Limited Liability Company Templates

Documents:

658

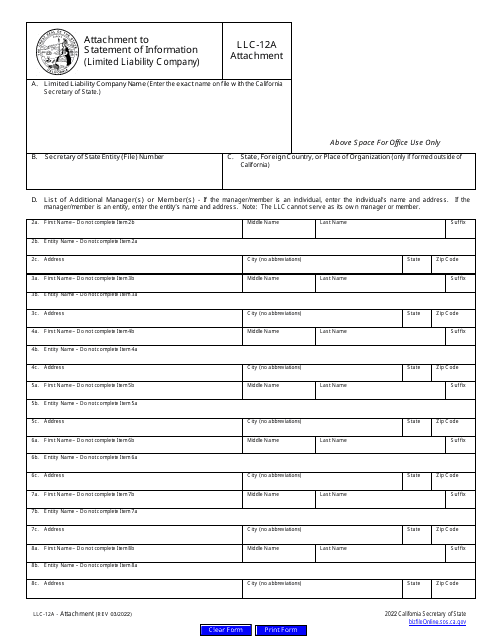

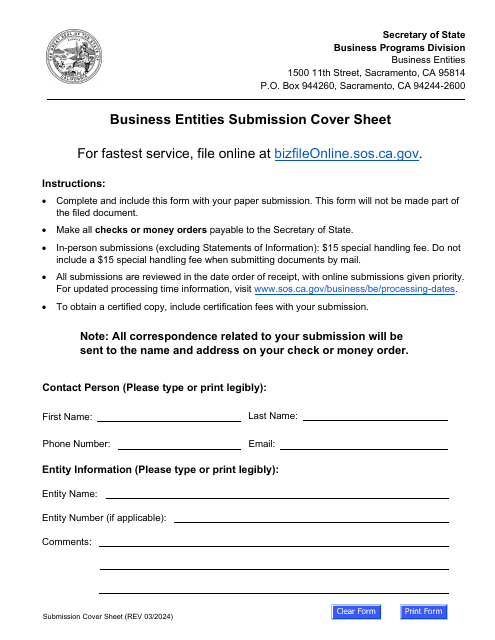

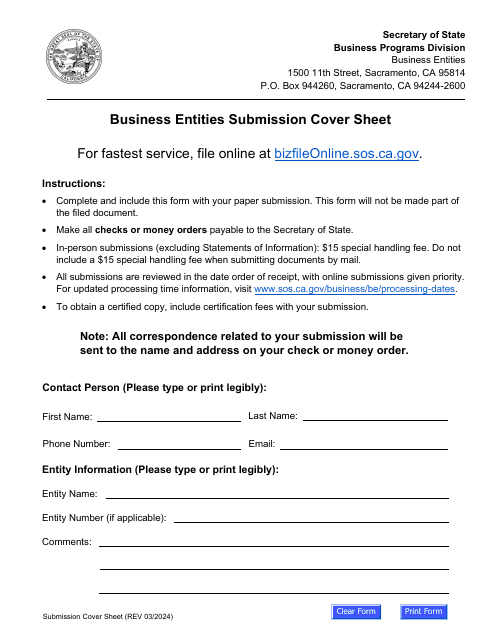

This is an official document that all California limited liability companies may use to report important details about the managers and addresses of their business.

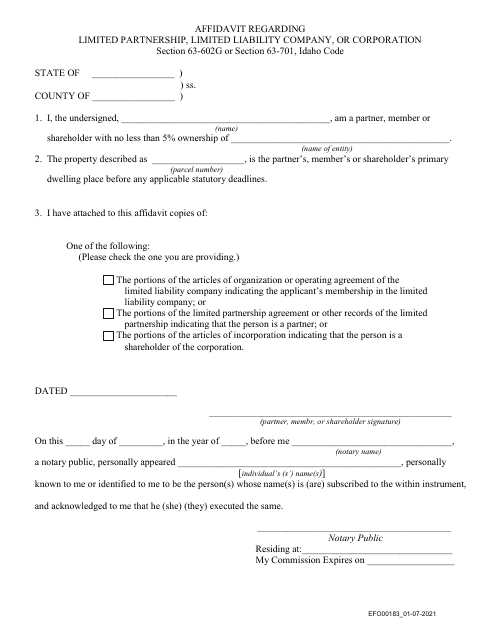

This form is used for submitting an affidavit relating to a limited partnership, limited liability company, or corporation in the state of Idaho. It is necessary for providing specific information and declarations regarding the entity in question.

