Employment Report Templates

Employment Report: Your Guide to Employer Reporting and Documentation

Welcome to our comprehensive resource on employment reporting. As an employer, it is important to understand and fulfill your obligations when it comes to reporting and documenting various aspects of employment. Whether you refer to it as an employment report, employer reporting, or employer report form, this collection of documents provides valuable insights into the reporting requirements and processes.

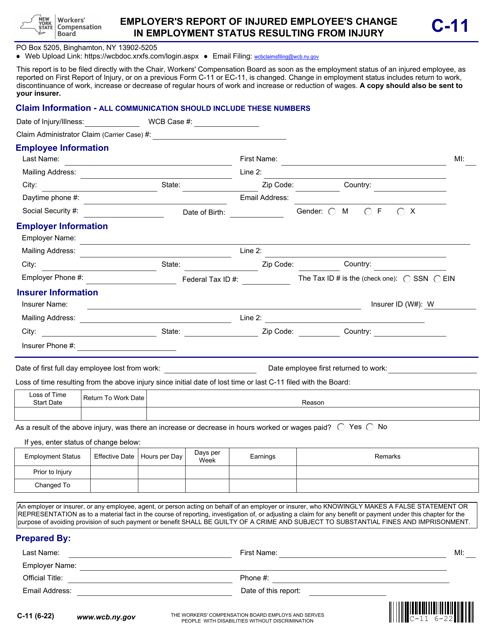

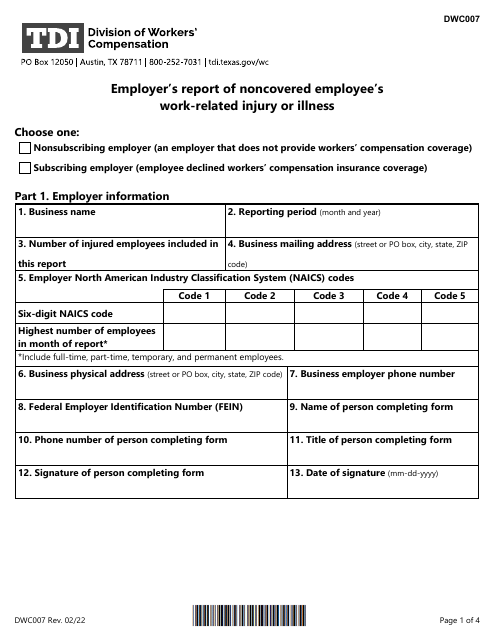

Employment reporting forms play a crucial role in a variety of scenarios. They can be used to report work-related injuries or illnesses, document federal civilian employment on a monthly basis, or report non-covered employee's occupational injuries or diseases. Some forms are specific to certain states, such as the Form UCT-1-E and Form UCT-5332-E used for employer reporting in Wisconsin.

By complying with reporting obligations, employers contribute to a safer and more transparent work environment. Timely and accurate reporting of work-related injuries or illnesses, employee census data, or non-covered employee's occupational injuries or diseases enables government agencies and insurers to monitor workplace safety, healthcare costs, and other crucial factors.

Our website serves as a comprehensive guide, providing you with the information you need to navigate the complexities of employment reporting. This includes detailed instructions on how to complete each form, the purpose behind specific reporting requirements, and any applicable filing deadlines.

Whether you are a small business owner, a human resources professional, or an employer operating across multiple states, our website offers a one-stop solution for all your employment reporting needs. Stay up to date with the latest reporting guidelines, ensure compliance with state-specific requirements, and access a wide range of resources to help simplify the reporting process.

At Employment Report, we believe that accurate and efficient employer reporting benefits both employers and employees. It helps protect workers' rights, promotes workplace safety, and contributes to a fair and equitable employment landscape. Explore our website and take advantage of our expertise to streamline your employment reporting practices.

Documents:

117

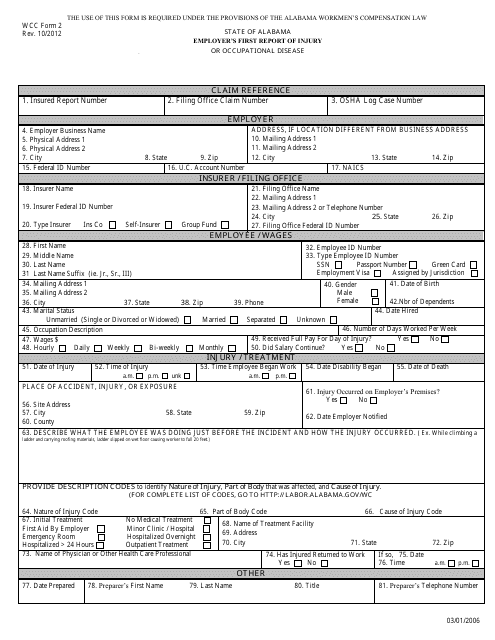

This form is used for employers in Alabama to report any work-related injuries or occupational diseases that occur to their employees.

