Interstate Fuel Tax Templates

Are you operating a commercial vehicle that travels across state lines? If so, you may be familiar with the complex regulations surrounding the payment of fuel taxes. Understanding and complying with these regulations is crucial to avoid penalties and keep your operations running smoothly.

At Templateroller.com, we specialize in providing comprehensive information and resources on interstate fuel taxes. Our expertise in this area enables us to assist businesses like yours in navigating the intricacies of fuel tax compliance and reporting.

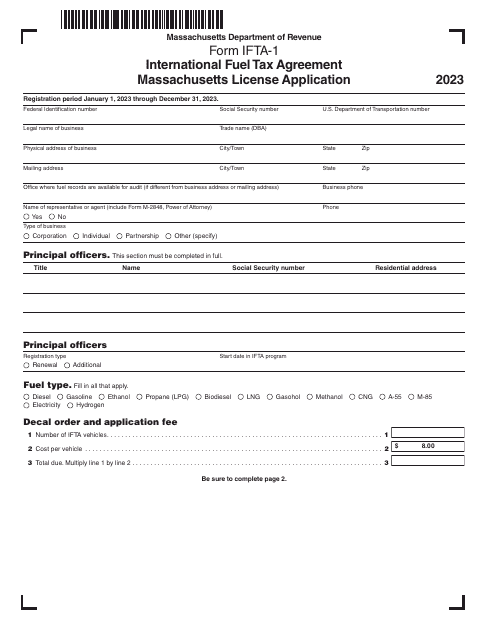

Also known as the interstate user diesel fuel tax or the international fuel tax agreement (IFTA), this tax requires commercial carriers to pay taxes on fuel used in interstate travel. Each state has its own rules and rates for these taxes, making the process quite complicated.

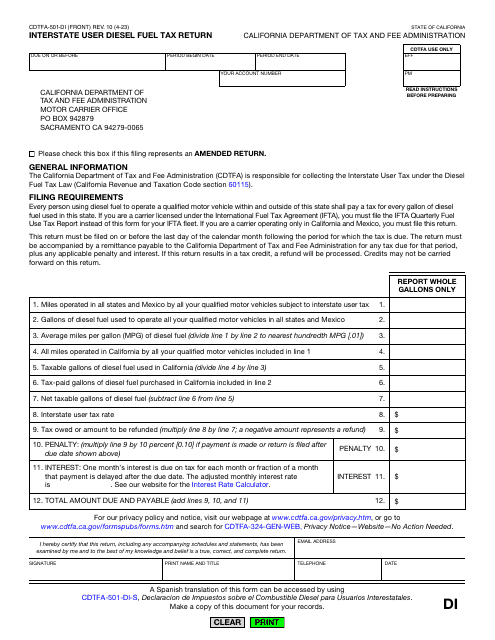

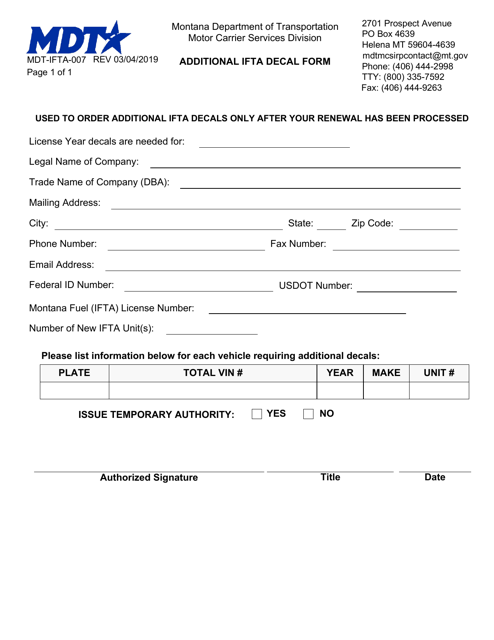

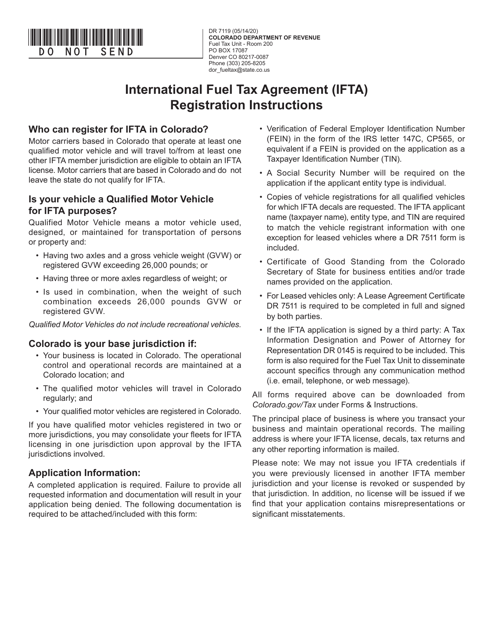

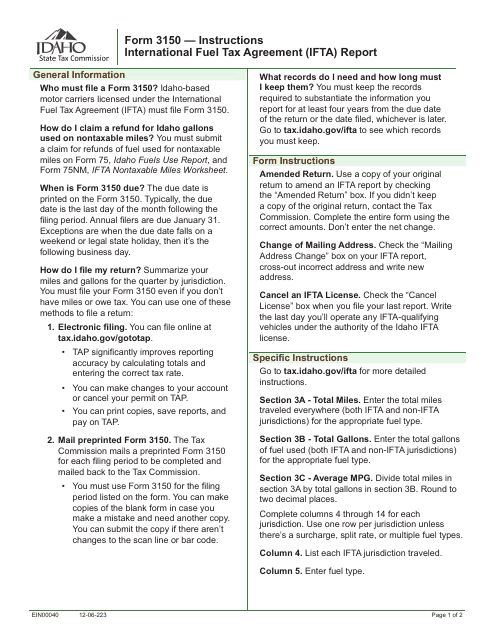

To ensure that you stay compliant with interstate fuel tax regulations, we offer a variety of resources and services. Our website provides access to forms such as the Interstate User Diesel Fuel Tax Return, Additional Ifta Decal Form, and International Fuel Tax Agreement (IFTA) Registration Application. We also provide step-by-step instructions on how tofill out these forms correctly.

In addition to providing access to the necessary documents, we also offer guidance on how to calculate interstate fuel taxes. Our team of experts can assist you in understanding the different tax rates imposed by various states and help you calculate fuel tax liabilities accurately.

We understand that interstate fuel tax compliance can be a daunting task, especially for businesses that operate in multiple states. That's why we are committed to simplifying this process for you. Our mission is to provide you with all the tools and information you need to handle your fuel tax obligations efficiently, saving you time and minimizing the risk of non-compliance.

Whether you are a trucking company, a bus operator, or any other business that operates commercial vehicles across state lines, our comprehensive resources will prove invaluable. Let us take the stress out of interstate fuel taxes, allowing you to focus on what you do best - running your business.

For more information on interstate fuel taxes and how we can assist you, please contact us. Our team is ready to answer your questions and provide you with the support you need to navigate the complex world of fuel tax compliance.

Documents:

5

This Form is used for requesting additional IFTA decals in Montana.