Benefits Plan Templates

Planning for employee benefits is an essential aspect of human resource management. A well-designed benefits plan ensures that employees are provided with a range of valuable perks and incentives, helping to attract and retain top talent. From retirement plans to health insurance coverage, a comprehensive benefits package can play a pivotal role in enhancing employee satisfaction and overall job performance.

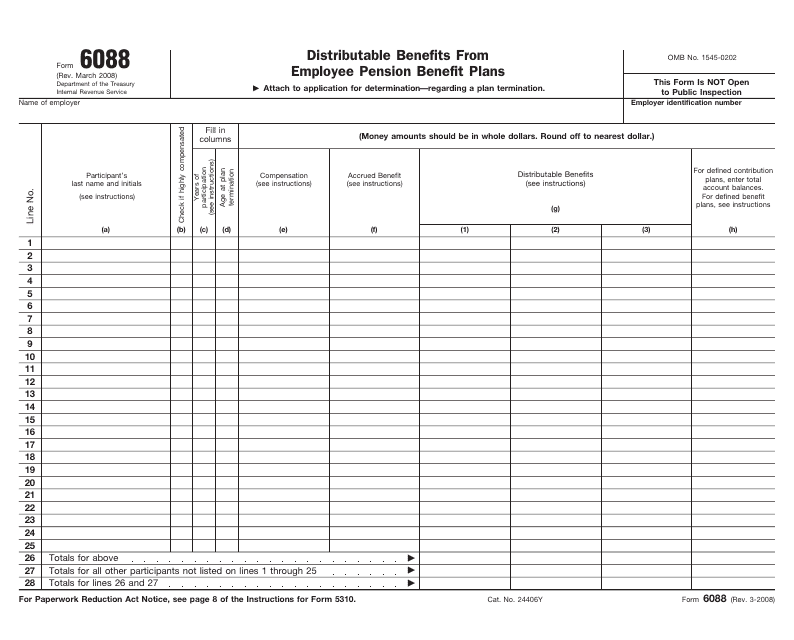

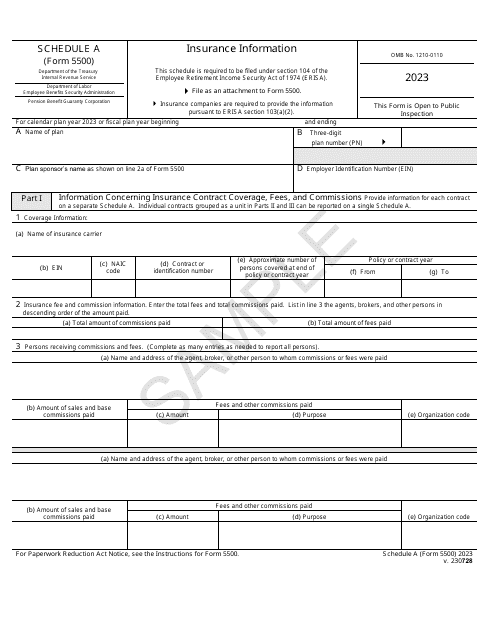

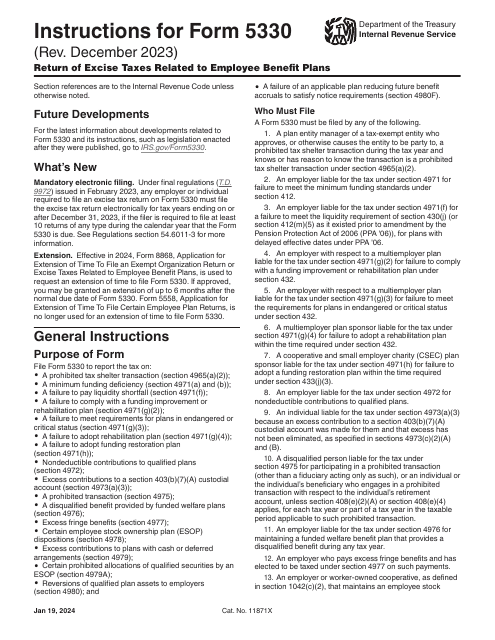

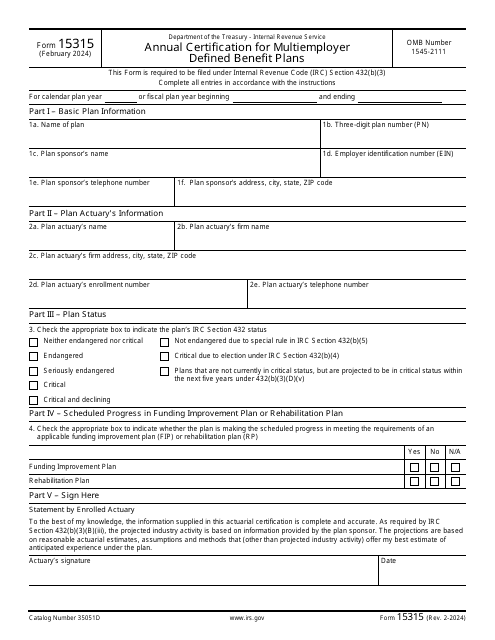

When it comes to benefits planning, there are several important documents and forms that employers and employees alike need to be familiar with. These documents serve as a roadmap for navigating the complexities of benefit plans and ensuring compliance with IRS regulations. Examples of such documents include the IRS Form 6088 Distributable Benefits From Employee Pension Benefit Plans, the Instructions for IRS Form 5330 Return of Excise Taxes Related to Employee Benefit Plans, and the IRS Form 15315 Annual Certification for Multiemployer Defined Benefit Plans.

