Tax Credit Eligibility Templates

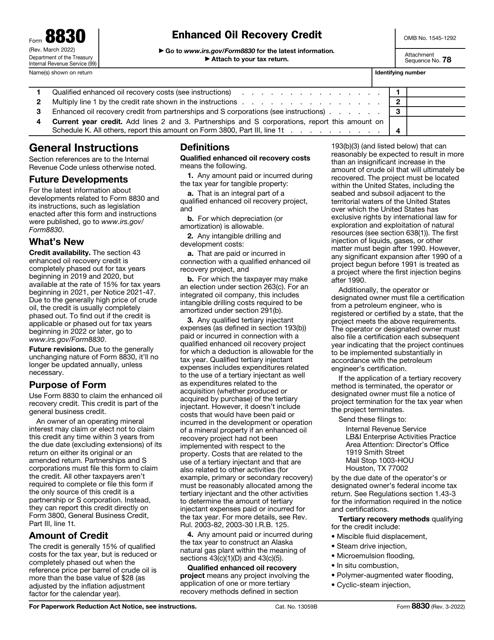

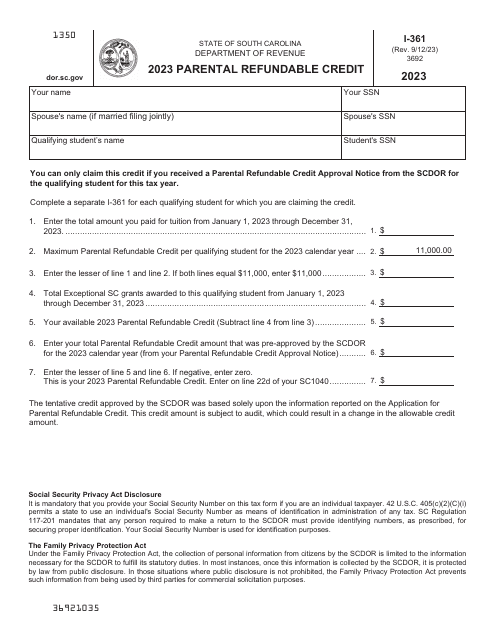

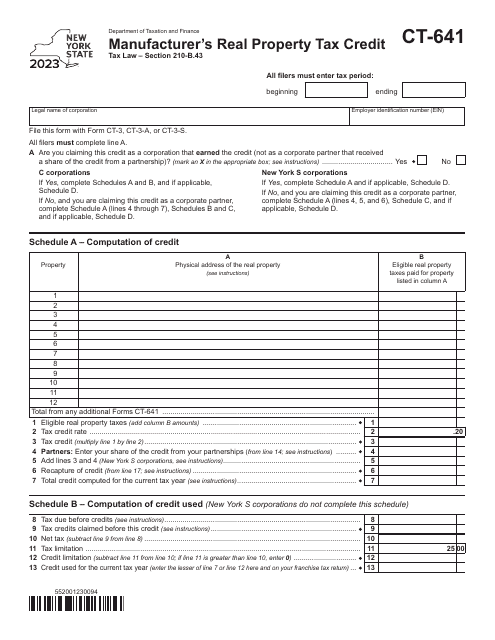

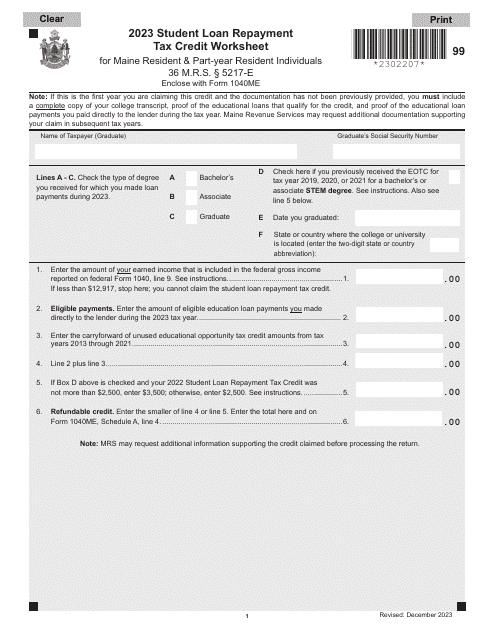

Looking to see if you qualify for tax credits? Our tax credit eligibility guidance can help you navigate the complex landscape of tax incentives and determine if you are eligible to take advantage of these financial benefits.

