IRS Formulario Templates

Looking for IRS Formulario? Find all the necessary information, guidelines, and instructions for filling out and submitting your IRS Formulario with ease. Whether you need help with Formulario 1040, Formulario 3911, or any other Formulario, we've got you covered.

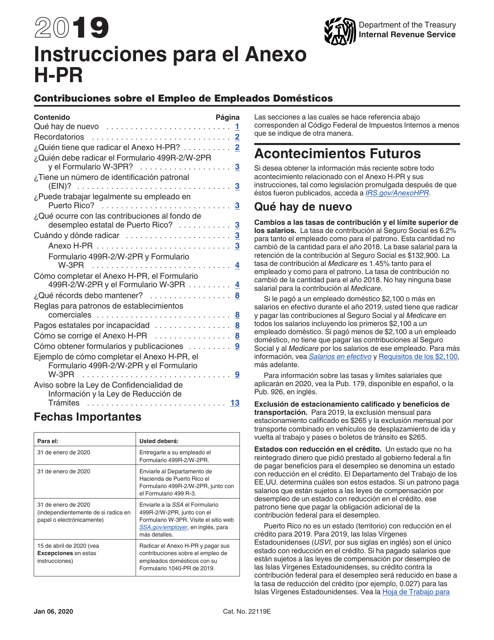

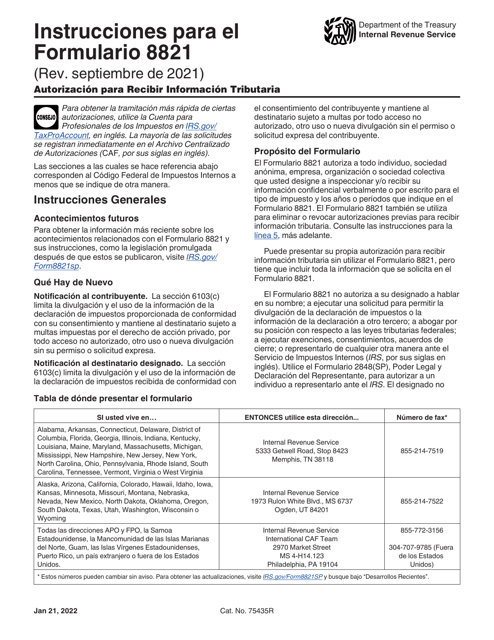

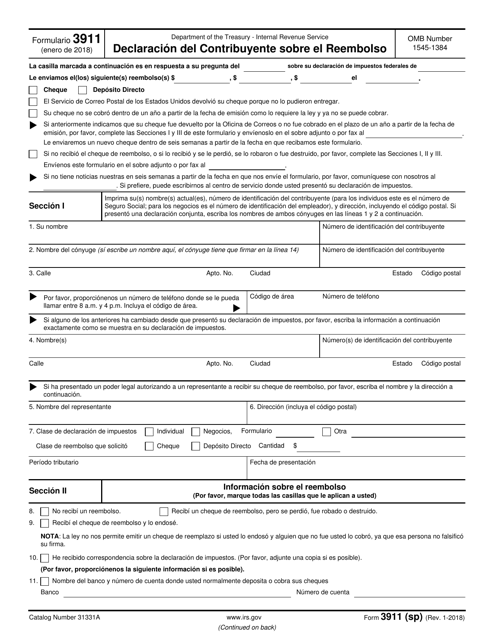

