Oil Production Templates

Are you interested in learning about the process and regulations surrounding oil production? Look no further! Our comprehensive collection of documents covers everything you need to know about oil production, also referred to as oil products or oil production form. From monthly reports on crude oil and lease condensate production to tax returns and operations reports, we have you covered.

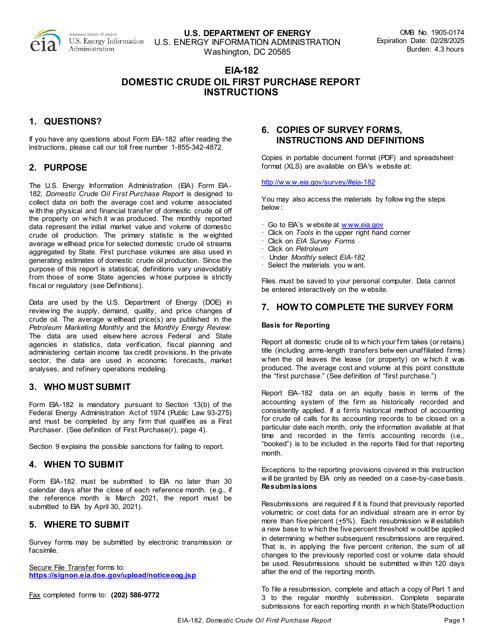

Whether you're a business owner, investor, or simply curious about the oil industry, our valuable resources will provide you with the necessary instructions and insights. Our documents include instructions for the EIA-914 Monthly Crude Oil and Lease Condensate, and Natural Gas Production Report, as well as the EIA-182 Domestic Crude Oil First Purchase Report. These forms are vital for monitoring and assessing the production of oil and related products.

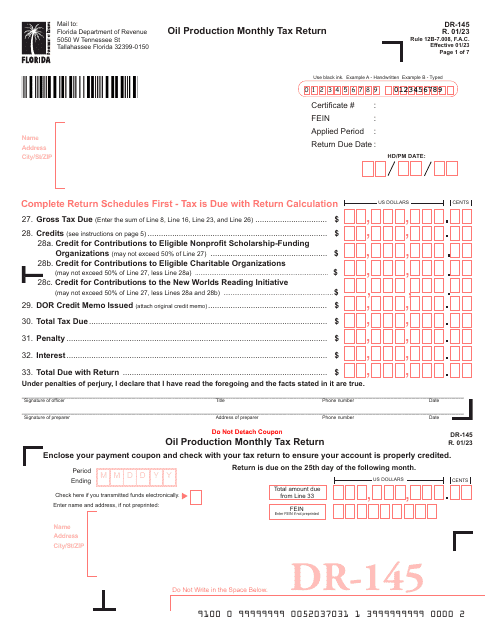

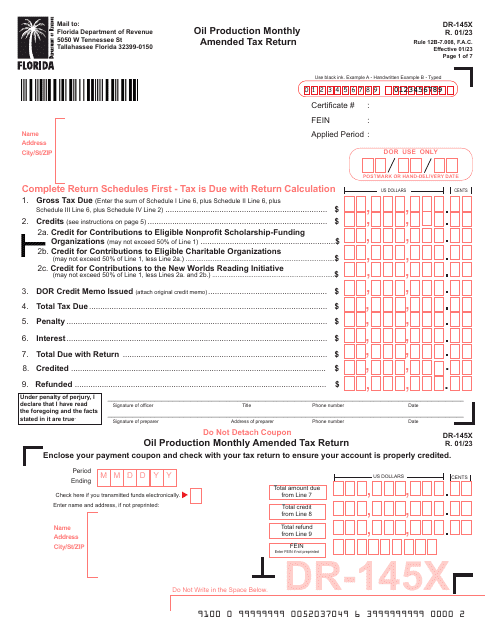

In addition to these primary forms, we also offer secondary documents such as the DR-145X Oil Production Monthly Amended Tax Return - Florida and DR-145 Oil Production Monthly Tax Return - Florida. These tax returns are used to ensure compliance and calculate taxes on oil production.