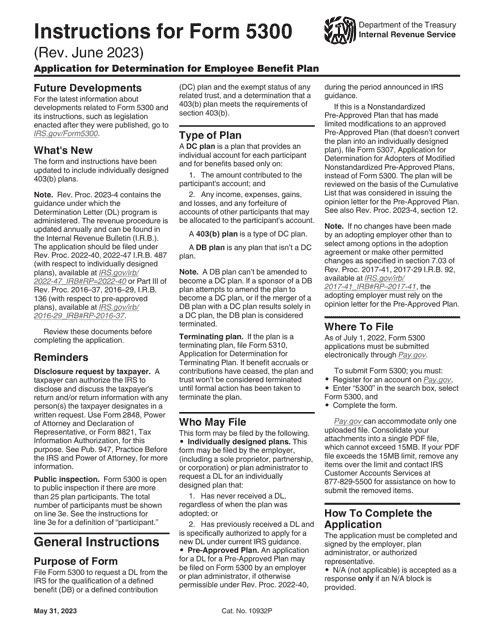

Furthermore, it's crucial to stay up-to-date with the latest guidelines and procedures related to benefit plans. The Instructions for IRS Form 5300 Application for Determination for Employee Benefit Plan provide valuable insights on how to apply for determination of employee benefit plans and gain IRS approval.

Whether you refer to it as a benefits plan, benefit plans, benefits planning, or a benefit plan, understanding and effectively managing your organization's employee benefits is crucial. By staying informed and utilizing the appropriate documents and forms, you can ensure that your benefits program aligns with legal requirements and offers the best possible support for your workforce.

Documents:

9

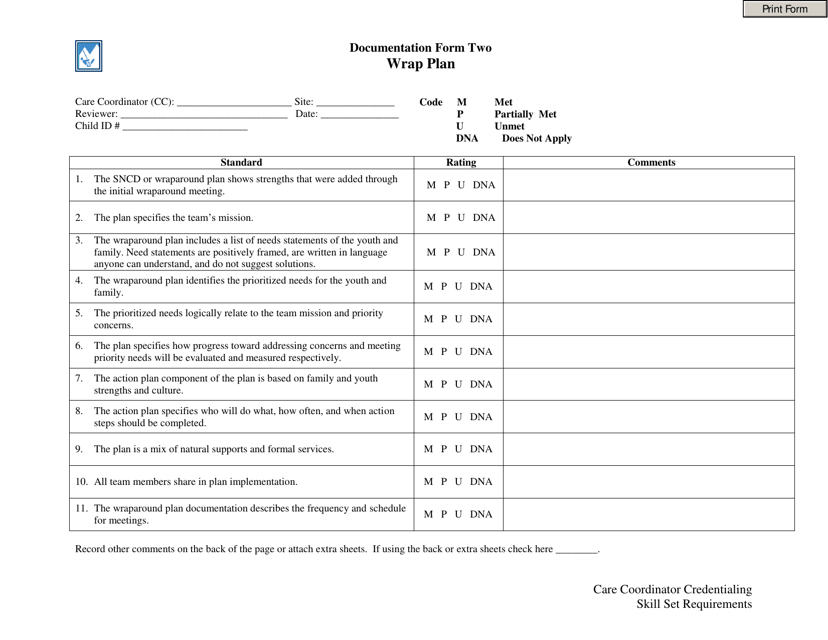

This document is a Wrap Plan for businesses in Oklahoma. It outlines the terms and provisions of an insurance policy that combines multiple insurance coverages into one policy. Businesses can use this document to ensure they have adequate coverage for their specific needs.

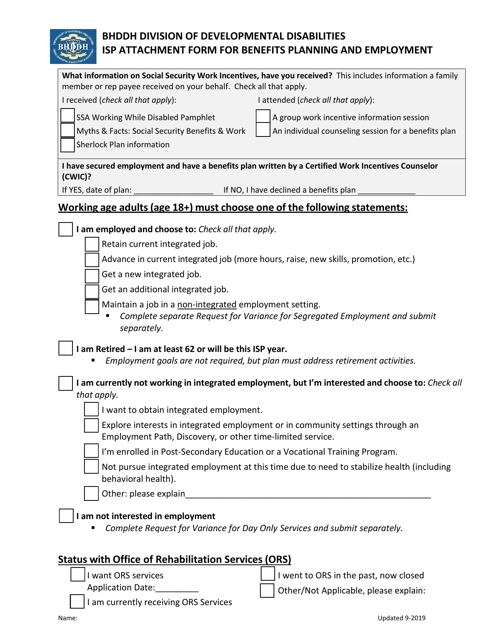

This document is used for requesting an ISP (Individualized Service Plan) attachment for benefits planning and employment in Rhode Island.