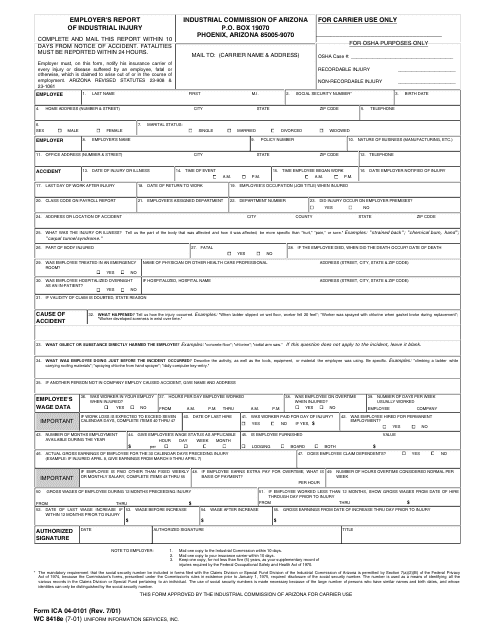

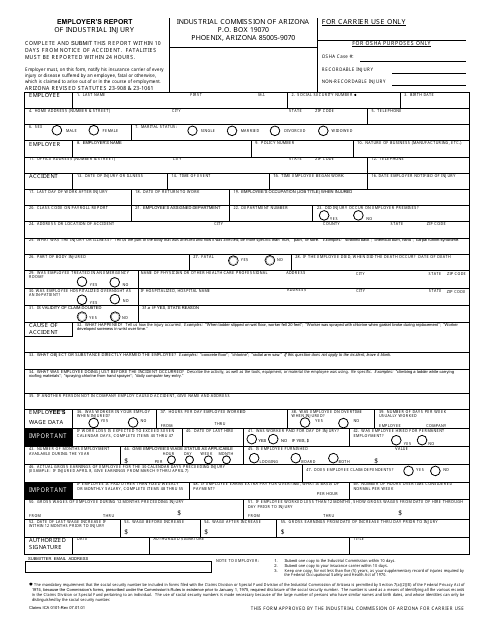

This form is used by employers in Arizona to report any work-related injuries that occur on the job.

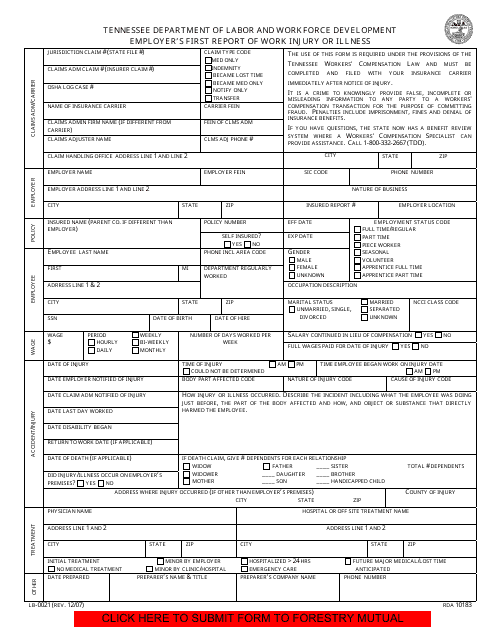

This Form is used for employers in Tennessee to report the first work injury or illness to the Department of Labor and Workforce Development.

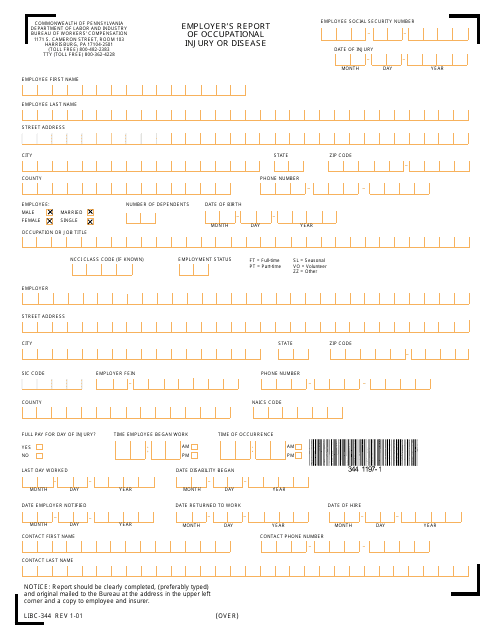

This Form is used for employers in Pennsylvania to report work-related injuries or diseases. It helps ensure proper documentation and communication for workers' compensation claims.

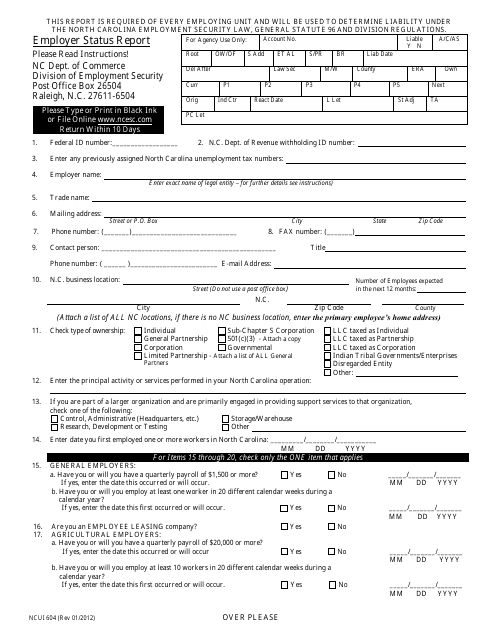

This form is used for reporting employer status in North Carolina. It allows employers to provide updated information about their business, such as the number of employees and their wages.

