Bond Insurance Templates

Bond insurance, also known as insurance bond or surety bond, provides financial protection and security for various entities involved in the bond market. This type of insurance helps mitigate risks and ensures that the obligations outlined in a bond are fulfilled.

Whether you are a contractor, an insurance or guarantee company, a third party administrator, or an insurance agency, bond insurance offers you peace of mind and safeguards against potential losses. It acts as a guarantee, assuring that the terms and conditions of the bond will be met.

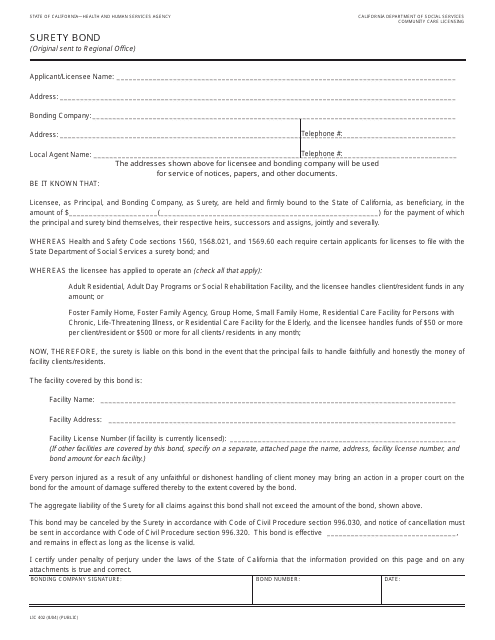

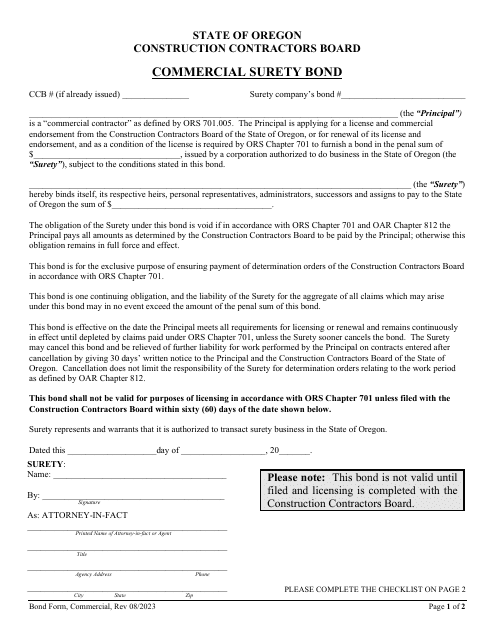

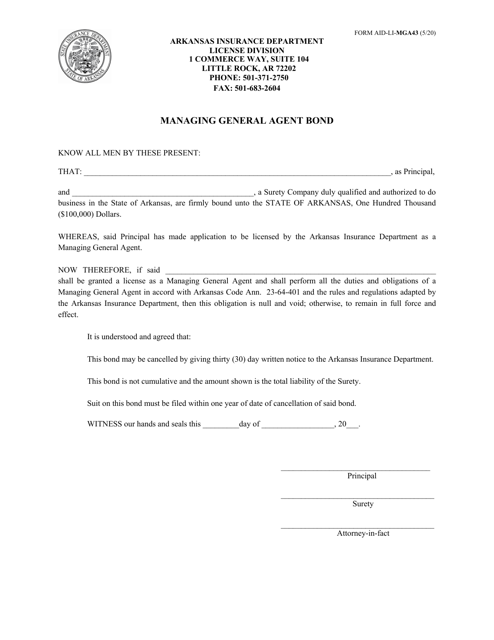

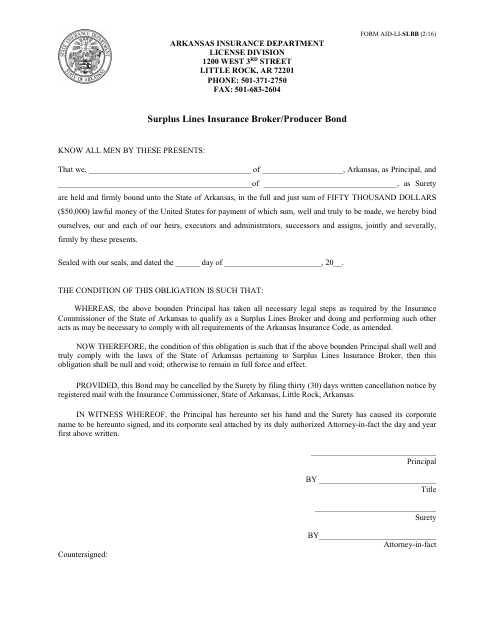

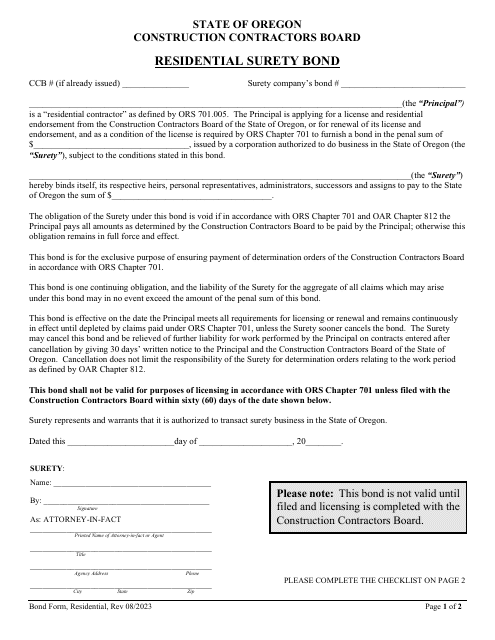

For businesses and individuals operating in various locations such as California, Arkansas, Ontario (Canada), Texas, and Oregon, bond insurance helps meet the specific requirements and regulations set forth in those regions. Each jurisdiction may have its own forms and processes, like the Form LIC-402 Surety Bond in California or the Residential Surety Bond in Oregon.

