Business Expenses Templates

Documents:

151

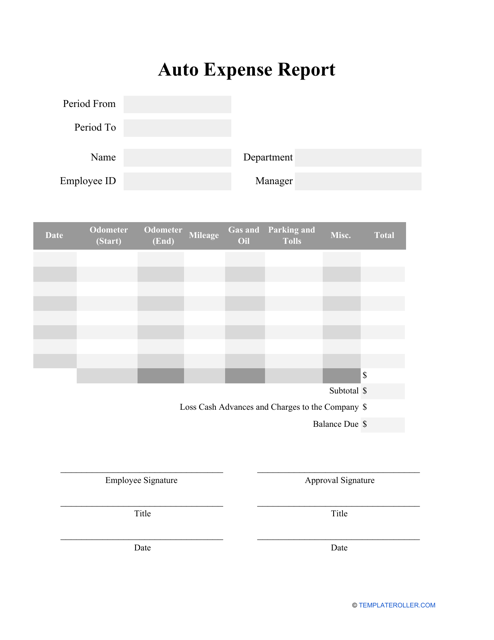

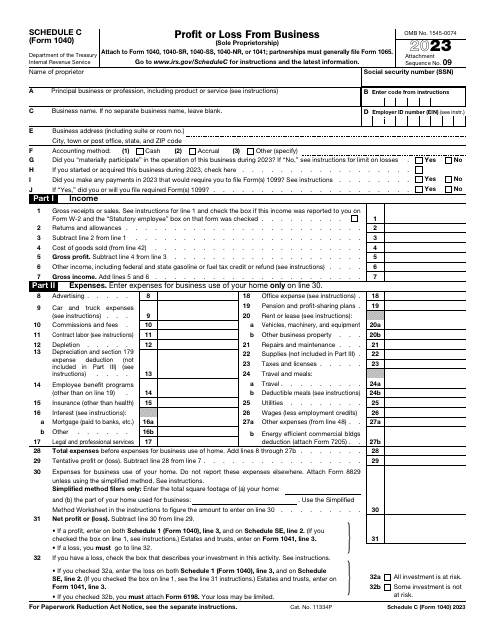

Use this document to record information about business and personal trips, vehicle maintenance, and repair expenses.