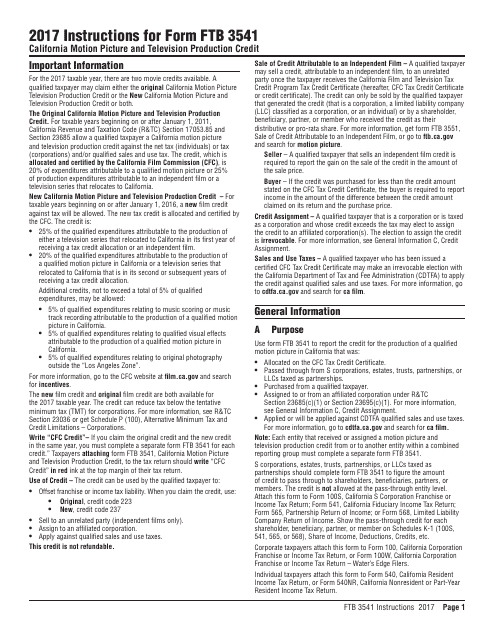

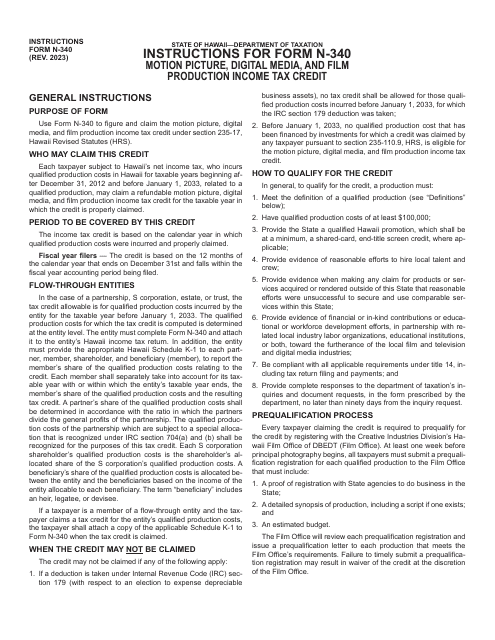

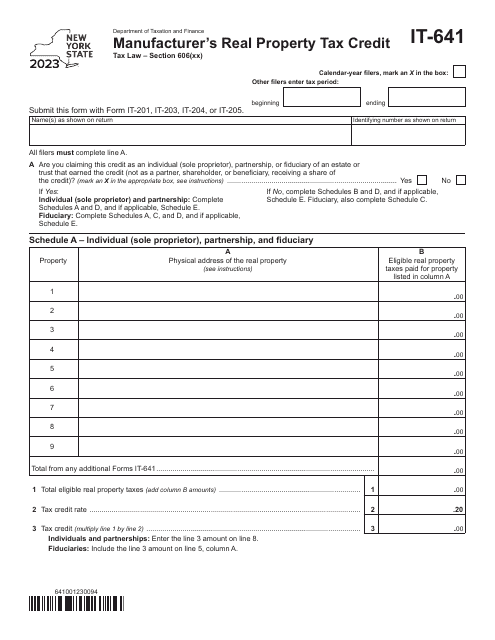

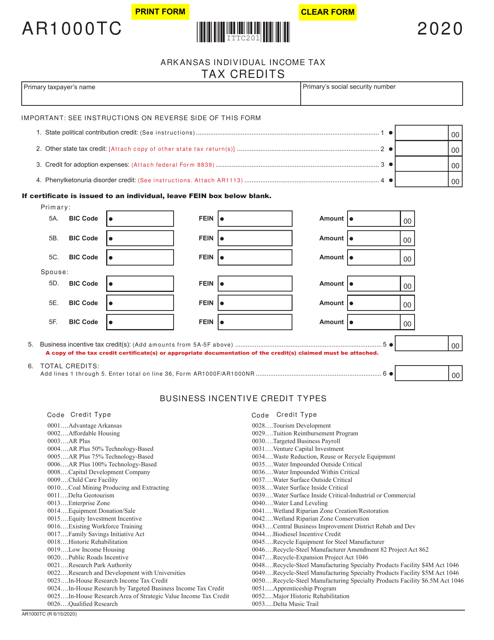

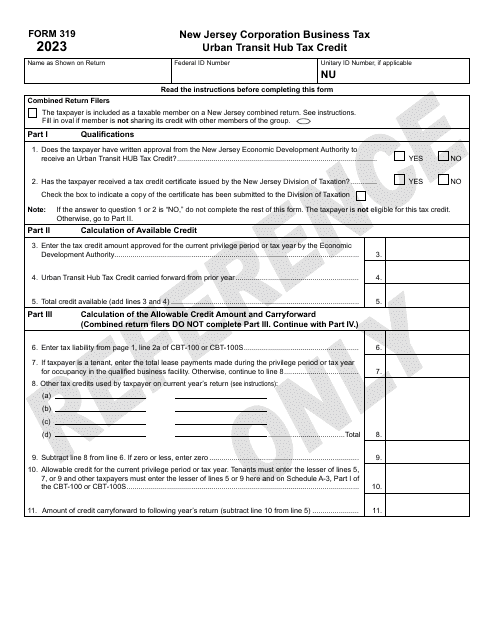

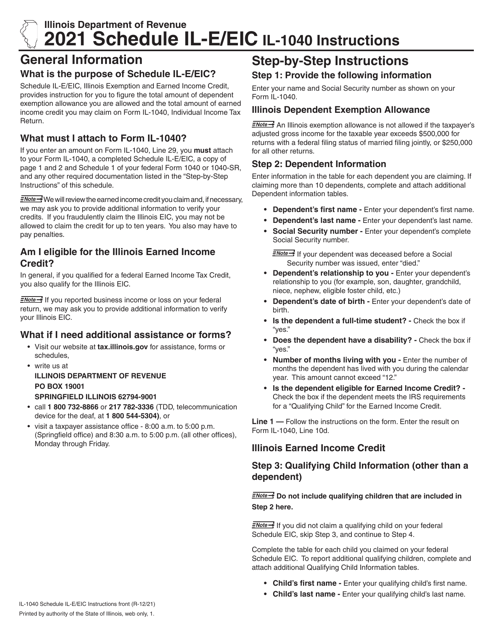

