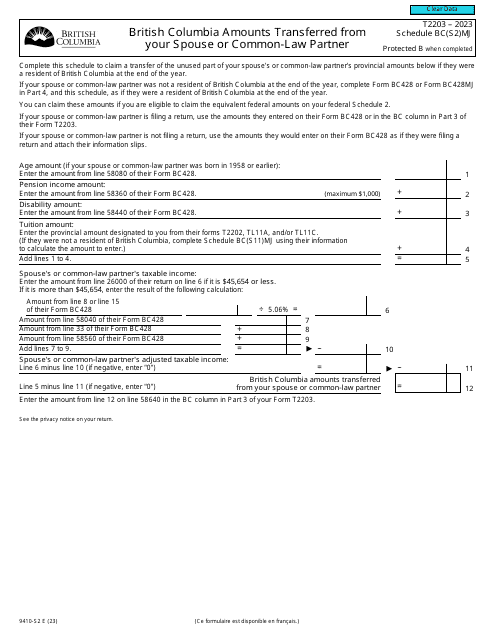

In Canada, common law partners are recognized by the government and have certain legal obligations and benefits. For example, they may be eligible for tax benefits and deductions, such as the Form T2203 Schedule ON(S2)MJ Ontario Amounts Transferred From Your Spouse or Common-Law Partner - Canada or the Form T2203 (9404-S2) Schedule NB(S2)MJ New Brunswick Amounts Transferred From Your Spouse or Common-Law Partner - Canada. These forms allow common law partners to transfer certain amounts between their tax returns to optimize their tax liabilities.