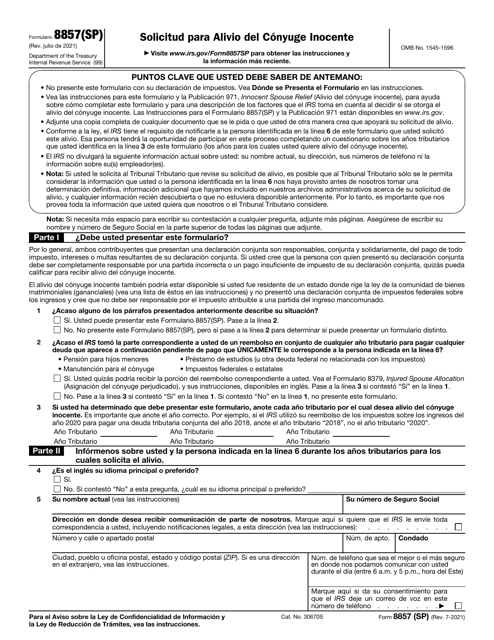

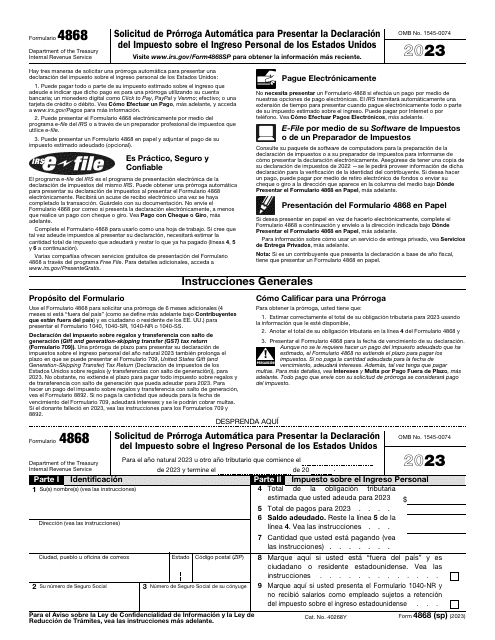

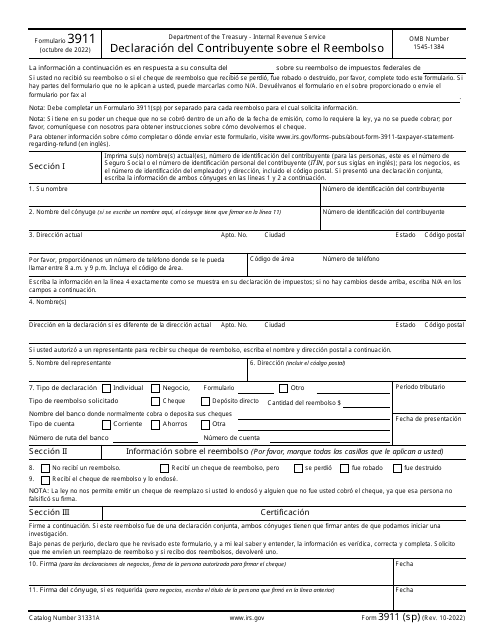

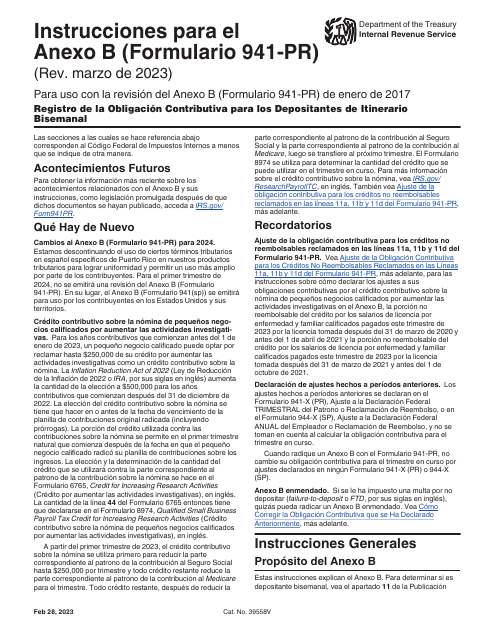

Our extensive collection of Formularios contains comprehensive instructions and guidance in various languages, including Spanish and Puerto Rican Spanish. We provide detailed instructions for filing, claiming refunds, adjusting annual declarations, and more.

