Forest Product Templates

Are you in the business of harvesting or utilizing forest resources? Are you looking for information on the taxation and regulation of forest products? Look no further! Our comprehensive collection of documents related to forest products is your one-stop resource for all the information you need.

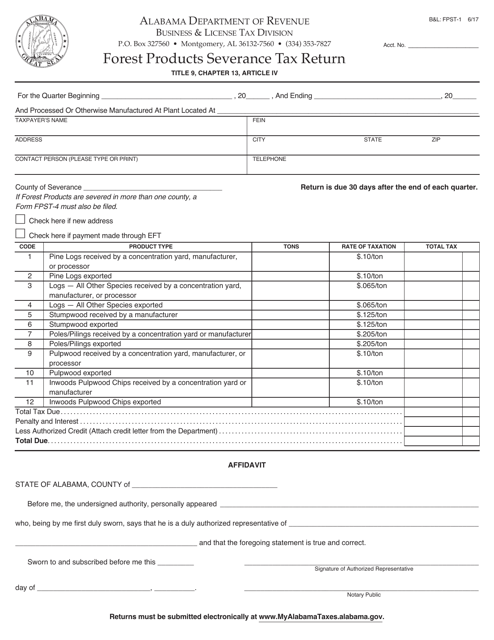

Our vast collection of documents covers various aspects of forest product management, taxation, and regulation. From tax return forms such as Form B&L: FPST-1 Forest Products Severance Tax Return to purchase journals like Form TM196 Purchase Journal of Forest Products, we have it all. Whether you operate in the United States or Canada, our collection includes relevant documents such as the Form 96-0425 Forest Products Use Fuel Refund Application for Arizona and the Special Forest Products Permit Application for Washington.

Discover everything you need to know about forest product taxation, regulation, and management. Our collection of documents, also known as forest production documents or forest products, provides valuable insights into the industry. Stay up to date with the latest regulations and ensure compliance with ease. Let us be your trusted resource for all your forest product documentation needs.

Documents:

25

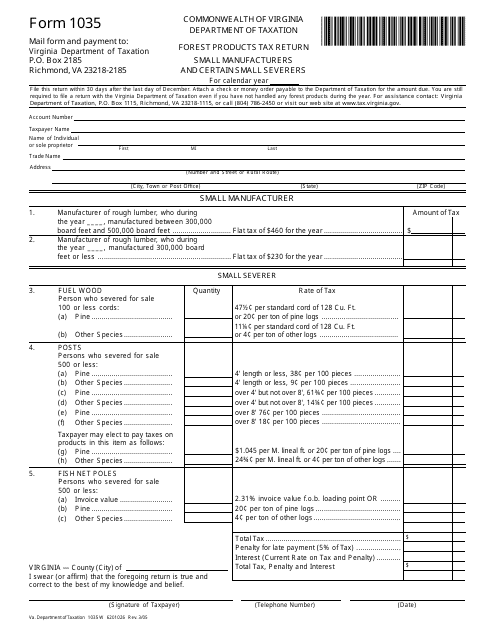

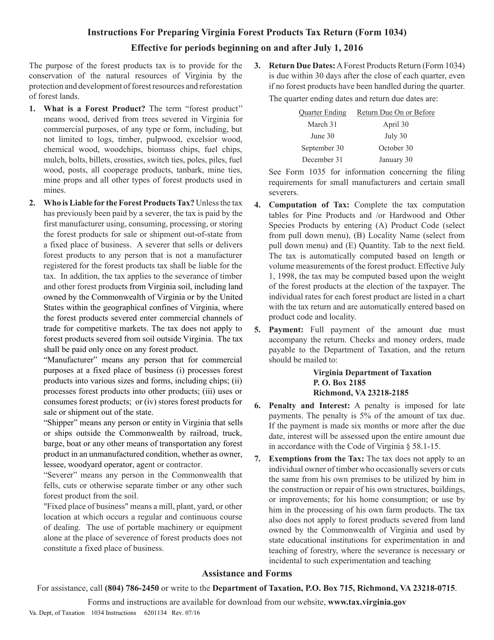

This Form is used for small manufacturers in Virginia to file their forest product tax return.