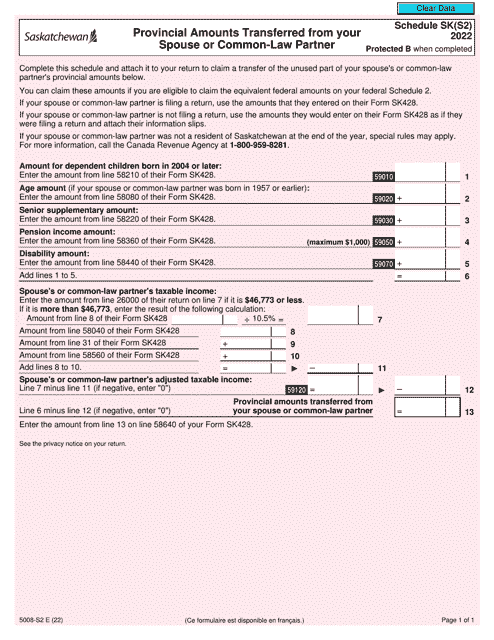

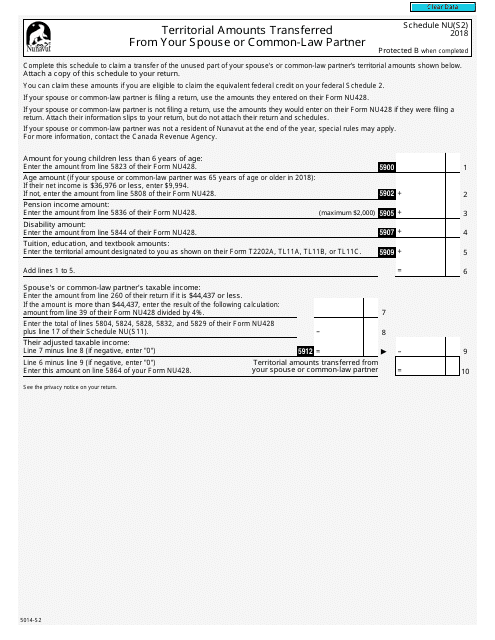

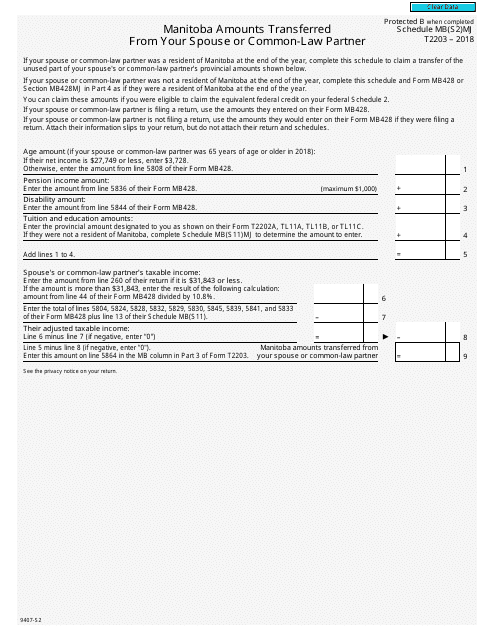

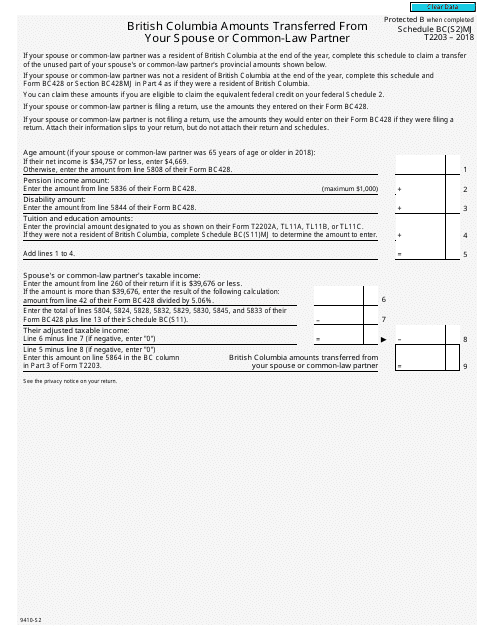

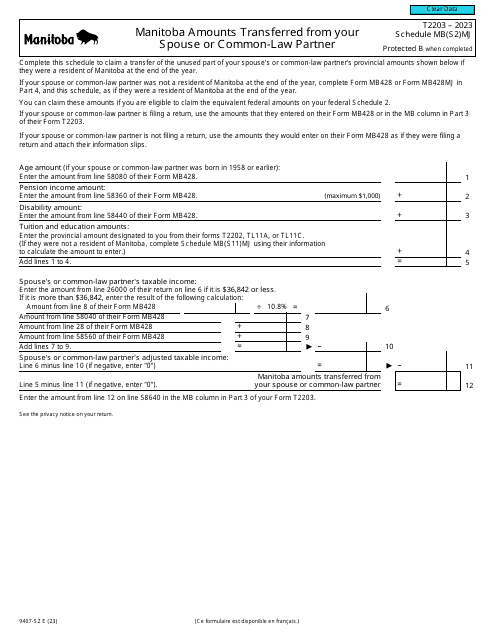

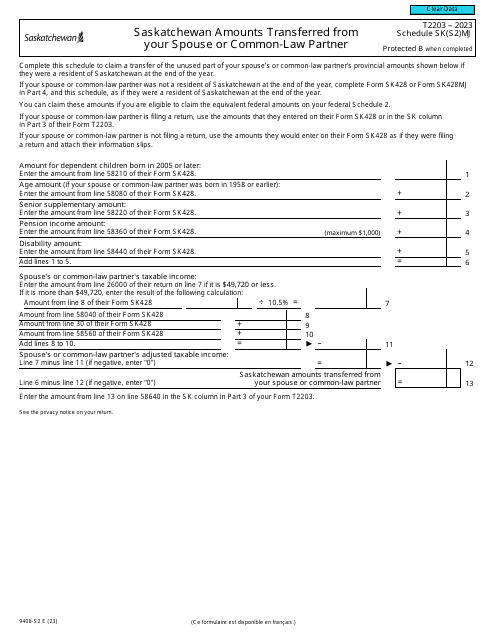

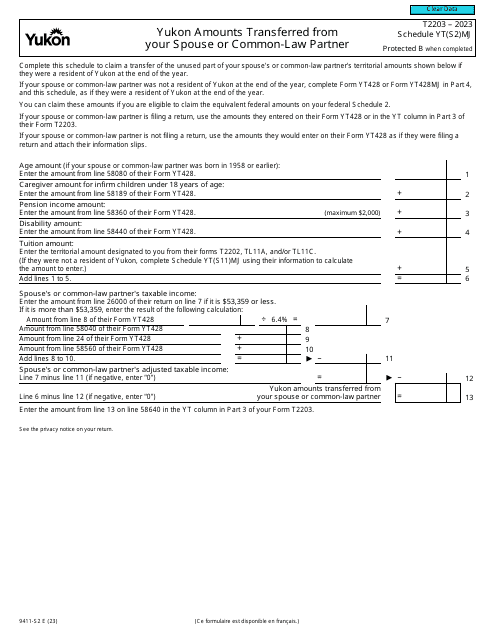

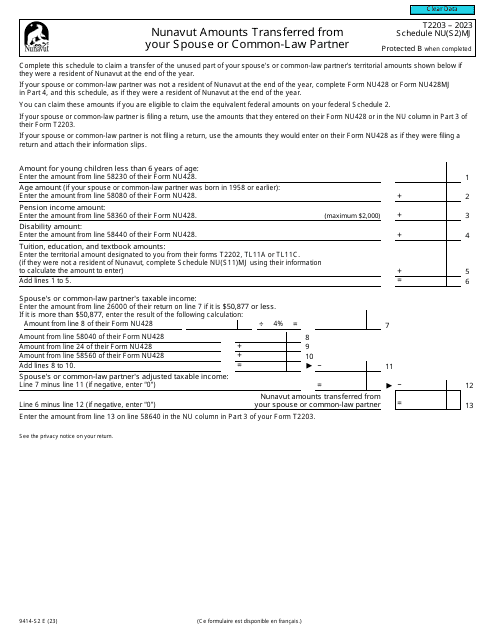

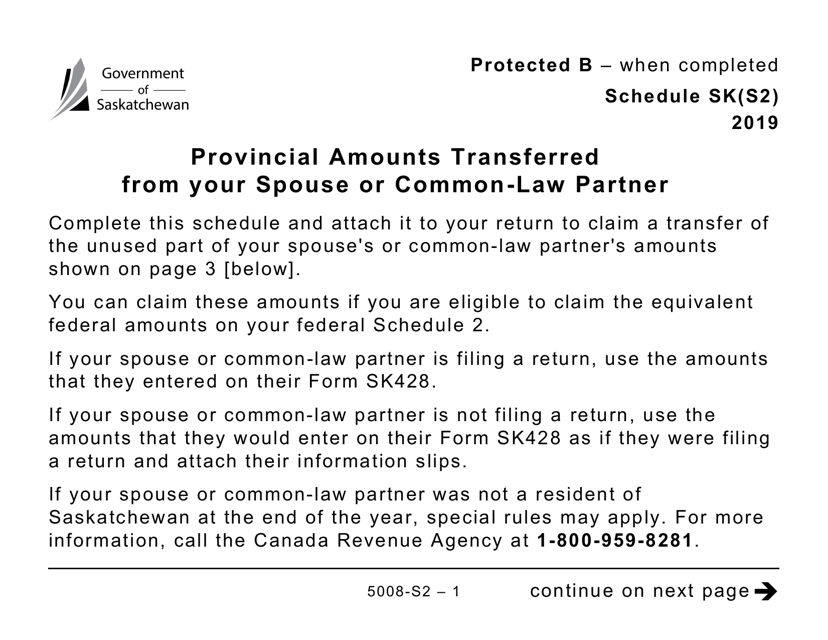

Moreover, common law partners residing in different territories or provinces in Canada may have specific forms to report transfers, such as the Form 5014-S2 Schedule NU(S2) Territorial Amounts Transferred From Your Spouse or Common-Law Partner - Nunavut - Canada or the Form T2203 (9408-S2) Schedule SK(S2)MJ Saskatchewan Amounts Transferred From Your Spouse or Common-Law Partner - Canada. These forms ensure that common law partners receive the appropriate tax benefits according to the jurisdiction they reside in.

If you are a common law partner, it is essential to understand your rights and obligations. Knowing how to leverage the tax benefits available through forms like the Form T2203 (9414-S2) Schedule NU(S2)MJ Nunavut Amounts Transferred From Your Spouse or Common-Law Partner - Canada can help you optimize your tax situation.

