Tangible Property Templates

Are you looking for information about tangible property? Whether you call it tangible property, safekeeping, or even a bill of sale, this collection of documents is essential when it comes to managing your physical assets. From safe deposit boxes to personal property tax returns, this group of documents covers a wide range of situations related to tangible property.

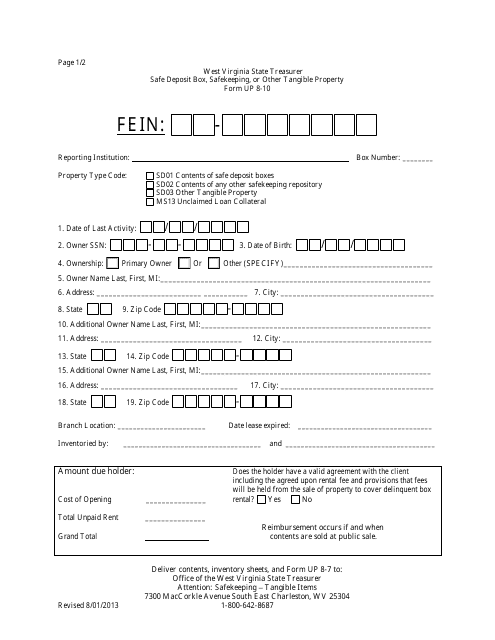

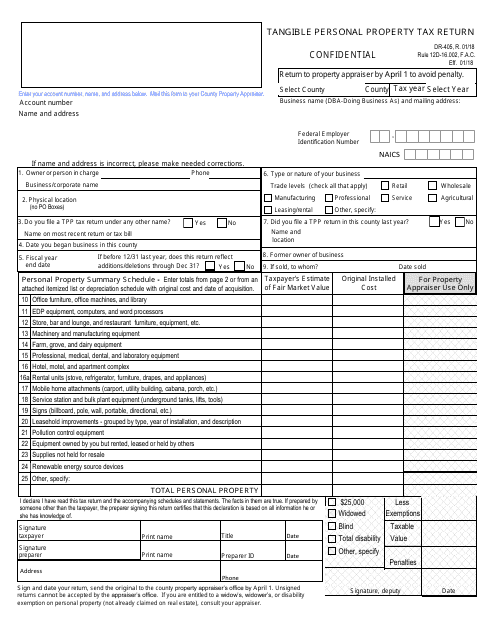

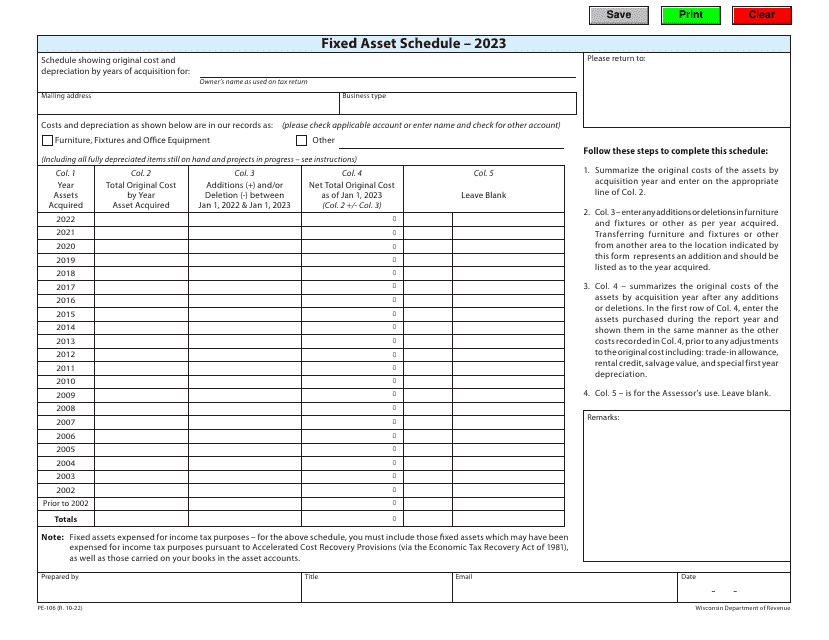

If you're a resident of West Virginia, you might be familiar with Form UP8-10, which covers the safekeeping of tangible property such as safe deposit boxes. Or perhaps you're in Florida and need to file Form DR-405, the Tangible Personal Property Tax Return. This form ensures that you're meeting your tax obligations related to your physical assets.