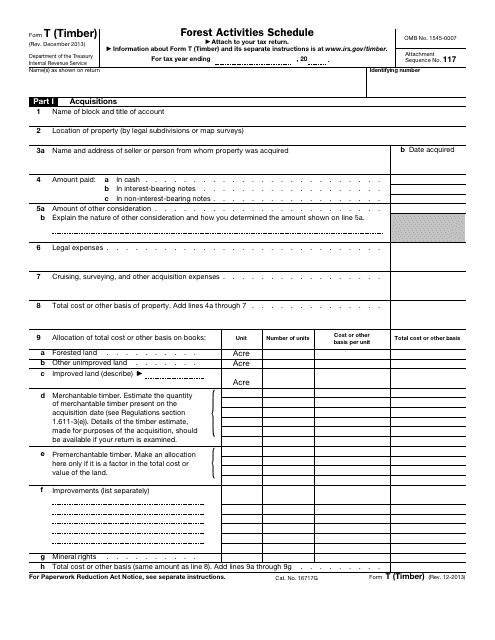

This document for reporting forest activities related to timber to the IRS.

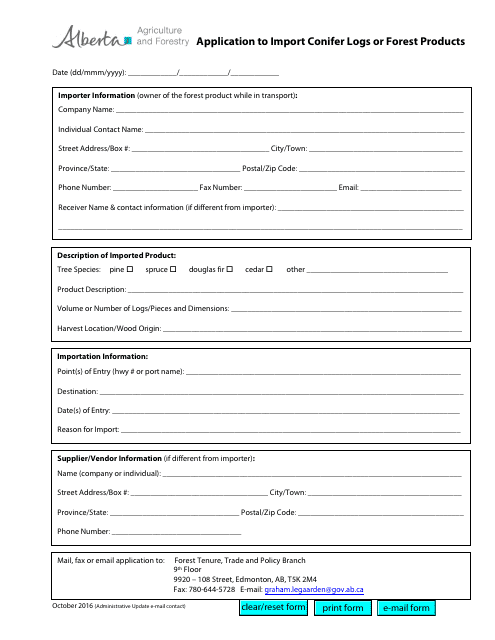

This document is an application for importing conifer logs or forest products into Alberta, Canada.

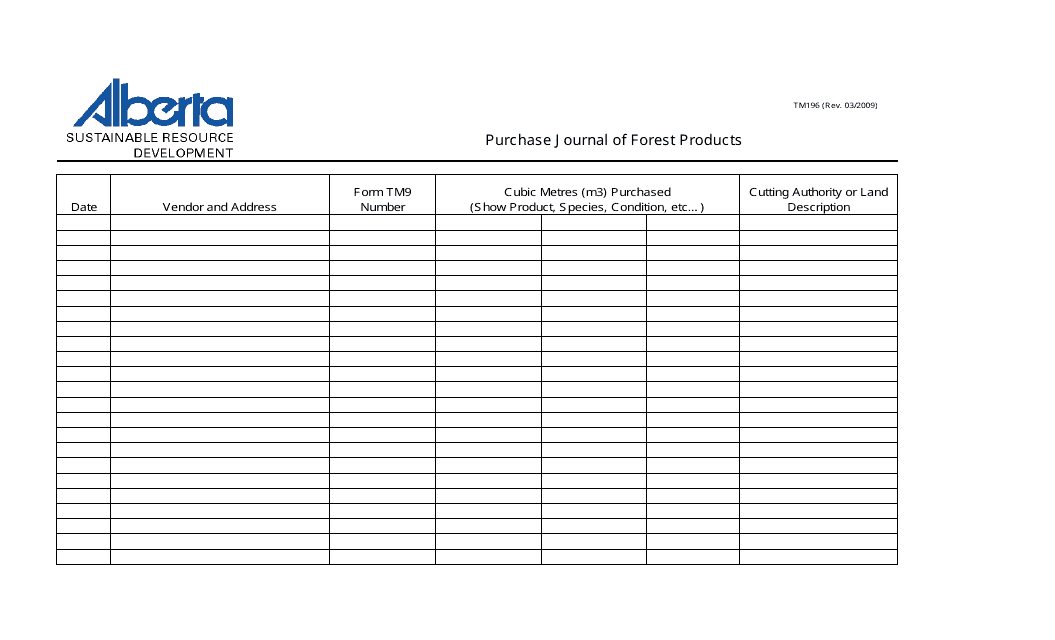

This form is used for recording the purchase details of forest products in Alberta, Canada. It helps keep track of transactions and manage inventory.