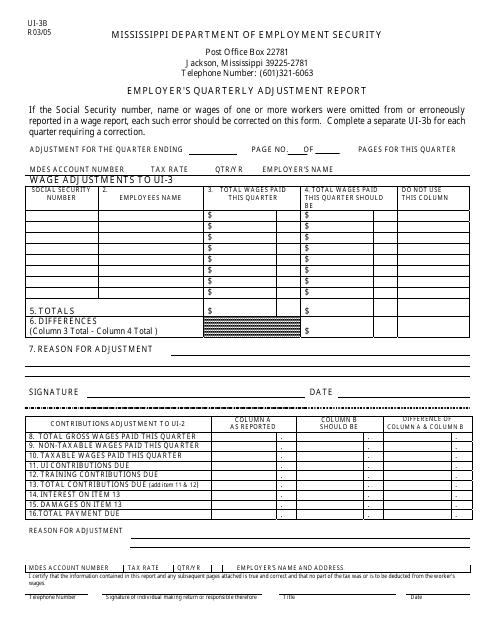

This Form is used for employers in Mississippi to report quarterly adjustments related to unemployment insurance contributions.

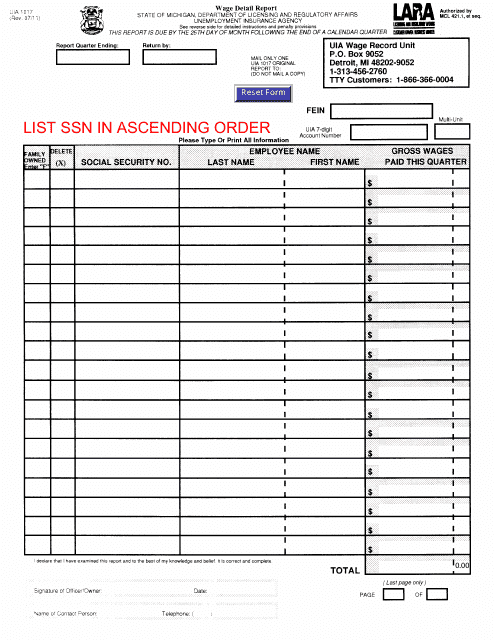

This form is used for reporting wage details in the state of Michigan.

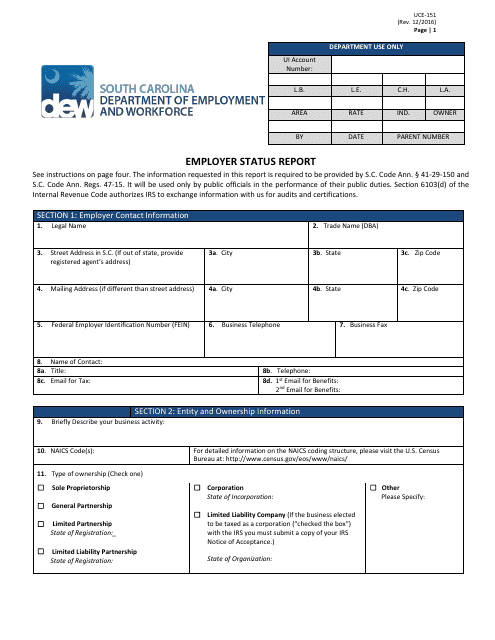

This form is used for employers in South Carolina to report their status.

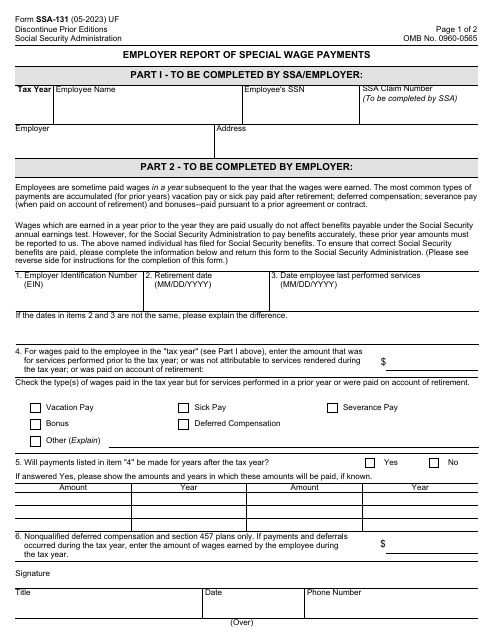

Download this form if you are an employer and need to report the special wages you pay to an employee.

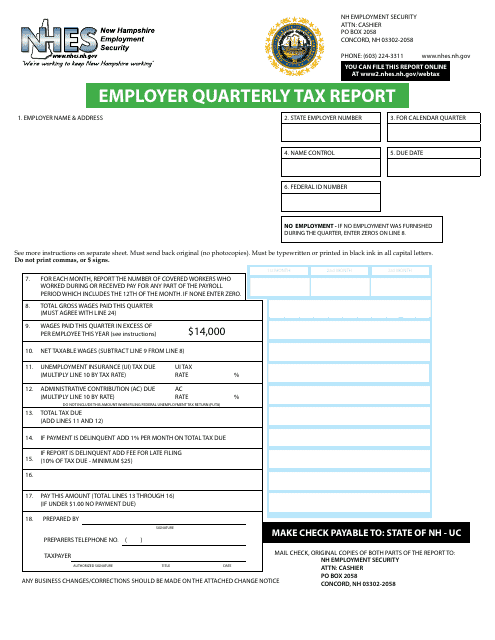

This document is for employers in New Hampshire to report their quarterly taxes.

