State Income Tax Templates

State Income Tax: Your Guide to Filing and Understanding State Income Taxes

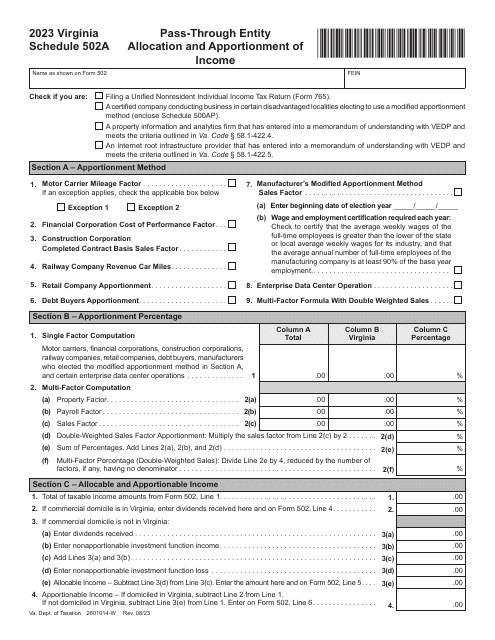

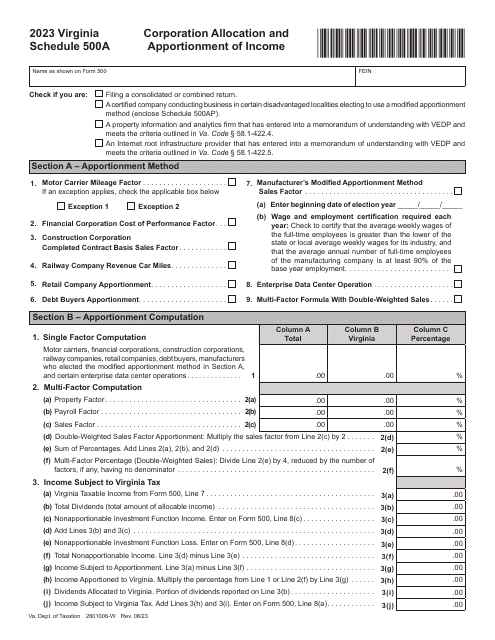

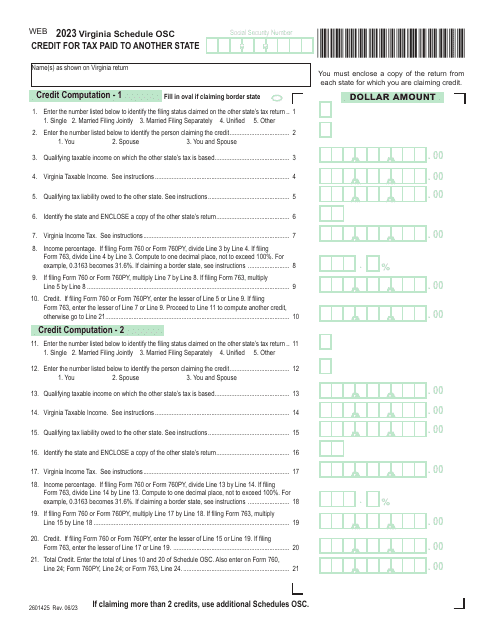

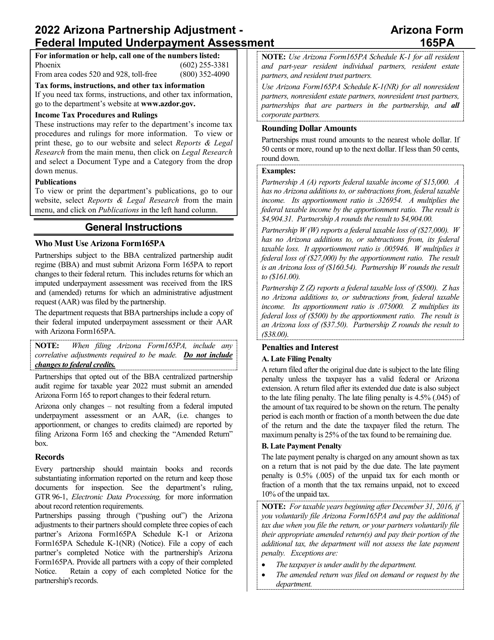

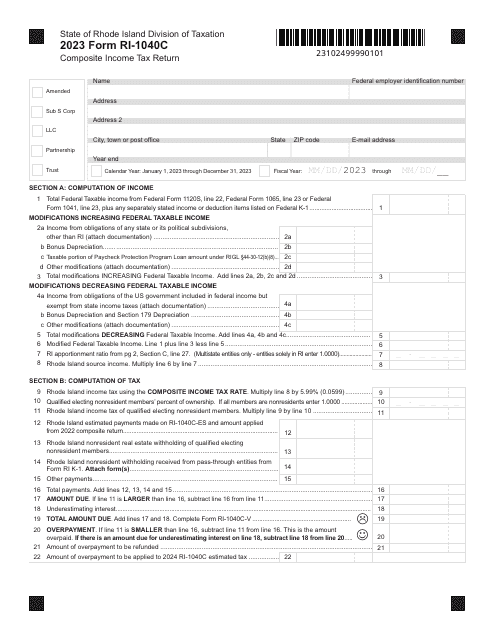

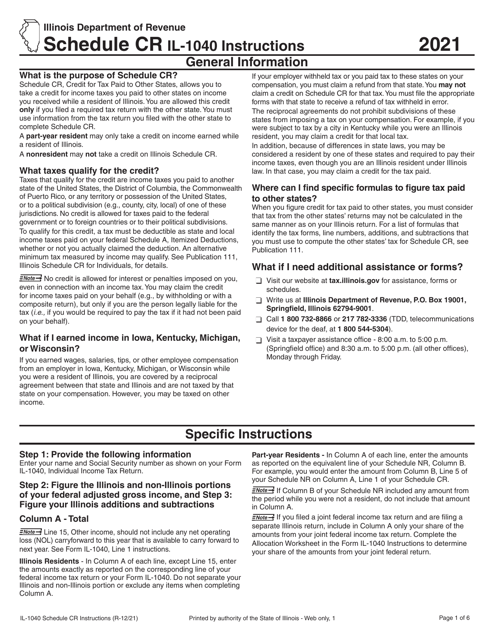

When it comes to state income taxes, there's no shortage of paperwork to fill out. Whether you're a resident, non-resident, or have income from multiple states, understanding the complexities of state income tax forms can be daunting. That's why it's important to have a comprehensive resource to guide you through the process.

Our State Income Tax webpage is here to provide you with all the information you need to navigate state income tax requirements with ease. From understanding which forms to use to ensuring you're eligible for all available deductions and credits, our webpage is your go-to source for everything related to state income taxes.