When it comes to bond insurance, having the right coverage is crucial. It not only protects your investment or project, but it also strengthens your reputation by showcasing your commitment to fulfilling your obligations. With the peace of mind offered by bond insurance, you can focus on your business operations and forge ahead with confidence.

So, whether you refer to it as bond insurance, insurance bond, or surety bond, it plays a vital role in the bond market by ensuring the smooth execution of contracts and providing financial security to all involved parties. Protect your investment and secure your future with bond insurance.

Documents:

28

This Form is used for obtaining a surety bond in California. Surety bonds are a type of insurance that provides financial protection in case the party being bonded fails to fulfill their obligations. This document is required for various business activities in California.

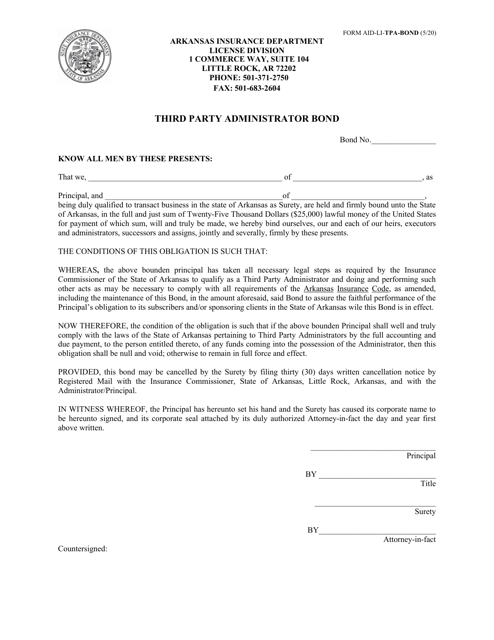

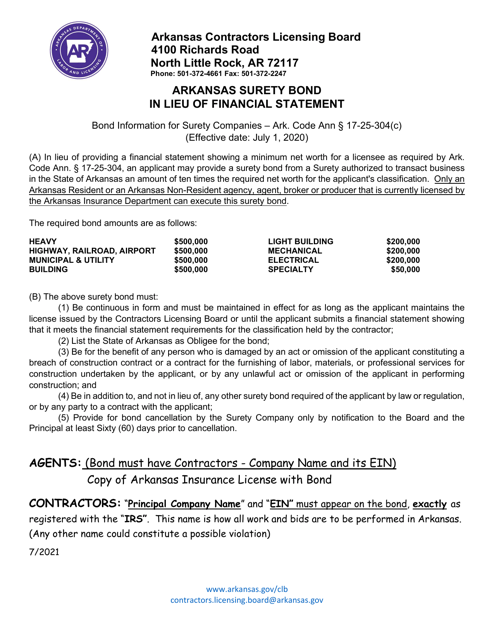

This form is used for obtaining a surplus lines insurance broker/producer bond in the state of Arkansas. The bond is required for individuals or businesses engaged in the surplus lines insurance industry to ensure compliance with state regulations.