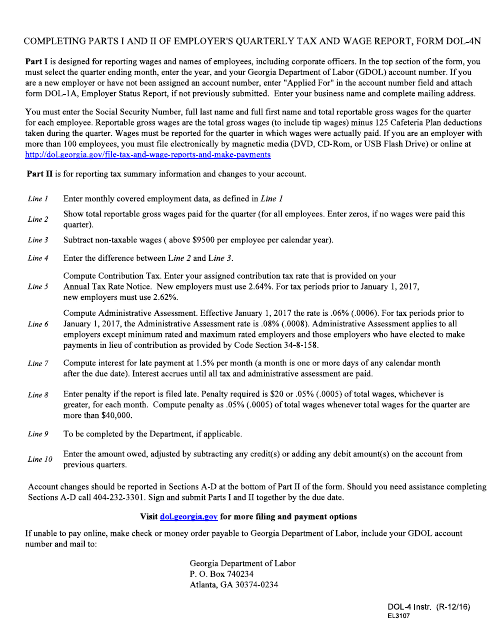

This is a formal document for the state of Georgia that all employers must file each quarter if their business is active to inform the authorities about the wages they have paid to their employees.

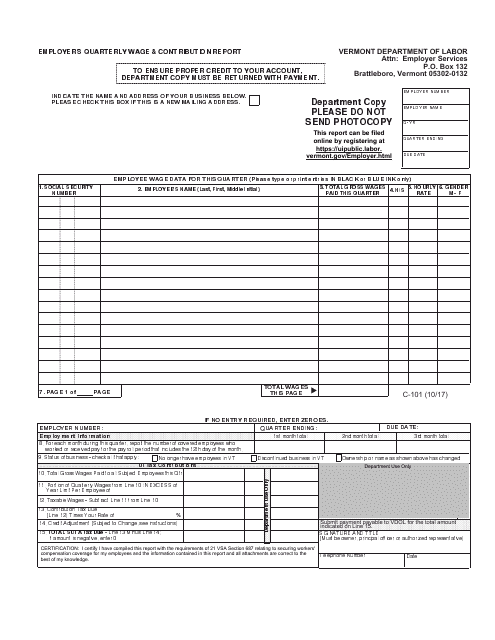

This form is used for employers in Vermont to report quarterly wages and contributions to the Department of Labor.

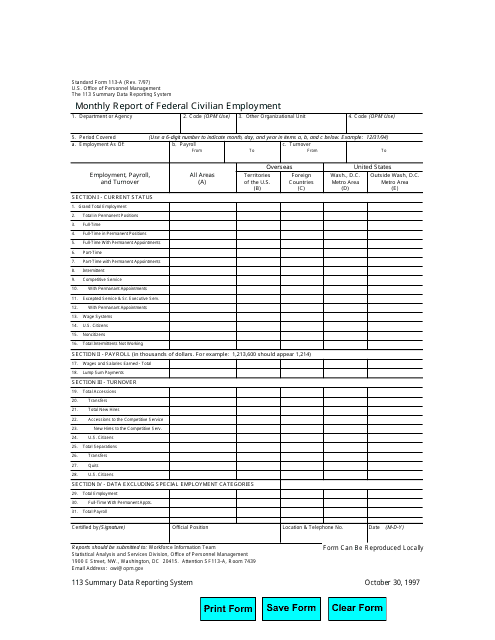

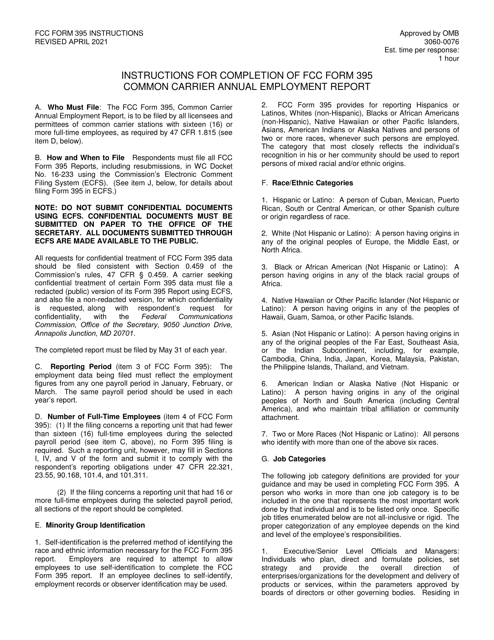

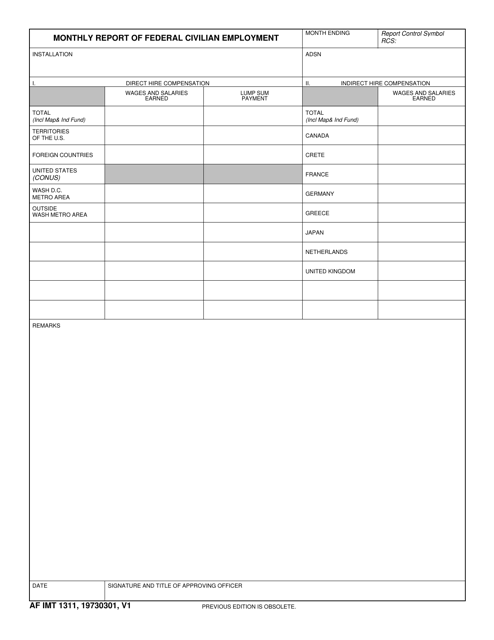

This form is used for reporting the monthly federal civilian employment.