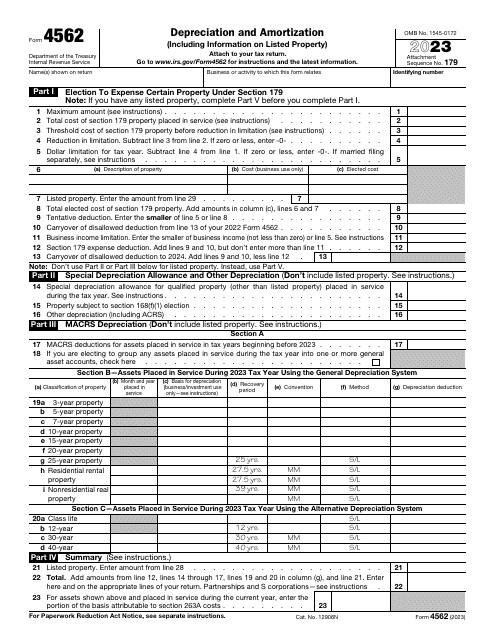

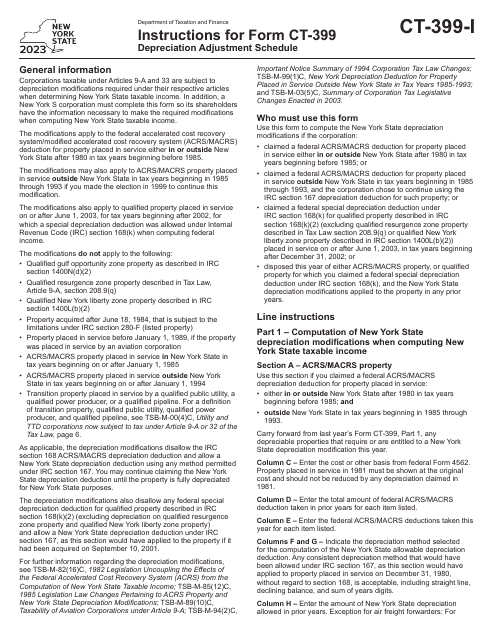

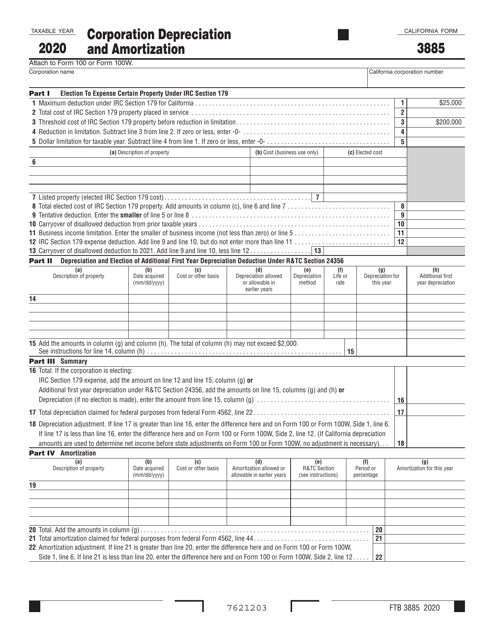

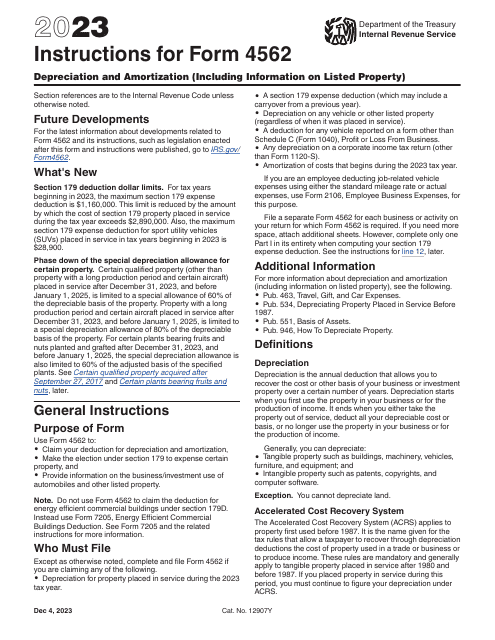

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

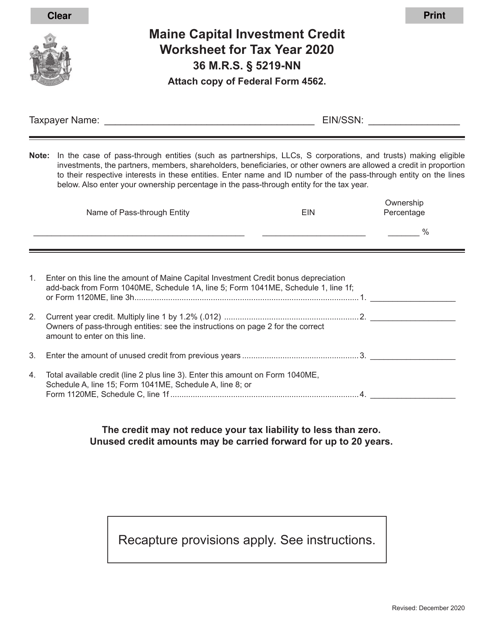

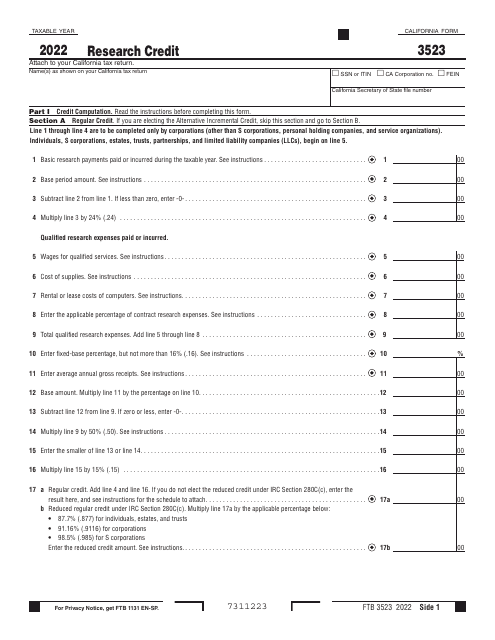

This document is used for calculating the capital investment credit in the state of Maine. It helps individuals and businesses determine the amount of credit they may be eligible for based on their qualified investments in certain industries.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

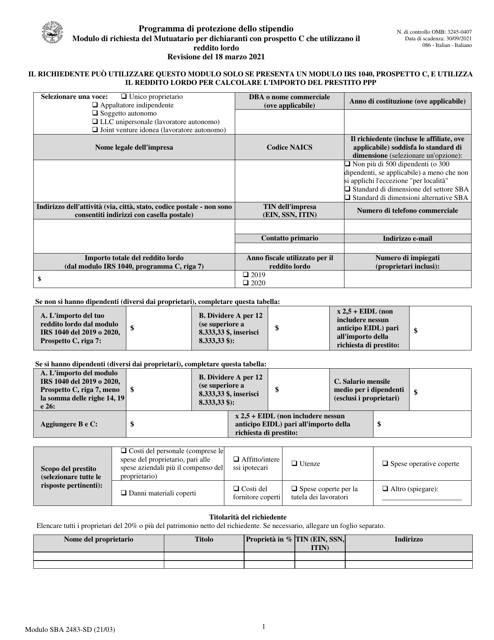

This Form is used for Italian Schedule C filers applying for the First Draw Borrower Application under the SBA program.