At USA, Canada and other countries document knowledge system, we provide detailed information and resources about common law partnership, including forms, regulations, and guidelines. Our goal is to ensure that you have the necessary information to navigate the legal aspects of being a common law partner and to make informed decisions regarding taxes and other relevant matters.

Please explore our website to find comprehensive resources and guidance on common law partnership and related documentation. If you have any questions or require further assistance, do not hesitate to contact our knowledgeable team of experts who are ready to assist you.

Documents:

124

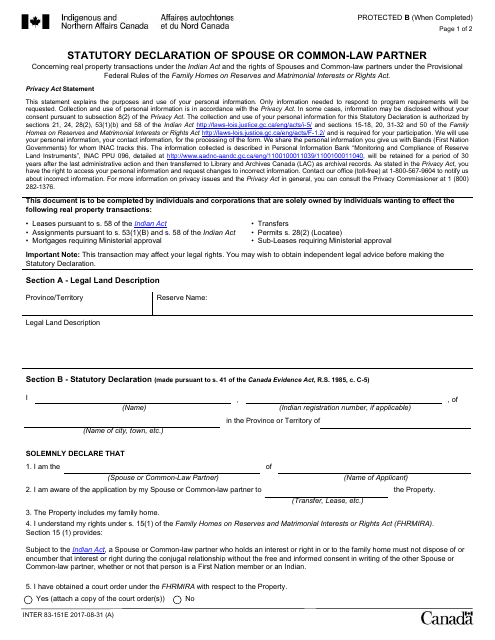

This Form is used for making a legal declaration about your spouse or common-law partner in Canada.

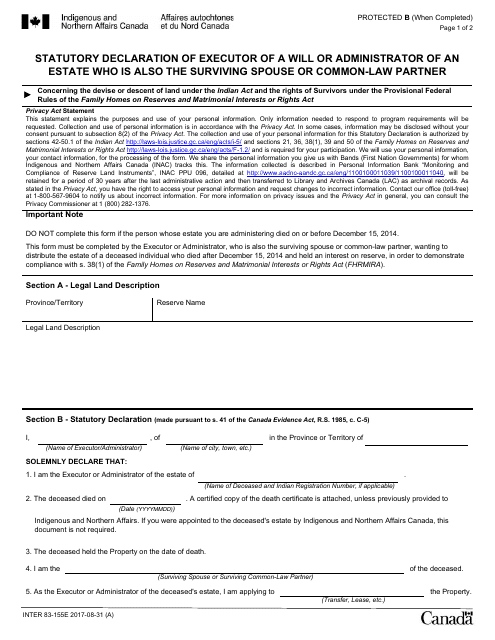

This form is used for the statutory declaration of an executor or administrator of an estate in Canada who is also the surviving spouse or common-law partner.