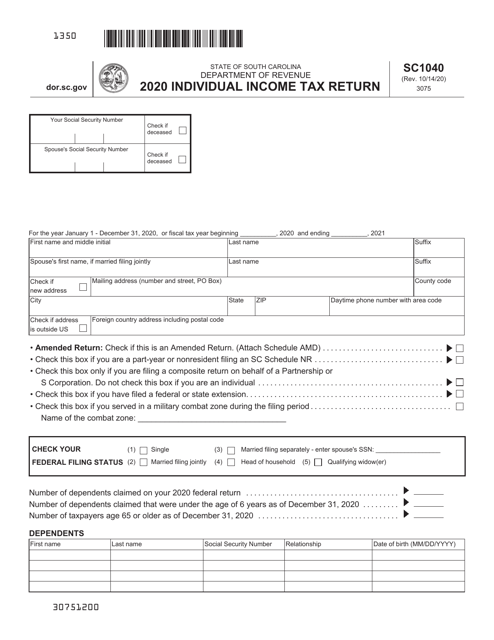

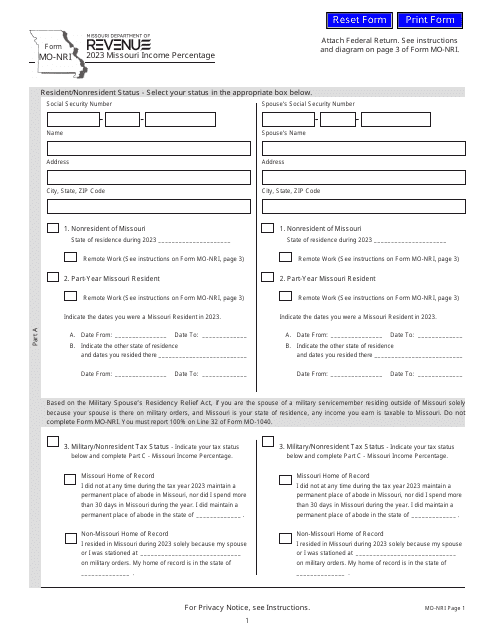

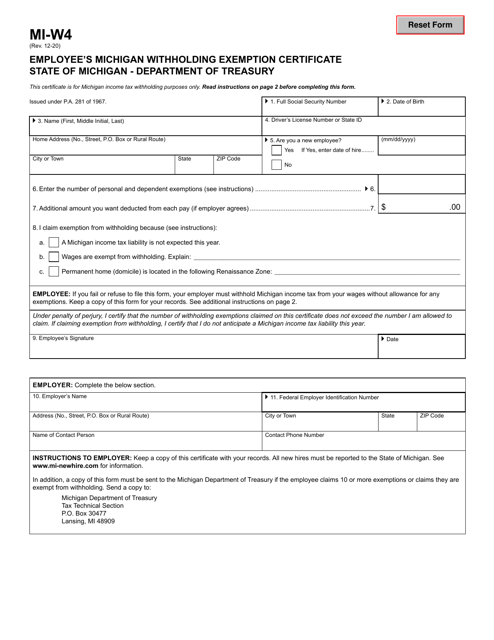

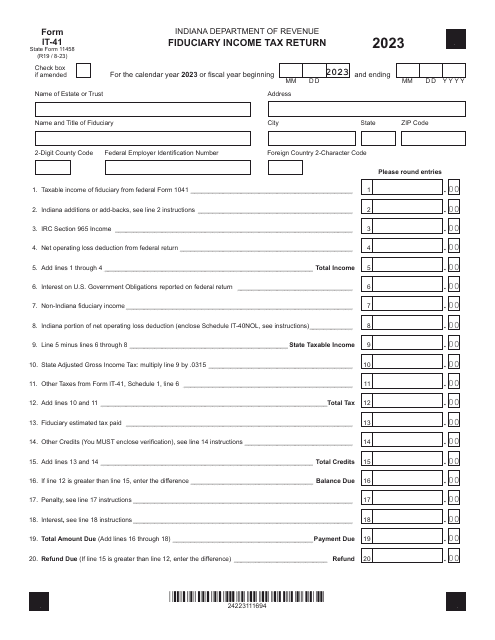

Don't let the terminology confuse you - we cover it all. Whether you're looking for the correct form for filing your personal income tax in Maryland or need guidance on fiduciary income tax returns in Indiana, our webpage provides clear instructions and explanations. With detailed explanations of each form, you won't have to second-guess yourself when it comes to filling out the necessary paperwork correctly.

We also understand that not everyone is a tax expert. That's why our webpage includes step-by-step instructions and helpful tips to make filing your state income tax return as painless as possible. Our goal is to demystify the process, helping you feel confident about your filing and ensuring you maximize your potential refunds.

Our webpage is also your resource for finding answers to frequently asked questions about state income taxes. Whether you're wondering about tax residency requirements, the impact of working remotely across state lines, or how to handle income from rental properties, we've got you covered. Our comprehensive FAQs section ensures you have access to the information you need, all in one convenient location.

So whether you're a seasoned professional or a first-time filer, our State Income Tax webpage is your ultimate resource. With clear instructions, helpful tips, and a wealth of information, you'll be well-equipped to tackle your state income tax obligations. Don't let the paperwork overwhelm you - let us be your guide to successfully navigating the state income tax landscape.