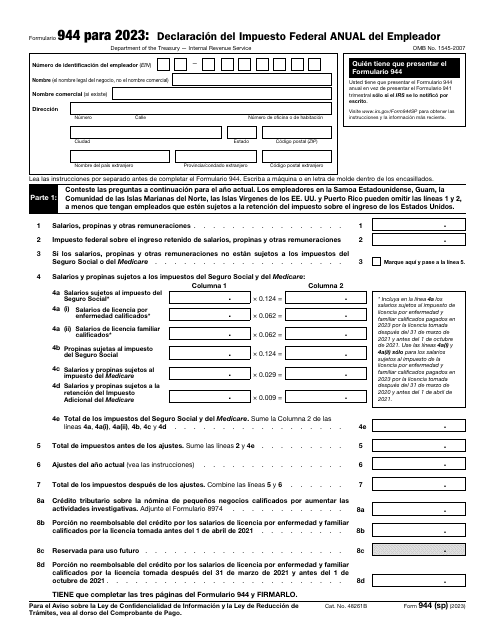

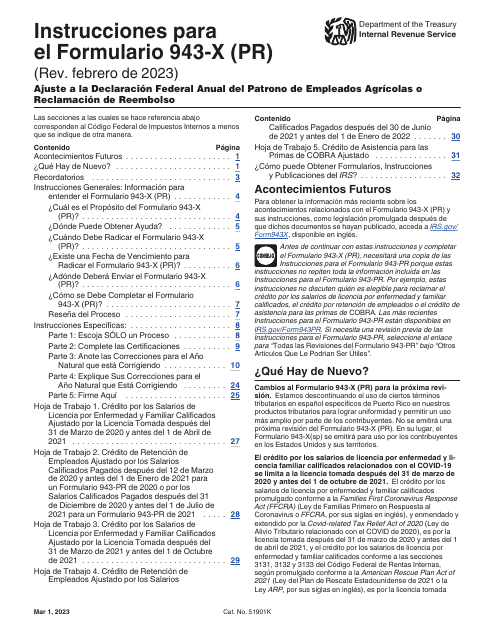

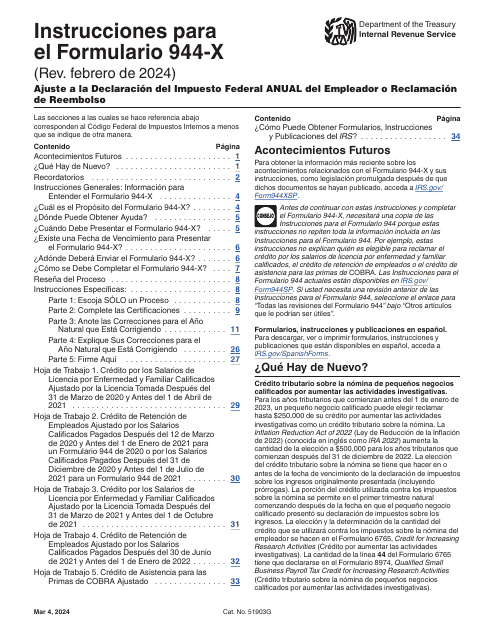

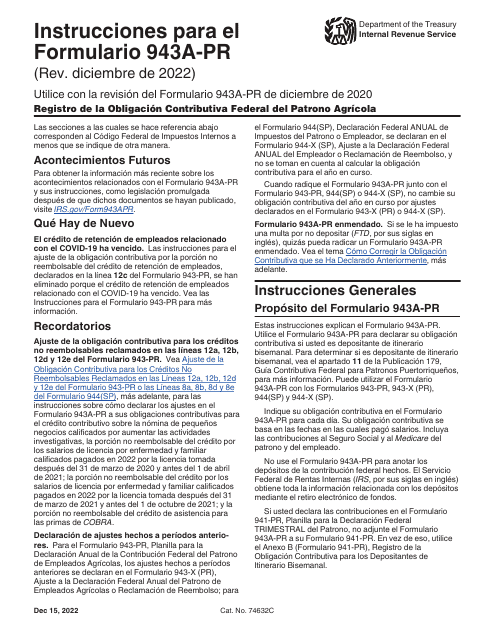

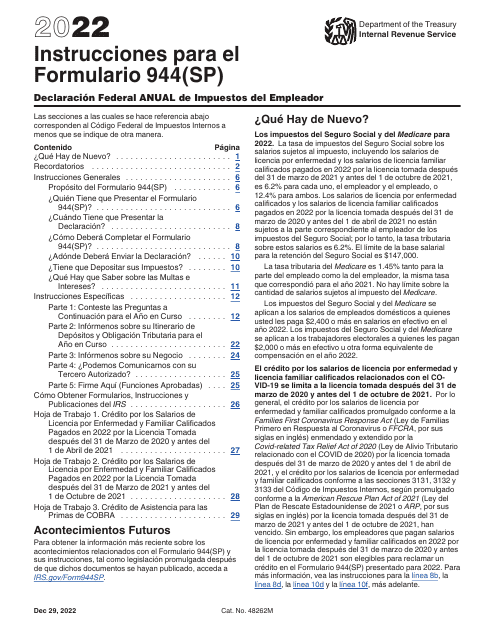

Avoid confusion and ensure accurate and timely filing by accessing our Formulario resources. Explore our assortment of Formularios, from Formulario 943-X for employers of agricultural employees to Formulario 944-X for employers seeking adjustments or refunds.

