Deposit Accounts Templates

Deposit Accounts, also known as account deposits or deposit account forms, are a fundamental part of managing and organizing your finances. Whether you're an individual or a business, having a deposit account is essential for various purposes.

Deposit accounts allow you to securely deposit and store your funds with financial institutions. These accounts offer numerous benefits, including ease of access, earning interest, and the ability to conduct financial transactions seamlessly.

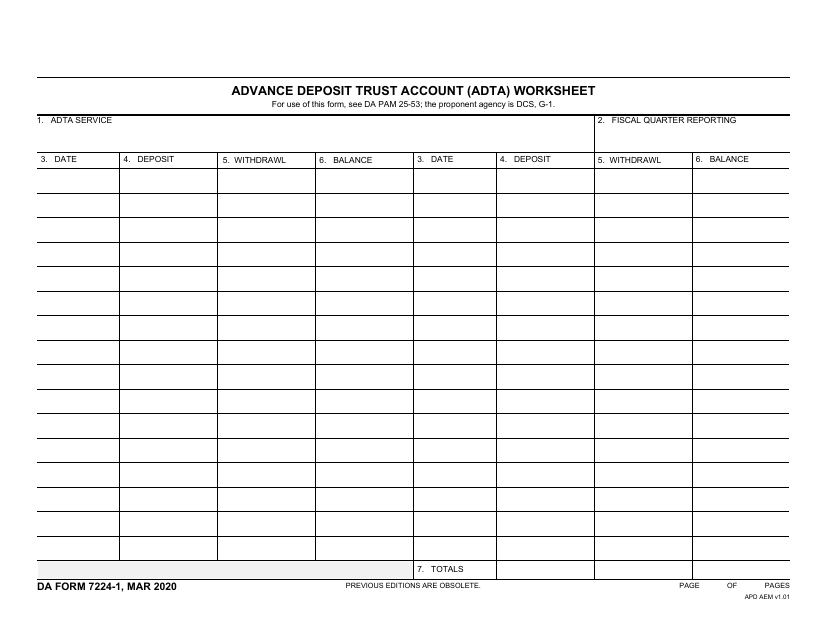

One example of a deposit account is the DA Form 7224-1 Advance Deposit Trust Account (Adta) Worksheet. This form helps individuals and organizations track and manage their advance deposit trust accounts. By maintaining accurate records, you can ensure that your deposits are accounted for and easily accessible when needed.