Documents:

48

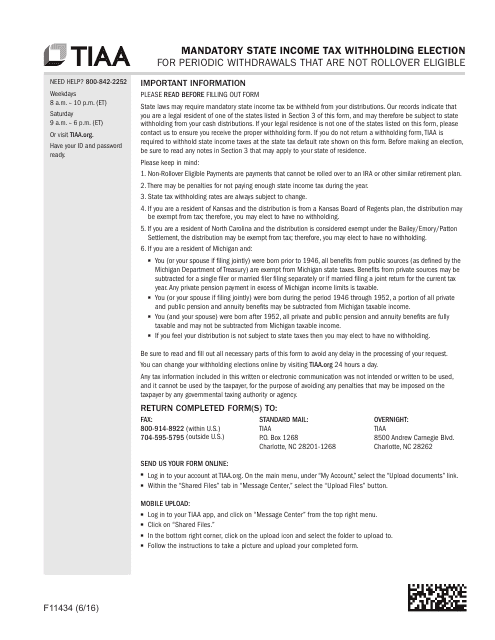

This form is used for making a mandatory state income tax withholding election for periodic withdrawals that are not rollover eligible with TIAA.

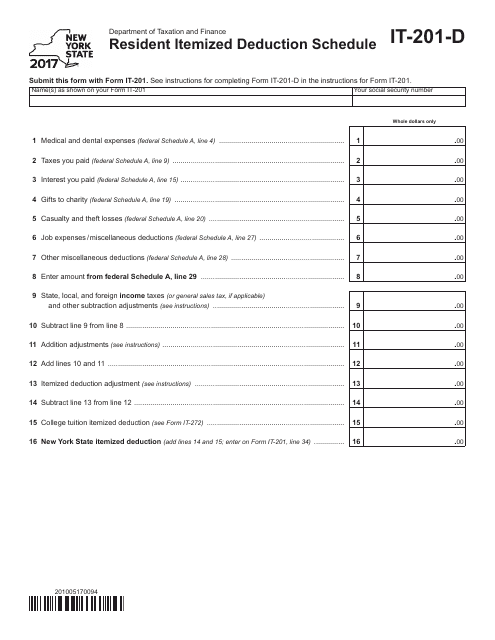

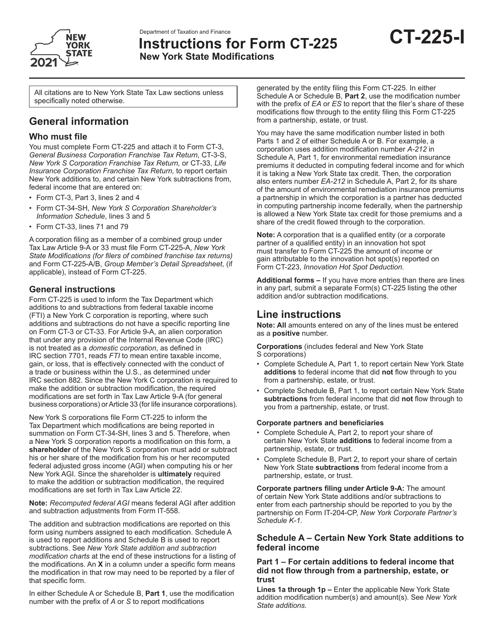

This form is used for reporting itemized deductions for residents of New York on their state tax return.