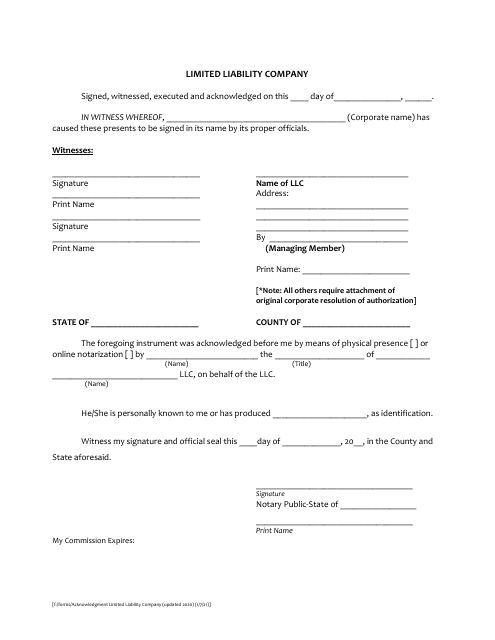

This document acknowledges the formation of a Limited Liability Company (LLC) in Miami-Dade County, Florida and protects members from personal liability for the company's debts or obligations.

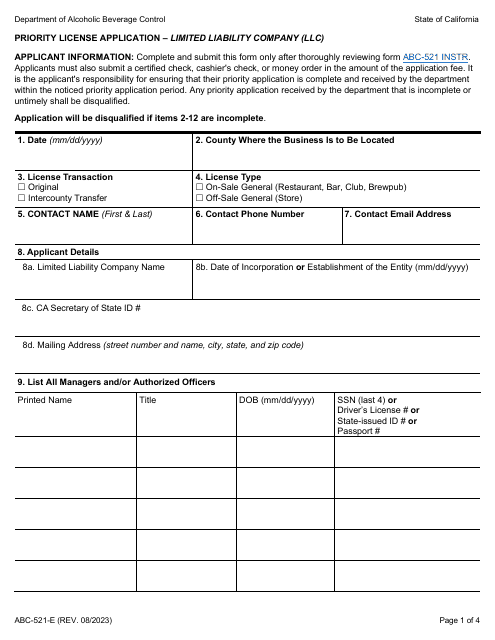

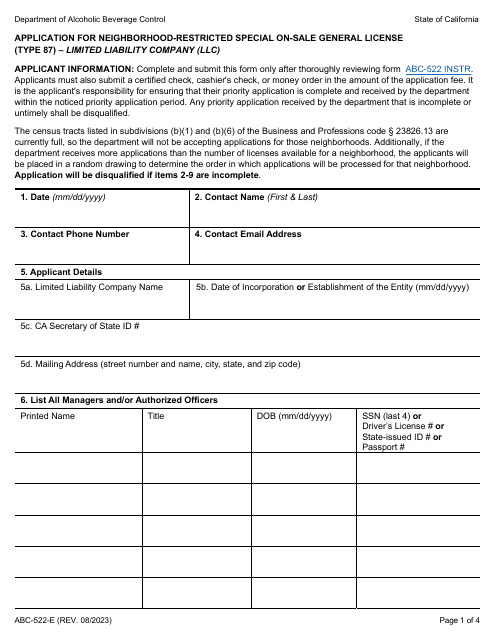

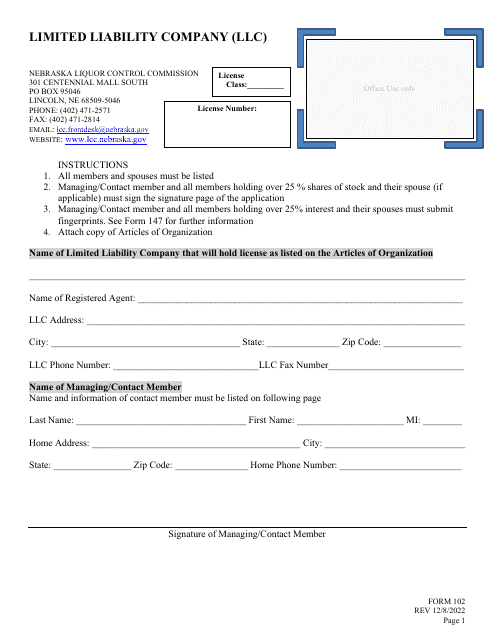

This form is used for applying for a liquor license as a Limited Liability Company (LLC) in the state of Nebraska.

