Tax Credit Schedule Templates

Are you looking to maximize your tax credits and minimize your tax liability? Look no further than our comprehensive tax credit schedule, also known as the tax credits schedule or tax credit schedule. This invaluable resource provides a detailed breakdown of the various tax credits available to individuals and businesses.

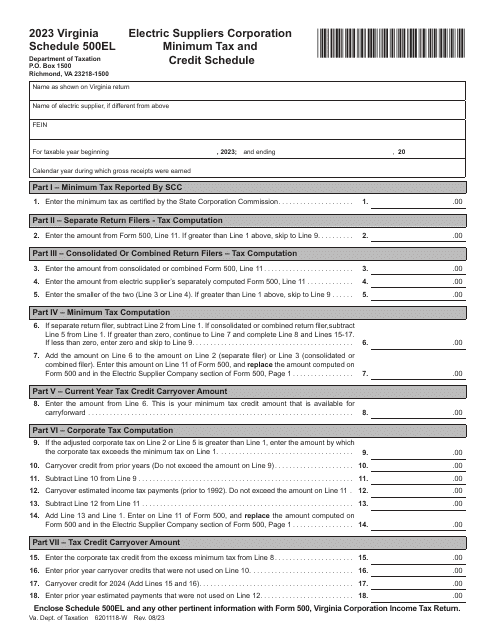

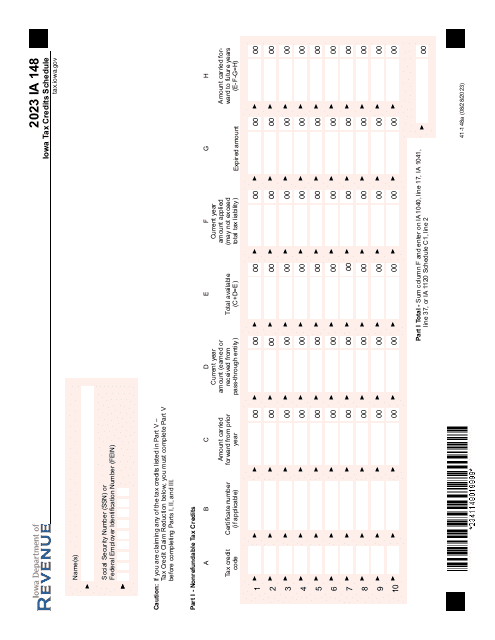

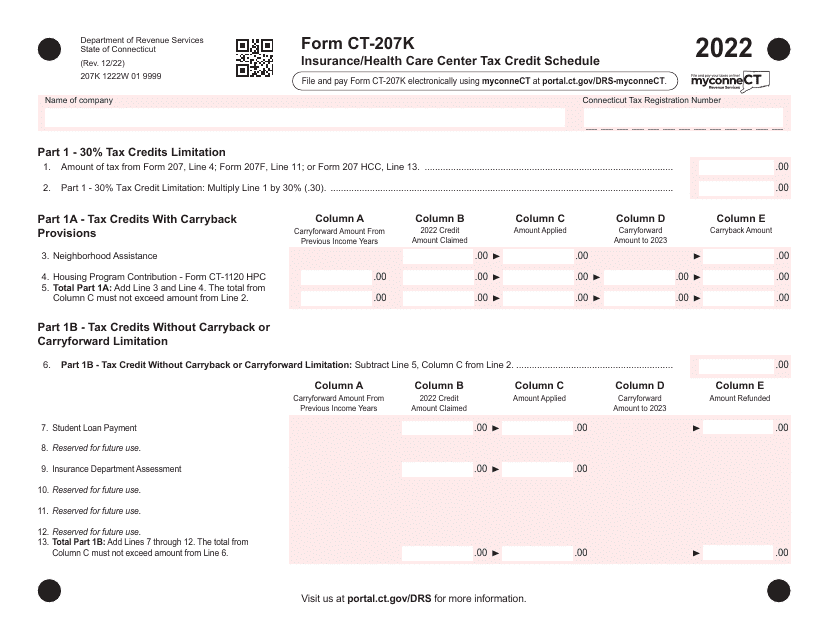

Our tax credit schedule includes important documentation such as the Schedule 500EL Electric Suppliers Corporation Minimum Tax and Credit Schedule in Virginia, the Form IA148 (41-148) Iowa Tax Credits Schedule, and the Form CT-207K Insurance/Health Care Center Tax Credit Schedule in Connecticut. With these forms, you can easily determine your eligibility for specific tax credits and calculate the amounts you may be entitled to.

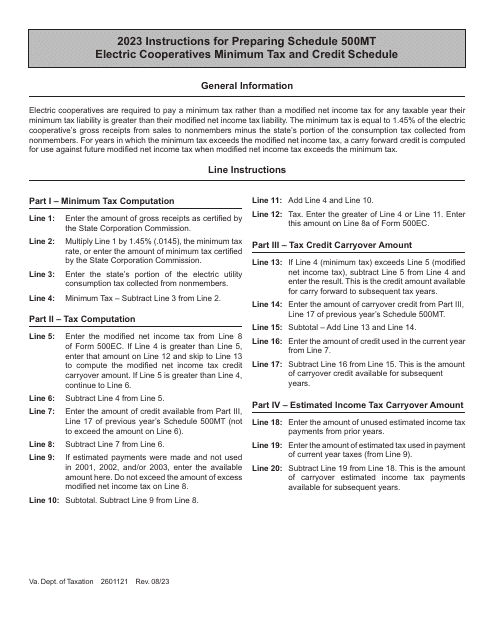

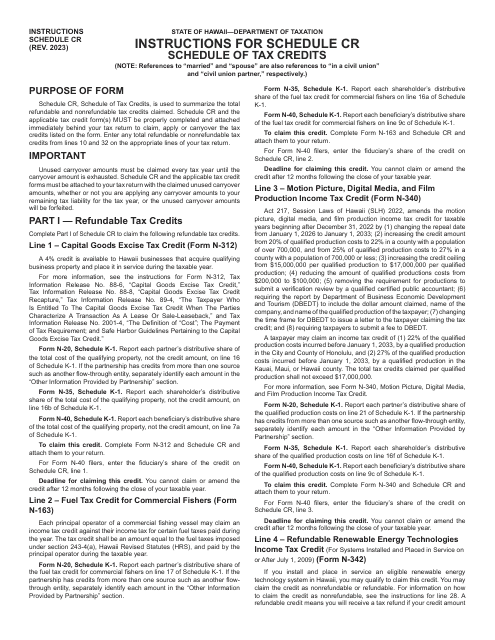

In addition to the specific forms mentioned above, our tax credit schedule also includes the Instructions for Schedule 500MT Electric Cooperatives Minimum Tax Credit Schedule in Virginia and the Instructions for Schedule CR Schedule of Tax Credits in Hawaii. These instructions provide step-by-step guidance on how to complete the respective tax credit schedules accurately.

Whether you're an individual seeking to claim personal tax credits or a business exploring various tax incentives, our tax credit schedule is a must-have resource. It allows you to explore and take advantage of the wide range of tax credits available to you, potentially saving you a significant amount of money.

Don't miss out on the opportunity to maximize your tax savings. Access our comprehensive tax credit schedule today and start taking advantage of the numerous tax credits that you may be eligible for.

Documents:

5