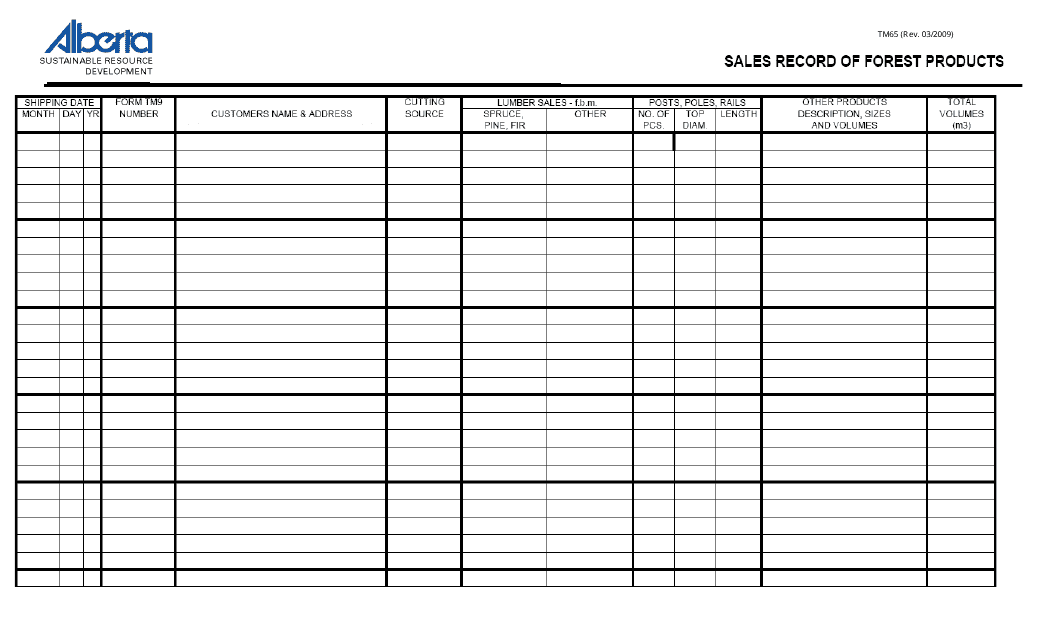

This Form is used for keeping track of sales of forest products in the province of Alberta, Canada.

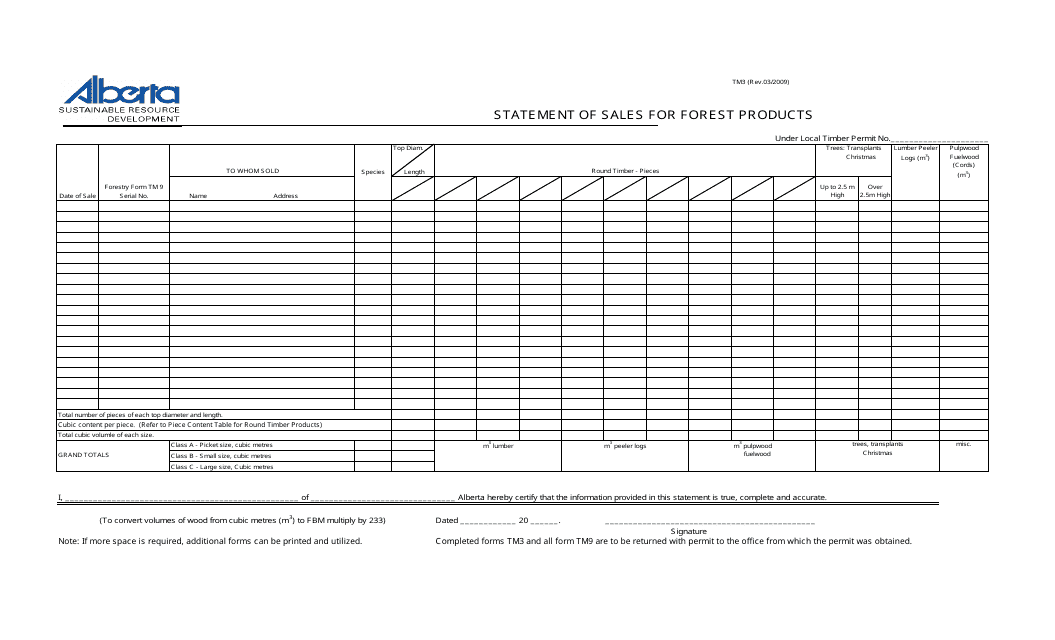

This Form is used for reporting the sales of forest products in the province of Alberta, Canada.