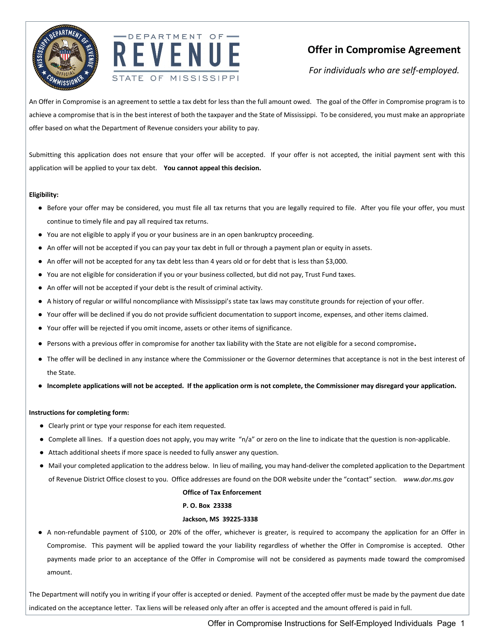

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

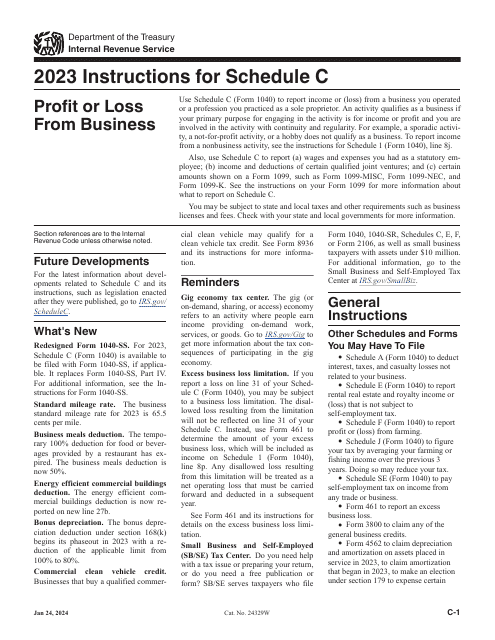

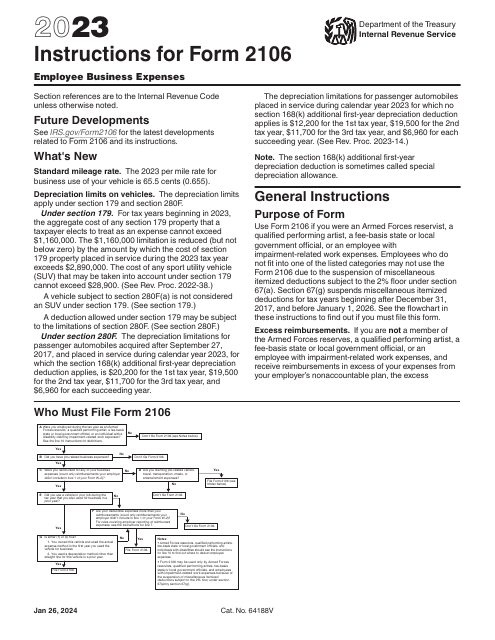

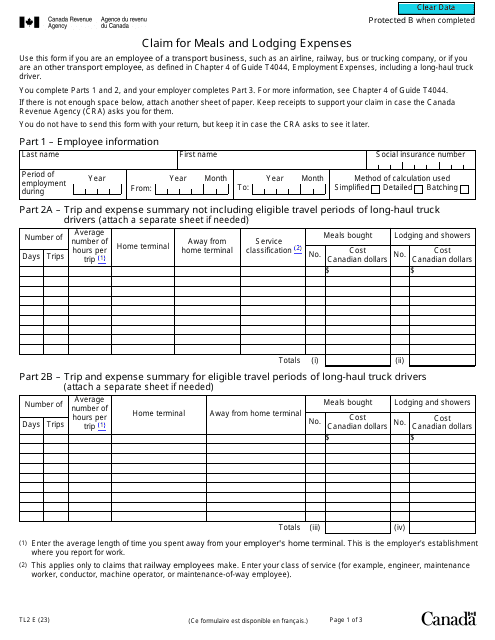

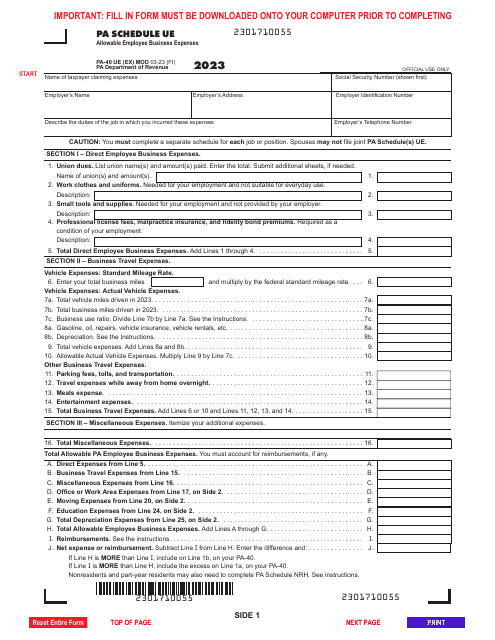

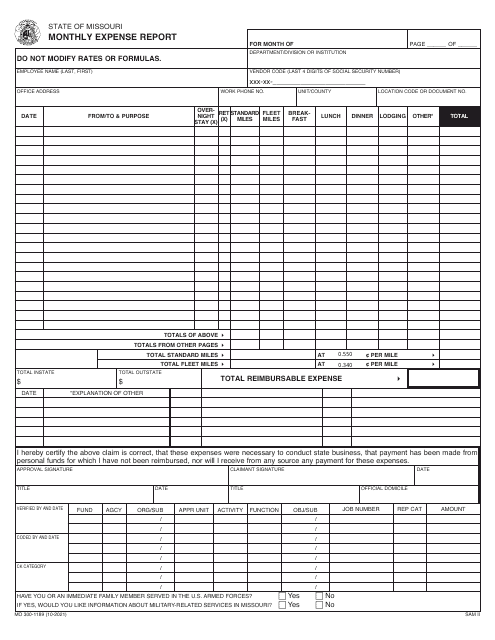

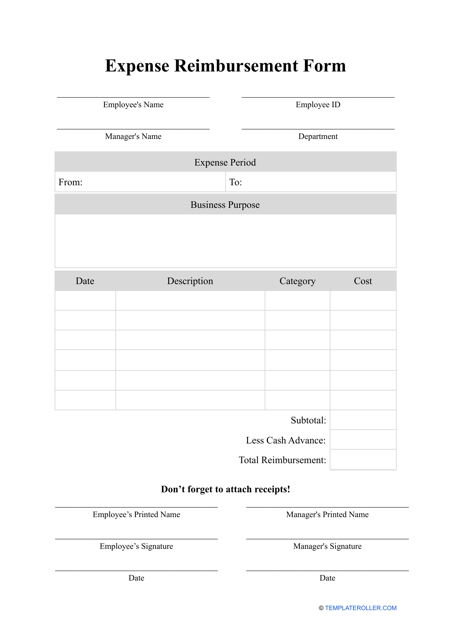