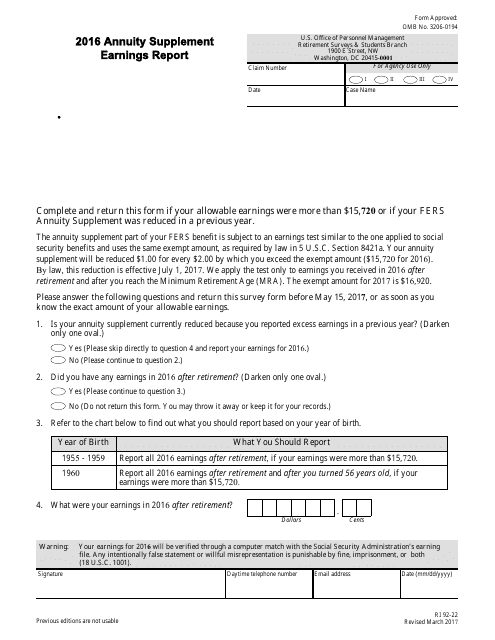

This document is used to report earnings for the annuity supplement program.

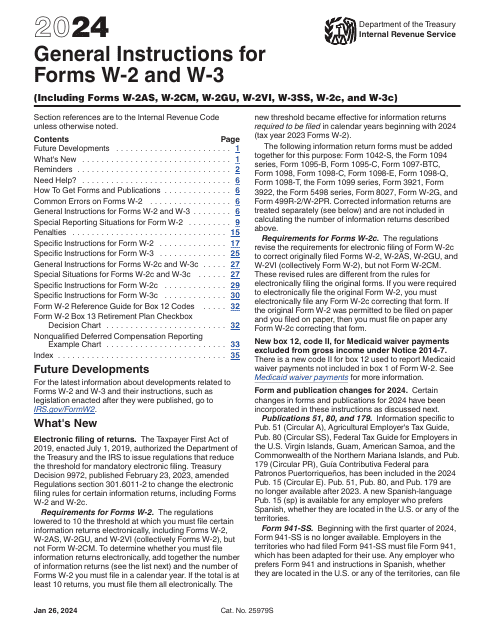

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

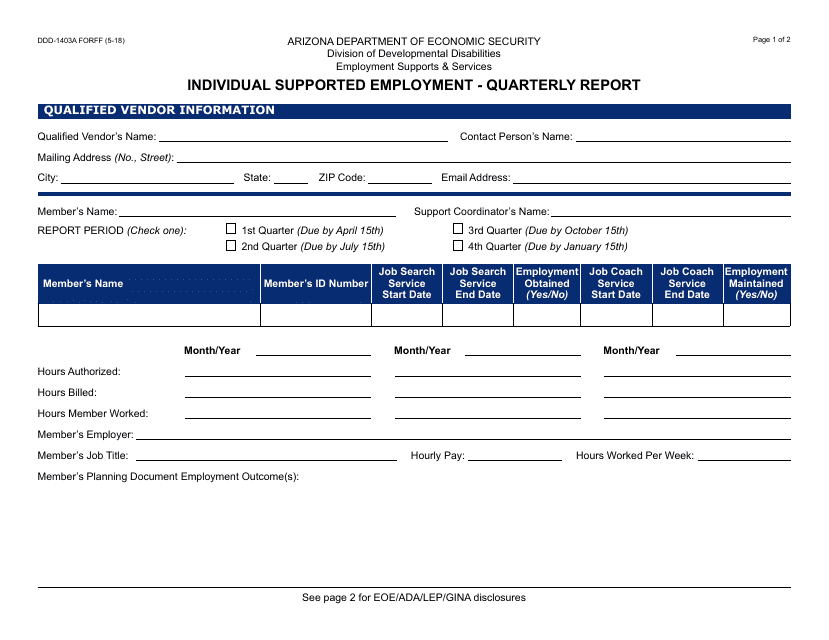

This Form is used for filing a quarterly report for individual supported employment in Arizona.

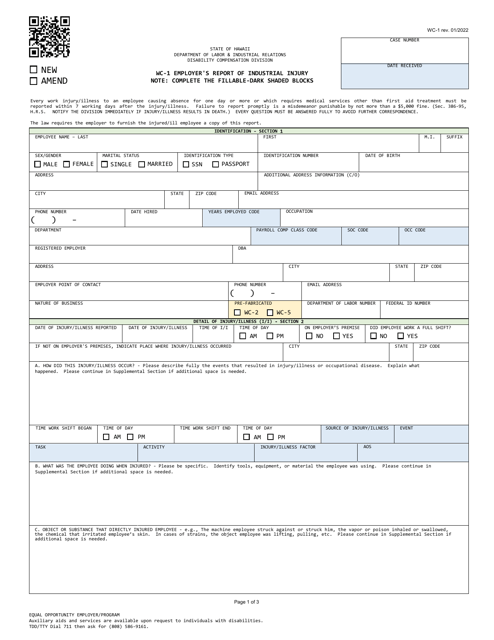

This Form is used for employers in Arizona to report industrial injuries suffered by their employees.