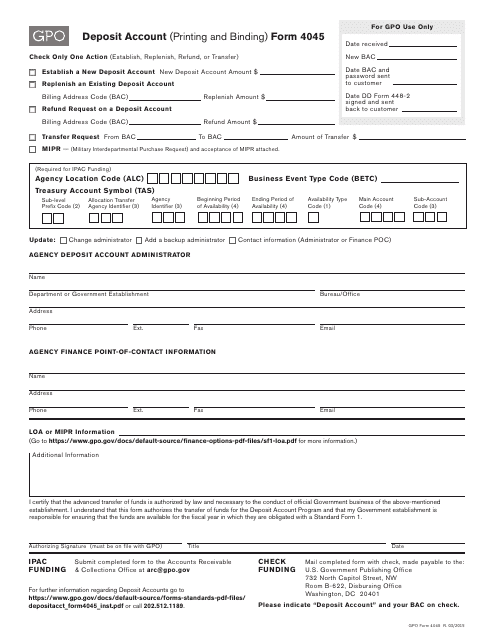

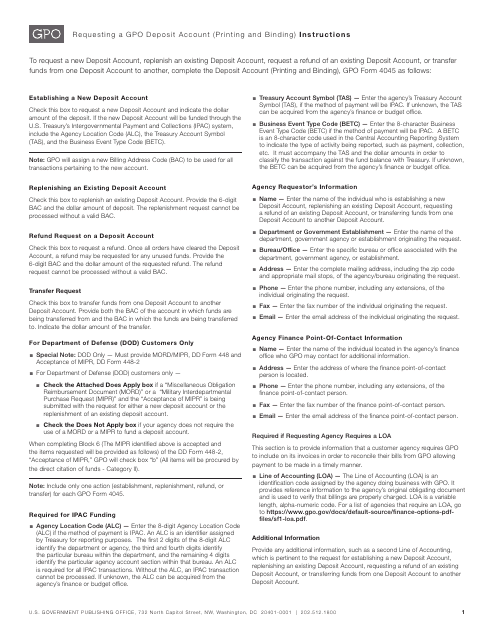

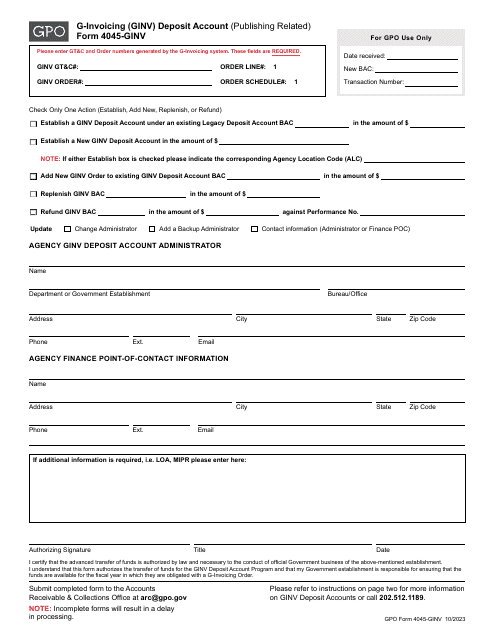

Instructions for GPO Form 4045 Deposit Account (Printing and Binding) is another valuable document that provides guidance on setting up and maintaining deposit accounts specifically for printing and binding services. This form helps streamline the process of managing financial transactions related to printing and binding projects.