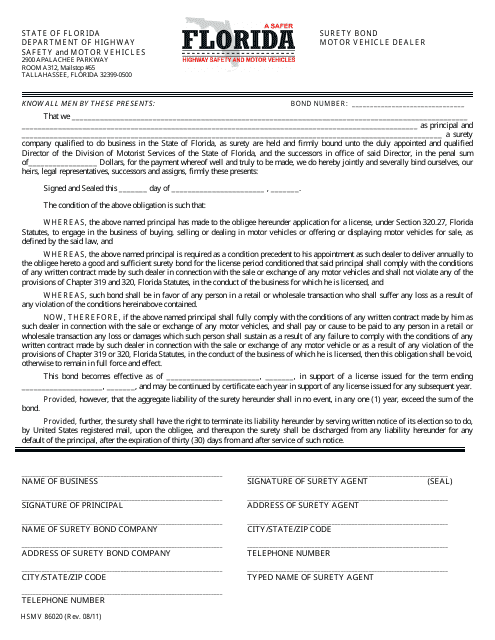

This form is used for obtaining a surety bond as a motor vehicle dealer in Florida. It helps ensure financial responsibility and compliance with licensing requirements.

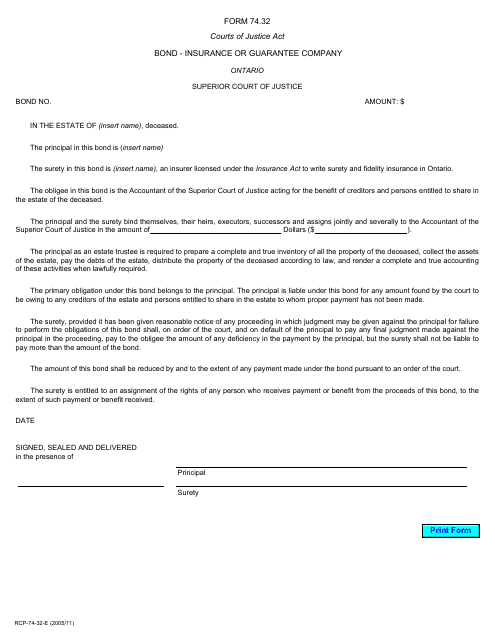

This Form is used for creating a bond by an insurance or guarantee company in Ontario, Canada.