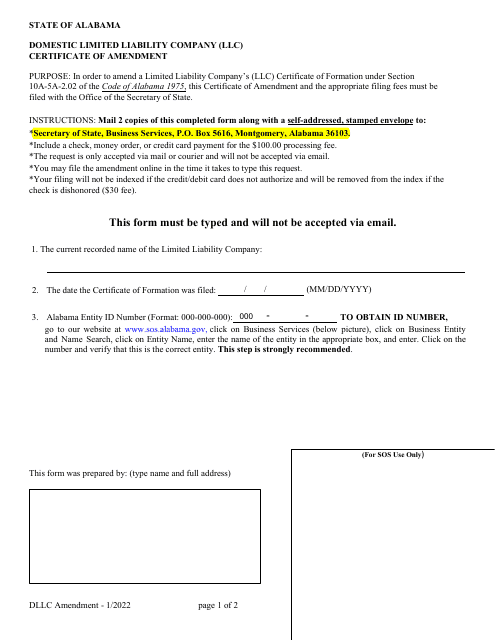

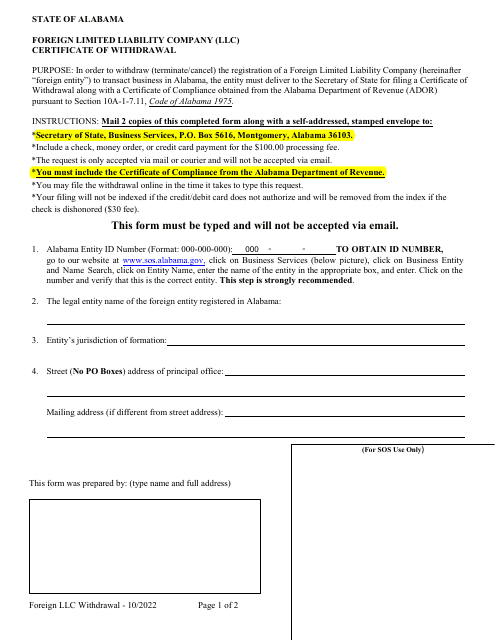

This document is used for amending the information of a Domestic Limited Liability Company (LLC) in the state of Alabama.