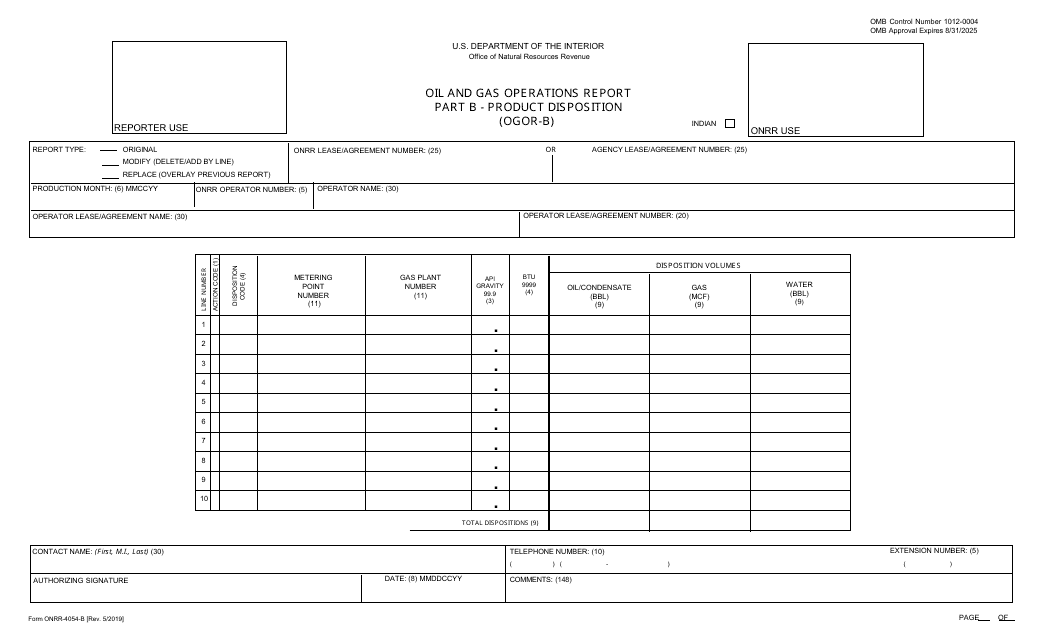

Furthermore, if you're interested in tracking the product disposition of oil and gas operations, our collection includes the ONRR-4054 Part B Oil and Gas Operations Report - Product Disposition (Ogor-B). This report details the various ways in which oil products are utilized and distributed.

So, whether you're involved in the oil industry or simply eager to expand your knowledge, our extensive collection of documents on oil production will provide you with the information you need. Don't miss out on the opportunity to explore this valuable resource.

Documents:

34

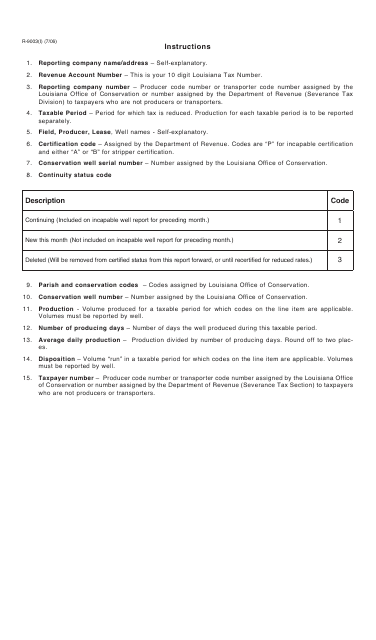

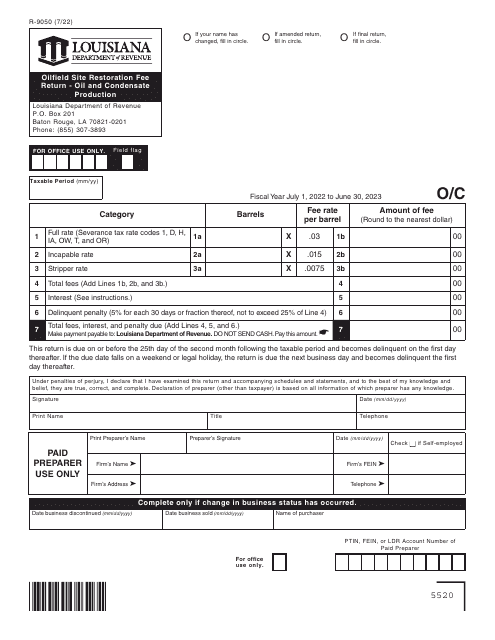

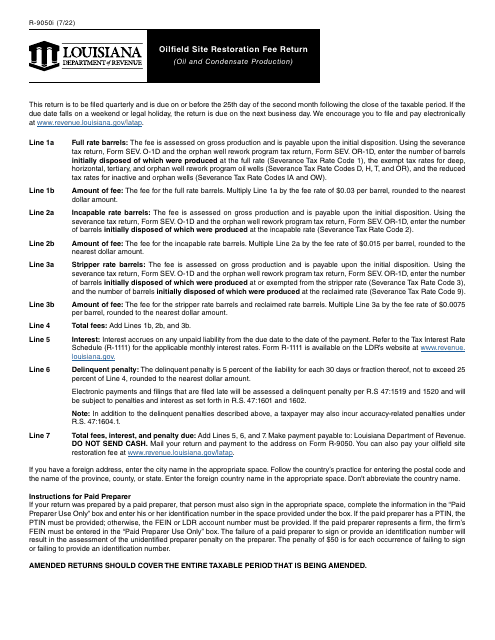

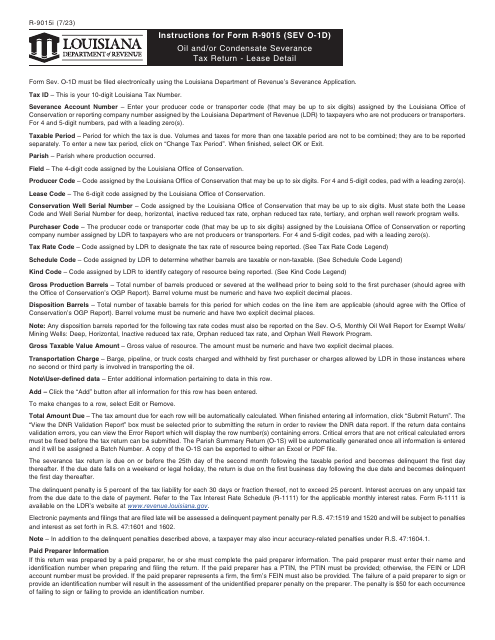

This form is used for reporting oil severance in the state of Louisiana. It provides instructions on how to properly fill out and submit the form.

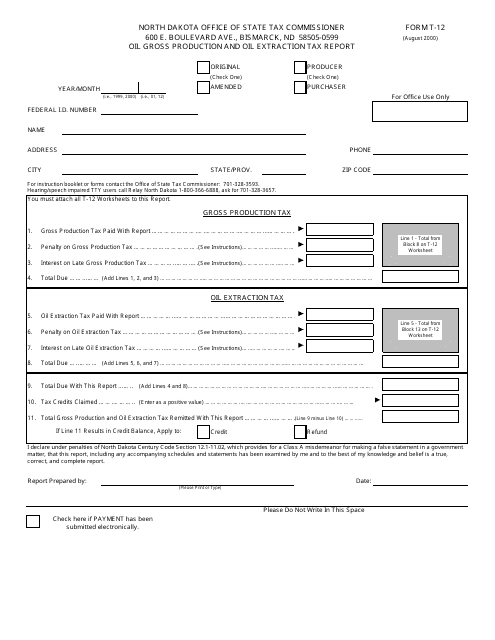

This form is used for reporting oil gross production and oil extraction taxes in North Dakota.