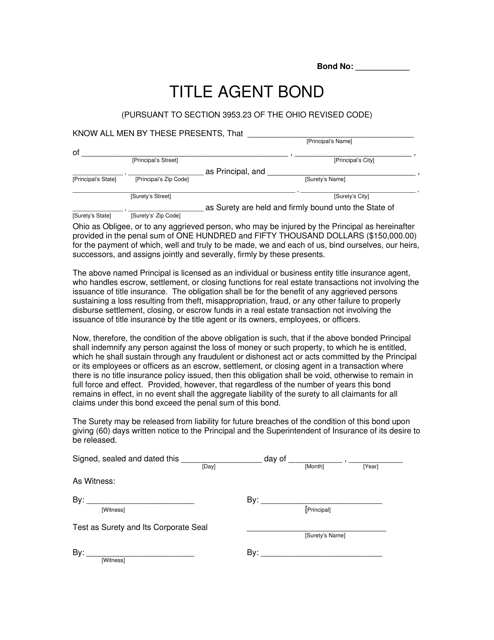

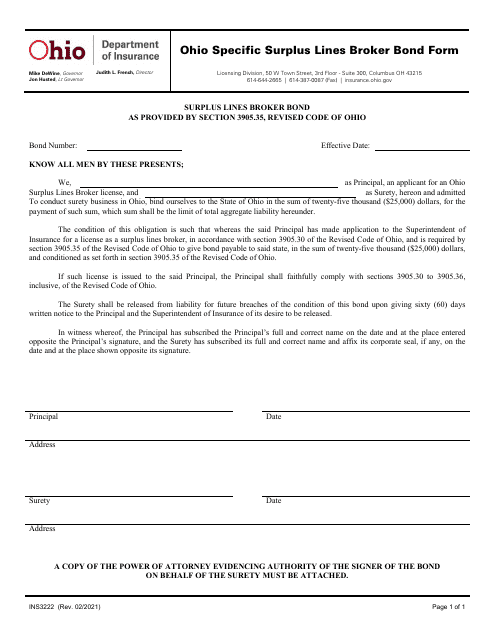

This document is used for obtaining an agent bond in the state of Ohio.

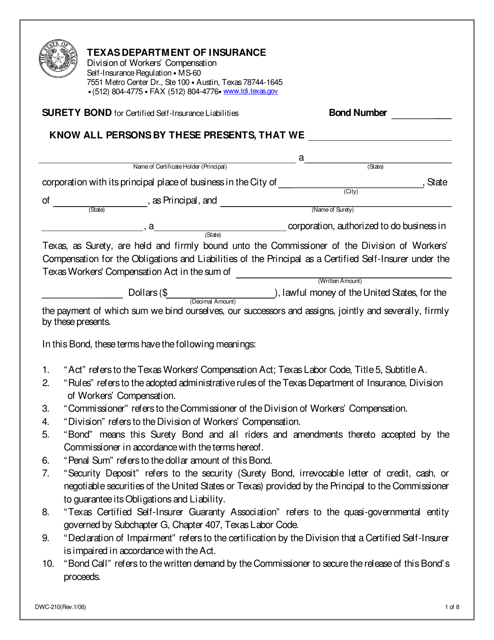

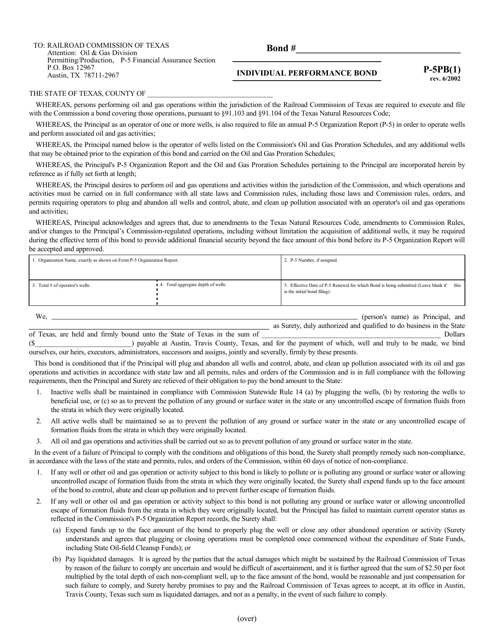

This Form is used for obtaining a surety bond to cover certified self-insurance liabilities in the state of Texas.

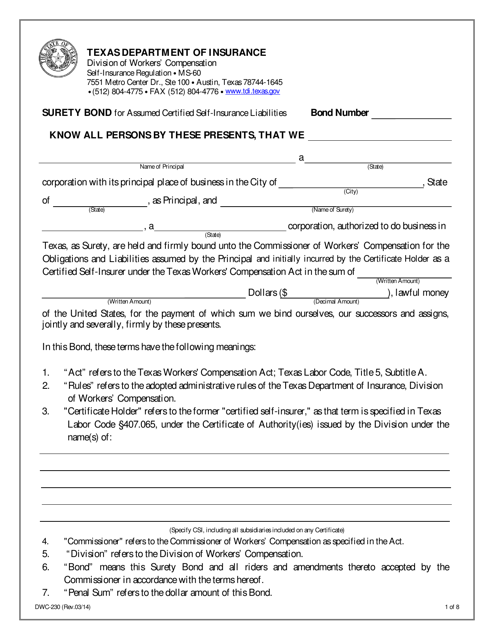

This form is used for obtaining a surety bond to cover assumed certified self-insurance liabilities in the state of Texas.