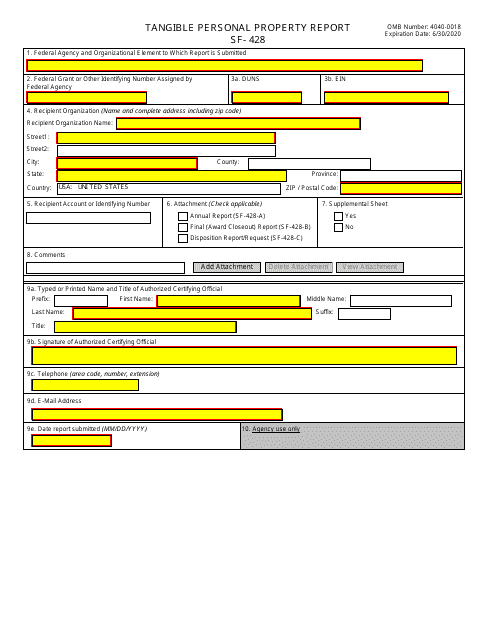

If you are required to report on your tangible personal property, Form SF-428 might be familiar to you. This form allows you to provide detailed information about your physical assets, helping government agencies understand the value and condition of your assets.

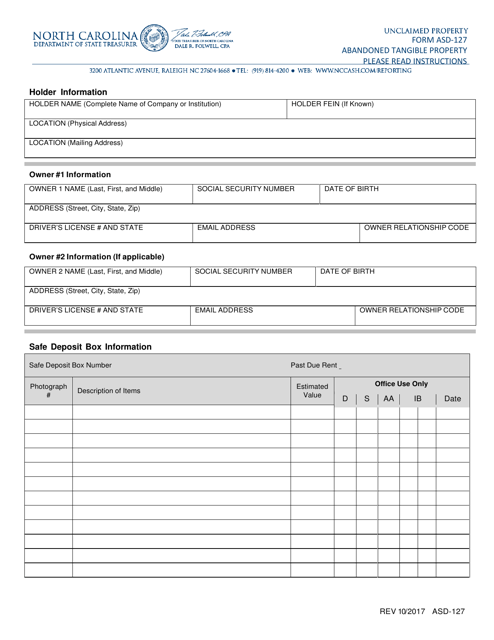

It's not just individuals who need to manage tangible property. In North Carolina, for example, Form ASD-127 is used to report abandoned tangible property. This form is essential for organizations and businesses that handle tangible assets, ensuring that abandoned items are properly documented.

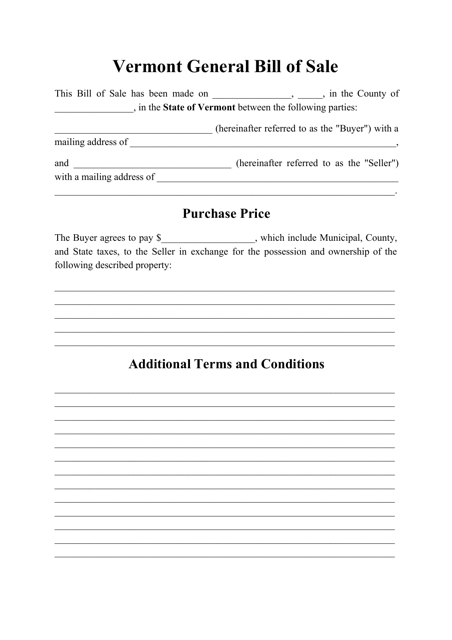

Lastly, a Generic Bill of Sale Form can be found in many states, including Vermont. This form is helpful when transferring ownership of tangible property, protecting both the buyer and the seller in the transaction.

Understanding and properly managing tangible property is essential for individuals, businesses, and organizations alike. By utilizing the appropriate forms and documents, you can ensure that your physical assets are accounted for, reported correctly, and legally transferred.

Documents:

6

This form is used for reporting safe deposit boxes, safekeeping, or other tangible property in West Virginia.

This Form is used for reporting tangible personal property and calculating tax owed in the state of Florida.

This form is used for reporting abandoned tangible property in North Carolina.

Download this Vermont-specific document and fill it out to document a property transfer from one party to the other. When properly composed, this document releases the seller from liability for the sold item and proves the buyer is the new owner of the property.