Don't let the complexities of IRS Formularios overwhelm you. Take advantage of our user-friendly platform to access the resources and information you need. Our goal is to simplify the process and empower you to file your Formulario accurately.

Choose us as your trusted source for IRS Formulario guidance. Our extensive knowledge base and comprehensive instructions will help you navigate the submission process seamlessly. Don't miss out on potential refunds or face penalties due to inaccuracies – rely on our expertise for all your IRS Formulario needs.

Note: This text is a sample SEO webpage content that describes a collection of IRS Formularios.

Documents:

41

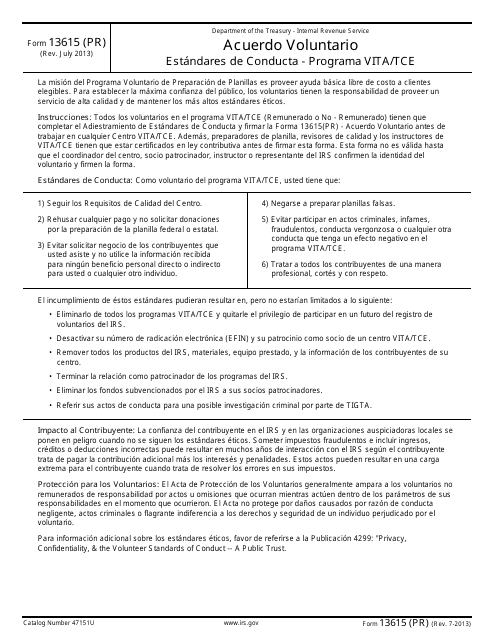

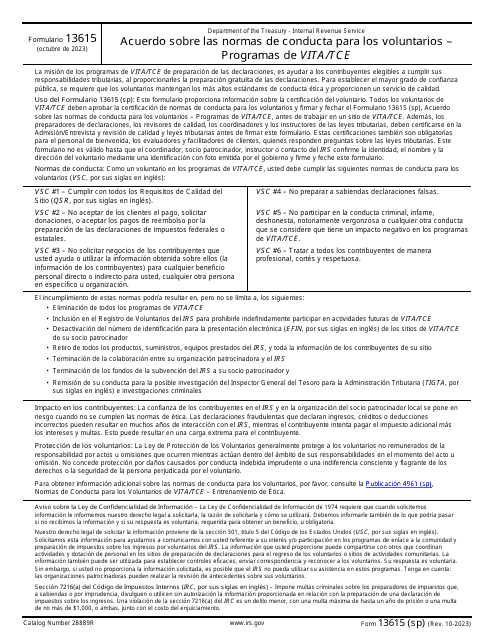

This document is for Puerto Rican residents participating in the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. It outlines the voluntary standards of conduct for participants.

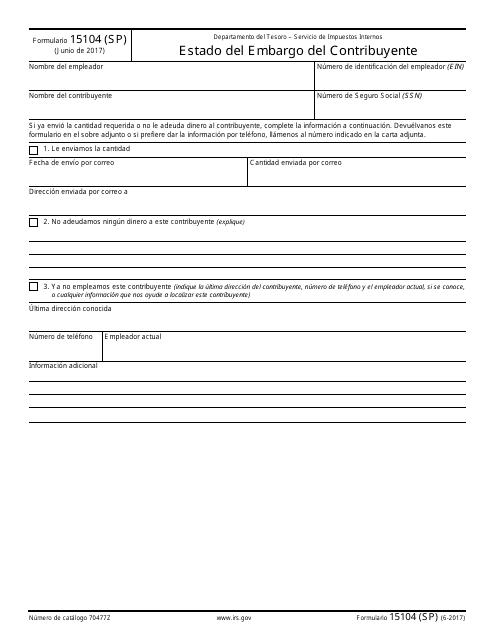

This Form is used for reporting the status of a taxpayer's embargo by the IRS. It is written in Spanish.