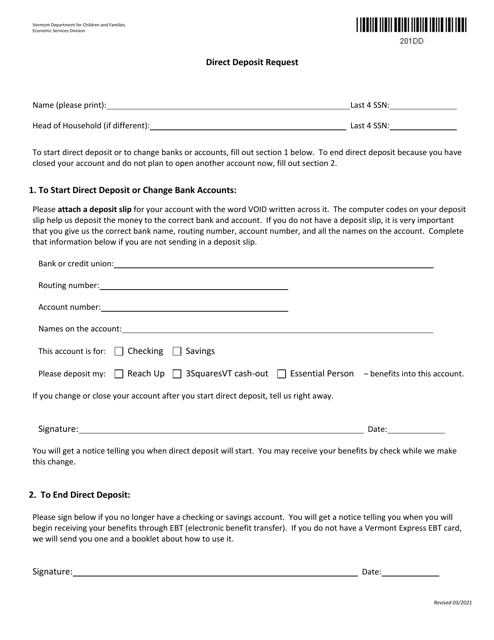

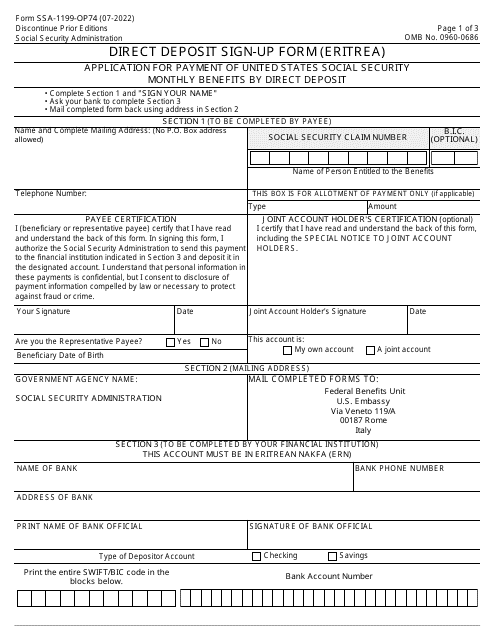

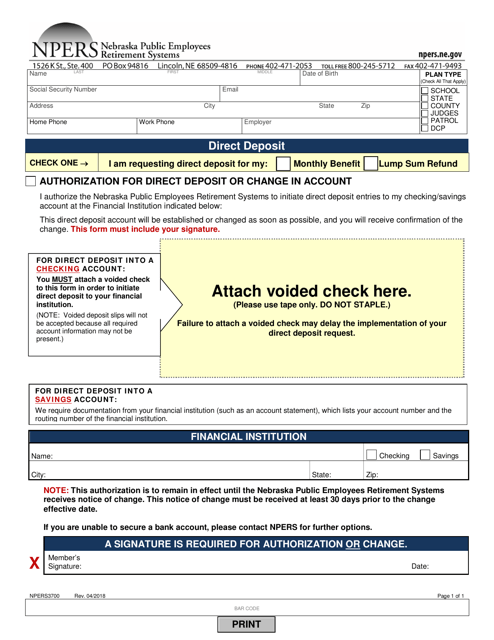

For individuals or businesses residing in Nebraska, the Form NPERS3700 Direct Deposit is a popular choice. This document allows individuals to set up direct deposit for their payroll, retirement, or other regular income sources. Direct deposit offers convenience and saves time, as funds are electronically transferred to your designated account on a specified schedule.

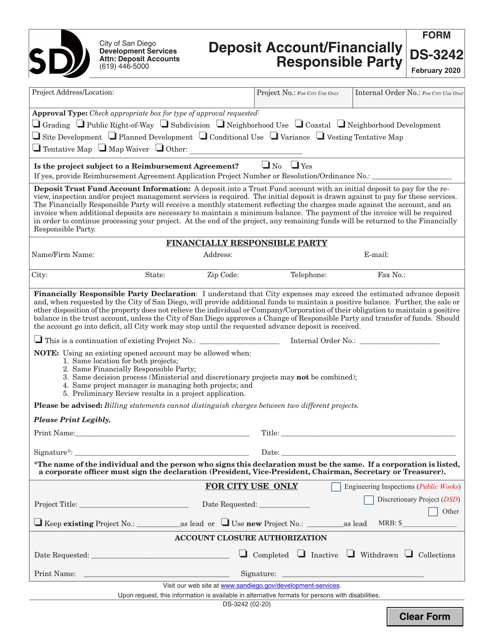

Local governments, such as the City of San Diego, California, utilize the Form DS-3242 Deposit Account/Financially Responsible Party. This form ensures that financial responsibilities are properly assigned and documented within the organization, allowing for accountability and transparency.

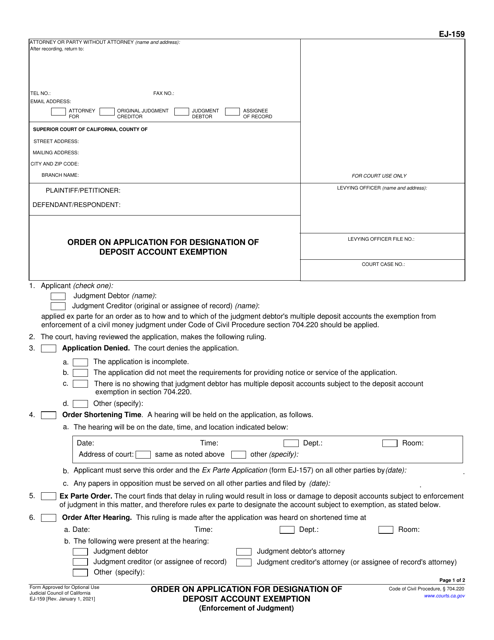

In the City of Aliso Viejo, California, the Form FS-100 Deposit Account/Financial Disclosure offers a comprehensive solution for financial disclosure. By completing this form, individuals can provide a detailed overview of their financial accounts, including deposit accounts, ensuring transparency and compliance.