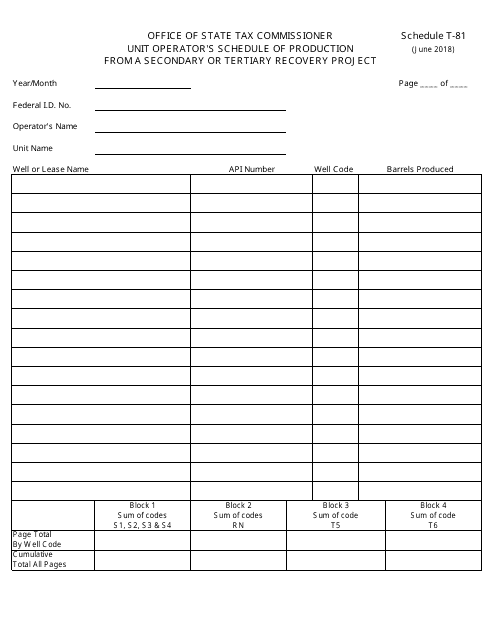

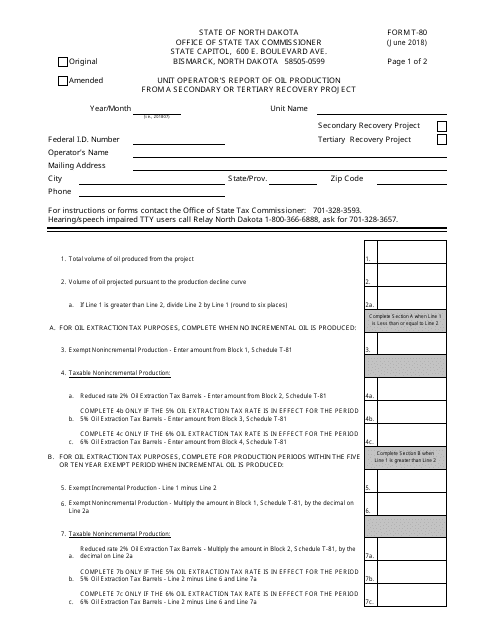

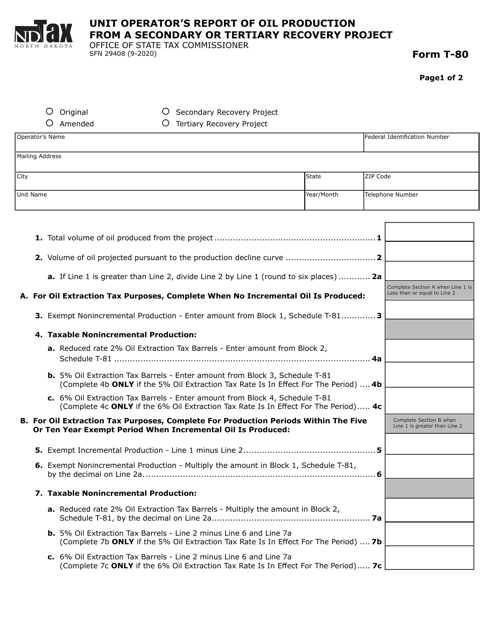

This form is used for reporting the production from a secondary or tertiary recovery project in North Dakota. It is specifically designed for unit operators to submit their schedule of production.

This form is used for reporting oil production from secondary or tertiary recovery projects in North Dakota.

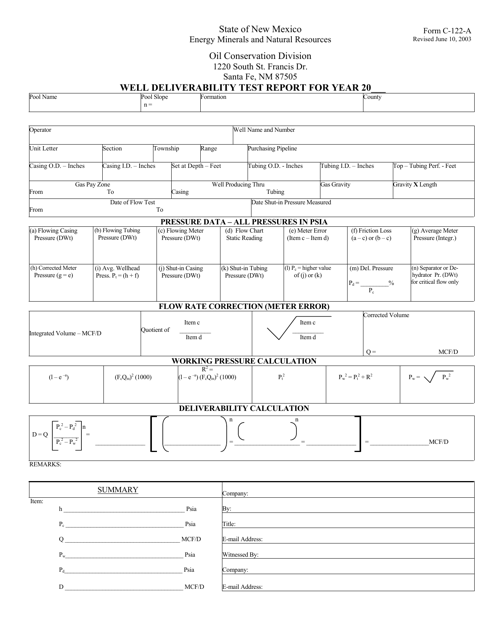

This document is used for reporting the results of a well deliverability test conducted in New Mexico. It provides information on the flow rate and performance of the well.