Use this form to recover back costs incurred while performing work on behalf of your employer.

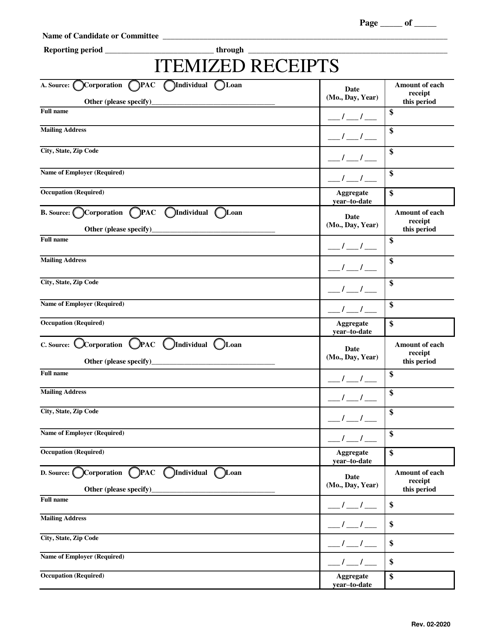

This document for itemized receipts in the state of Mississippi. It provides a detailed breakdown of expenses incurred during a transaction.

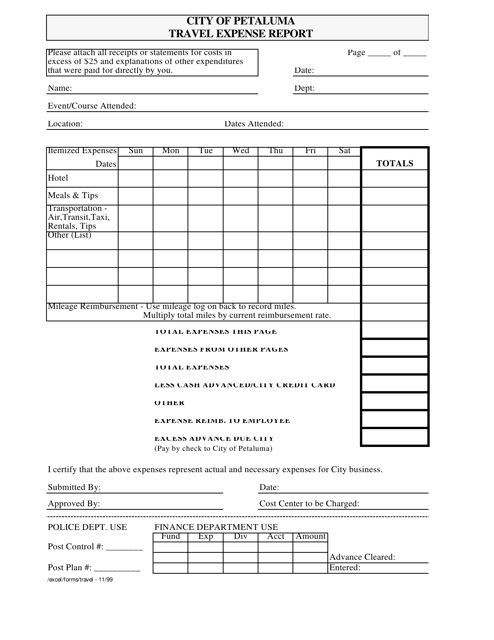

This document is used for reporting travel expenses to the City of Petaluma, California.