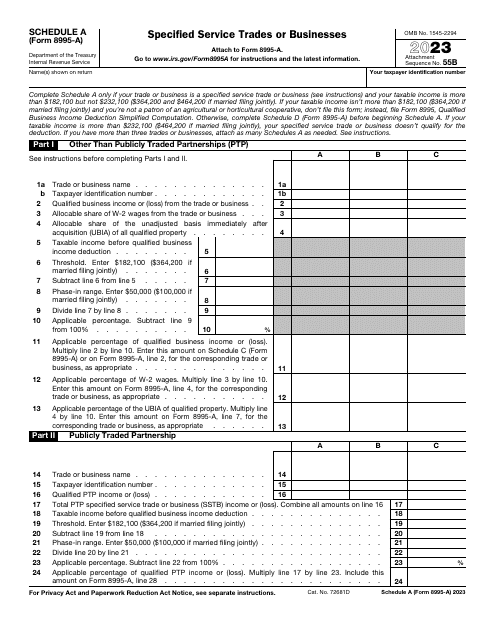

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

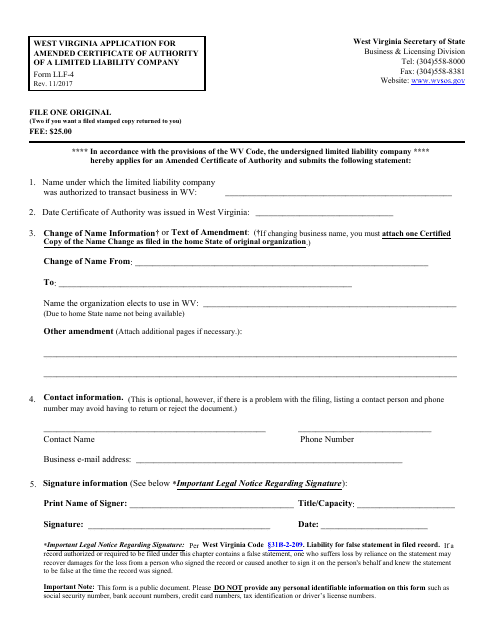

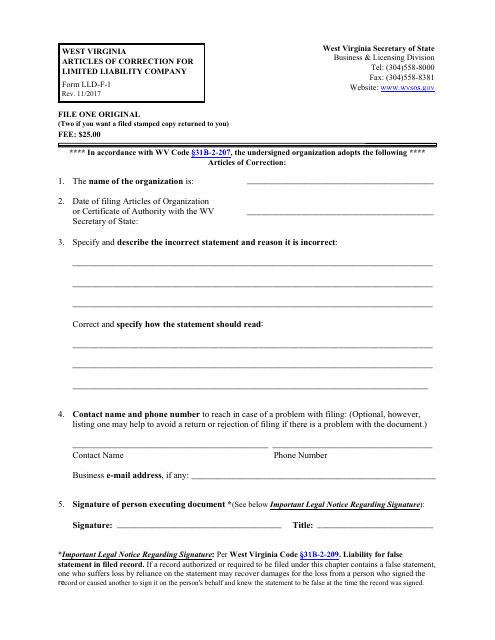

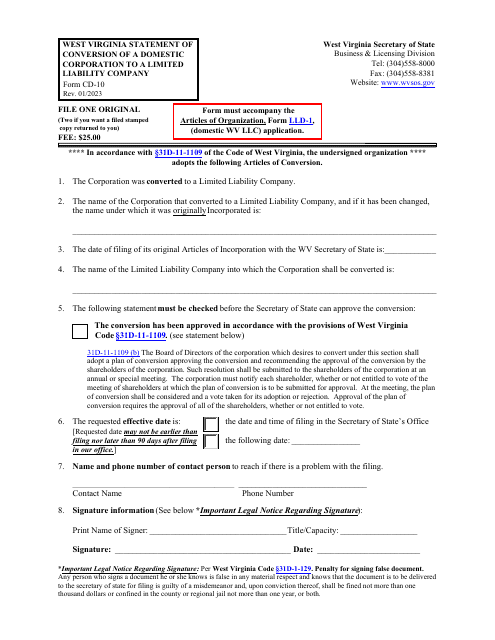

This Form is used for applying to amend the certificate of authority of a limited liability company in the state of West Virginia.

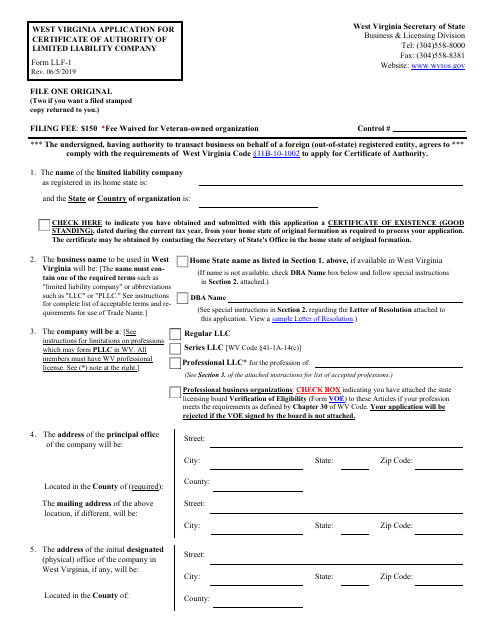

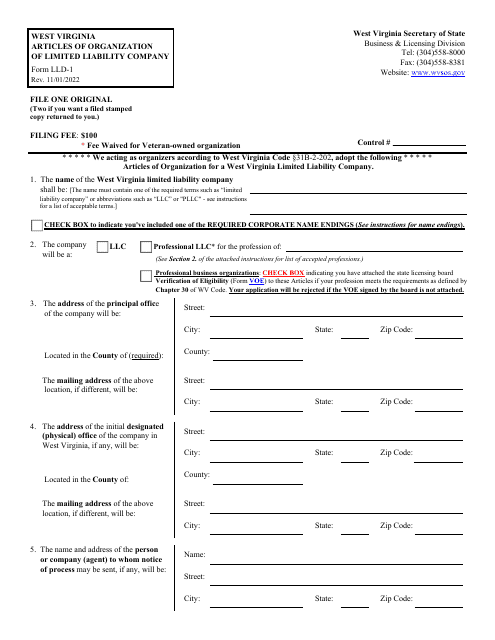

This document is used for applying for a certificate of authority for a limited liability company in the state of West Virginia.