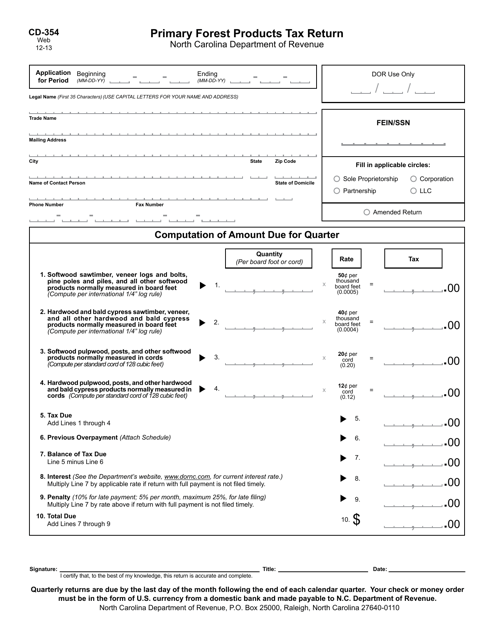

This form is used for reporting and paying taxes on primary forest products in North Carolina.

This Form is used for filing the Virginia Forest Products Tax Return in the state of Virginia. It provides instructions on how to report and pay taxes on forest products.

This form is used for filing the Forest Products Manufacturers Tax Return in Alabama. It is specifically designed for businesses in the forest products industry to report and pay their taxes.

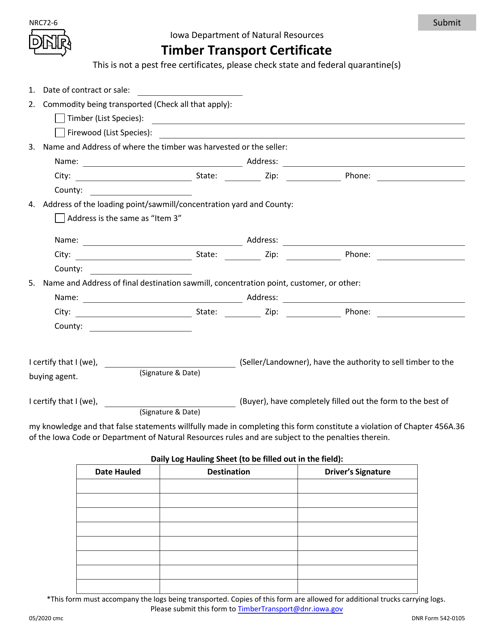

This document is used for obtaining a timber transport certificate in Iowa. It is a form that allows individuals to legally transport timber within the state.

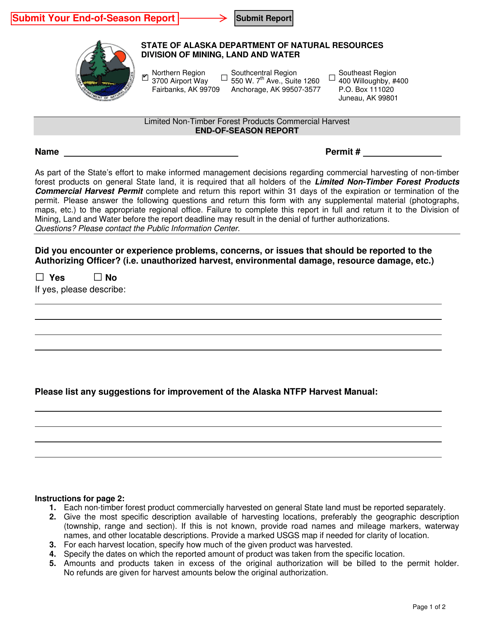

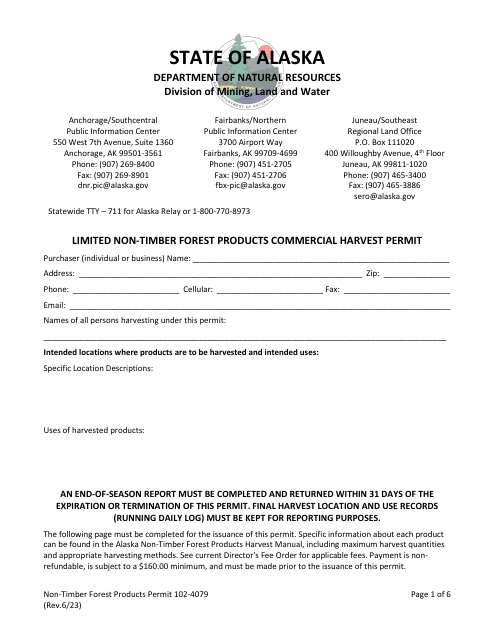

This form is used for reporting the end-of-season harvest of limited non-timber forest products in Alaska.