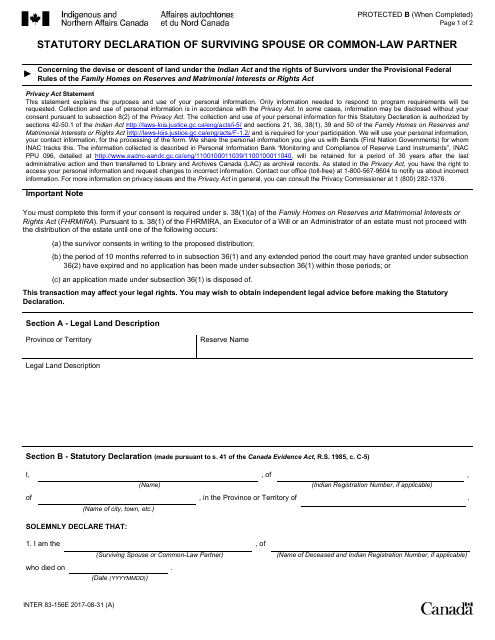

This form is used for declaring the surviving spouse or common-law partner in Canada.

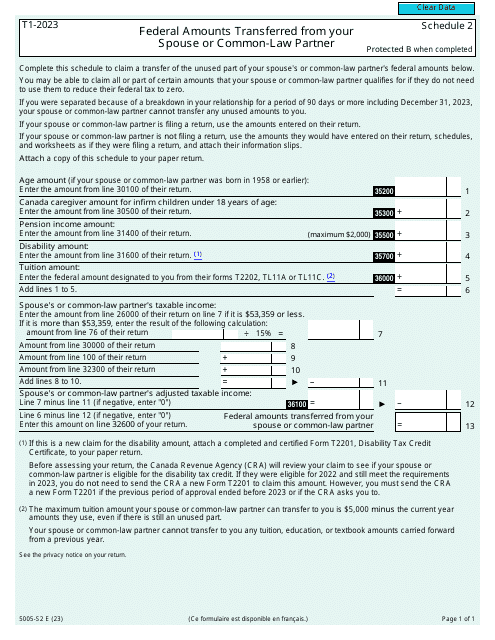

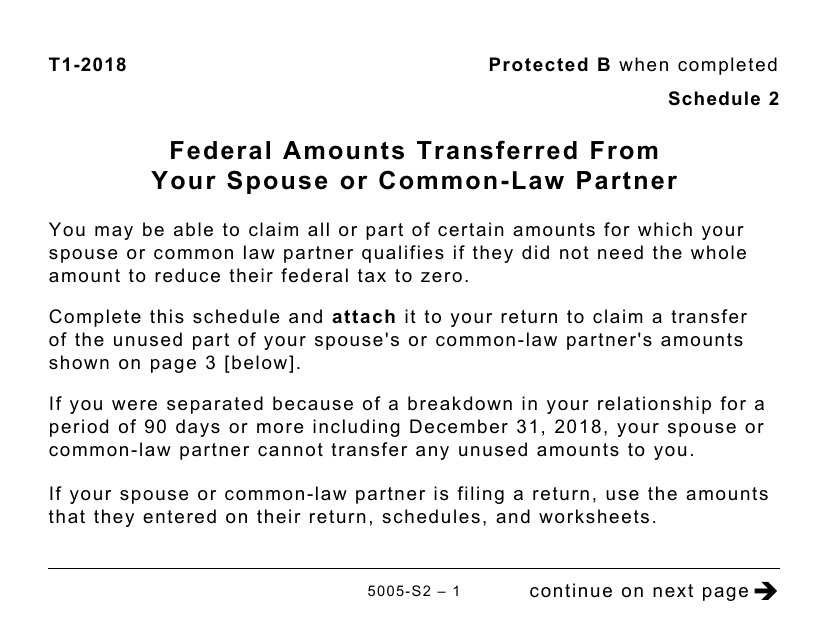

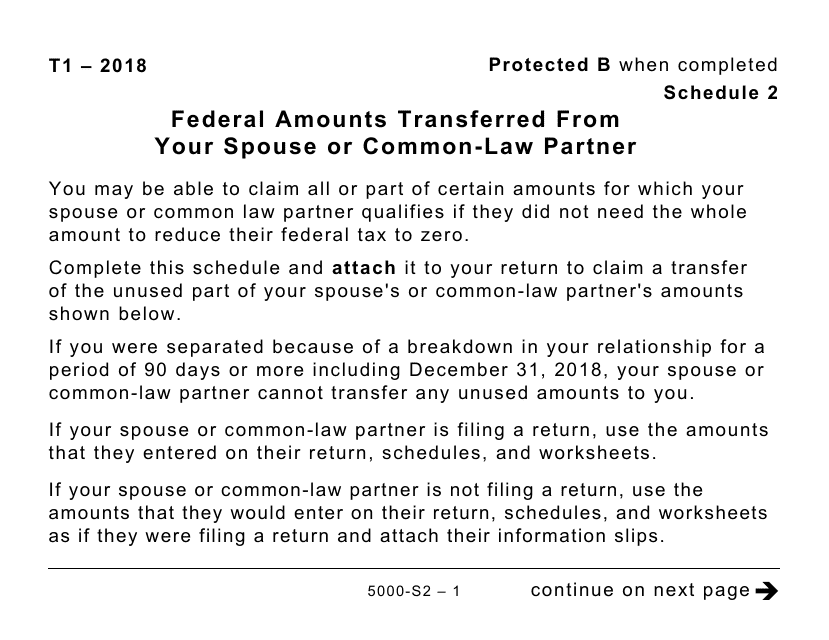

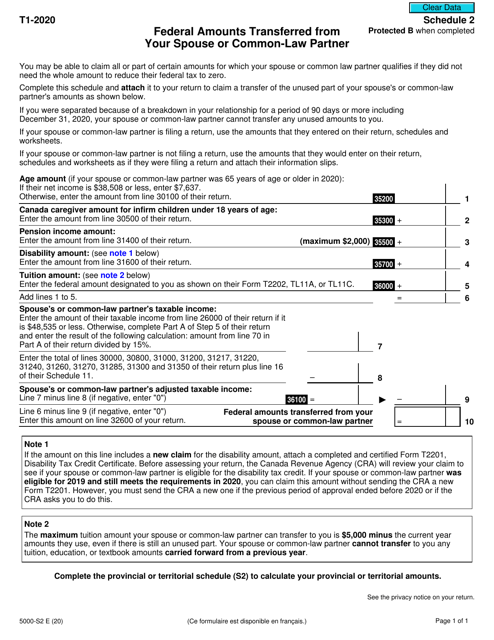

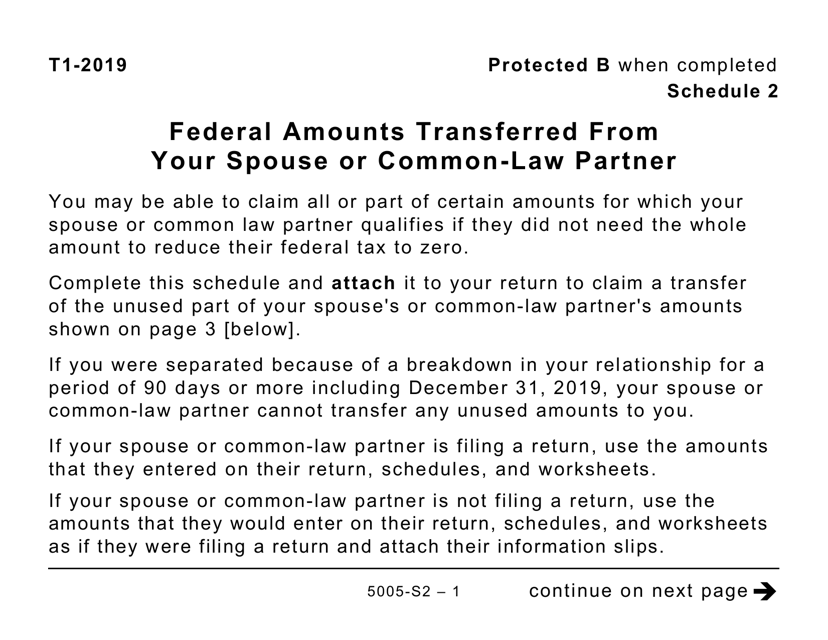