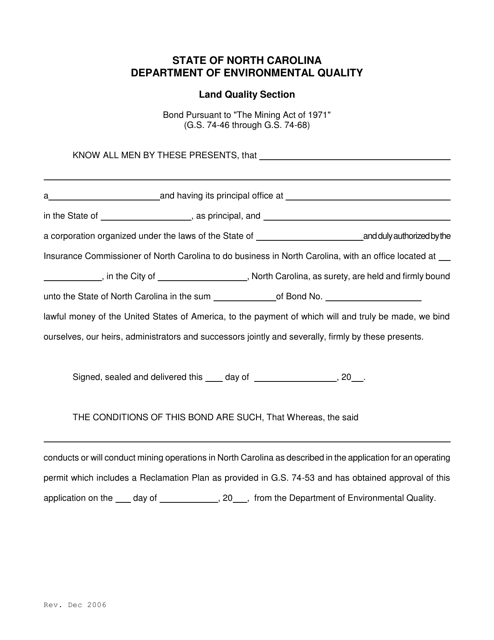

This document is a type of bond used in North Carolina. It serves as a guarantee that the bonded party will fulfill their obligations.

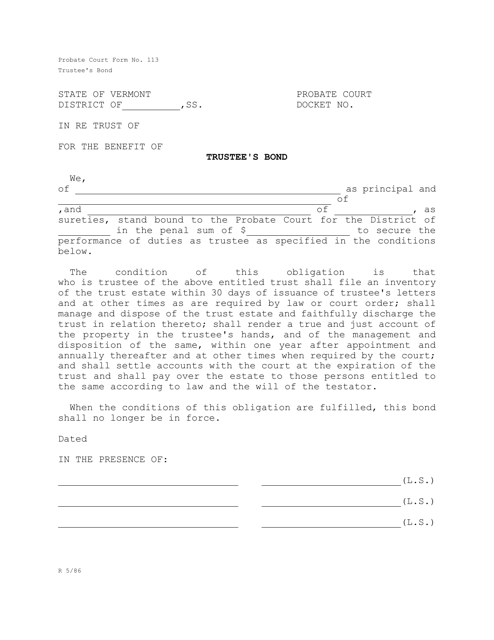

This form is used for obtaining a trustee's bond in the state of Vermont. It is a legal document that ensures the responsible and trustworthy management of assets by a trustee.

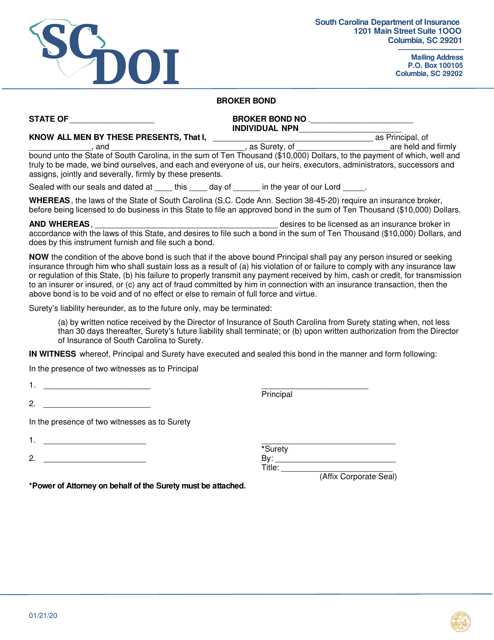

This type of document is a surety bond required for brokers in South Carolina. It provides financial protection to clients in case the broker fails to fulfill their obligations.

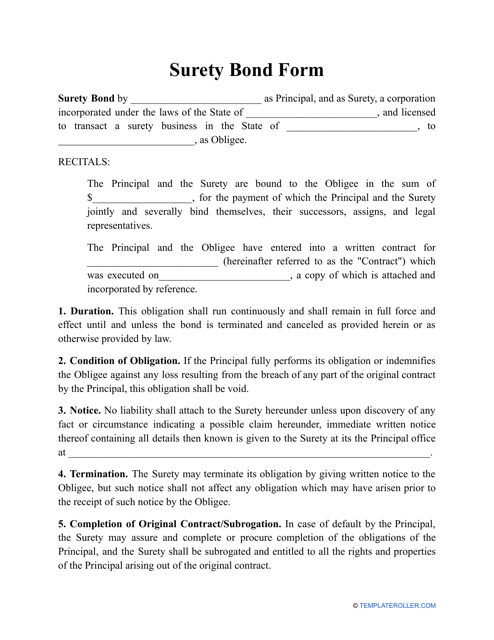

This bond obligates the principal to perform some kind of work for the obligee, and the third party promises to compensate the obligee if the principal fails to comply with their responsibilities.