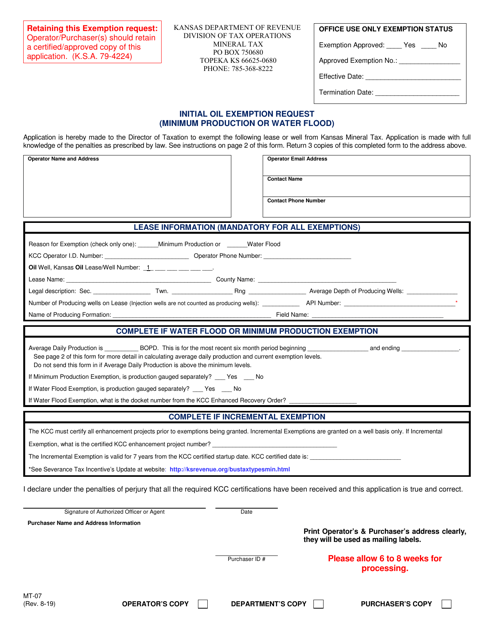

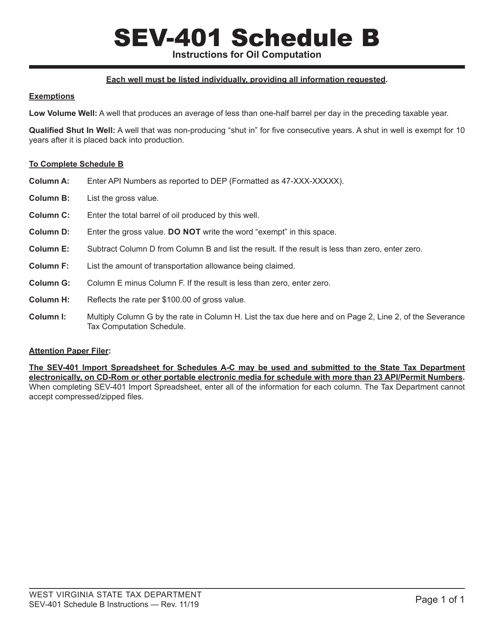

This document is used for calculating the oil tax and claiming exemptions in West Virginia.

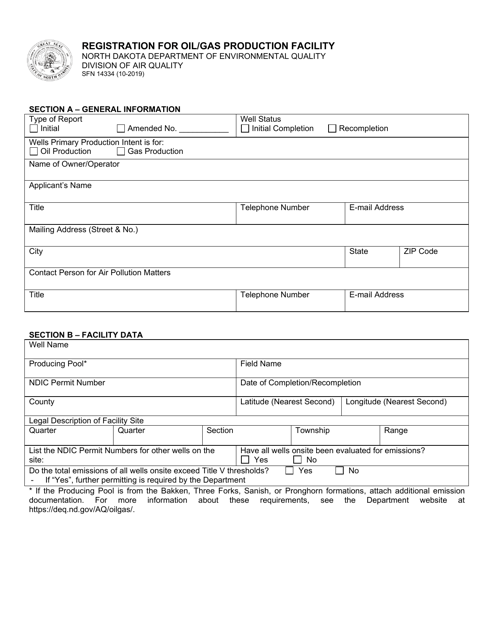

This Form is used for registering an oil/gas production facility in North Dakota.

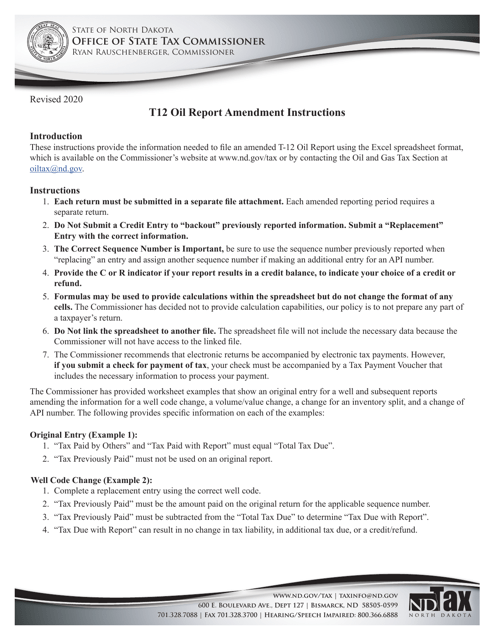

This Form is used for reporting oil gross production and oil extraction tax in North Dakota. It provides instructions on how to complete the T-12 Oil Gross Production and Oil Extraction Tax Report.

This Form is used for conducting surveys related to oil and gas operations in West Virginia. It provides instructions on how to properly fill out the survey form.

This form is used for reporting monthly crude oil and lease condensate, and natural gas production. It provides instructions on how to fill out and submit the EIA-914 report.

This type of document provides instructions for submitting Form H-1, which is used to apply for permission to inject fluid into an oil or gas reservoir in Texas.

This Form is used for applying for the Positive Production Response Certification in Texas.