Whether you need to manage advance deposits, printing and binding transactions, direct payroll deposits, or financial disclosures, deposit accounts serve as a reliable tool for organizing your finances. These accounts offer security, accessibility, and efficiency, making them essential for individuals and businesses alike. So, if you're looking to optimize your financial management, consider setting up a deposit account today.

Documents:

27

This Form is used for depositing money into a printing and binding account for ordering services from the Government Printing Office.

This Form is used for depositing funds into a Government Printing Office (GPO) account for printing and binding services. It provides instructions on how to complete the deposit process.

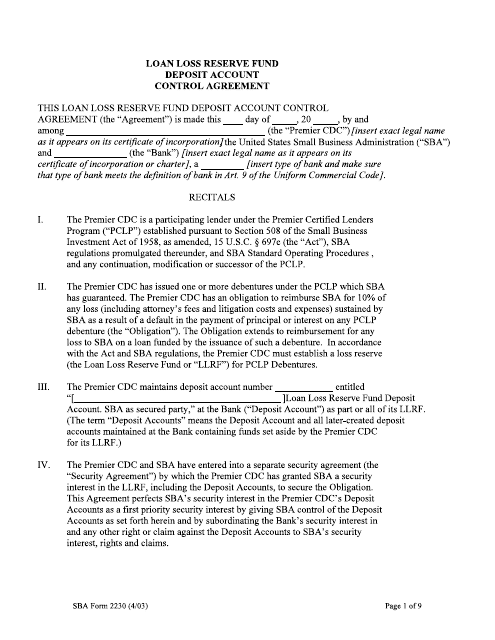

This Form is used for establishing a Deposit Fund Control Agreement for a Loan Loss Reserve Fund through the Small Business Administration (SBA). It outlines the terms and conditions for the management and distribution of funds to cover potential loan losses.

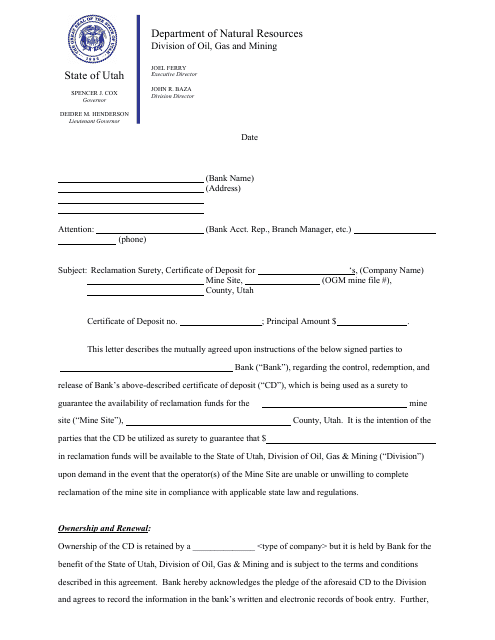

This document is used for assigning a Certificate of Deposit as collateral for a partnership bond.

This form is used for applying to establish a factory assembled structure deposit account with the Department of Labor & Industries in Washington.

This document is used for making a deposit into a contractor's or miscellaneous account in Washington.

This form is used for making a deposit into the account of the account holder for factory assembled structures in Washington state.

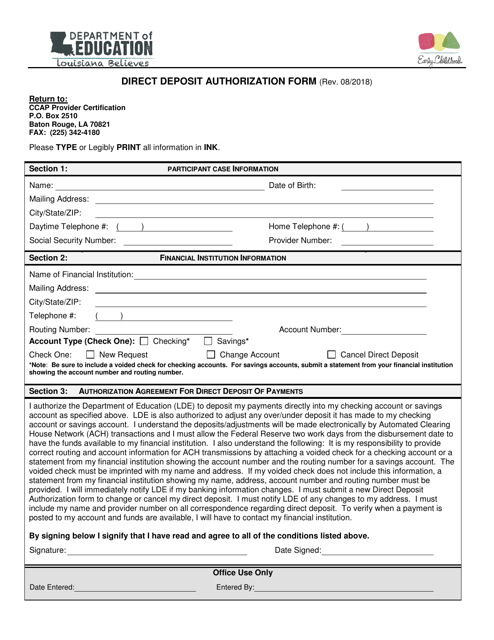

This form is used for authorizing direct deposit of funds in the state of Louisiana.