This form is used for obtaining an individual performance bond in Texas.

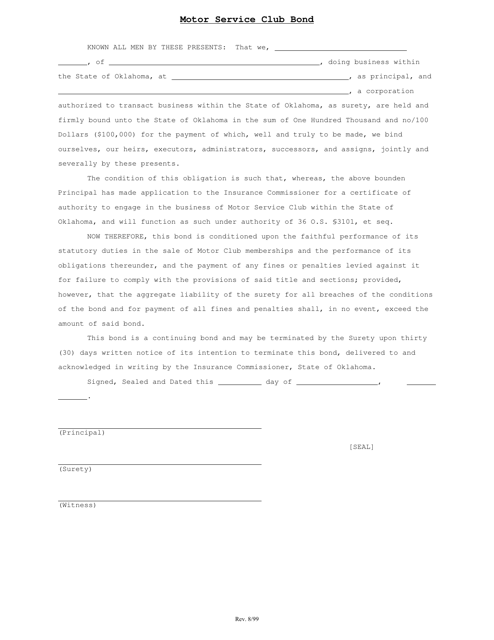

This document is a bond specifically for motor service clubs in the state of Oklahoma. It ensures that these clubs comply with relevant regulations and provide the services they offer to their members.

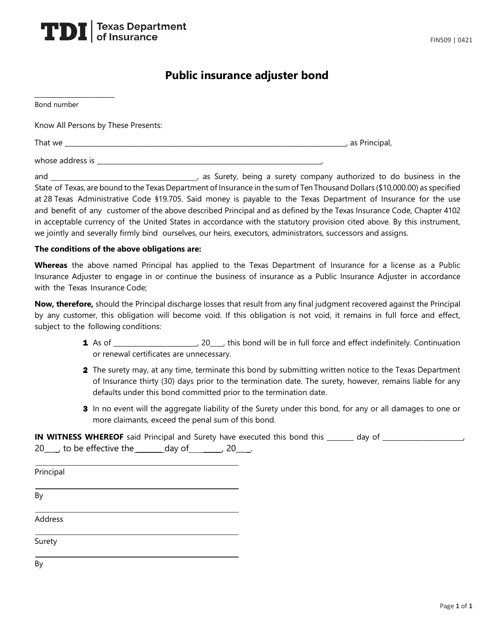

This document is used for obtaining a surety bond for public insurance adjusters in Nebraska.

This document is a bond required for third-party administrators in the Virgin Islands. It provides financial protection in the event that the administrator fails to fulfill their duties.

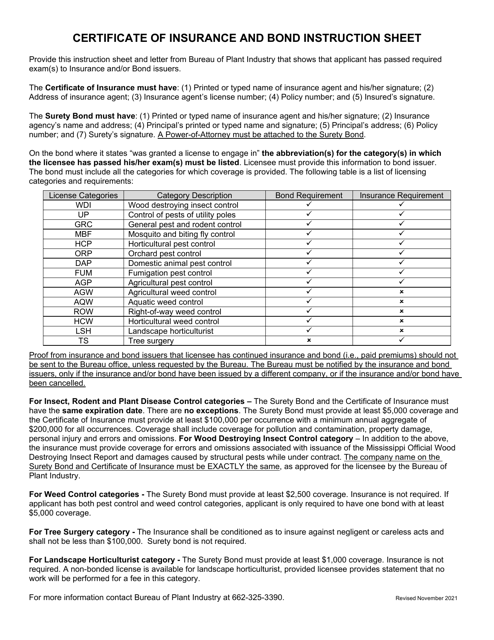

This type of document, called a Surety Bond, is used in Mississippi as a financial agreement between three parties: the principal, the surety, and the obligee. The bond guarantees that the principal will fulfill their obligations according to the terms agreed upon.