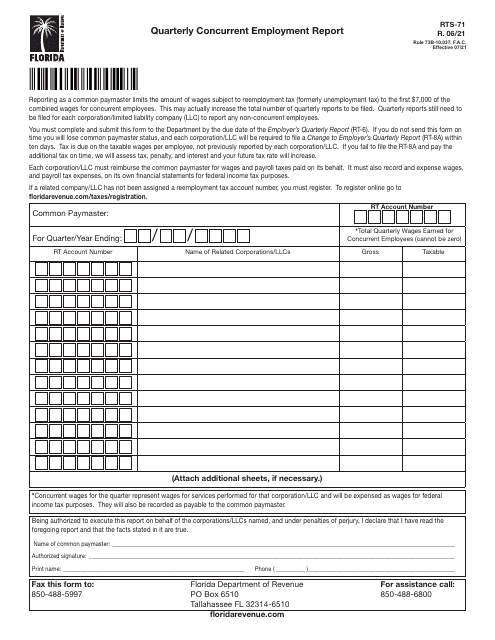

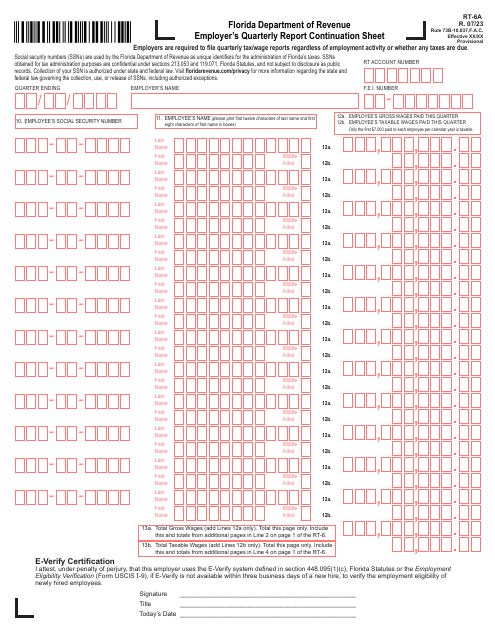

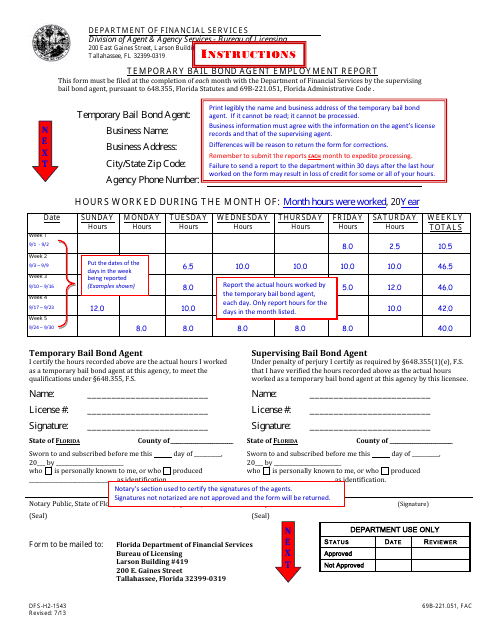

This form is used for reporting the employment status of temporary bail bond agents in the state of Florida.

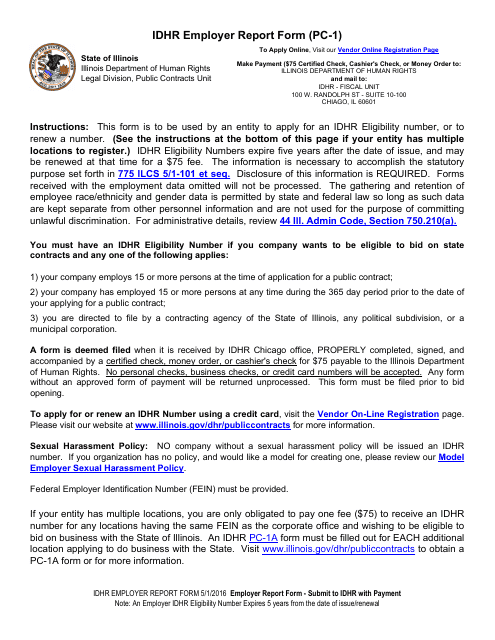

This document is used for reporting employer information in the state of Illinois.

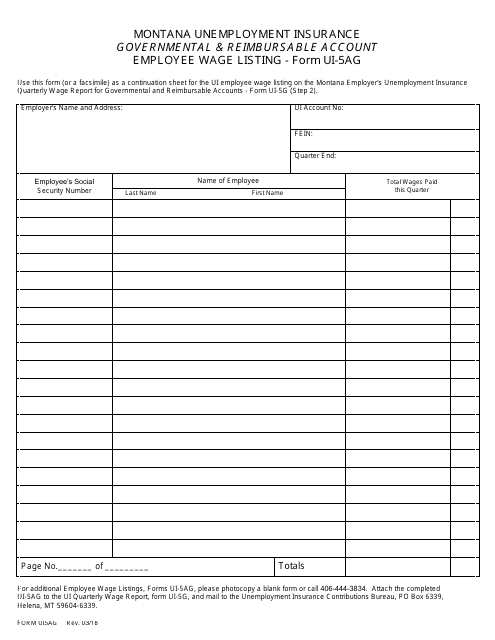

This Form is used for reporting employee wages for a Governmental & Reimbursable Account in Montana.