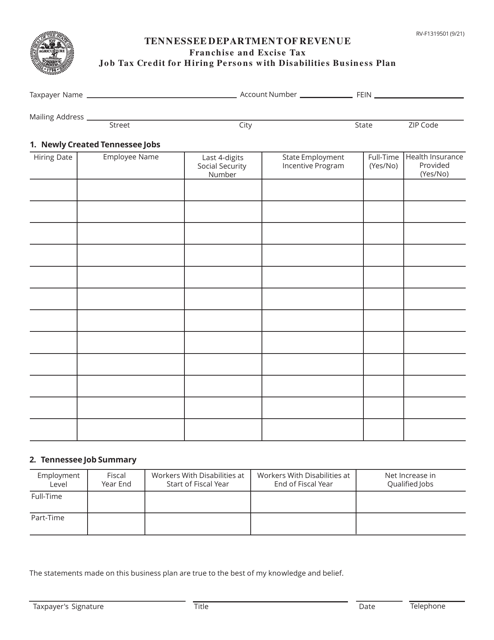

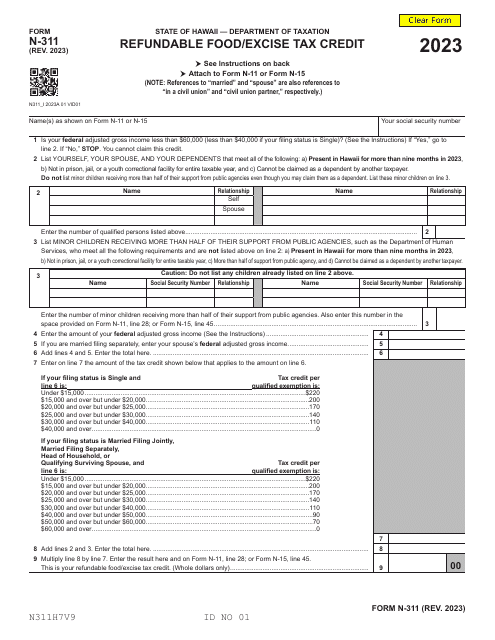

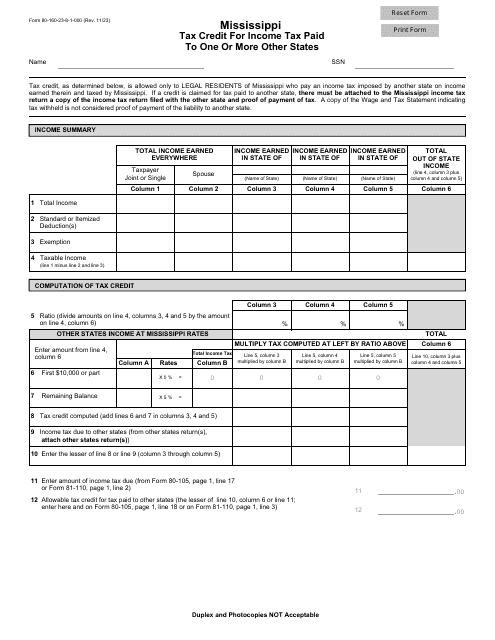

Whether you are a business owner seeking tax credits for hiring individuals with disabilities, a filmmaker looking to take advantage of motion pictureproduction tax credits, or an individual seeking credits for income tax paid to other states, we have the resources and information you need. Our tax credit eligibility documents provide step-by-step instructions and necessary forms for each type of tax credit.