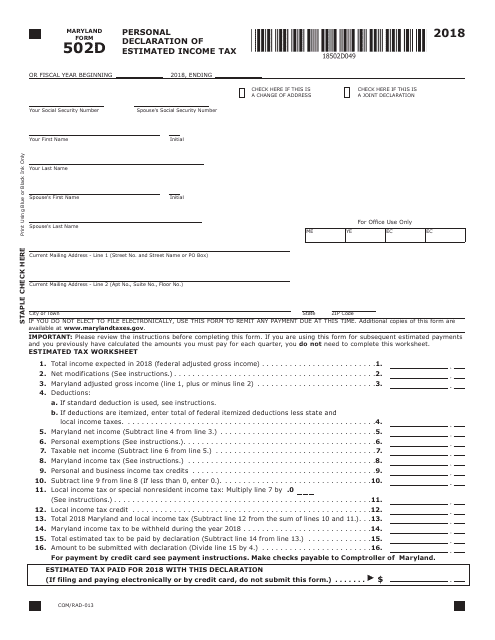

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

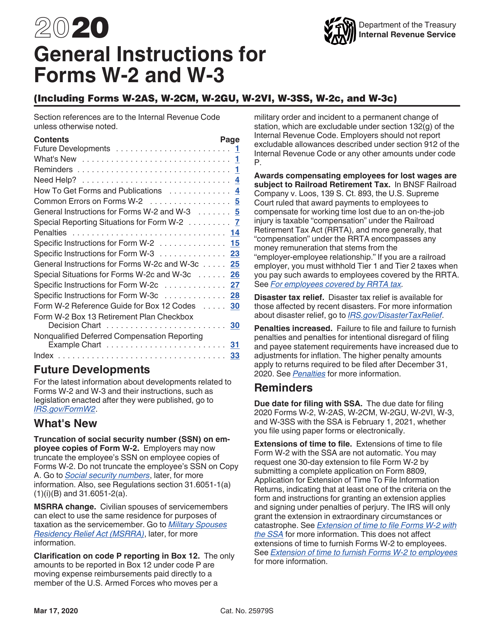

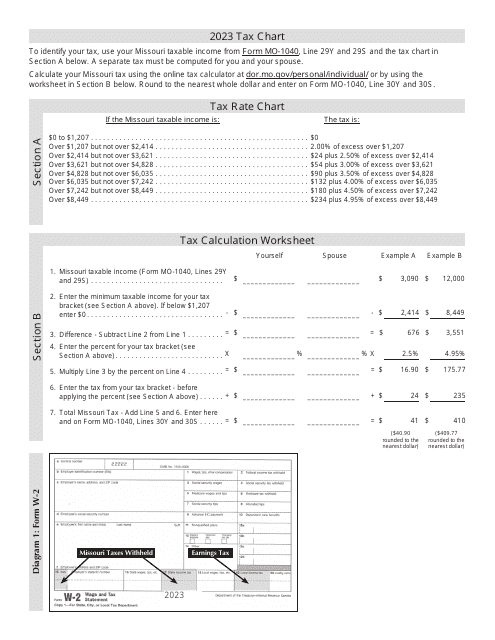

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

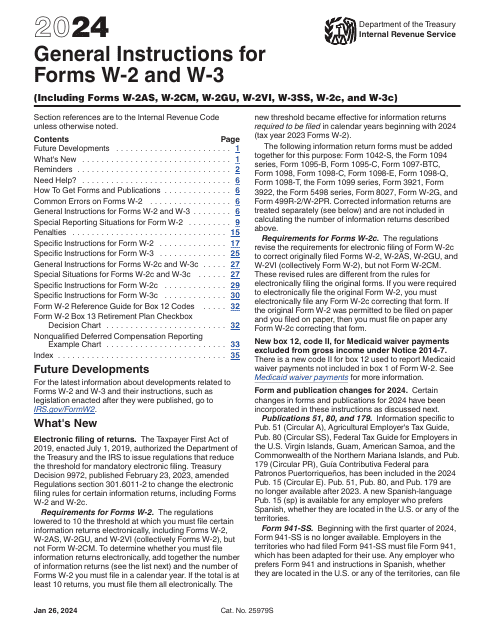

This type of document is used for reporting wages and taxes withheld for employees. It is required by the Internal Revenue Service (IRS) for employers to file annually. The different variations of the form (W-2, W-3, W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2C, W-3C) correspond to specific circumstances and requirements.