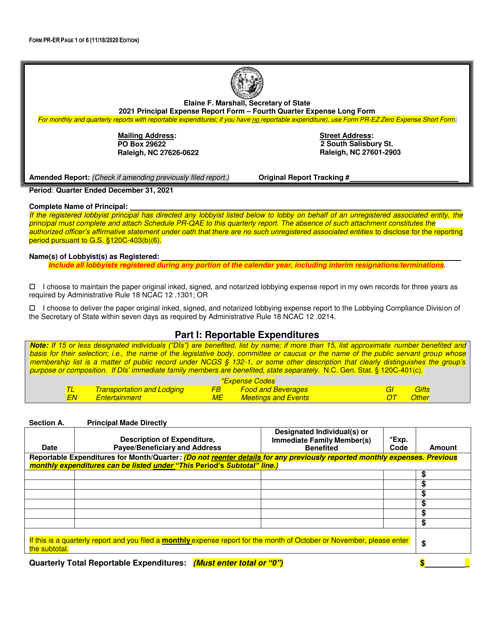

This document is used for reporting expenses incurred by a principal in North Carolina during the fourth quarter. It is a long form that allows for detailed reporting of expenses.

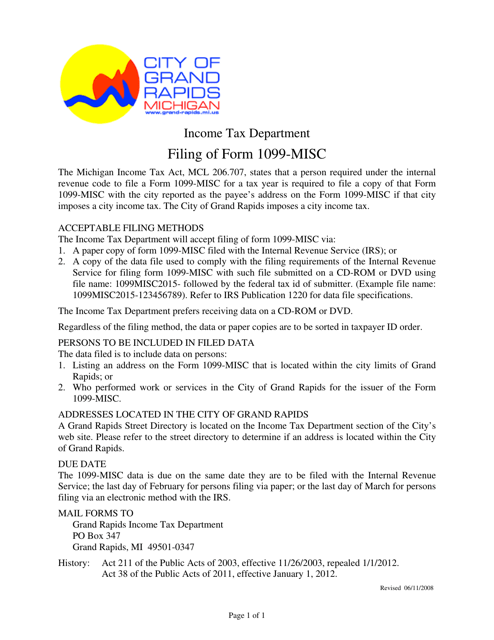

This Form is used for reporting miscellaneous income, such as freelance earnings or rental income, to the IRS.

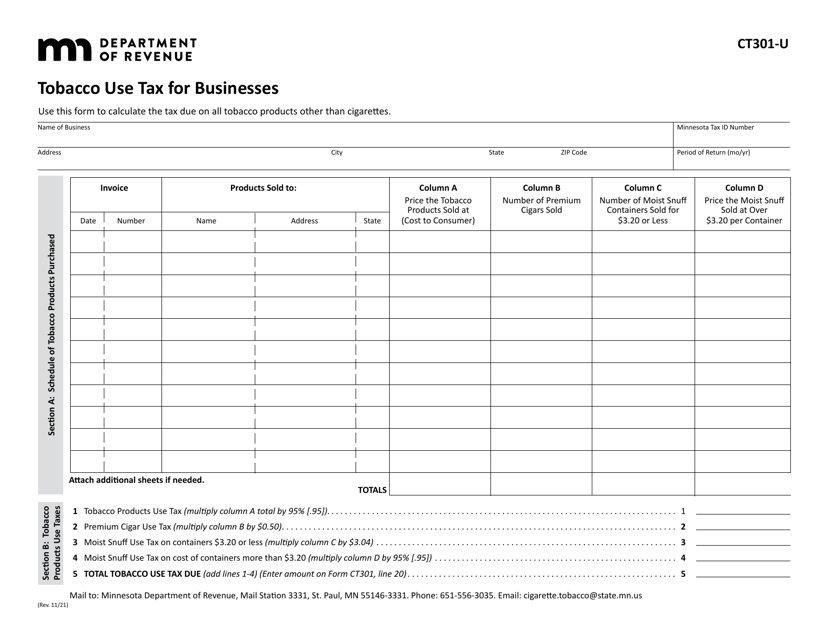

This form is used for businesses in Minnesota to report and pay tobacco use tax.