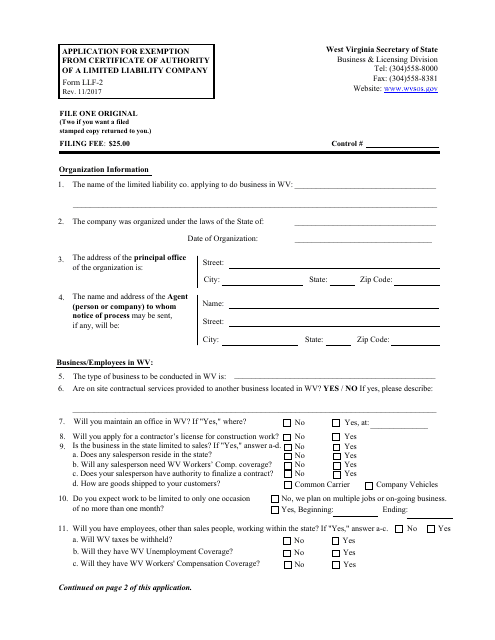

This document is used to apply for an exemption from the Certificate of Authority requirement for a Limited Liability Company (LLC) in West Virginia.

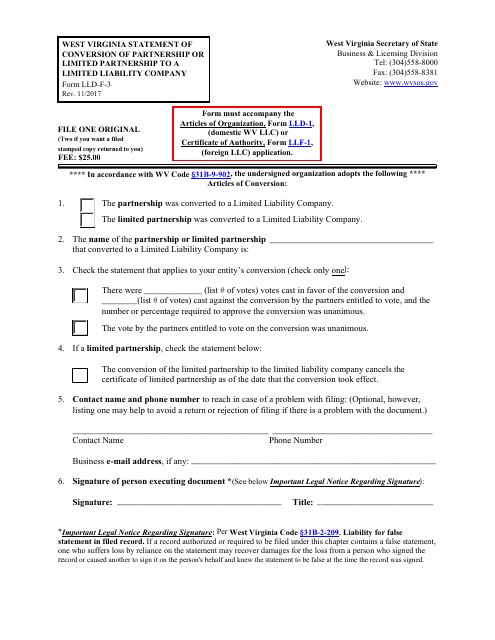

This Form is used for converting a partnership or limited partnership to a limited liability company in the state of West Virginia.