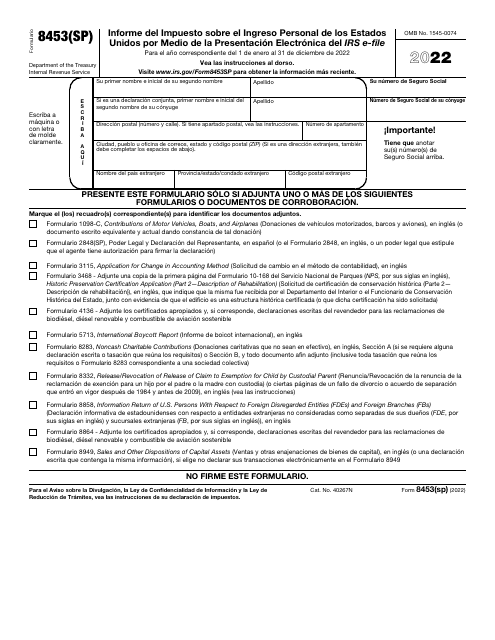

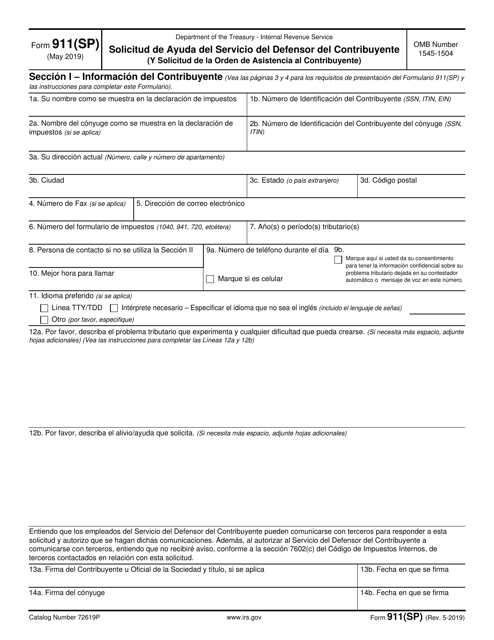

This document is used for requesting assistance from the Taxpayer Advocate Service and for filing a request for the Order of Taxpayer Assistance. (In Spanish)

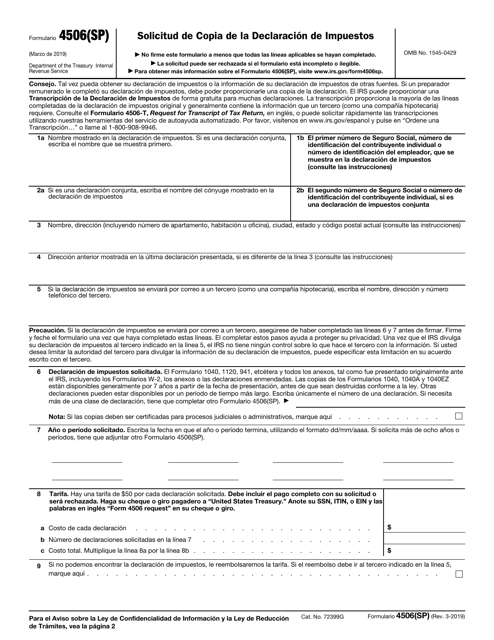

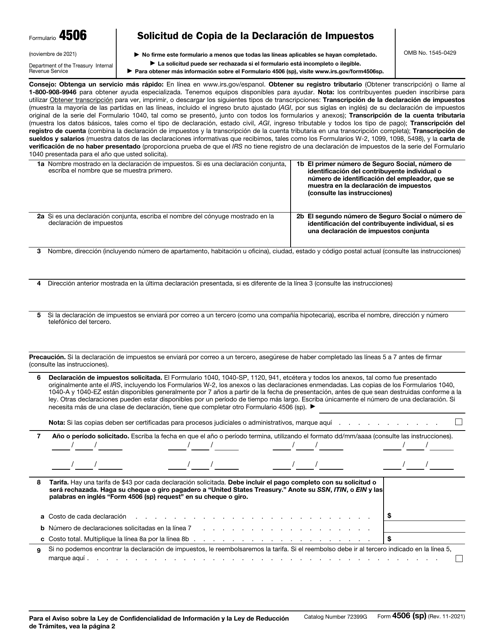

This document is used for requesting a copy of your tax return in Spanish.