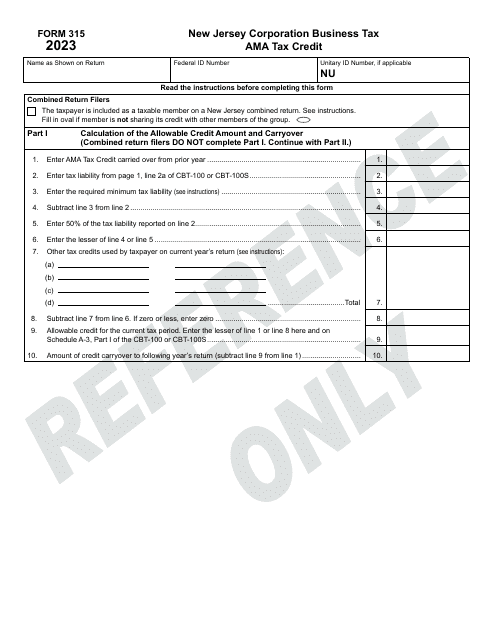

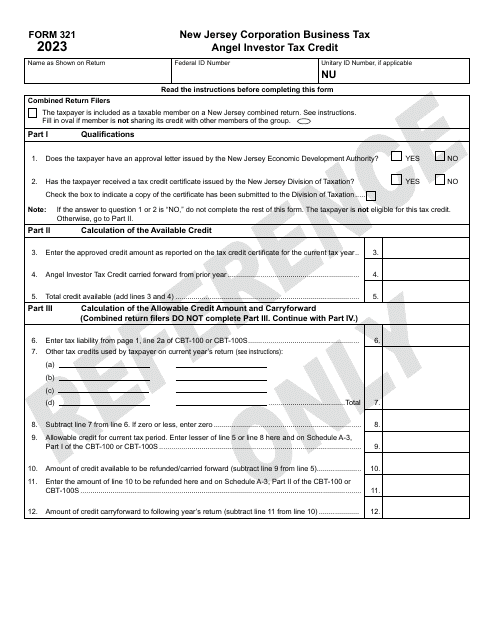

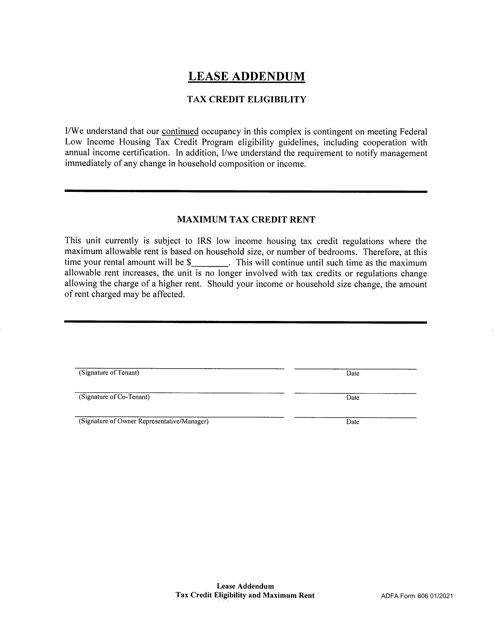

Some of the alternate names for this collection of documents include tax credit eligibility and tax credits eligibility. These documents cover a wide range of tax credits offered by different states, including the Ama Tax Credit in New Jersey, the Motion Picture, Digital Media, and Film Production Tax Credit in Hawaii, the Lease Addendum - Tax Credit Eligibility in Arkansas, the Job Tax Credit for Hiring Persons With Disabilities Business Plan in Tennessee, and the Mississippi Tax Credit for Income Tax Paid to One or More Other States.

Don't miss out on the opportunity to save money on your taxes. Explore our tax credit eligibility documents today and see if you qualify for valuable tax incentives.

Documents:

19

This form is used for claiming the California Motion Picture and Television Production Credit in California. It provides instructions on how to complete the form and what documentation needs to be included.

This document is used for applying for provincial tax credits in Prince Edward Island, Canada. It is used to claim potential tax deductions and benefits specific to the province.

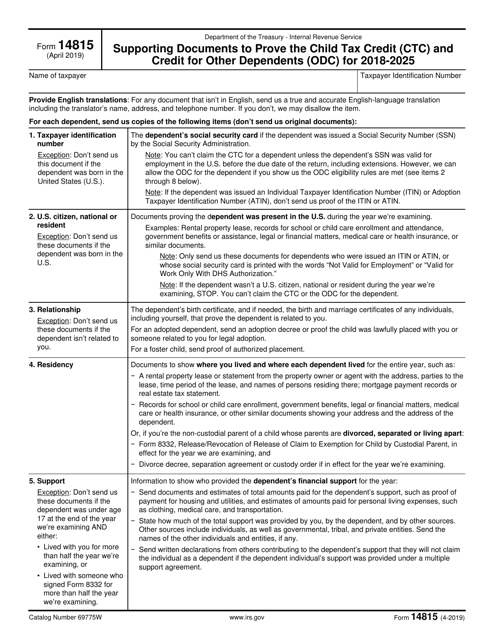

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

This Form is used for claiming tax credits on your Arkansas state taxes. It allows you to reduce the amount of tax you owe or increase your tax refund.

This form is used for adding a lease addendum related to tax credit eligibility in Arkansas.