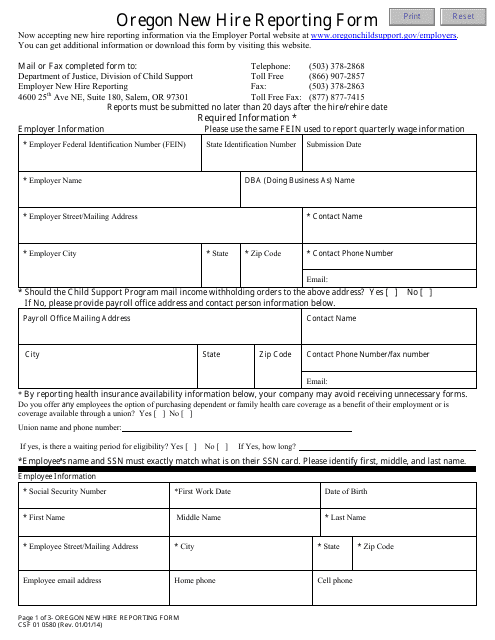

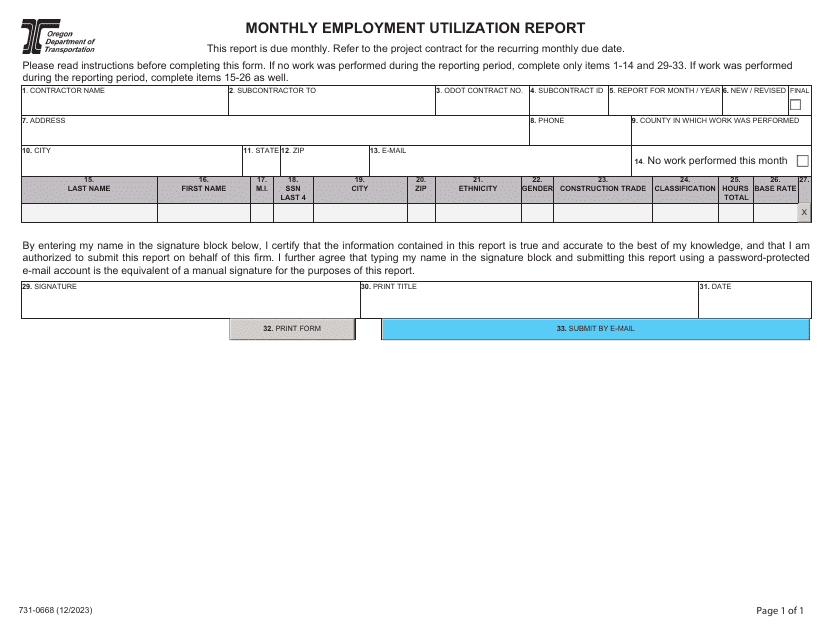

This Form is used for reporting new hires in the state of Oregon.

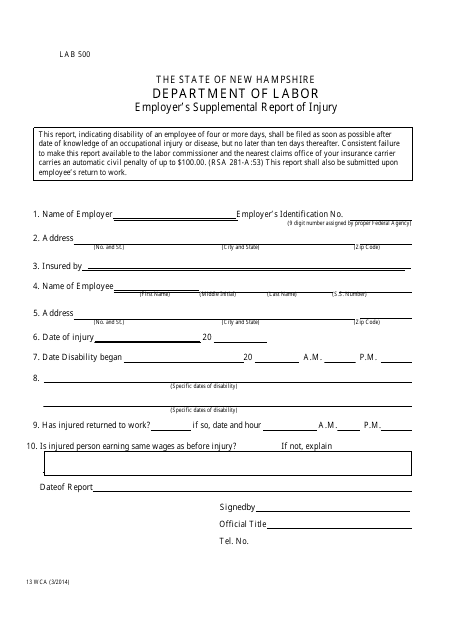

This form is used for employers in New Hampshire to report additional information regarding a work-related injury.

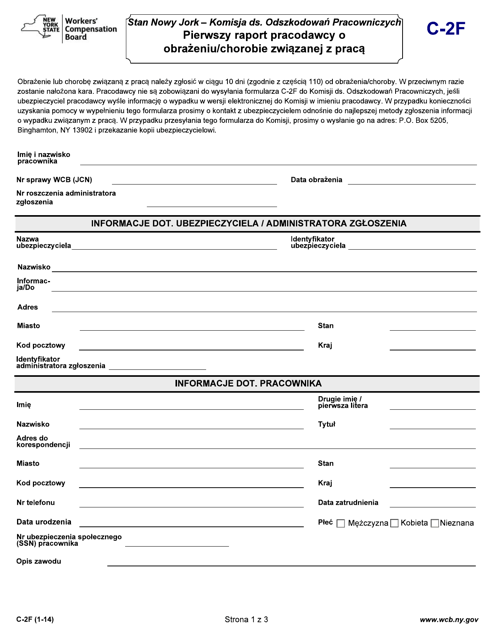

This document is used for employers in New York to report work-related injuries or illnesses and is available in Polish language.