This form is used for setting up direct deposit for employees in Nebraska. It allows employers to securely deposit paychecks directly into their employees' bank accounts.

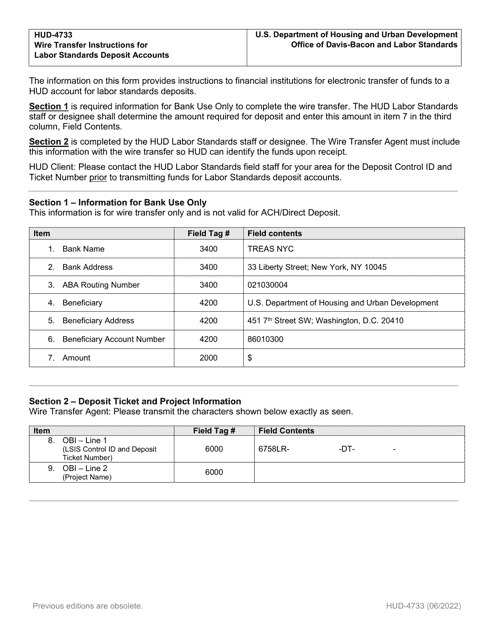

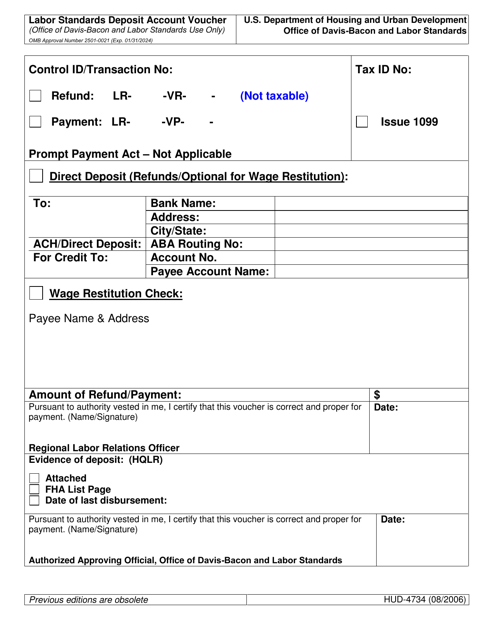

This form is used for making deposits to the Labor Standards Deposit Account for projects subject to wage rate requirements under federal contracts.