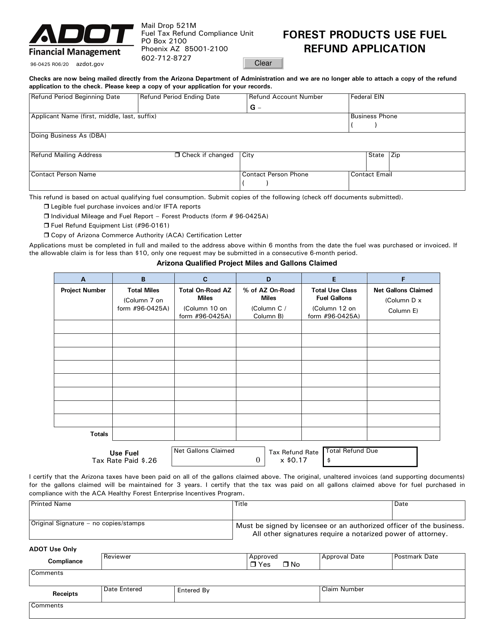

This Form is used for applying for a refund on fuel used for forest product transportation in Arizona.

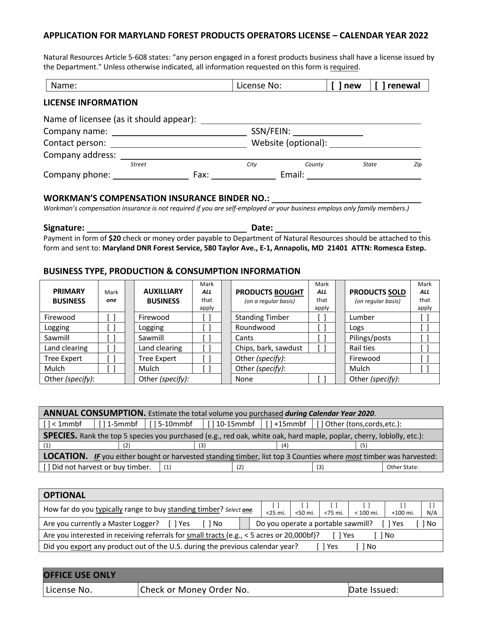

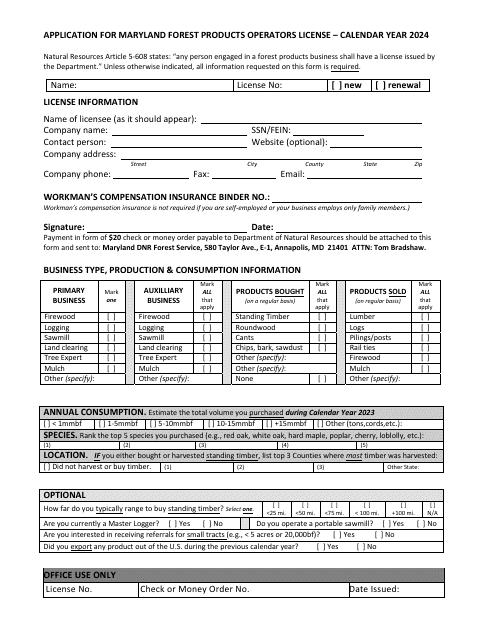

This document is used for applying for a Forest Products Operators License in the state of Maryland.