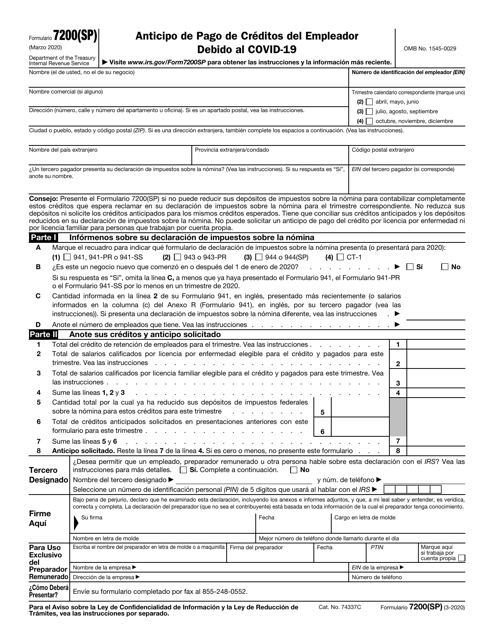

This Form is used for requesting an advance payment of employer credits due to Covid-19.

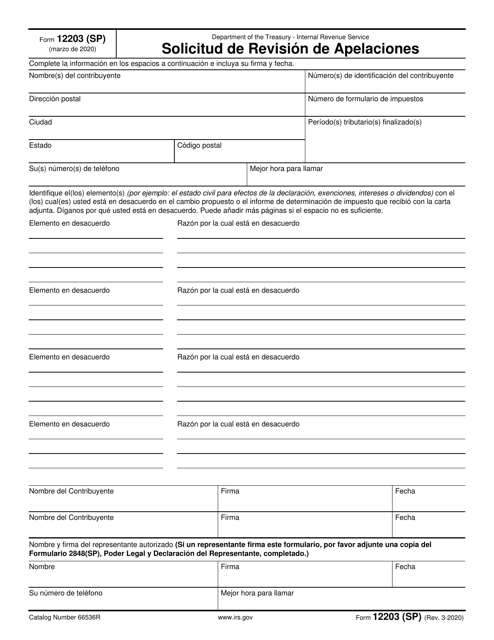

This type of document is an IRS Form used for requesting a review of appeals in Spanish language.

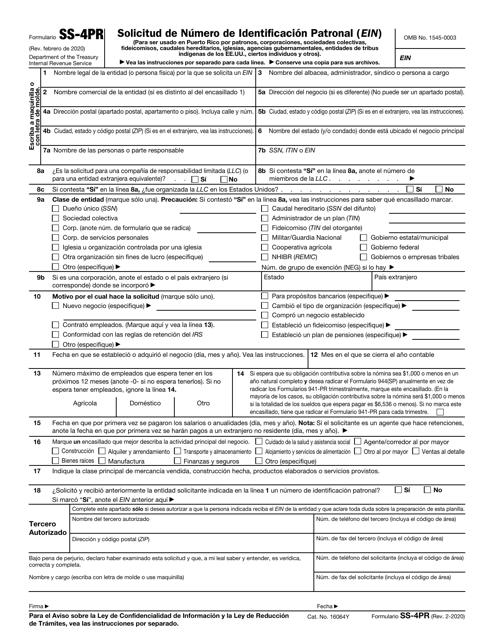

This Form is used for applying for an Employer Identification Number (EIN) for businesses located in Puerto Rico. It is written in Spanish.

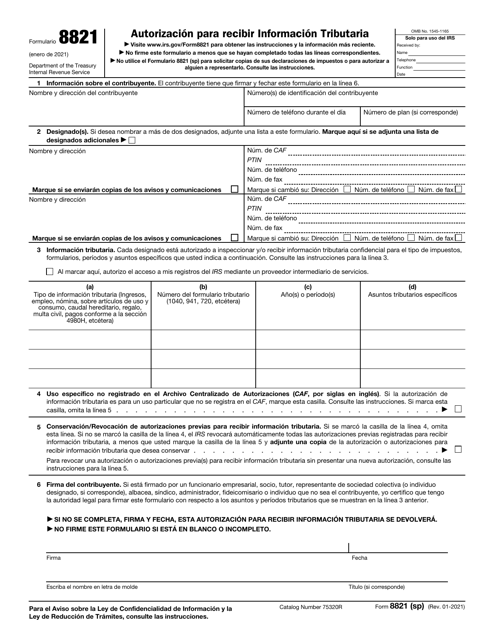

This Form is used for granting authorization to receive tax information.