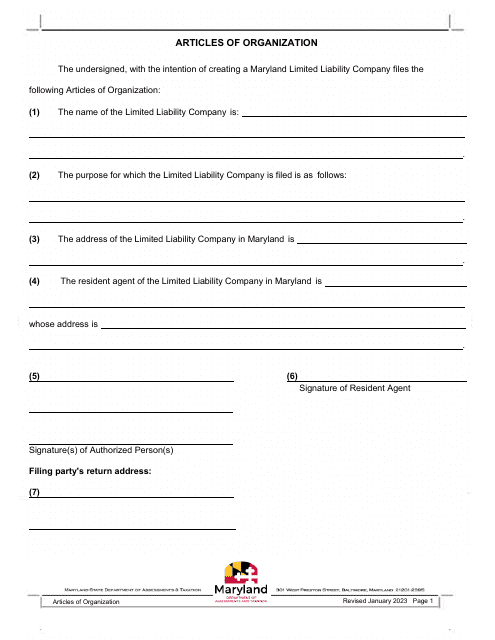

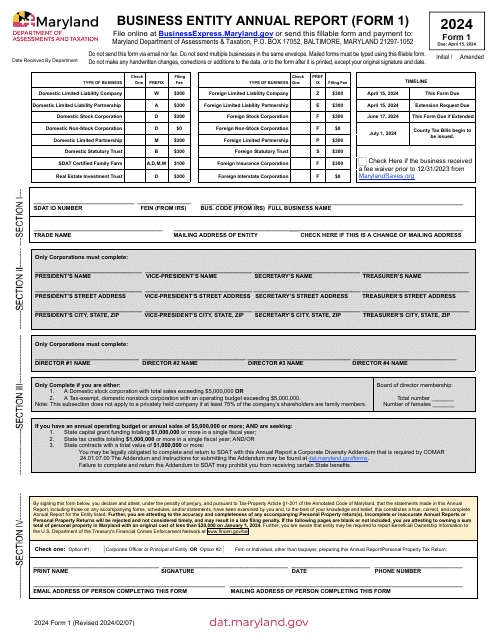

This document is used for forming a limited liability company (LLC) in the state of Maryland. It outlines the organization's name, address, purpose, management structure, and other key details.

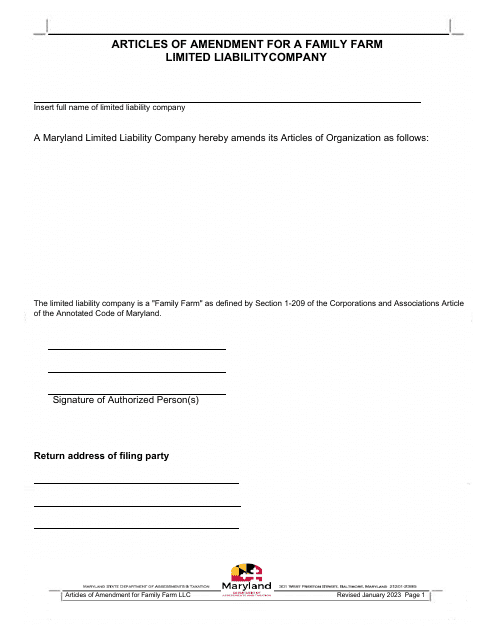

This form is used for making changes to the articles of a family farm limited liability company in Maryland. It is used to update important information such as the company's name, address, or registered agent.

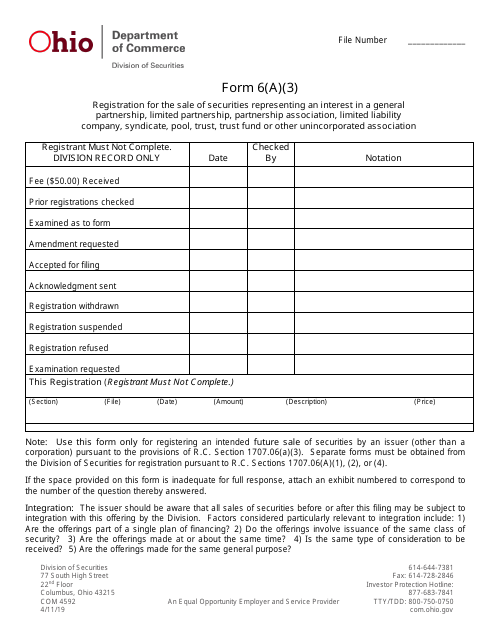

This document is for registering the sale of securities representing an interest in various types of unincorporated associations, such as partnerships, limited liability companies, and trusts in the state of Ohio.