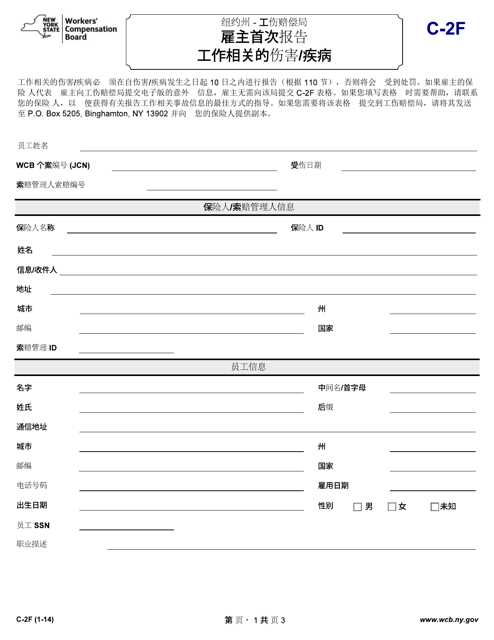

This Form is used for reporting work-related injuries or illnesses by employers in New York. It is specifically tailored for Chinese-speaking individuals.

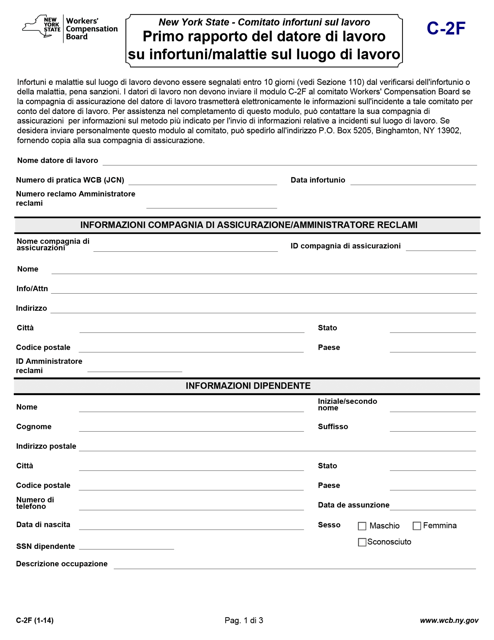

This form is used for employers in New York to report work-related injuries and illnesses, specifically for Italian-speaking individuals.

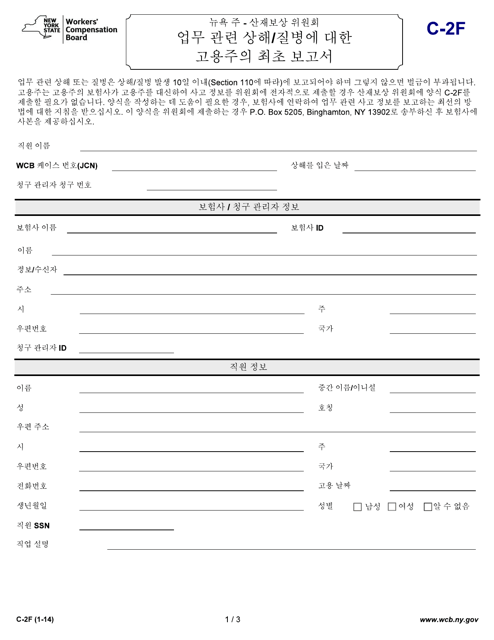

This form is used for employers in New York to report work-related injuries or illnesses. The form is available in Korean language.

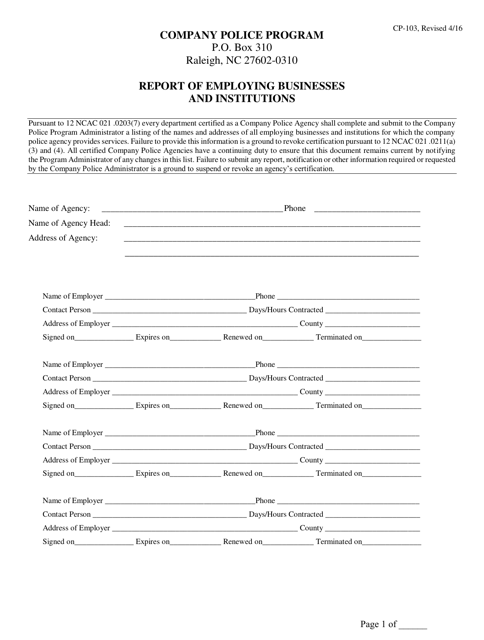

This Form is used for reporting employing businesses and institutions in North Carolina.

This form is used for reporting the monthly federal civilian employment.

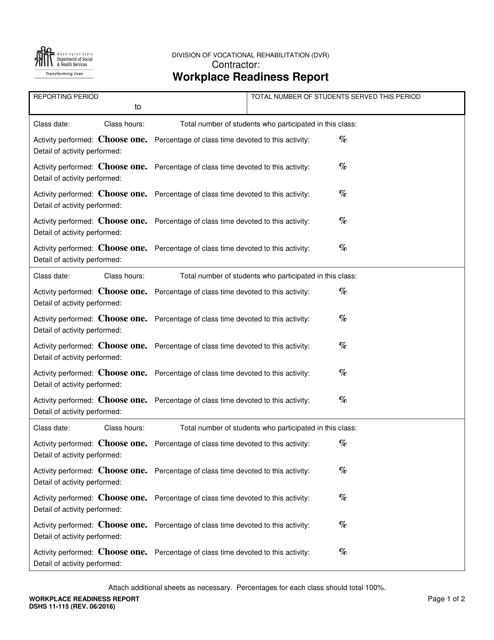

This form is used for reporting workplace readiness in the state of Washington. It is used to assess the skills and abilities of individuals for employment purposes.