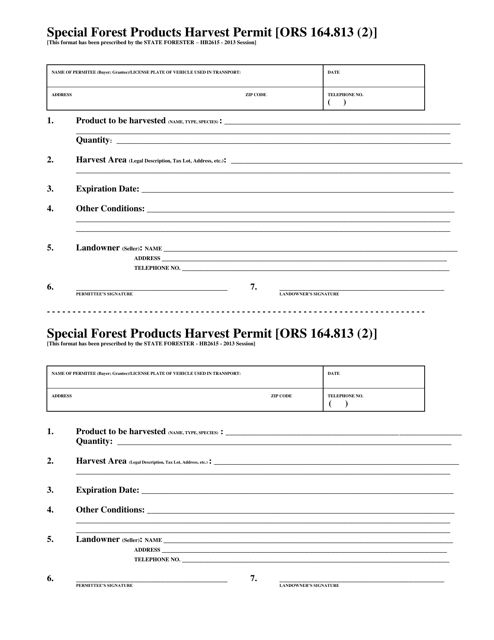

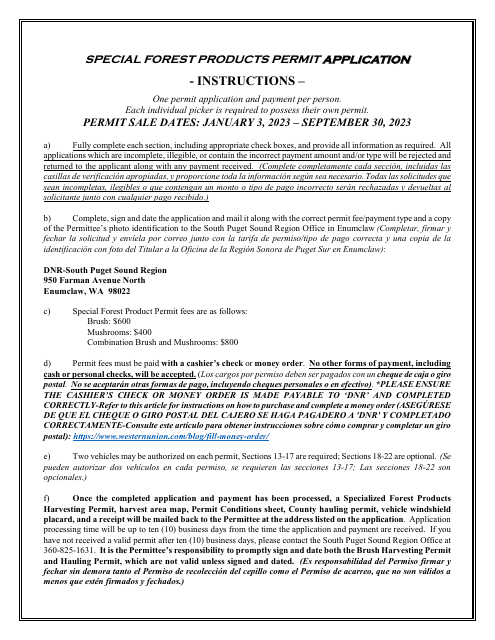

This form is used for obtaining a permit to harvest special forest products in Oregon.

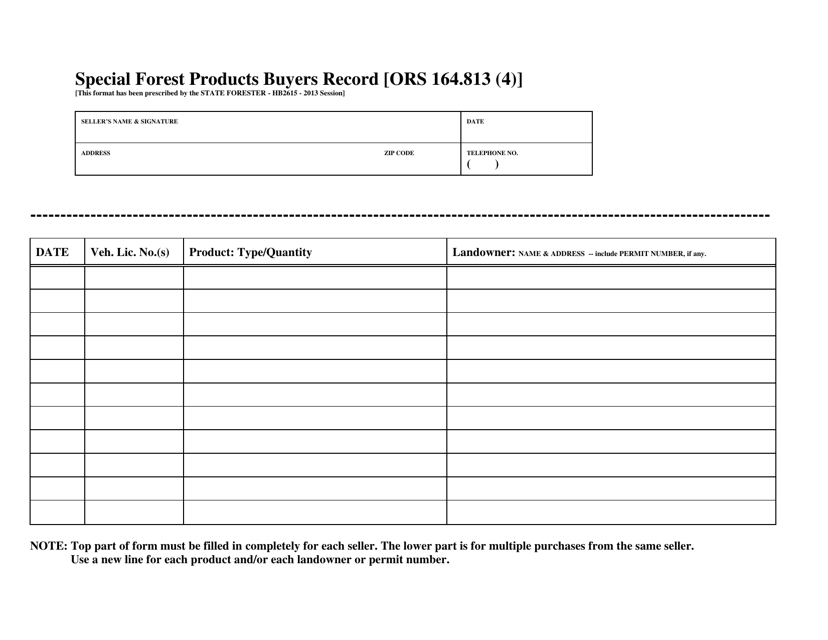

This document is used for keeping records of buyers of special forest products in Oregon.

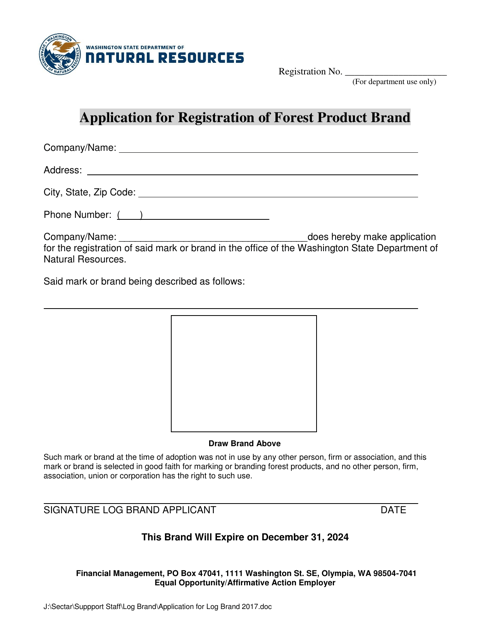

This document is used to apply for the registration of a forest product brand in Washington.