This form is used for transferring federal amounts from your spouse or common-law partner in Canada. The large print version provides easier readability for individuals with visual impairments.

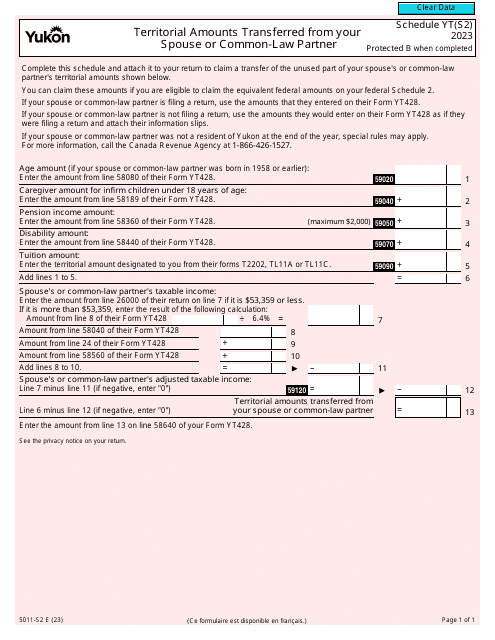

This form is used for reporting the territorial amounts transferred from your spouse or common-law partner on Schedule NU(S2) in Canada.