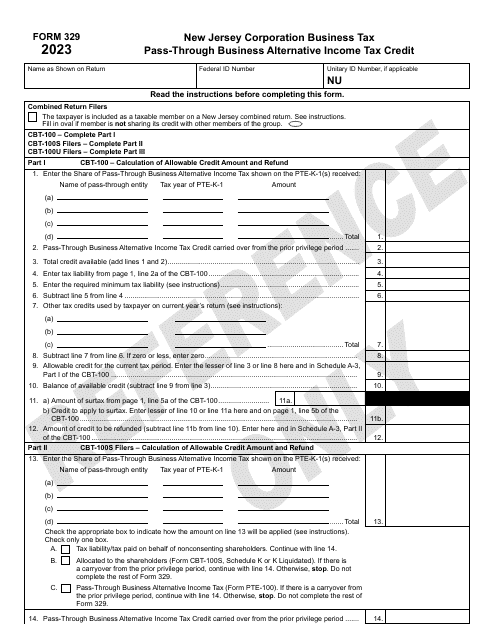

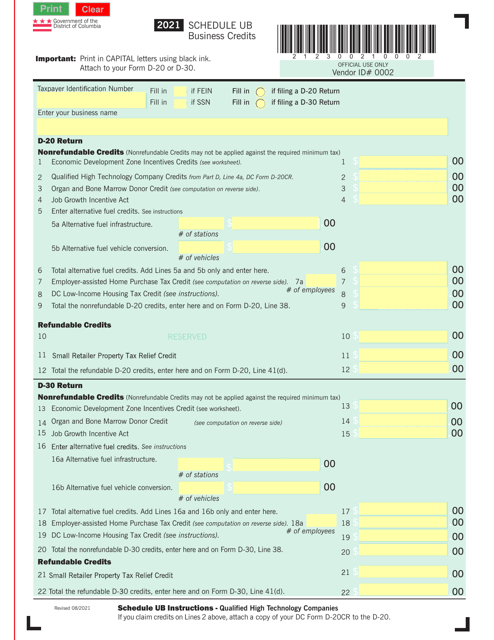

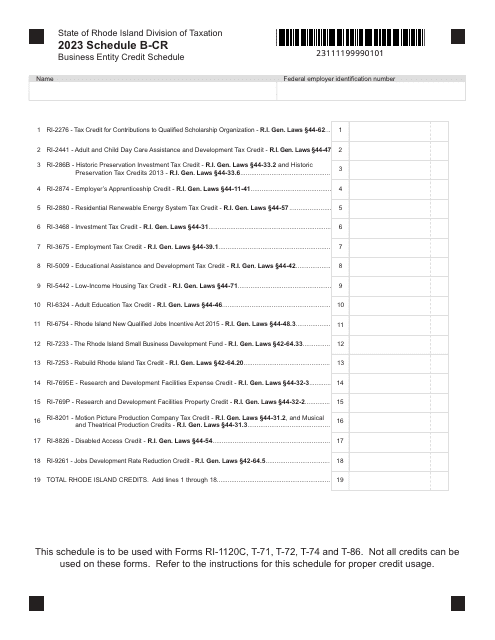

This Form is used for claiming business credits in Washington, D.C. It allows taxpayers to report and potentially reduce their tax liability by taking advantage of various business credits available in the city.

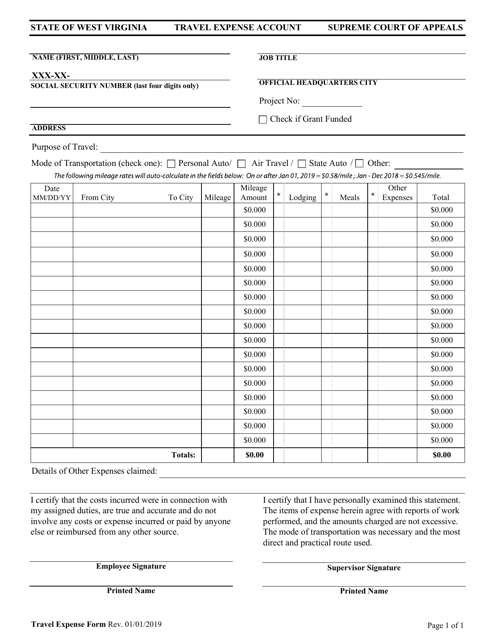

This Form is used for reporting travel expenses incurred in West Virginia. Keep track of your expenses and submit this form for reimbursement.