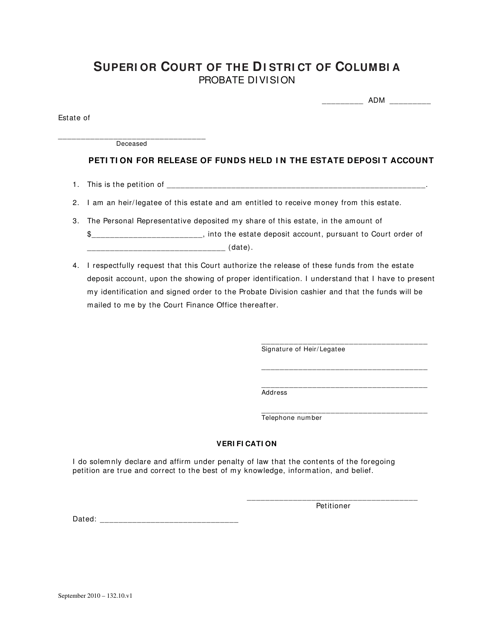

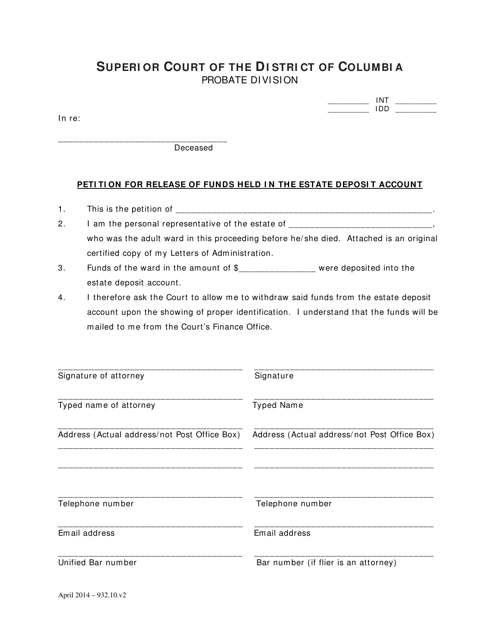

This document is used for requesting the release of funds from an estate deposit account in Washington, D.C.

This document is used for petitioning to release funds held in an estate deposit account in Washington, D.C. It includes an order for the release of the funds.

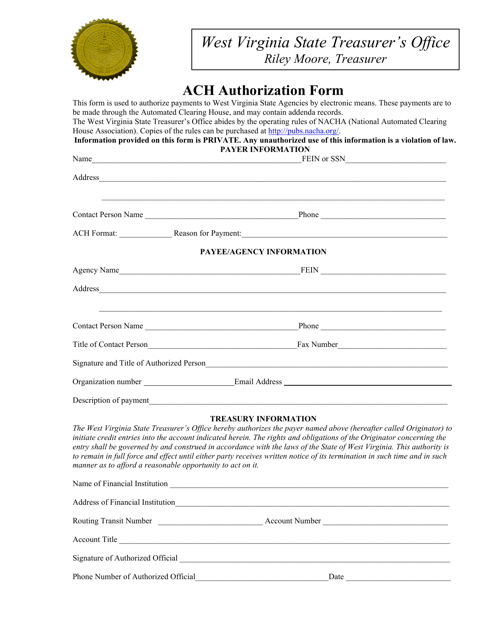

This form is used to authorize automated clearing house (ACH) payments in the state of West Virginia. ACH payments allow funds to be electronically transferred between bank accounts.

This form is used for depositing money into a City of San Diego account or designating a financially responsible party for the account.

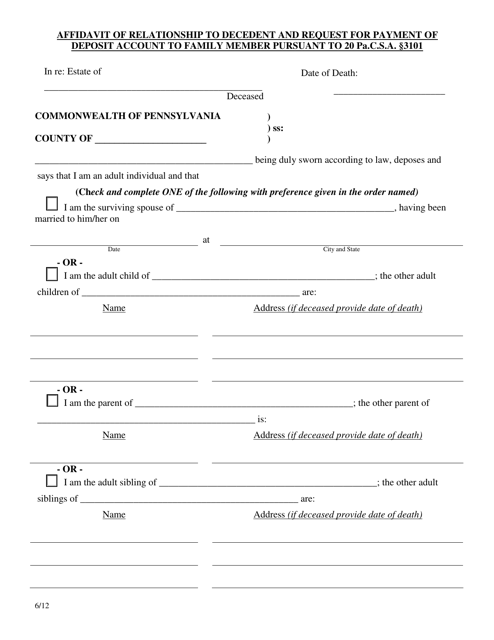

This document is for the residents of Pennsylvania who are requesting payment of a deposit account to a family member after the death of a loved one. It involves an affidavit of relationship to the decedent and follows the legal guidelines outlined in the 20 Pa.c.s.a. 3101 code.