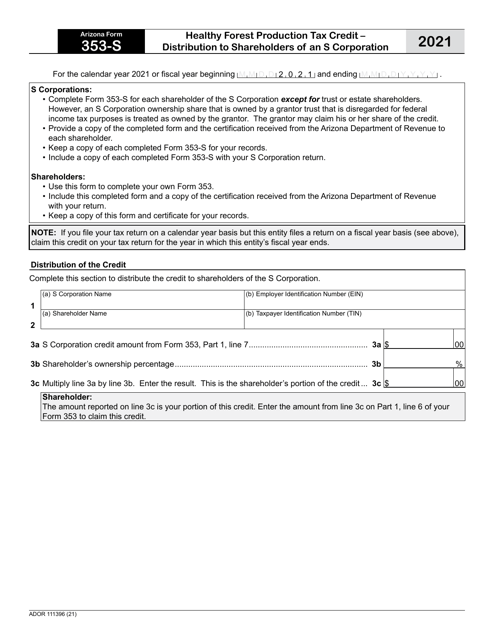

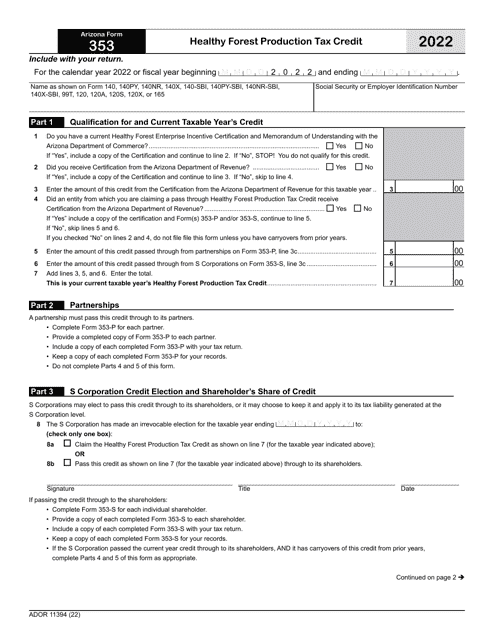

This Form is used for claiming the Healthy Forest Production Tax Credit in Arizona as a shareholder of an S Corporation.

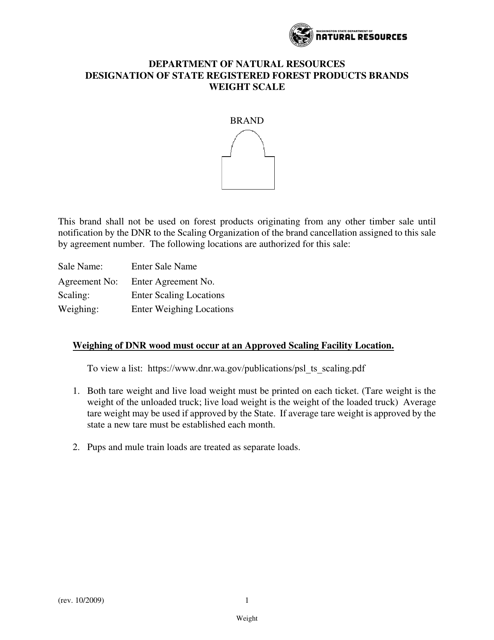

This document is used in Washington to designate the weight scale for state registered forest products brands.

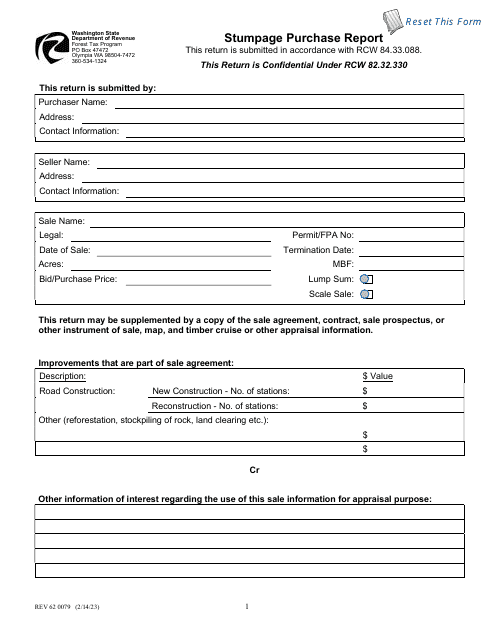

This Form is used for reporting the purchase of stumpage in Washington state. It is a necessary document for those involved in the logging industry to document and report their purchases of timber from state or private lands.