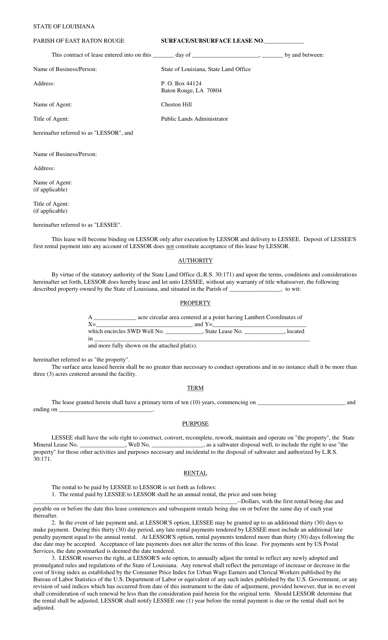

This document is a lease agreement used in Louisiana for the exploration and development of oil or gas resources on both the surface and subsurface of a property.

This form is used for reporting the oil production from a secondary or tertiary recovery project in North Dakota.

This Form is used for reporting the first purchase of domestic crude oil. It provides instructions on how to accurately complete Form EIA-182.

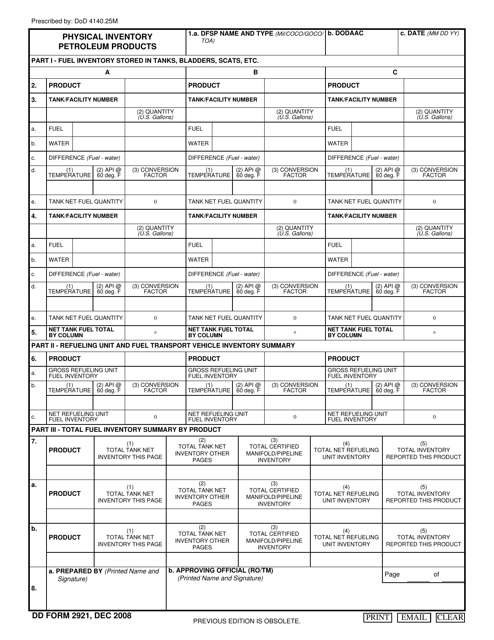

This document is used for reporting the disposition of oil and gas products in part B of the ONRR-4054 form for oil and gas operations.

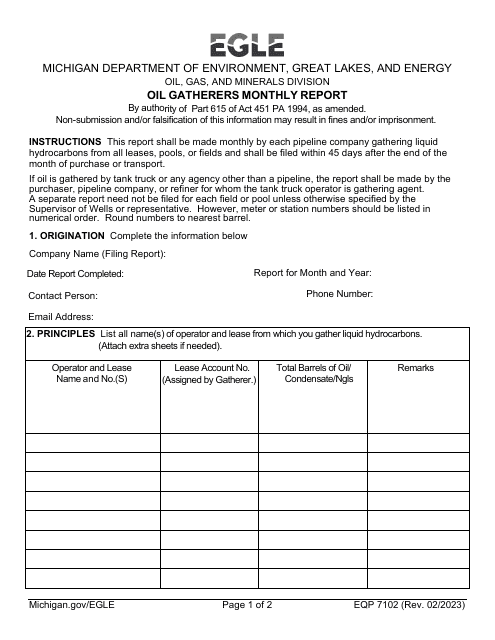

This form is used for oil gatherers in Michigan to submit a monthly report.

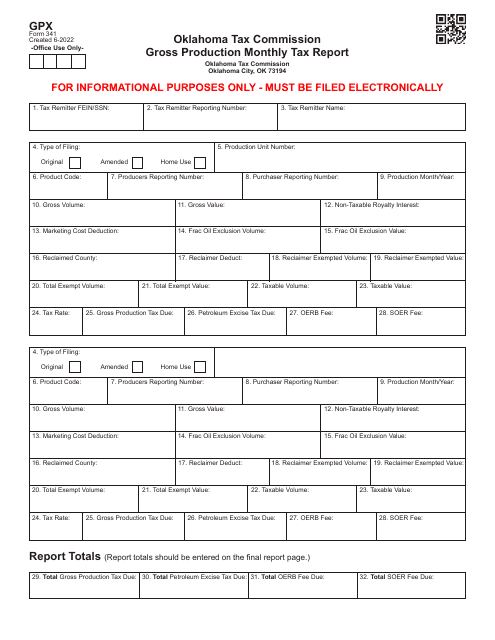

This form is used for reporting monthly gross production tax in Oklahoma.