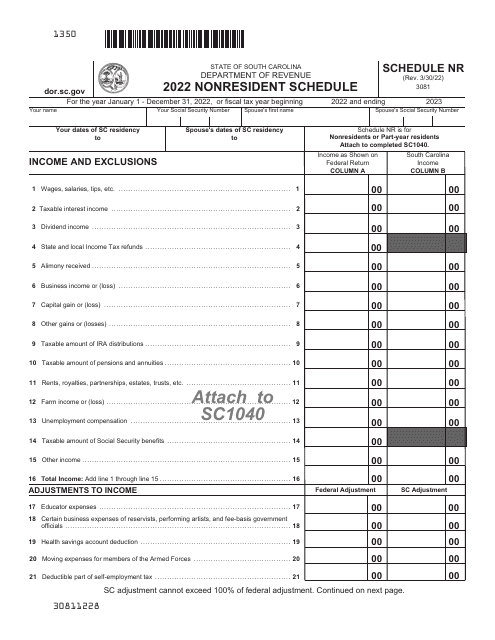

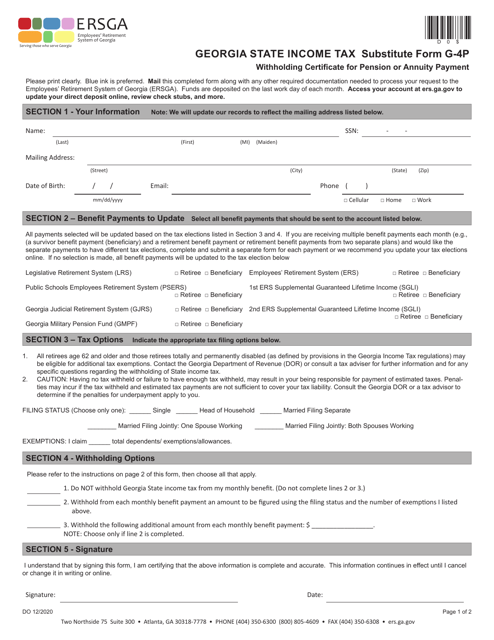

This form is used for withholding state income tax in Georgia. It is a substitute form for the standard G-4 form.

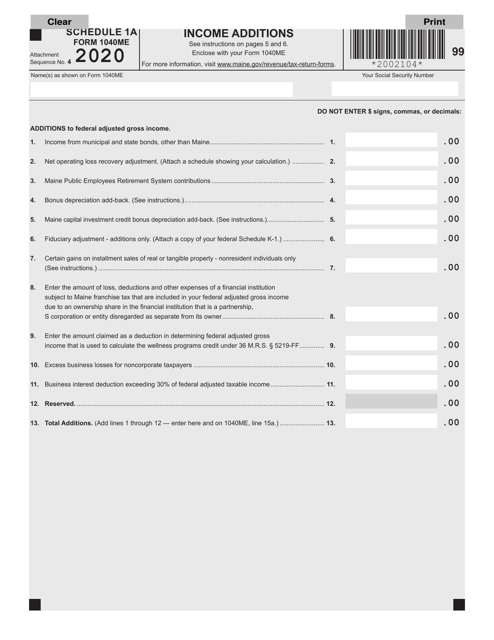

This form is used for reporting additional income additions for Maine residents filing the Form 1040ME. It helps taxpayers accurately include any income sources that need to be added to their overall income calculations.