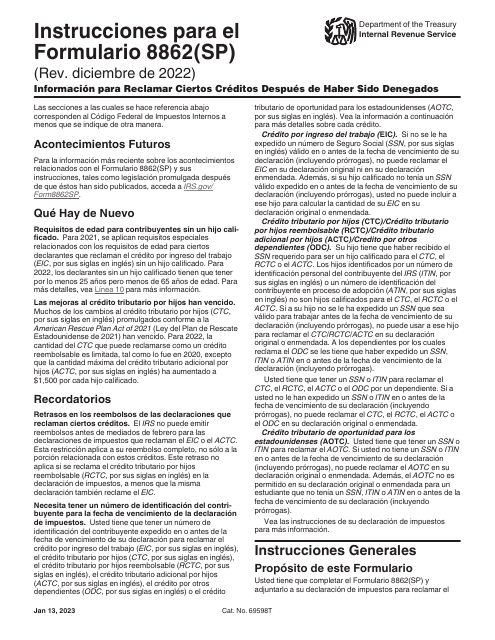

This Form is used for claiming the Earned Income Tax Credit (EITC) on your tax return. It is available in Spanish and is used to calculate the amount of the credit you may be eligible for.

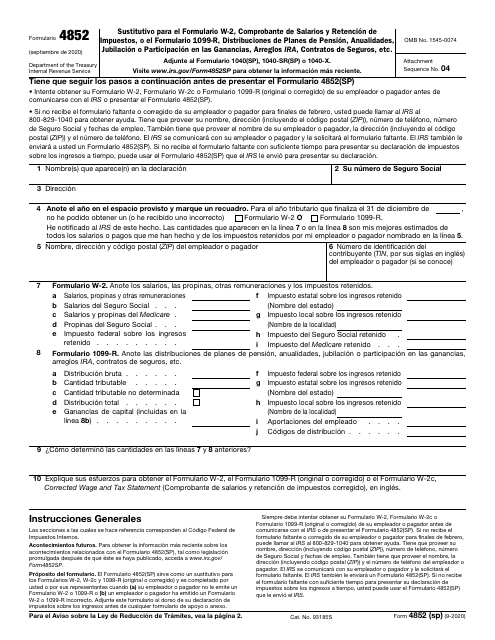

This Form is used for reporting wages and tax withholdings. It can also be used for reporting pension distributions, annuities, retirement income, IRA arrangements, insurance contracts, etc.

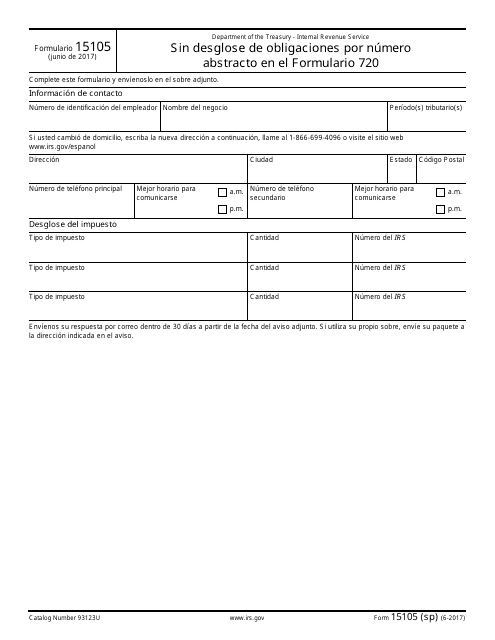

This document is a Spanish version of IRS Form 15105 (SP) used for reporting abstract number obligations on Form 720 without itemizing them.

