Adjustment Worksheet Templates

An adjustment worksheet, also known as a balance sheet adjustment template or financial statement adjustment form, is a useful tool for businesses and individuals to track and calculate financial adjustments. This document group includes various forms and templates that make it easy to accurately record and analyze adjustments to financial statements.

Adjustment worksheets are commonly used by businesses to make corrections or updates to their financial data. These worksheets help in the identification and calculation of adjustments such as depreciation expenses, amortization, accruals, and prepayments. By using an adjustment worksheet, businesses can ensure that their financial statements accurately reflect the current financial condition of the company.

For individuals, an adjustment worksheet can be beneficial when preparing personal income tax returns or applying for financial assistance. These worksheets help in calculating adjustments related to income, deductions, and credits, ensuring accurate reporting and potentially maximizing tax deductions or credits.

Whether you are a business owner, a financial professional, or an individual taxpayer, an adjustment worksheet can be a valuable resource. It provides a structured format and guidance to help you accurately calculate and record adjustments, ensuring the integrity of your financial statements or personal financial data.

Browse through our collection of adjustment worksheets, balance sheet adjustment templates, and financial statement adjustment forms to find the right document for your needs. Streamline your financial calculations and ensure accuracy with our easy-to-use adjustment worksheets.

Documents:

6

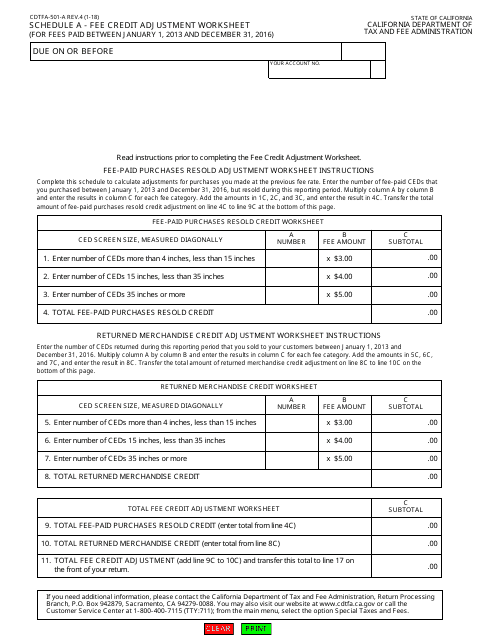

This form is used for calculating and adjusting fee credits in California.

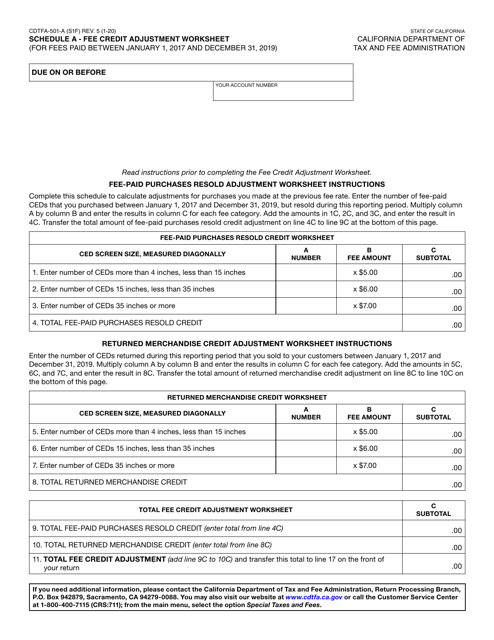

This form is used for calculating fee credit adjustments in California.

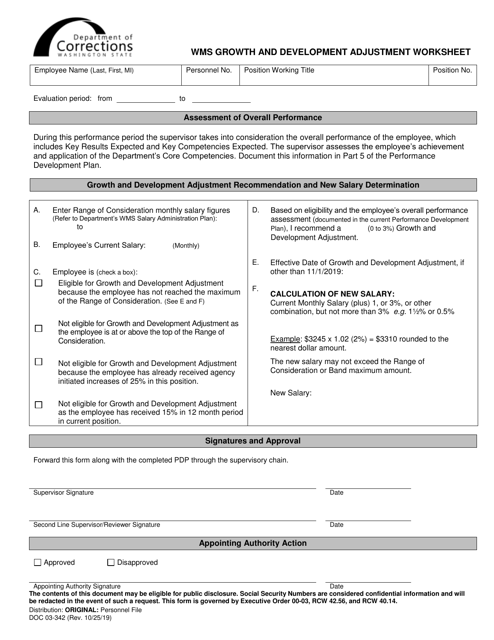

This Form is used for calculating growth and development adjustments in Washington state. It helps in assessing the changes in the value of properties over time.