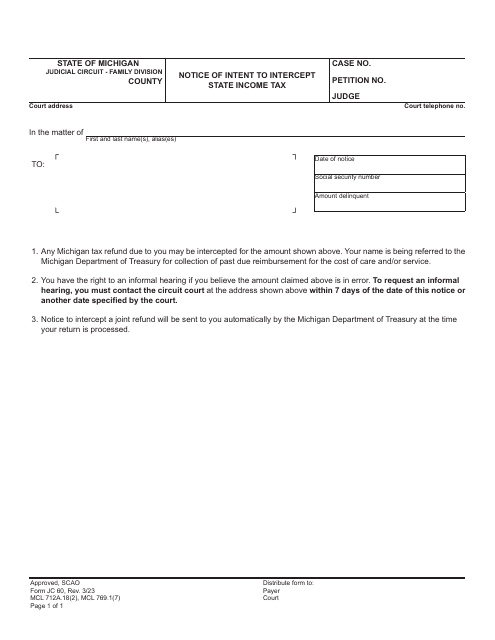

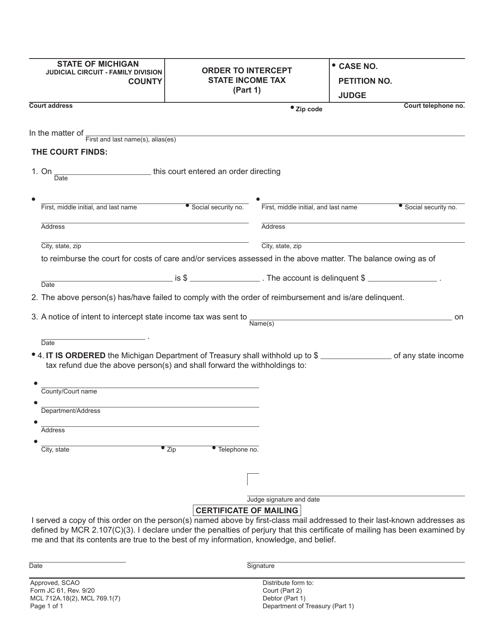

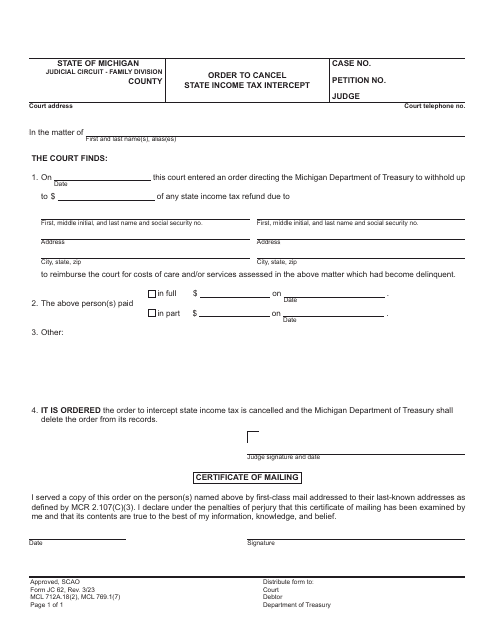

This form is used for requesting an order to intercept state income tax in the state of Michigan. It allows for the collection of unpaid debts through the interception of income tax refunds.

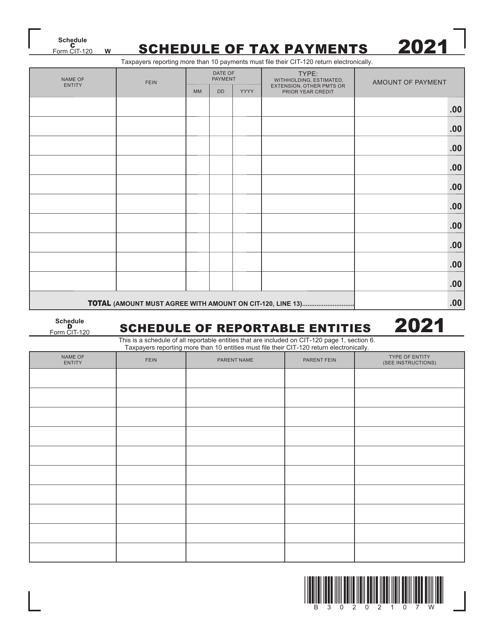

This form is used for reporting tax payments made in West Virginia. It is specifically used for Schedule C in the CIT-120 form.

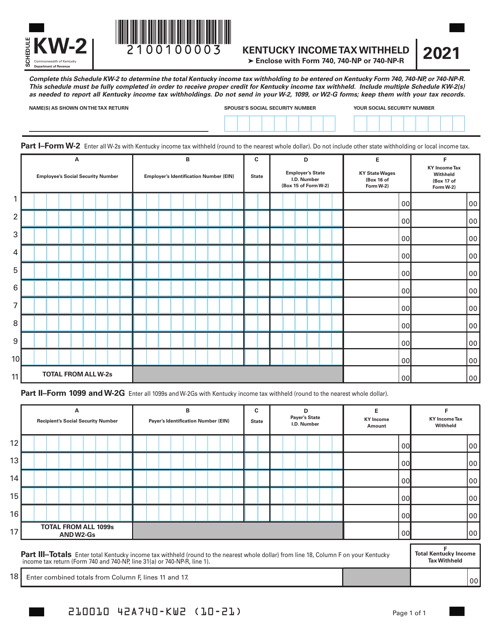

This Form is used for reporting Kentucky income tax withheld from employee's paychecks in Kentucky.