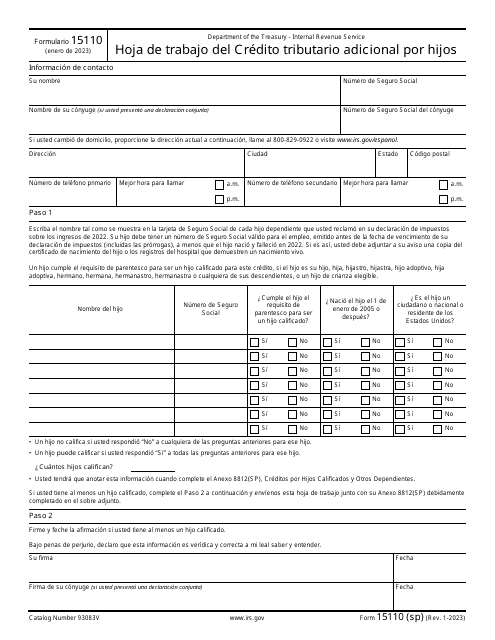

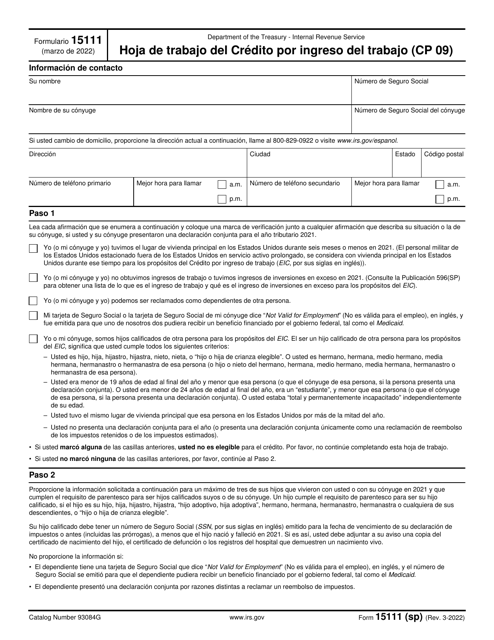

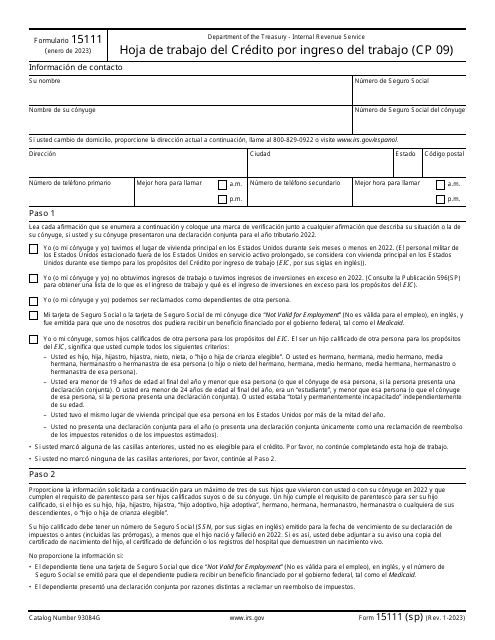

This document is a Spanish version of IRS Form 15111 (SP), which is used for calculating the Earned Income Credit.

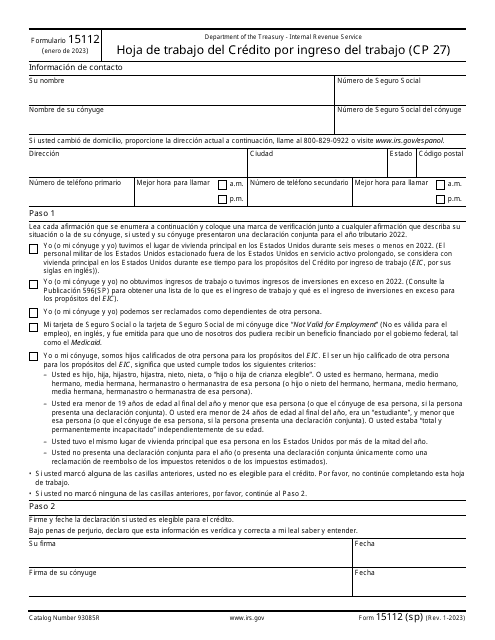

This document is a Spanish version of IRS Form 15112 (SP) and is used for the Worksheet for the Earned Income Credit (CP 27). It is used to calculate and claim the Earned Income Credit, a tax credit for low to moderate-income individuals and families.