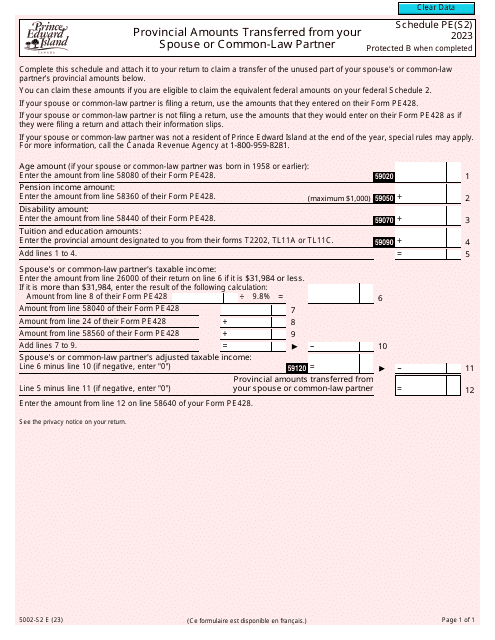

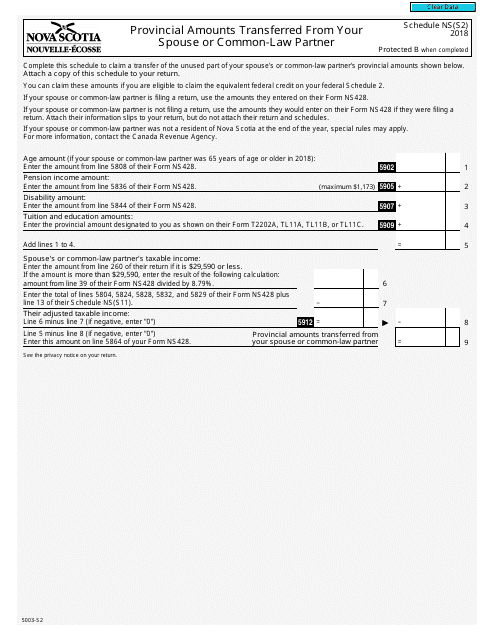

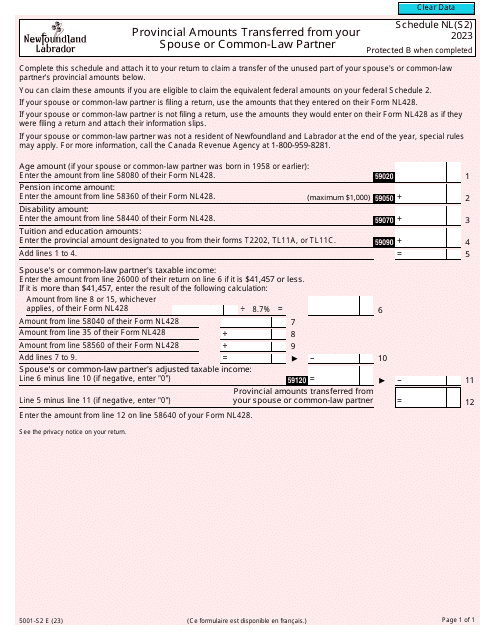

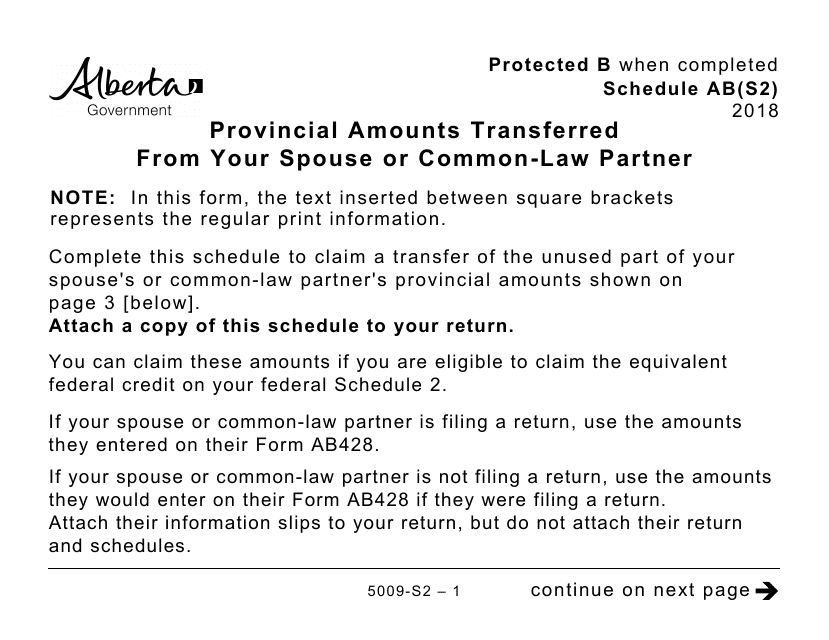

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner in Canada.

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner on your Canadian tax return. It is in large print format for easier reading.