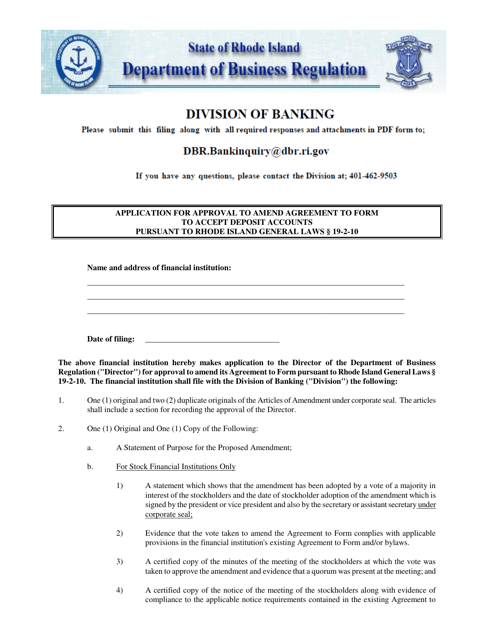

This Form is used for applying for approval to amend an agreement to form and accept deposit accounts as required by Rhode Island General Laws 19-2-10 in Rhode Island.

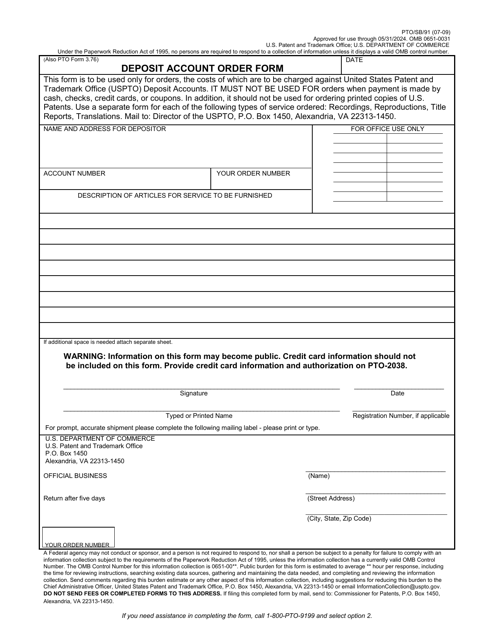

This form is used for ordering a deposit account for the United States Patent and Trademark Office (USPTO).

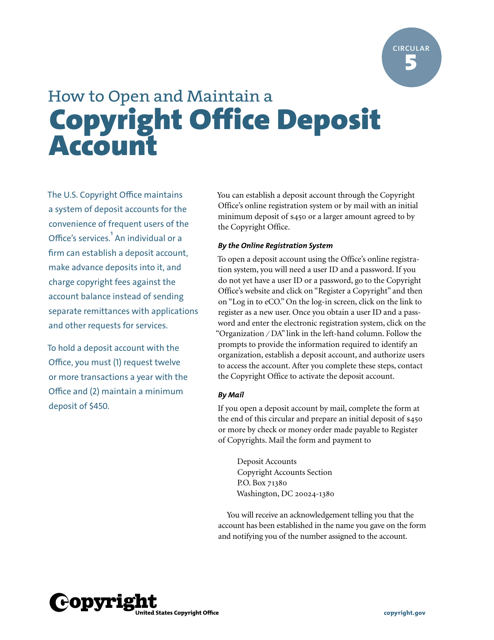

This Form is used for setting up a deposit account with the Copyright Office.

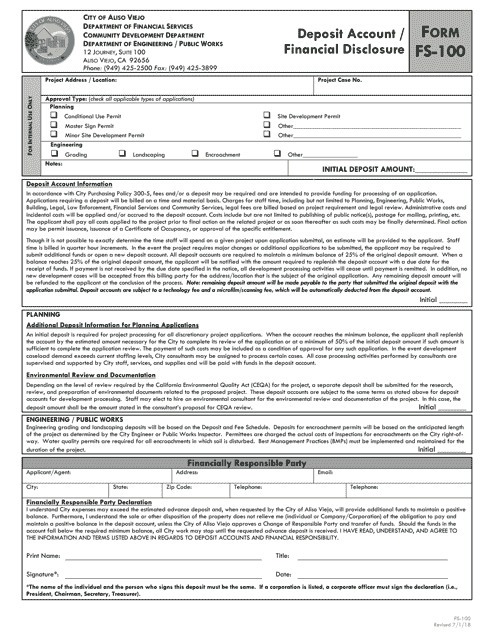

This form is used for deposit account and financial disclosure in the City of Aliso Viejo, California.