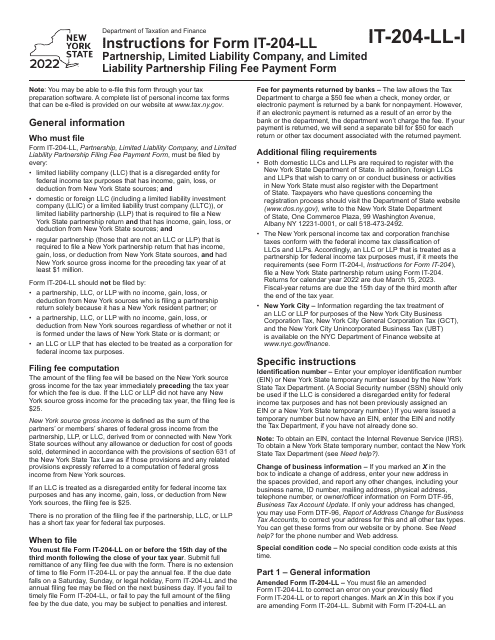

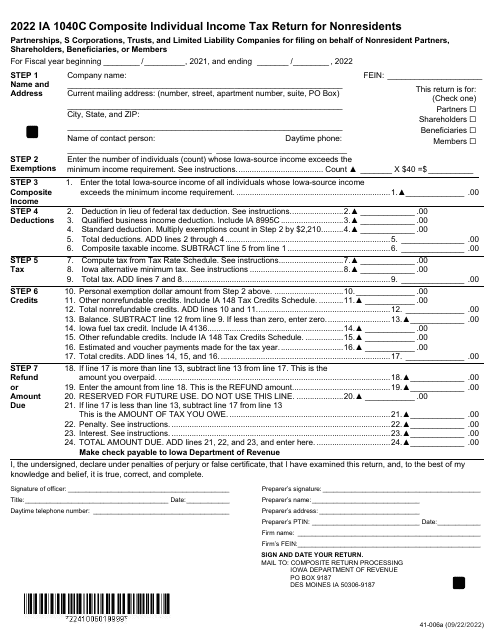

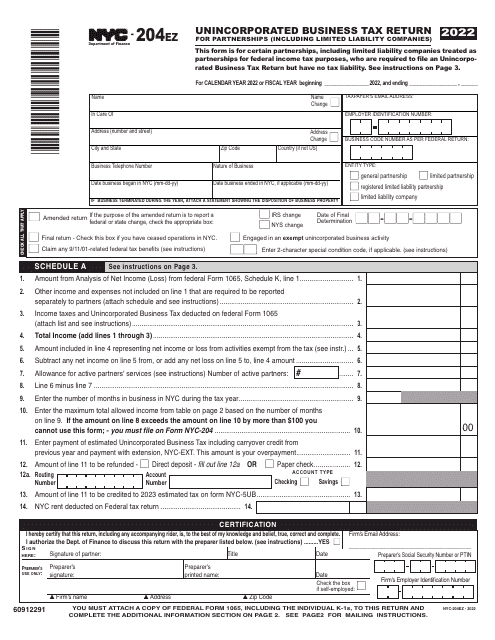

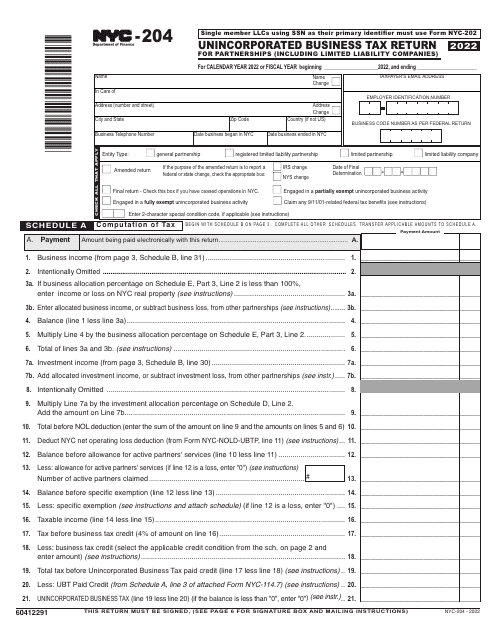

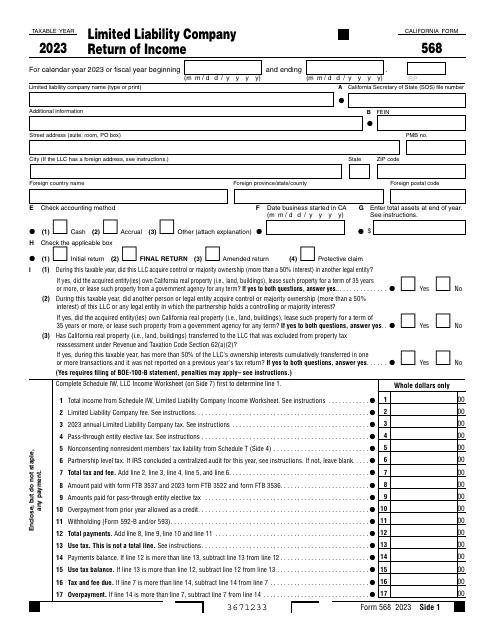

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.