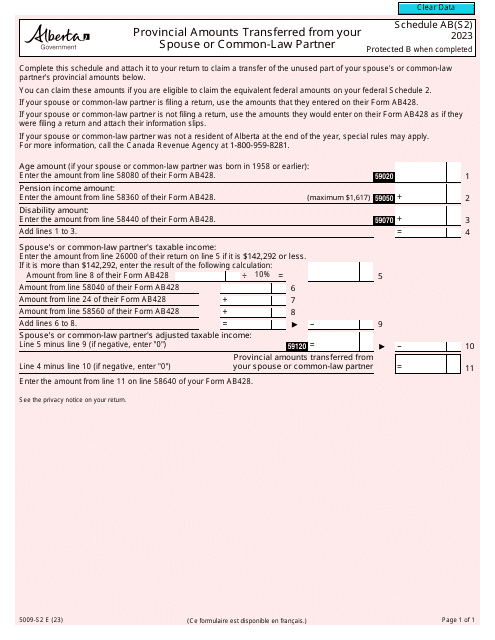

This form is used for reporting provincial amounts that have been transferred from your spouse or common-law partner on Schedule AB(S2). It is available in a large print format.

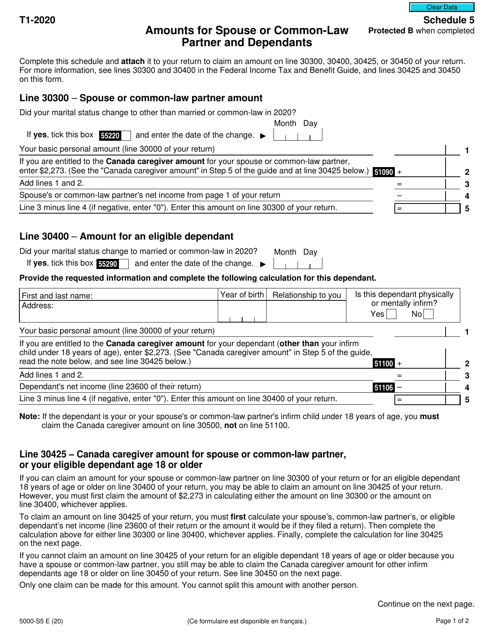

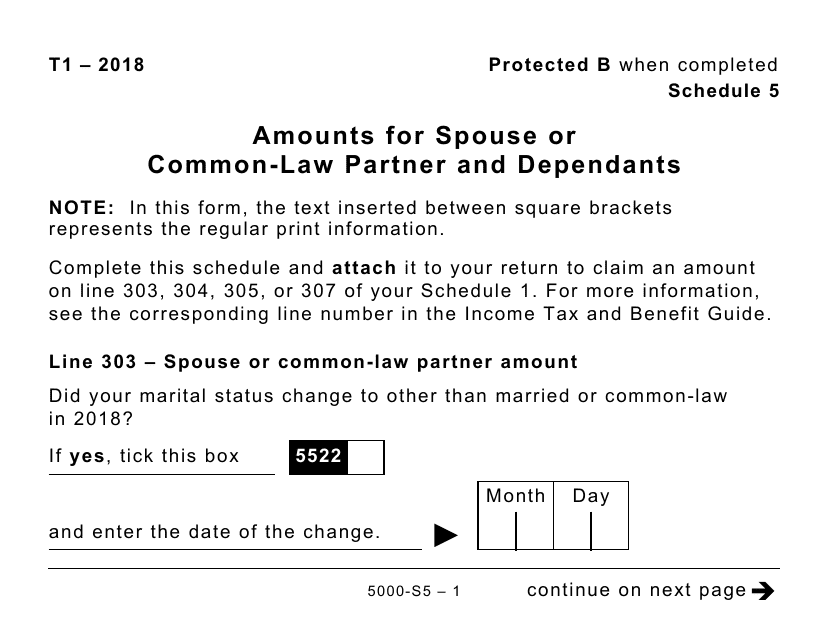

This form is used to report the amounts for a spouse or common-law partner and dependants in a larger print format. It is specifically for Canadian taxpayers.

This type of document is used in Canada to report federal amounts transferred from a spouse or common-law partner. It is available in large print format.

This form is used for reporting the amounts transferred from your spouse or common-law partner on your income tax return. It is specific to the province of Ontario in Canada.

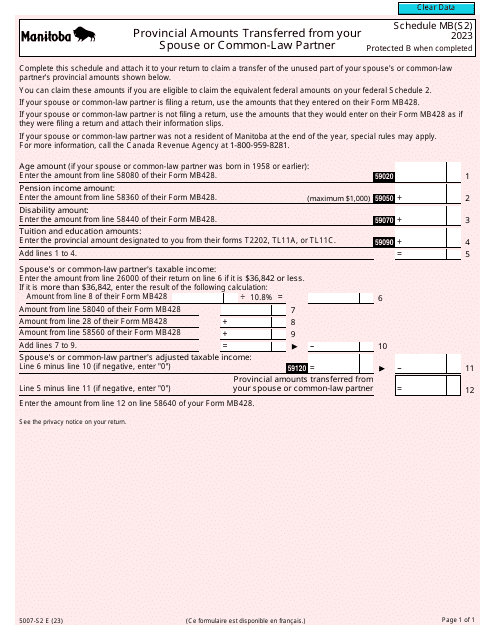

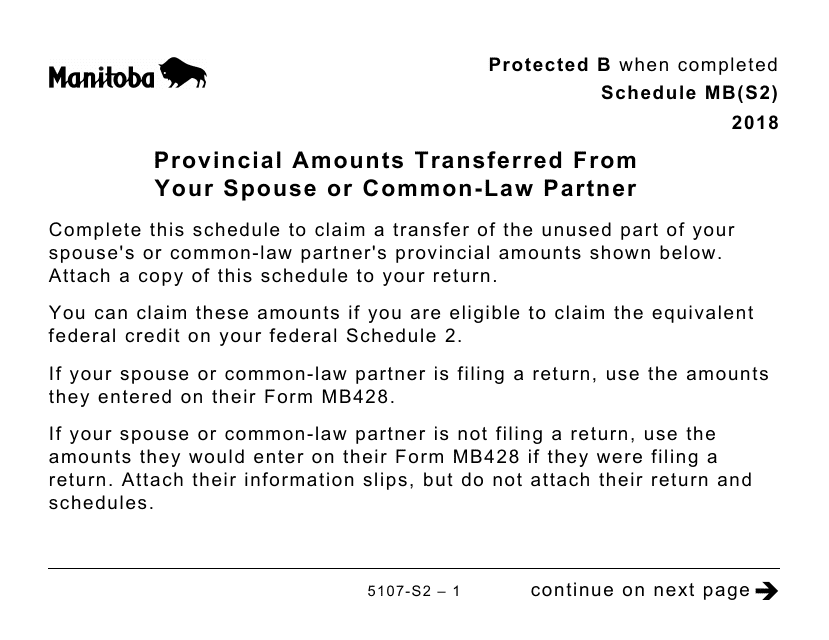

This form is used for reporting the amounts transferred from your spouse or common-law partner for tax purposes in the province of Manitoba, Canada.

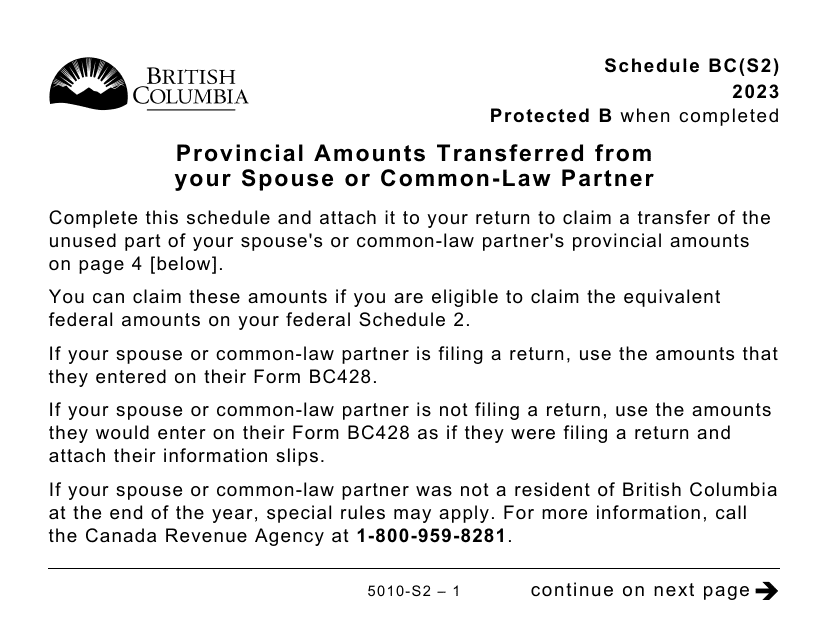

This form is used for reporting the amounts transferred from your spouse or common-law partner in British Columbia, Canada.

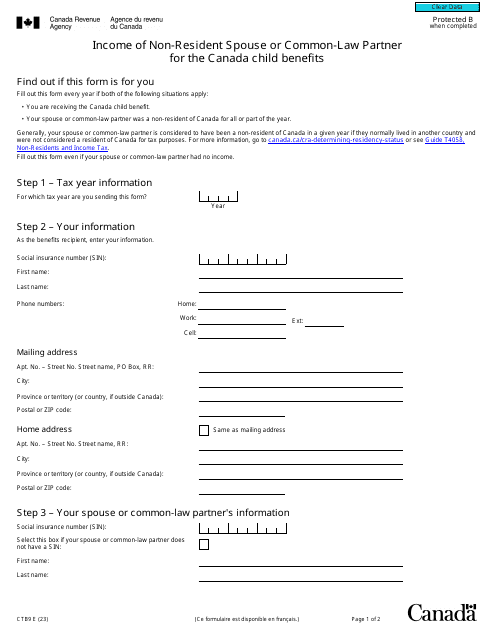

Form CTB9 Income of Non-resident Spouse or Common-Law Partner for the Canada Child Benefits - Canada

This type of document is used in Canada for reporting provincial amounts transferred from your spouse or common-law partner. It is a large print version of Form 5008-S2 Schedule SK(S2).

This form is used for reporting federal amounts transferred from your spouse or common-law partner in Canada. It is provided in large print format for easier reading.